Don't Believe the Hype: There Is No Way Free Trade Within Canada Will Net $200-Billion

All the claims about the benefits of complete free trade in Canada are based on a single analysis based on assumptions with no basis in fact.

In the face of U.S. tariffs, there is a renewed push for Internal Free Trade in Canada, with people saying it’s a no brainer, complaining that it hasn’t been done.

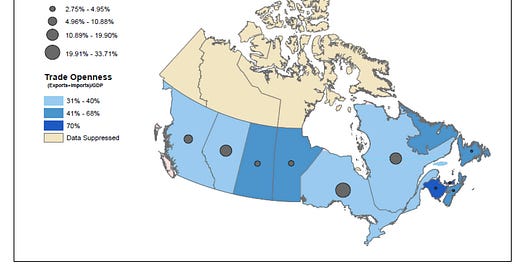

The map above is from a Government of Canada paper, “Tear Down These Walls” which promotes internal free trade in Canada as being “free money.”

A glance at the map tells a different story. The darker the colour, the freer the trade. The provinces with the most free trade? Manitoba, New Brunswick, PEI, Newfoundland - Labrador? Well, they’re all “have not” provinces. The provinces with the least free trade? Well, they’re all the rich ones: BC, Alberta, Ontario.

(The report also cites former Conservative Cabinet Minister James Moore, who complains that business support for Indigenous economic development is unfair.)

There is no way that we are going to get $200-billion return on investment in extra GDP, with an investment of nothing.

$200-billion is larger than the GDP of several Canadian provinces. We should all ask how, in a domestic economy, we are supposed to increase GDP internally by $200-billion without invesment. You can’t.

Now, because people treat the pronouncements of economists as if they were Papal pronouncements, and therefore infallible, I am going to have to explain why I have any business criticizing an economist, when I am not one.

Now, whether an argument is valid or not is based on the argument and the evidence, not who is making it.

I have spent 30+ years as a public policy researcher. I have worked in the private and the public sector, including securing capital for small businesses and talking to many, many entrepreneurs in Manitoba. I have developed and written policy platforms and legislation that, when they were implemented, were effective. During the pandemic, the federal government implemented a plan at my urging that saved the entire Western Canadian freshwater fishery, with a value of over $100-million a year, putting 3,000 people back to work.

I was also a lecturer in Government-Business relations at a local university, where the course I developed included 500 years of economic history, explaining different economic perspectives, especially around financial crises, including the one we experienced in 2008, as well as the Euro Crisis, and that meant reading the many of the critiques and post-mortems of what went wrong.

As an elected official, when I was presented with research, I always read it with a critical eye, because what matters is the mechanics of the policy and whether it will work, not the marketing.

It would appear that almost no one has read, much less critically examined the papers where this claim is made, with all rely on the same model by the same economist, Trevor Tombe, which are then padded out with references to articles, marketing materials and opinion polls that all lead back to the same study.

Whether it is Pierre Poilievre, Minister Anita Anand, Pamela Heaven in the Financial Post, the CFIB, Senator David Tkachuk, the Canadian Chamber of Commerce, the CFIB, The Business Council of Alberta, the CD Howe Institute, the IMF, the Macdonald Laurier Institute, the Fraser Institute or Governors of the Bank of Canada Stephen Poloz or Tiff Macklem, Jason Kenney, Deloitte, Macleans or the CBC, it amounts to relying on a single study.

While Tombe is a respected economist, the $200-billion claim is not based in fact or empirical evidence. The IMF paper is a “working paper”, and it is based in theory and assumptions that have been taken at face value, when they don’t reflect or predict reality.

The argument for more trade is built on a single-minded assumption that what is holding back productivity, growth, business development and job creation is trade, even though it can’t be measured.

Canada used to have much more internal trade, which ended with the introduction of the FTA after 1988 and NAFTA after that. Most Canadians live within an hour’s drive of the U.S. and many hours drive from other Canadian cities. The FTA and NAFTA meant that U.S. companies that used to operate in Canada closed up shop and support for Canadian-to-Canadian sales business were dismantled.

The change is not because of new trade barriers, it’s because of the constitution. Provinces have juridiction over professions like law, health, education, roads and highways, engineering, labour, business registration, securities regulation, alcohol, and more.

Many of these are in fact, the cost of doing business in another juridiction.

There are a few areas where harmonization would improve matters. One is truck safety. Another is investments and securities. Both have been plagued with lax regulation at the provincial level.

In my experience as an elected official for five years, I was surprised again and again that I was continually being approached for greater regulation, because there was none, which meant that people who were cheats and criminals could keep carrying on business no matter what offenses they might commit, or result in real harm, in construction, trucking, workplace safety.

I was also on the Government of Manitoba public accounts committee, where we reviewed the Auditor General’s reports into failures of policy and government. It made it absolutely clear that a near total lack of regulation and enforcement in areas like trucking had had deadly consequences: unsafe semi-trucks were killing people in growing numbers on Manitoba roads. Driver training was unregulated, inspections weren’t taking place, and it was killing people.

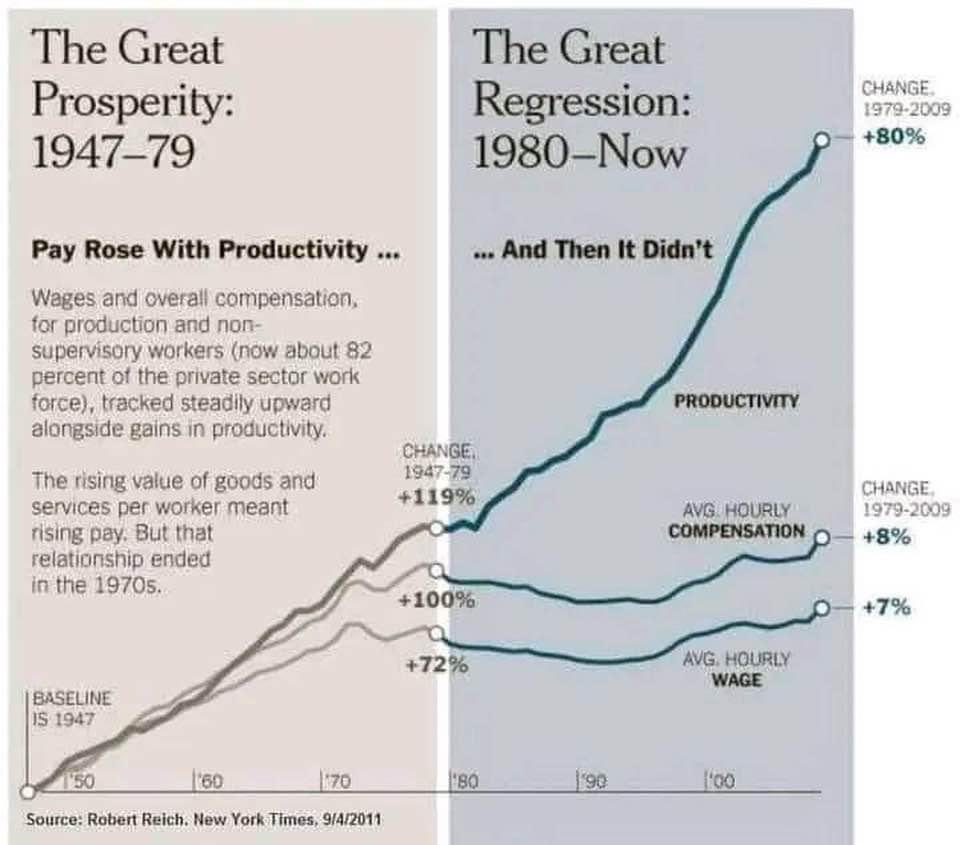

I’ve also read the critiques of Free Trade agreements. These are always measured on the basis of GDP, while ignoring the reality that for years, the vast majority of economic growth in Canada, the US and the world has gone to the top. Canadian and US companies outsourced production with a loss of tens of thousands of local jobs, with the benefits flowing to the owners and executives.

In the past, there was at least an acknowledgment that free trade is bound to create winners and losers. That is now completely ignored and these deals are sold as if they will be good for everyone. This is related directly to unrealistic assumptions baked in to free trade and economic models, because they don’t include distribution, income, job creation or capital.

For example one of the things that is assumed is that if one company or industry is driven out of business, that the capital in those sunsetting industries flow to new industries. That does not happen.

The assumption around workers is similar. Neoclassical macroeconomics treats unemployment as a choice. In the 1990s, in response to potential job losses, people argued that everyone could just learn to code.

Neoclassical economics is entirely focused, not on the creation of new, real value, but on the preservation of existing value, even at the expense of new growth. That is the reason for the economic scrape we are in: 50 years of policies that have driven monopolies in the name of “efficiency” that are stagnation instead.

Multiplying fact and fiction is not a good basis for prediction

Economics is routinely treated as a science. It is not. It is a discipline of the humanities, with a lot of mathematics attached.

I have to point to former Economist for the World Bank, Paul Romer, and his critique of the discipline in his 2016 The Trouble with Macroeconomics, where he argues that macroeconomics has been in “intellectual regress for 30 years” because “imaginary” shocks and assumptions without a factual basis are routinely used to make calculations.

Romer points out that economists use what he sarcastically calls “Facts With Unknown Truth Value” (FWUTV) to plug into their formulas, and they do.

When you multiply a number (FACT) from observation and multiply it by an assumption (FICTION), the result is not reliable information.

The fact that the +/- estimate of benefits in the 2015 paper ranges from $50-billion to $130-billion - a variance of $80-billion - is an indication that this is a shot in the dark.

That is the core problem with Tombe et al’s analysis. The reports source real-world information based on economic data, of sales of products from provinces to others, which is why it is called a “quantitative analysis.” However, these numbers are processed in a way that is purely theoretical, based on assumptions for which there is no evidence.

One of those assumptions is that trade barriers - and not some other challenge - are the cause of the problem. This is an example of the old saying “If all you have is a hammer, everything looks like a nail.”

1. Canada has no tariffs. In fact, it has no trade barriers that can be measured, at all.

The papers themselves state:

“Measuring internal trade costs directly is not feasible.”

(Page 8 of the IMF report on estimating the internal trade barriers).The 2016 paper said “explicit tariffs do not exist”. (Albrecht and Tombe).

These claims are made by creating a mathematical model of a Canada with no trade between provinces.

2. The Benefits are Estimated by Creating a Fictional Mathematical Model of Canada

Because Canada has internal trade barriers that can be measures, they have to be “inferred” and this is done by creating a mathematical model.

This is from Albrech and Tombe’s May 2015 Internal Trade, Productivity, and Interconnected Industries: A Quantitative Analysis.

“We first ask: Who gains from trade in Canada? This is a common experiment in the international trade literature and involves comparing initial welfare to the counterfactual level of welfare when trade is prohibited.

“Counterfactual” in this context means creating an imaginary model of the Canadian economy.

In this imaginary model, the economists try to calculate what Canada’s economy would be if there was no trade between provinces, and each province was somehow totally self-sufficient. That’s called an “autarky” - where a jurisdiction is closed off and trades only with itself.

“Aggregate welfare” calculates benefits for the whole population, and this is important. It doesn’t mean the entire population benefits. In fact, it can - and often does - mean that some sectors of the population will lose out. How those benefits are distributed doesn’t matter. If 50% of the population loses $10-billion, but 1% gain $20-billion, it’s the total that matters.

We find aggregate welfare is 18.3% higher than in autarky. Compared to the case of no interprovincial trade, but allowing for international trade, aggregate welfare is 4.4% higher. For internal trade costs, reducing them by 10% increases aggregate welfare by roughly 0.9% (equivalent to a real GDP increase of $17 billion). Eliminating trade cost asymmetries, aggregate gains are over 3%; removing trade costs unrelated to distance, gains are nearly 7%. These estimates suggest reducing internal trade barriers could add $50-$130 billion to Canada’s GDP. If inter-provincial trade costs were completely eliminated, an implausible but illustrative experiment, aggregate gains for Canada exceed 50%. Moreover, we consistently find poor regions gain more from liberalization than rich regions.”

Now, I’ll the point again that these initial estimates improvements of between $50-billion and $130-billion. That is a wide range. By 2020, in the IMF paper had increased it to $200-billion.

They have no empirical validity, and there is an acceptance of sources that can only be described as promotional material. It’s only the top number that is cited. The $200-billion figure should be described as being a “best-case scenario”, but it’s not.

So, the point here is that this is an extremely mathematically sophisticated back-of-the-envelope calculation that makes some colossal assumptions that don’t have facts to back them up.

The claim that poor regions (Manitoba, Prince Edward Island) gain more is a powerful part of the sales pitch.

2. Opinion Polls are Not Outcomes

To the question, “Is there public support for Internal Trade Liberalization?” Tombe’s answer is:

“There is overwhelming public support for free internal trade. The surveys of the Canadian Federation of Independent Business (2014) showed that most Canadian firms (87 percent)”

The CFIB is not the Canadian public. It is a business lobby that seeks to persuade its members, the public, and the politicians it lobbies to make changes to government regulation and taxes. There are over 1-million SME’s who don’t belong to CFIB.

3. Trade is assumed to be the problem, when real-world economic context is ignored.

The entire basis of Tombe’s exercise is based on the assumption that trade barriers are a problem, even when they can’t be measured.

Having spent decdes in public policy research, in the private sector and the public sector, and having been a legislator and spoken to many entrepreneurs, the problem is not a lack of trade barriers, it is a lack of access to capital.

Canada has experienced massive economic shocks in the last 25 years - a dot.com crisis, China joining global trade, the Global Financial Crisis, the 2014 oil crash, and the 2020 pandemic. During that time, hundreds of thousands of manufacturing jobs were lost, oil jobs were created and lost, and during every crisis, the Bank of Canada dropped interest rates to goose borrowing and investment, which mostly drove up the real estate market and helped create a housing and affordability crisis. In addition, we have hyperconcentration of wealth and ownership.

The challenges around productivity in Canada are related to a lack of capital investment into innovative “real economy businesses” because banks and financial institutions and governments alike keep inflating the prices of existing assets (real estate + mergers and acquisitions). This results in inflated asset prices, not the creation of new value.

The result of all this consolidation, and investment in inflating asset prices, is an less-productive economy with less competition. It has directly constributed to inequality, lack of opportunity - and a lack of economic growth.

What is actually required in Canada is access to Canadian Capital to focus on the creation and scale-up of Canadian owned and operated businesses, because if Canada and its provinces don’t, no one will.

The idea that is always repeated is the idea that jobs, businesses and investment must all be imported, when there are Canadians who could use new or better jobs, entrepreneurs with marketable ideas who need capital, and the only place Canadian dollars are used or made is in Canada.

Capitalism Needs Capital

Many of the basic arguments around trade have not changed in 200 years, despite drastic changes in every aspect of our economy and technology. David Ricardo argued that free trade works due to comparative advantage: countries can benefit by specializing in what they are best at, so they aren’t actually competing head-to-head.

This is not the reality. In Canada, the complaint people are making is that they want to compete with other companies. You might ask what the problem is, and the answer is that means the benefits from comparative advantage aren’t there. That means the gains aren’t there. It is just a zero sum game.

As Professor Steve Keen noted,

Ricardo’s theory assumes constant output per worker, which isn’t true.

The other thing that really matters is that Ricardo’s theories are based in a the idea that technology won’t change. It is based on the idea that certain countries should just “specialize in what they are good at” when what they are “good at” can and does change with training and new technology.

In his book Economics: A User’s Guide, Ha-Joon Chang wrote a critique of the assumptions of free trade, and its more modern iteration, the Heckscher-Ohlin-Samuelson version of the theory of comparative advantage.

These are the international free trade models and assumptions on which Tombe’s formulas are based.

“Since Ricardo invented it in the early nineteenth century, the theory of comparative advantage has provided a powerful argument in favour of free trade and trade liberalization, that is, reduction in government restrictions on trade.

The logic is impeccable - that is, insofar as we accept its underlying assumptions. Once we question those assumptions, its validity becomes much more limited. Let me explain this, focusing on two key assumptions behind the Heckscher-Ohlin-Samuelson version of the theory of comparative advantage (henceforth HOS), as lying at the heart of the modern argument for free trade?

HOS structurally rules out the most important form of beneficial protectionism by assuming that all countries are equally capable

The most important assumption underlying HOS is that all countries have equal productive capabilities - that is, they can use any technology they want…. This totally unrealistic assumption rules out a priori the most important form of beneficial protectionism, namely, infant industry protection, whose key role in the historical development of today's rich countries we discussed in detail throughout the book.

HOS is overly positive about trade liberalization because it assumes that capital and labour can be remoulded for use in any sector at no cost

In HOS, not only is free trade good for the country but moving towards it in countries that have not practised it produces no casualties… the reality is that most capitalists and workers in the industry that has lost protection remain hurt.

Factors of production - capital and labour - are often fixed in their physical qualities; there are few 'general-use' machines or workers with a 'general skill' that can be employed across industries. Blast furnaces from a bankrupt steel mill simply cannot be remoulded into a machine that makes micro-chips and thus may have to be sold as scrap metal. When it comes to the workers, how many steel workers do you know who have retrained to work in the semiconductor industry or, even more unlikely, in investment banking?

HOS can present such a positive view of trade liberalization because it assumes that all capital and labour are the same ('homogeneous' is the technical term) and thus can be readily redeployed in any activity (technically this is known as the assumption of perfect factor mobility). 4

Even the use of the compensation principle cannot quite hide the fact that a lot of people get hurt by trade liberalization

Even the use of the compensation principle cannot quite hide the fact that a lot of people get hurt by trade liberalization

Even when they acknowledge that trade liberalization may produce losers, free-trade economists justify trade liberalization by invoking the 'compensation principle' (see Chapter 4). They argue that, as trade liberalization makes the whole better off, the losers from the process can be fully compensated and the winners still have additional income left.

In the rich countries, there is partial - but only partial - compensation through the welfare state, which provides unemployment insurance and access to basic social services, such as education and (except in the US) health care. But in most developing countries the welfare state is very weak and has patchy coverage, so the resulting compensation is minimal, if not non-existent.

If the compensation is not made, invoking the compensation principle to justify a policy that hurts some people, such as trade liberalization, is tantamount to demanding that some people make a sacrifice for the 'greater good' - a demand that used to be made of people by the government in socialist countries, which free-trade economists so heavily criti-cize.

International trade is essential, especially for developing countries, but that is not to say that free trade is the best

When they hear someone criticizing free trade, free-trade economists tend to accuse the critic of being 'anti-trade. But criticizing free trade is not to oppose trade.

These are the baked-in assumptions of the benefits of free trade in Tombe’s models.

That everyone in Canada has access to the same technology

That if a business goes under and everyone loses their job, both the capital from the bankrupt business and the workers will just flow into a new business.

That even if there there losers, the gains for the winners will be so great that you can tax and redistribute winners’ gains to compensate, and everyone will be better off.

None of these are accurate, and none of these happen.

Access to new technology requires both capital and the energy, transportaion and communications infrastructure to support it.

When businesses go bankrupt, their capital value dies with them.

When people who are highly trained in one industry lose their job, they cannot immediately re-skill and get a new job at a comparable wage

As for compensation, where it does happen, in Canada it is the only thing that has prevented the stagnation of wages at 1970s levels.

In 2014, Larry Summers, a former advisor to Presidents Obama and Clinton wrote the “classical era of Free Trade deals is over”. The new trade agreements have nothing to do with free trade at all, because (as in Canada right now) there were no tariffs. Instead they are about “regulatory harmonization” and “investor protection.”

That “regulatory harmonization” essentially handcuffing democratically elected governments and putting a prohibition on capacity to act, because it puts the rights of investors from outside of juridiction ahead of voters, citizens and taxpayers.

By ‘investor protection” it means that if a foreign corporation (or, in Canada out-of-province corporation) can sue governments if they want to support businesses within their jurisdiction, or even if they try to protect the environment or support Indigenous entrepreneurs, taxpayers are on the hook for it.

The civil and political unrest we are seeing right are a result of the economic consequences of these policies - fiscal, trade, monetary and more - over the last decades, which have all been neoliberal.

They have succeeded in creating unimaginable wealth, but did not keep its promise that it would be shared through everyone.

This is not a failing of governments: it is a consequence of a market economy where the huge gains for a few that were made possible by deregulation, bailouts, ultra-low interest rates, offshoring, and investor protection have left everyone else behind.

That’s because these free-market ideas, while appealing, have themselves never, ever been true. No rich country ever became rich through free trade.

Every rich country in the world became rich through protectionism: the UK, the US, Canada, South Korea, Japan, Germany, and now China. They turn to free trade after developing wealth.

The “gains from trade” often have nothing to do with local job creation or growth.

The argument is that Canadians will gain from greater efficiency, but the efficiency is defined strictly as the ability of a company to generate more profit with less costs, particularly when private companies are selling to provincial governments.

What that means for citizens, is that while taxpayers are being told they will save money by contracting to an out-of-province company, instead of those taxes being recycled back into the local community, the government is sending out tax dollars out of province. And whether it’s private contractors or public employees, if the government wants local procurement, companies from other provinces can sue and taxpayers will be on the hook for that too.

This is almost always a disadvantage to small- and medium-sized companies.

It’s mostly about large, existing companies from one province operating in another. For the residents of that province, that means the taxes they are paying to government are leaving the province, but that it is supposed to be better because they get lower costs. It’s much more about outsourcing public services and selling off public assets and putting them in private hands (like provincial alcohol monopolies and Crown corporations).

So it is not about growth, it is not about productivity, it will not grow the GDP. It may sound old-fashioned to say, but capitalism requires capital, and the reason for laws and regulations (especially after the New Deal) was because of the abuse of monopoly power.

A Modest Proposal: Get Rid of Provinces

All of the problems that everyone is complaining about can really only be solved one way: to eliminate provinces entirely and just have two levels of government in Canada: a federal government and municipalities. Then you really would have no internal trade barriers.

You would also have no premiers, you’d have the same standards for everything, health care and natural resources, education all public and funded federally. It would probably clean up a ton of corruption at the provincial level, which is where most of it happens without being reported on. The fact that people can register provincial shell corporations with secret ownership means they are used by criminal organizations to launder money, and engage in sex and drug trafficking. The Federal Government shows beneficial owners. The provinces don’t.

The thing about that, is that you’d have to change the constitution. And that takes the agreement of the Federal Government, and seven out of ten provinces with 50% or more of the population.

Does Alberta want to stop being a province? Does Quebec? Because getting rid of all the provinces would absolutely accomplish it.

Now, I want to make something clear. I don’t want that. I want to keep provinces, but we need to recognize that the juridictional problems are provincial.

But the economic problem is ideological, and, I would even say, cultural, because the level of informed, or critical, or skeptical debate around the economy in Canada is absolutely abysmal.

Trevor Tombe has, I believe, made what I see as an honest mistake, but these assumptions need to be challenged.

However, there are lots of other examples where think tanks are releasing reports, like the Fraser Institute and others that release reports that are pure political propaganda, which makes statements that are blatantly misleading. The Fraser Institute and other Canadian think tanks like the MacDonald Laurier Insitute should not be considered reliable sources or be taken seriously by any academic, or journalist for that matter.

There are instances when people are citing reports, that state that the information is to be considered “marketing materials”. This is advertising to persuade Canadians and their leaders that we can all get rich quick.

For one thing, many of these think tanks are funded by donors who put conditions funding - for example, the Alberta-based Hunter Family Foundation makes it clear that they will not fund organizations that are critical of the fossil fuel industry. On their “initiatives” web page they list the following organizations: The Fraser Institute, The Hub.Ca, the Montreal Economic Institute, the Insititute for Liberal Studies, the Frontier Center and the MacDonald Laurier Institute.

In many cases, we don’t know who the funders are, at all.

I say that because I think the debate around internal free trade in Canada is totally misplaced, because it’s a lack of free trade is not the problem. And because it’s not the problem with Canada, trying to solve that problem will achieve nothing.

It’s a huge waste of time and energy which means we’re ignoring the real problem’s with Canada’s economy, and how to address it.

I wrote a similar critique of the Business Council of Canada’s profoundly misleading ad campaign.

Canada’s economy does have serious problems that need to be addressed.

That means directly addressing the major events over the last 15 years and more.

Reason #1 for Canada’s fouled-up economy: It’s the Price of Oil, Stupid.

“It’s the Price of Oil, Stupid” is from a reader’s comment, pointing out that problems with Canada’s economy are inevitably due to the price of oil, a global commodity with global prices.

In October, 2014, OPEC and Saudi Arabia started a global oil price war. The price of oil sank faster and deeper than at any time in history.

It had been over $100 a barrel for years, Alberta and Saskatchewan and Newfoundland and other energy producing provinces were rolling in money, then Saudi Arabia turned off the taps.

This is 100% the cause of the crisis in Canada’s oil sector. Not the Federal Government. Not the carbon tax. Not regulations. Not taxes. Not pipelines. There was a massive boom in oil, followed by a massive bust. It was financial warfare. It affected countries around the world, including the U.S.

THIS is the major reason for the loss in Canada’s GDP, loss of investment, and loss of income, employment.

Reason #2 for Canada’s fouled up economy: High personal debt from a colossal Real Estate bubble

We are currently in a massive financial “superbubble” created by the incompetent and reckless policies of unelected central banks. Since the Global Financial Crisis of 2008 and before, Governments and Central Banks have been trying to fix the economy by lowering interest rates so that people go into more debt by driving up real estate prices.

Instead of investing in productive “real economy” businesses, R & D and innovation, Canadians as individuals have added more than a trillion dollars in personal debt that has gone into driving up the price of real estate

Commercial real estate is already in deep trouble.

This relates DIRECTLY to economic misery in provinces like Alberta and Saskatchewan, where there were housing and mortgage debt booms along with the oil boom.

Reason #3 for Canada’s fouled up economy: A Global Pandemic, Especially Central Bank Responses

The policy decision to address the Pandemic with monetary measures, where people were encouraged and expected to take on debt to keep themselves and the economy going has played the single greatest role in fouling up the economy. The trillions of dollars that were loaned out - on top of previous trillions - drove up the price of existing assets including real estate, stock, and meme stocks.

It was not long-term investment in productive industry. It drove greater concentration of wealth, including considerable wealth based only on reckless speculation. That concentration also included mergers and acquisitions.

This has created the economic trap that Canada, and the U.S. and countries around the world all face.Contrary to the market dictum for making money “buy low, sell high,” speculation fuelled by low-interest debt means people are paying top dollar for assets - including major investors.

That leads to a self-evident market conundrum: the more you pay for an asset, the harder it is to get a return. This drives inflationary pressures, as companies have to hike rents and prices in order to keep achieving elevated returns.

In response to inflation created by easy money, central banks then moved forward with some of the sharpest interest rate hikes in history. This mindless monetary response to a crisis of central banks’ own making has accelerated personal and small business defaults.

If central banks were looking to emulate the “success” of Paul Volcker’s inflation-crushing 20% interest rates in the early 1980s, they didn’t bother to compare levels of debt in that era (very low) to today (very high). Add to that that in his first term (1980-84) Reagan reversed his initial tax cuts and brought in the largest tax increases in history, and ran huge deficits, grew government and had an economic stimulus larger than Obama did after the Global Financial Crisis of 2008.

These three realities - which are indisputable, and based in evidence and facts, are the three major reasons for the overall problems with Canada’s economy.

We have overpriced assets due to bad monetary policy whose prices must come down, but there is no non-destructive way to do that.

We need to re-industrialize and Canadian entrepreneurs do not have adequate access to capital available to make that happen.

The answer, as I have written, is a New Deal / Marshall Plan

We are in a “correction” and many people are underwater on their debt. The idea that a crash or collapse is inevitable is only because, as mentioned above, effective and efficient measures like monetized deficits, jobs programs and public investment in national industry (including privately owned industry) is how we escaped depressions and supported ourselves through crises in the past.

Financial crises are debt and credit crises. What makes collapse seem inevitable is that a lot of debts are coming due that can’t be paid. All those debts - and the crisis itself - are much, much worse because of the way that central banks and governments keep leaning so hard on monetary stimulus or monetary austerity. Monetary stimulus is based on the debt people can take out, which means that the greater the wealth, the greater the stimulus. It’s a direct engine for driving the concentration of wealth, and for driving up housing prices.

The challenge here is that assets are overpriced, and people are depending on those overpriced assets - but they are still creating a crisis. That’s because housing is a non-productive asset, and when you make it a productive asset, that’s a problem.

We need to recognize that we are in a trap. We all recognize these prices are creating a crisis, but no one knows a good way to adjust the prices without a lot of people having to default. Canada’s housing crisis is for the same reason as other houding crises around the world. It’s a price crisis, not a supply and demand crisis.

All those mortgages are someone else’s investments, which is part of the whole problem. The soaring investment market depends on individuals taking on more and more debt. The individuals must have debt relief, but we don’t want to bankrupt investors either.

What Canada needs to really spur growth and build for the future

We need to respond to this by improving Canadians’ capacity to restructure their debt significantly downward. This can be done through debt compromise boards and support for credit counselling.

We need to rebuild industrial capacity, and improve productivity and competitiveness by providing access to capital for Canadian real economy entrepreneurs. Finance, Insurance and Real Estate would not be eligible.

We need to run a high-pressure economy and use this opportunity to make generational investments in the public measures that will move our country forward: research, development and education; capital for Canadian companies to scale up and improve innovation and competition; full employment programs including a job guarantee as an EI option to shield against economic shocks. Major environmental initiatives so that we are actively improving the environment through the expansion of wilderness, reduction of chemical contaminants, and expansion of alternate energy options.

To all of this, I will add, that people who are talking about a “free market” today are generally not aware of this history, or that the term “free market” generally did not apply to government and taxes, because neither government nor taxes were a significant part of the economy.

The issue was that the economy and the government were based on a few aristocrats owning almost everything, with most people owning little or nothing. When you don’t own anything, you spend your life renting - giving people money for things the whole time, for things that will never be yours, and never getting ahead. And the people getting the rents are earning in their sleep. That’s serfdom and aristocracy. That’s what an oligarchy is. No matter what you’re doing, you’re always giving them money somehow.

They are “Rentiers” - and that’s what these these thinkers, across the political spectrum all agreed needed to change, and that the market needed to be free of. Part of the reason in the 1800s that people in America could get so rich and that Europe was uncompetitive while so many lived in poverty was the “overhead” cost of a wealthy aristocracy - private oligarchs - was so high.

While Communists believed in violent revolution - and enacted it, social democrats believed in reform.

What they wanted, instead of paying rent to aristocrats, was to pool their money with a government they had a say in running, which would actually spend money helping to improve everyone’s lives, instead of all that money going only to improve the lives of a few at the top.

Today, the concentration of wealth is a sign of monopoly power. There are two few owners of too many companies, and oligarchs corporate equivalent is oligopolies, and they have driven independents out of existence.

We can add to the wealth and growth and competitiveness and productivity by provicing the investment for new companies, some of which may be complementary, and which can be assigned to doing all the critical things we keep kicking down the road.

We are in the midst of an economic war. It’s about time we get real about what it takes to fight it.

-30-

Thanks Dougald. Always an interesting read. Perhaps you have some insights on this particular area of impediment to interprovincial trade? I'm in the building industry and have been frustrated for years with:

1. separate licensing by Provinces for professions like Engineers, Architects, healthcare professionals, teachers all while each profession has a national association. This hampers mobility for professionals by adding cost, discourages collaboration (which we need more of) and adds significant costs to projects with added complexity to procurement.

2. Provincial Building Codes - the NRC working with industry updates the National Building Codes every 5 years. This is then adopted by Provinces/Territories through Legislation and then Provinces draft their own codes based on the National code. Insanity!!

I've been on both the public & private sector side and the frustrations are shared by both.

These professions should follow the Construction Association's Red Seal Program that licences Journeyman to practice across the country. (Quebec has slightly added requirements for French) Codes, construction, various engineering and architecture knowledge requirements do not change by geography (I have an Architecture degree from the UofM).

This Provincial impediment is particularly egregious as all these professions/industries are experiencing worker shortages due to a demographic shift. This may/may not be the same regulatory nightmare for other industries? As far as motor vehicles are concerned, when a vehicle crosses provincial borders, there should not be more/less regulation. Road & vehicle safety doesn't change. Perhaps Provinces simply need to invest in more inspectors and work together more closely??

I do certainly share your views of neoclassical applied economics and follow Steve Keen as well. Economically, the building industry has also been assaulted by Private Equity financing which has allowed housing to become a commodity seeking higher profits above all else. This is also a global issue.

There are many challenges - economic and otherwise however, collaboration has always resulted in greater successes for everyone rather than competition - even in the building industry. Is it possible to over regulate governments or politicians? Not likely.

Agree completely with your assessment of the way it is versus the hype. Of course those committed to the hype can’t or won’t see the forest for the trees, but that is to be expected. Thanks for your work.