Elon Musk is Totally Wrong About Canada's Economy. So is Everyone Else.

He's the South African you love to hate! Also, just cause he's uber-wealthy doesn't mean he knows everything about everything. Especially macroeconomics.

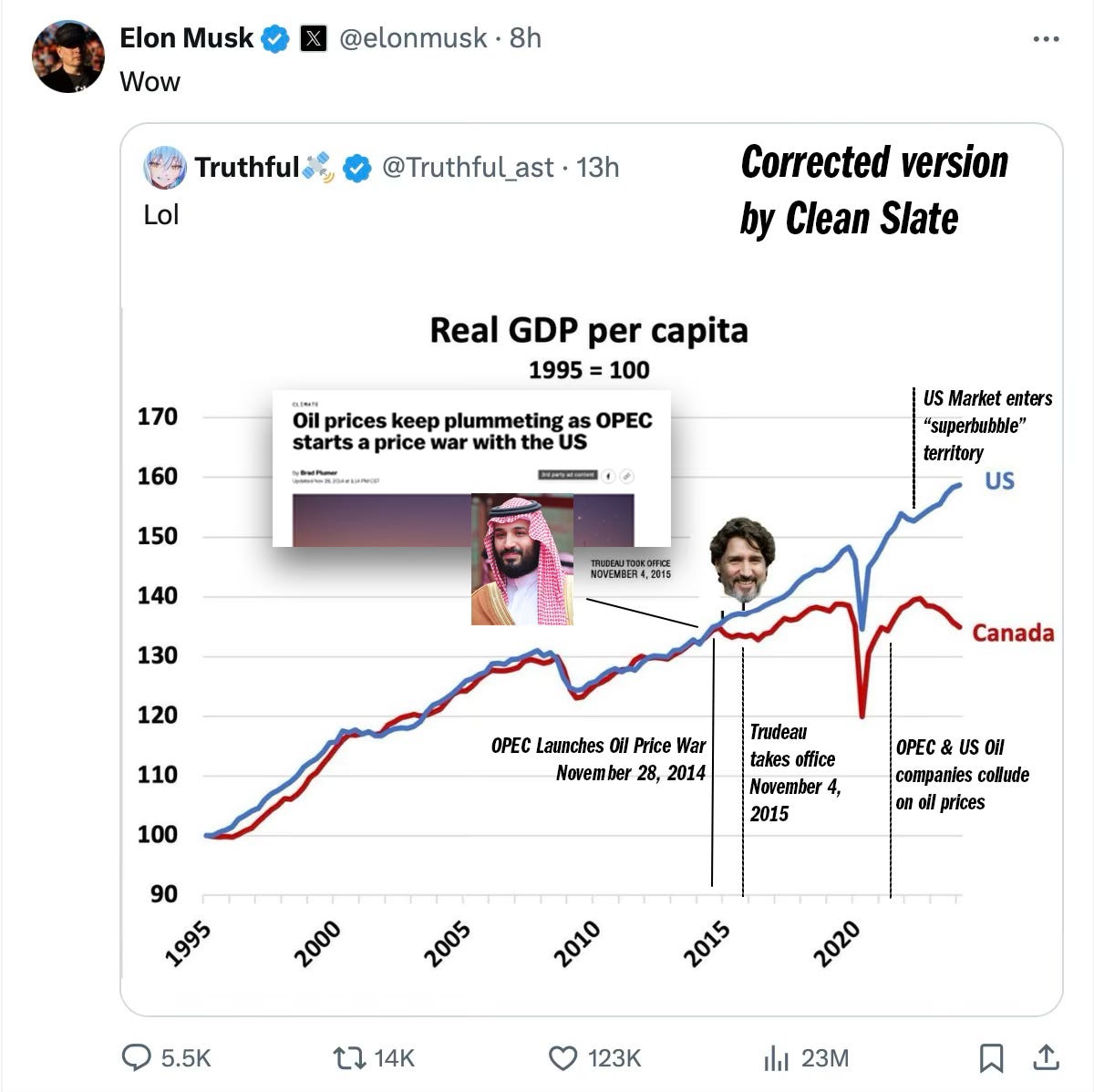

Elon Musk recently tweeted the graphic below about Canada’s economy - which clearly blames Canada’s economic challenges on Liberal Prime Minister Justin Trudeau. I’ve posted a corrected one above, that includes the thing that really matters - and actually adjust the timelines to be correct.

It’s really important, because it is quite literally one of the most important things to happen in the world, as well as to Canada, in the last decade, and everyone is pretending it didn’t happen - or that there is some other explanation.

There are a couple of thing wrong with the chart Musk is retweeting. One is that, while it’s hard to tell exactly which line is 2015, Trudeau was sworn in in November, 2015. Canada was hurting and going into a recession. While the NDP and Conservatives both promised to balance the budget, Trudeau promised to raise income taxes on the wealthiest and bring in some new social programs.

It came as a total shock. The price of oil had been over $100 a barrel for several years, and no one could imagine it going down. To give you an idea of how much money was flowing into Canada, the economy of the Province of Alberta was growing faster than China was.

Canada’s dollar has become extremely tightly linked to the value of oil. Oil is denominated in U.S. dollars, so when the price of oil goes up and the U.S. is buying lots of Canadian oil, they need to buy lots of Canadian dollars.

You can see in this Vox article from November 28, 2014 how the price of oil dropped off a cliff. The impact was swift and devastating, in ways that have never really been fully appreciated. Many people in the oil patch experienced a Depression that blew a hole in their economy and their lives, which I believe has absolutely led to political radicalization.

To show just how unexpected this was - and how the Canadian Government did not expect it to last, this is a chart from Canadian Business in September, 2015, showing that year’s Federal Budget oil Price projection (in red) which was that oil would go back near $80 a barrel. The futures market was under $70. The reality ended up being much worse.

What this really tells you is that no one saw this coming. The boom drove up the cost of everything - wages, real estate, you name it.

Banks were also caught by surprise - they were writing plenty of very big mortgages thinking that the oilfields worker would keep making $150K+ for years to come. That meant that people were left “underwater” on their houses - no job, huge mortgage, and if you sell you have no house and you still have debt. That is devastating - you have less than nothing.

People and businesses went bankrupt, governments cut back, and hundreds of billions of dollars in investments were cancelled because they were being built for $100 a barrel oil, for years into the future.

A lot of people in the oilpatch suffered through the kind of bad times that are associated with Depressions. This has not been acknowledged. Diesel mechanics making $300,000 a year lost their jobs.

So why did no one see it coming? First, it was a deliberate decision by Saudi Arabia.

This next chart shows 30 years of historic events affecting the price of oil and gas in Canada, from the Government of Canada’s page about 30 years of crude oil prices. Labelled “OPEC Fights for Market share, you can see the incredibly sharp drop-off starting in 2014, the year before Trudeau was elected. The price of oil started going up steadily in 2002, and though there was a mighty drop during the global financial crisis, it picked back up and went to over $100 a barrel for about five years. So people in the oil patch had been seeing prices go steadily higher for more than a decade.

The other thing this chart shows, in very clear terms, are the direct impacts that conflicts and political events have on the price of energy, which is included in inflation. It’s not government spending money, and it’s not taxes.

In May, the Federal Trade Commission allowed Exxon a merger but barred a U.S. oil executive, Scott Sheffield, from sitting on the board, because of evidence that in hundreds of private text messages as well as in public statements, had worked with OPEC to keep the price of oil high.

Stoller calculated that the oil price fixing efforts accounted for all of “27% of All Inflation Increases in 2021” in the U.S.

In late 2021, I noticed that the increase in corporate profits in aggregate was responsible for 60% of inflationary increases, using this chart and doing a bunch of rough calculations that have since mostly been borne out. The jump in profits in 2021 was about $730 billion, or $2,100 per person.

How do you aggregate just the oil industry? Well, it’s pretty clear that in 2021 and 2022, the industry did fantastically well, with the “the top 25 companies [making] more than $205 billion in profits in 2021,” and an “even more astounding” amount in 2022. Of course, not all profits are due to price-fixing, but $205 billion is just the top 25, not the whole industry. And profits got much much better the next year.

In Canada the same pattern happened. Companies did not invest in new production, and chose to reward shareholders instead, as this article reports:

The industry currently faces a bit of a conundrum, said Jeremy McCrea, managing director of energy research with financial services firm Raymond James: The world's energy consumption is rising, but companies are reluctant to ramp up spending to dramatically boost oil and natural gas production.

And from Statistics Canada:

In 2021, oil prices reached their highest level since 2015. As a result, the industry looked to recover the losses that were incurred during the COVID-19 pandemic. Total gross revenue in the oil and gas extraction industry increased 85.7% to $174.0 billion in 2021 from $93.7 billion in 2020. According to the Raw materials price index, the price of crude oil and bitumen increased by 70.8% from 2020, while the price of natural gas increased by 15.8%. Total production for crude oil rose by 6.2%, while total natural gas production increased by 3.9%.

In 2022, total revenue for the Canadian oil and gas extraction industry rose 53.6% to $269.9 billion, following an 87.5% increase in 2021. The 2022 increase was attributable to increased economic activity and increased demand for energy products.

According to the Raw materials price index, the price of crude oil and bitumen in 2022 increased by 49.0% from 2021, while the price of natural gas increased by 25.6%. Total production for crude oil rose by 2.3% in 2022, while total natural gas production increased by 7.3%.

Just to recap:

Canada’s oil industry gross revenue was:

$93.7 billion in 2020

$174.0 billion in 2021 (increase of 87.5%)

$269.9 billion in 2022 (increase of 49.0%)

From a CBC report August, 2022

In January, the oilpatch was expected to produce record-high after-tax cash flow of $99 billion this year, according to a report by the ARC Energy Research Institute. That same organization is now expecting the Canadian oilpatch to rake in $147 billion.

During the latest quarterly earnings, Imperial Oil posted a $2.4 billion profit, which was a six-fold increase compared to the same three-month period a year ago. Suncor Energy had a $4 billion profit, which was a four-fold increase. Cenovus Energy and Canadian Natural Resources both also collected billions in profit too.

This is biblical, what's happening- Canoe Financial's Rafi Tahmazian

"Suncor, CNRL, Cenovus — wow. Big, big windfall," said Rafi Tahmazian, a senior portfolio manager at Canoe Financial in Calgary.

"Imagine a bank machine that's broken and it's spitting out $100 bills and there's not enough people to pick them up and there's $100 bills gathering on the ground. This is how profitable these businesses are right now," he said.

There are two really important aspects to this - where those stacks of bills were coming from, and who was getting them. Obviously, consumers were the ones who were stuffing money in at such a rate that it came pouring out the other end, where it was divided between shareholders and bondholders, and not put into new production or investment.

While this may have been the oil industry catching up for a tough pandemic - and years prior - it undoubtedly drove inflation, at the pumps and throughout the supply chain. In Canada, the carbon tax goes up by about $2-billon a year. Oil companies increased their revenues by over well over $100-billion.

The other thing is that there has been a ton of automation. So that $100,000+ job has disappeared and been replaced with a self-driving vehicle.

This is what has really happened in the oil industry in Canada.

While the current federal government is always being blamed for trying to bring in what are actually fairly modest regulations and taxes, including a carbon levy with rebates for consumers, and emissions caps, when private industry would not invest in a renewed pipeline to export oil from landlocked Alberta to British Columbia, the Trudeau Government built one, which has had a major positive impact on Alberta’s economy.

It also has to be said exactly the same impacts hit parts of the U.S. as well as Alberta.

Oil Prices as a Tool of Financial Warfare

The development of shale fracking as a technology had an incredible impact on the capacity to extract more energy, and it was done under the Obama administration. For the first time in decades, the U.S. was producing more energy than it used.

In market where some producers have massive market share, there are price takers and price makers. Saudi Arabia (and OPEC) are price makers. When North America appeared to be energy-self-sufficient, people started talking about how they would no longer be price-takers.

Saudi Arabia’s decision to start a price war was a response to that. It was a deliberate effort to drive the shale companies out of business. It did not succeed entirely, as many companies adapted.

However, there are multiple aspects to a boom economy that existed in Alberta or North Dakota.

There’s the higher revenue because oil prices are higher, but the really intense investments and jobs are in the development of capital projects, which are being built (and debt financed) on the expectation of high prices. All those high-paying jobs mean that banks make bigger loans, which means higher house and property prices.

All of these bubbles stack on top of each other, and when the oil price breaks, so do the others.

The Trump administration often pushed (and is pushing) for lower oil and gas prices, equating them with political popularity. This creates an obvious problem for the oil industry, which is that they are expected to spend more for less profit. This is one reason Exxon has said they are not likely to “drill baby drill” because the untapped capacity is not there. Instead, it usually means asking OPEC to increase production.

The problem - at the end of all of this - is that there is a still a massive debt overhang, and many people have not recovered from the 2008 global financial crisis to say nothing of the oil price crash.

We are absolutely at a point of economic crisis, because the response to any economic crisis has been to offer “Monetary stimulus” which means that central banks lower interest rates, which boosts the economy by driving up the price of existing assets by having individuals and companies take on more debt, instead of fiscal stimulus, which would result in less debt.

A Marshal Plan for Revival

At the end of the Second World War - The Marshal Plan was launched to help support the recovery of European and other countries. It did two things: monetary and debt reforms, paired with new industrial investment.

Step 1: Deflating the debt bubble

To resolve the housing and economic crises, so that prices can actually normalize requires reducing mortgage debt and farm debt. There are ways to do this, as spelled out in this paper by a Bank of Canada researcher, “The Macroeconomic Effects of Debt Relief Policies During Recessions.”

“Since the Great Recession, a widely held view is that alleviating underwater borrowers’ financial distress could have prevented the sharp rise in foreclosure and dampened the fall in house prices. Moreover, preventing large initial declines in house prices might have reduced subsequent foreclosures, thereby supporting house prices at later dates and household spending over time. … I find that in a recession that involves an unusually large drop in house prices, a large-scale mortgage principal reduction can lower foreclosure but does not mitigate the recession. Instead, it amplifies a recovery.” (Emphasis mine)

This process amplifies the recovery because funds that are currently going keeping the price of housing high, or rising, can be spent and invested elsewhere by individuals. As a policy, it can also be targeted for maximum effectiveness.

The reason for the focus on household, personal debt is that it is debt that was invested in a non-productive asset - an individual’s home.

This is about negotiating down debt to prevent default, and keep the owner in their home or the farmer on their farm.

Lowering farm debt which is a result of artificially high property prices is critical for farm families.

Private Sector Recapitalization and Investment for an Industrial Plan

If individuals and households are able to redirect their spending, it can help drive a private sector recovery.

Because of the size of the bubble, there needs to be a strategy to replace lost value of debt investments with new investments in more productive enterprises, and increase access to capital, in the form of equity, not just debt.

This will provide access to capital for entrepreneurs in their own country to start up, scale up and upgrade.

In Canada, the Bank of Canada played a role in financing such enterprises in the post-war era through the predecessor to the Business Development Bank of Canada (BDC). The BDC’s mandate and practices need to be overhauled, since it now operates little differently than other banks and charges interest rates for loans that verge on usury. In the U.S. there have been small business grants and loans. Apple started with one.

This should be part of a new national industrial policy, to make investments in productive businesses and organizations - and if they are to have the maximum community return on investment, local ownership makes a difference.

Public Sector Investments for Renewal & Economic Security

There is an urgent need for infrastructure renewal that should not be delayed. Infrastructure investments are an additional factor of production, and the focus should be on public financing, because it is the lowest cost option. Private financing for such projects means higher costs on infrastructure projects that reduce costs for business and citizens alike.

It should cover:

Energy security - this includes improved infrastructure, as well as the development of alternative energy sources as a hedge against oil price volatility

Food Security - grows more than it consumes,

Health Security - We need to ensure that we have secure access to pharmaceutical and medical technology

Research and Development in Agriculture, Health, Energy and Climate Change

For decades, the pursuit of economic efficiency has been often been through financial engineering. Both resilience and flexibility depend on redundancy.

That is why an aggressive push on investments in fighting climate change - planting forests and measures aimed at rewilding, electrification and energy efficiency will all make a difference.

We need a New Deal, not the old ideas on steroids.

-30-

Very informative article. Economic theory is challenging at the best of times when calculating local variables and impacts. Understanding economics in a complex global economy is even more challenging. It’s important to keep the explanations coming and the references to Stats Canada data provides the required Canadian context. Thanks!

Good thing the oil patch has another Trudeau to blame for their woes. Just like the good ol days of the National Energy Program.

“It’s the price of oil, stupid!” Should be a mantra in Canada.