It’s the Private Economy that’s Broken, not the Federal Government

The quality of debate and coverage of economics and economic policy in Canada is atrocious. Fiscal conservatism isn't fiscally responsible: it's fiscally delusional.

The quality of debate and coverage of economics and economic policy in Canada is atrocious.

We have had two decades of financial catastrophe after financial catastrophe, yet in Canada, we have learned absolutely nothing from it, yet we are being lectured and hectored by people who have never been able to predict anything correctly, even in their areas of expertise. The fiscally conservative economic ideas they all take for granted have been shown to be divorced from reality.

Why are we listening to economists who didn’t see the 2008 global financial crisis? If their theories can’t predict that, what the hell use are they? They have been disproven.

The is a two-word reason why we are in this colossal mess: fiscal conservatism. This not just a political disagreement about the best way to do things. It is because its models and beliefs are doomed to failure, because they are disconnected from reality. They don’t describe the way the economy works.

Crashes cause deficits and public spending, not the other way around

Government spending and deficits don’t cause recessions or inflation in the private sector. The order of events is clear: markets boom then bust. When they boom, government revenues go up. When they bust, revenues go down. Private mortgages, housing and asset bubbles have led to financial collapses for centuries.

In 2008, the global financial crisis was caused by bad mortgages, bundled into bad investments, that were rated as good as government bonds. Then they had bad insurance policies written against them. All of this was made possible by bad monetary policy, and bad fiscal policy - all of which is “fiscally conservative” “free market” policy, from the neoclassical economics models to decades of deliberately dismantling New Deal policies, economics and regulation.

When government deficits exploded in 2008, and unemployment soared, it wasn't because of government spending. Governments had been balancing their budgets or running surpluses for years, in the US, Canada and the UK, whose economy and economic theories tend to be in loose sync.

Financial and private debt crises start in the financial sector and they mess up the entire economy because that’s where most people get all their money.

Banks overextend credit - they lend out money they don’t have, and the money being loaned, instead of creating new value, is bidding up the price of existing properties - real estate and stocks. When everyone is in too much debt at the same time, so much money starts going to debt payments that it starts eating into the rest of the economy.

If, to pay down all this debt, everyone tries to cut back at the same time, it makes everything worse. If it hits a breaking point, the system collapses, and it’s a disaster, because money is how everyone gets things done.

Canada’s Housing Crisis is a Private Housing Market Failure

Canada has a housing crisis - a private market crises. Builders, lenders, investors. We have a debt crisis attached to the housing crisis. But it’s all private sector. So why is the Federal Government being asked to intervene? Because the private market is broken.

Canada also has a productivity problem - a private sector problem, often solved by investing in new capital machinery that makes employees more productive, with higher wages and greater output. That hasn’t happened, because private banks loaned trillions for real estate instead.

Canada is not the communist or socialist place people claim and believe it to be. It is profoundly economically conservative. Quite frankly, you must be on the extreme right-wing to think that Canada is that far left when it comes to economic beliefs. Most governments in Canada right now have much lower taxes than in the 1950s under Progressive Conservative Prime Minister John Diefenbaker.

And there are plenty of extreme-right libertarians in Canada, and there are prominent think tanks that try to normalize their radical views, which are, quite frankly, a combination of dystopian power fantasy and long confidence scheme, and increasingly delusional theories that are divorced from reality.

Yes, Canada’s economy is in trouble - and that’s why we must act

It has been made worse by provinces, who have been, and are, obstructionist and willing to make their own citizens suffer, to spite and blame the Federal government. There was the entire PR campaign by the Premiers, that blamed the Federal Government while they were the ones doing the cutting.

If it is not hypocrisy or dishonesty, the only polite conclusion must be self-delusion.

In the last 15 years, Canadian banks alone have received over $150 billion in newly created funds from the Bank of Canada. During the pandemic, the U.S. Federal Reserve committed to printing money “without limit” where banks and corporations could unload failing stocks and bonds.

The reality of our economy - of every economy - is that the private sector is more volatile, and just as it takes big risks, when those risks go wrong, they have big losses.

But for decades, every time they blow it, they get bailed out, and the rest of us pay for it, one way or another.

That is why we have laws, and regulations, and taxes, and oversight. Because financial systems can create great prosperity, and they can destroy prosperity too, in ways that are incredibly dangerous.

Catastrophe & Turning Point 1:

The Global Financial Crisis & Canada’s $200-billion bank bailout

Canadians believe in fairy tales, Scotiabank analyst Derek Holt wrote recently, decrying government’s interference in the economy. I don’t know what fairy tale castle Holt lives in, since - as I wrote earlier - Scotiabank was technically insolvent in 2008-2009 during the Global Financial Crisis (GFC) and received over $25 billion in money created for that purpose by the Bank of Canada.

The GFC was because private banks and companies and markets were failing - and the cause was like what we are facing now.

After the 1999 dot.com crash, and 9/11 in 2001, central banks decided to stimulate the economy by lowering interest rates.

This led to an explosion in the size and growth of mortgages. People’s personal debt fuelled a property boom. Bad mortgages were packaged up into bad investments. People then sold bad insurance against the investments failing which set off a chain reaction of explosive defaults. All in private markets - many in markets that were completely unregulated.

In the U.S. the Federal Reserve bailed out U.S. banks by buying their bad assets, and giving them money instead, to keep lending.

Under the Harper Conservatives, CMHC bought $66 billion in bad mortgages, and banks received a total of $114 billion in public support. That bailout was enough money to completely wipe out the entire provincial debt of several provinces and major Canadian cities. It was twice the Federal fiscal stimulus.

Not only did Canadian banks get over $100 billion in money, but Canadians also had to endure austerity and cuts for years. Why? Because investors in the private market - including banks - took massive bets that didn’t pay off. It broke the world economy - and it hasn’t yet been fixed, because governments went straight back to fiscal conservativism. Obama’s economic stimulus was less that Ronald Reagan’s in the early 80s. Canada Federal Conservatives imposed austerity on the provinces, unilaterally. They cut health care, police, veterans, federal transfers, just about everything. The UK had a worse downturn than the Great Depression.

That meant even less money into the economy, but the government was coasting for a while on sky-high oil prices. The oil-producing regions of Canada - Alberta, Saskatchewan and Newfoundland & Labrador - had private money and public revenues rolling in.

Then the price of oil crashed - and that’s when you can see the problem really take off.

The 2014 Oil Price Crash

As the price of oil kept going up - especially after the invasion of Iraq and the war in Syria - it stayed around $100 a barrel or more for several years, until 2014. Several factors played a role - China bought less the fracking revolution in the U.S., restored oil production in the Middle East, overproduction, and the deliberate choice by Saudi Arabia to flood the market. As this paper points out, “The decline in oil prices in 2014-16 was one of the sharpest in history”

“While oil and gas extraction accounts for only 6 per cent of Canadian gross domestic product (GDP), it made up roughly 30 per cent of total business investment in 2014. Initial Bank estimates found that in the absence of any monetary policy response, the oil price decline would have reduced the level of Canadian GDP after 2014 by roughly 2 per cent (Bank of Canada 2015). The Bank therefore decreased interest rates twice in 2015 to help the economy adjust to lower oil prices.”

This accelerated the use of consumer debt to try to compensate for a historic collapse in the price of oil, which went to inflating real estate and other existing assets - when Canadians were already under a heavy burden of private debt.

The solution to that problem - the oil crash - created and built on a bigger problem, which is that the Bank of Canada in 2014 was blowing an ever-bigger housing bubble, when most Canadians had just gone through several years of austerity.

What most economists and commentators completely fail to realize, is that there is a direct correlation between private debt and public debt. When governments try to cut back and have austerity to reduce borrowing, they shift that debt to the private sector. When governments borrow, private debt goes down.

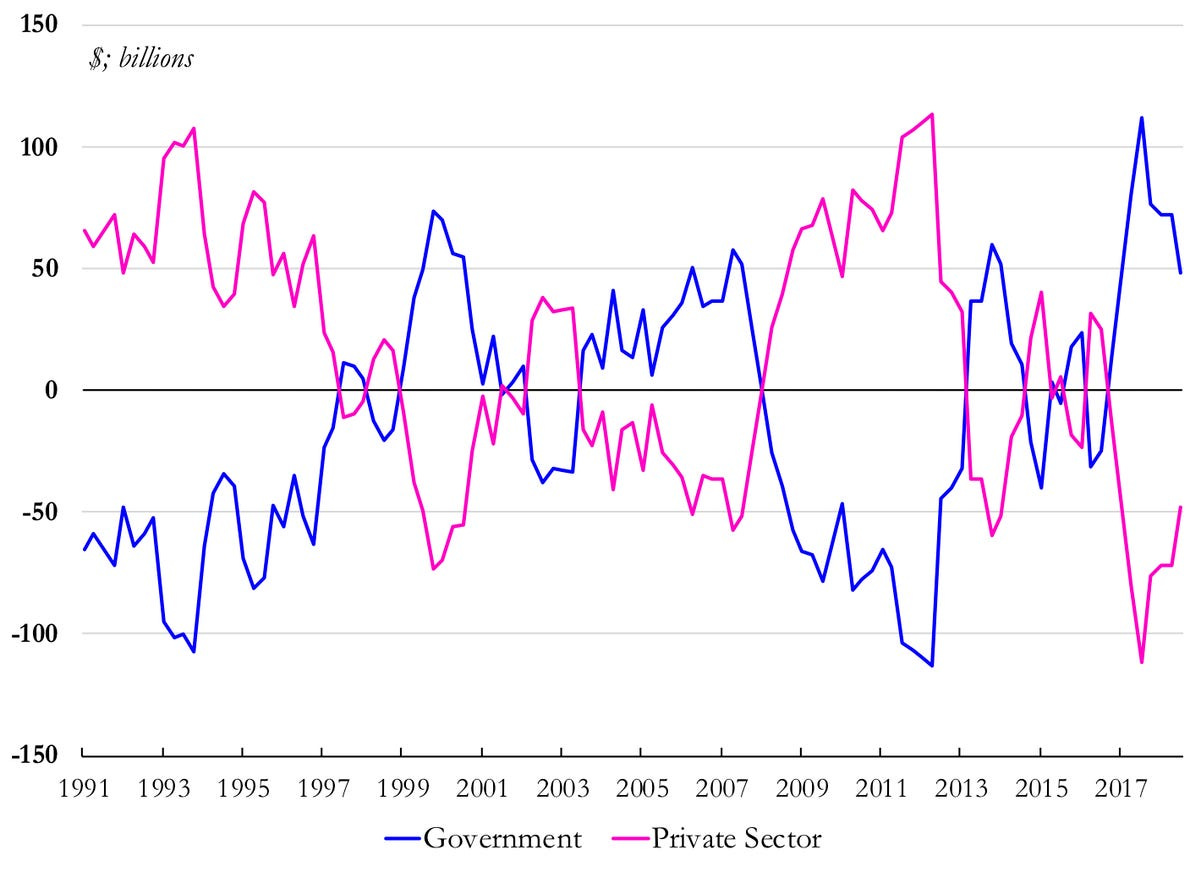

Annual Change in Financial Assets, 1991-2018

Source: Cansim table 36100580. ‘Private sector’ aggregates data for ‘Households and non-profit institutions serving households’, ‘Corporations’ and ‘Non-residents.’ ‘Governments’ is ‘General governments.’ Note: Series is the year-over-year change in quarterly values.

This is quite literally what Prime Minister Justin Trudeau was talking about when he said, “We’ll borrow, so you don’t have to,” at the beginning of the pandemic.

Many economists - especially William White - kept warning that there was a chance of a repeat of 2008, only larger, because debt had grown so much.

In fact, Canada and the U.S. were both heading into another interest and debt crisis in early 2020 when the Pandemic struck.

Then, the Bank of Canada and CMHC repeated the “winning” formula from 2008-2009. They dropped interest rates even lower.

Now, Pierre Poilievre talked about this in his “Housing Hell” video - but he’s got it completely wrong, which should not be a surprise.

Poilievre’s ignorance of economics is absolutely shocking - and to be frank, it’s not clear he is even conservative. For someone who was once Finance Critic, his ignorance of economics shown especially through his embrace and promotion of flaky cryptocurrency is absolutely mind-blowing. A U.S. Federal Reserve governor and prosecutor both referred to cryptocurrency as being as sound as investment as beanie babies were, and they are absolutely right.

So, when Poilievre and anyone else claims that it’s government fiscal deficit spending that’s causing inflation and the housing crisis, that is just wrong. Because the housing crisis is because of private debt.

The reason for the size of the Federal Fiscal deficit after 2020 was because the entire national economy collapsed because of the pandemic. Export markets, supply chains.

The federal fiscal measures were designed to replace lost revenue and income. Replacing lost income is not inflationary. It’s not an increase, it’s a replacement. That is stability. This should be self-evident.

When the private economy collapses, it triggers defaults, and insurance payouts which basically burn out the system then crash it. The economy is like software that got too buggy or corrupted and now it won’t work. We need a reboot, with better economic software.

The affordability crisis is because the private economy is not working properly, and parts of it have collapsed, because it is very highly leveraged. In spring 2020, Canada was on the verge of another recession and possibly a financial crisis, because the economy was stalling, and Canadian personal debt was so high.

Canadian personal debt got high every time the Bank of Canada lowered (or manipulated) interest rates in response to a crisis, usually undermining the fiscal response.

I am 55, and I have lived through all of this before. This happened in 1989, when I was in university, and it was for the same reason. We had had an oil crash in 1986 and then we had a real estate boom, and crashes in 1987 and 1989. There was the same craziness leading up to it as well. Instead of crypto, we had pyramid schemes, but there was lots of political unrest because of growing economic distress. Separatism, discontent.

And here’s the thing. While everyone should have learned from all of this, virtually no one has. Not anyone who is allowed a public platform in Canada. The idea that there might be an alternate economic explanation to anything, but fiscal conservatism is all-but ignored. It is the default for government accounts, and therefore for all parties.

Because fiscal conservatism or “neoliberalism” has been centred as the norm, the draconian and authoritarian political efforts to outlaw Keynesian views in public office are ignored. That’s what balanced budget amendments and laws are. Different economic theories have different outcomes for different constituencies, and these are effectively undemocratic, because they attempt to enshrine one economic ideology which will remain in place, no matter who gets elected.

Why doesn’t anyone recognize - that is extreme behaviour? Keynesian economics won the Second World War and rebuilt Europe and North America afterwards, in what is known as “the golden age of capitalism.”

Austerity kills people. It does not work. This is not a political opinion, it is conclusion based on historical evidence.

What has happened - and is happening, right now, is a 21st century financial collapse. And we’re using 19th century theories, methods and formulas and values to manage it.

In fact, our current, mainstream “economics 101” neoclassical economics does not even model money: it models a barter economy, with calculus. That is beyond inadequate.

Many of the problems in our society - and around the world - are purely financial and can be solved through purely financial means. Debt relief. Poverty. Industrial investment. Environmental restoration. Employment. Instead, we blame people.

Of course, there are limits to what we can do - limited people, resources, skills, time, energy, existing agreements, jurisdiction, political disagreements. Reality is the hardest limit of all, and fiscal conservatism fails on that test.

The NDP’s economic theories and policies are right wing

This a colossal misconception in Canadian politics. Fiscal conservatism is the default for every single political party in Canada. In fact, according to CUPE’s former top economist, Toby Sanger, the Liberals, not the NDP, are the most Keynesian - (and, to my mind, realistic.)

Since 1990 at least, the NDP in government has been a strictly fiscally conservative Party. Roy Romanow and Lorne Calvert in Saskatchewan; Gary Doer, Greg Salinger, and Wab Kinew in Manitoba; Rachel Notley in Alberta; John Horgan and David Eby in BC. These are all provinces that had majority governments of an allegedly “socialist” party that for 30 years, have cut taxes for the rich, frozen support for the poor, opposed stronger environmental regulation and trampled Indigenous rights.

The NDP have never been Keynesian. Since their first leader, Tommy Douglas, the NDP were fiscal conservatives. Douglas won his first election in 1944 fear mongering about debt levels under the Liberal government - in the middle of the WWII after 15 years of Depression.

In government, NDP provincial governments have supported billions in tax cuts, not just for the wealthiest residents, but for some of the wealthiest people in the world. When the Manitoba PC Government brought in $500 million of unfunded education property tax cuts, the NDP kept it in government. Part of the reason the NDP are doing it because they don’t have an economic model that is not an alternative to the fiscally conservative capitalism they claim to oppose, but which they have given a multibillion-dollar votes of confidence with their fiscally conservative budgets.

In Canada, NDP Governments rejected Keynesianism and engaged in austerity, and balanced their budgets on the backs of the poor - the poorest of the poor in Canada. BC, Saskatchewan and Manitoba would all take turns for child poverty capital of Canada. They all cut taxes and put a lot of Indigenous people in jail, while taking away their children, and child benefits, too.

It’s not just Canada. Fiscal conservatism is also true of Labour in the UK, from its very first election to government in 1945. While they nationalized industries - taking factories and workers into public ownership from private - they still pursued an austerity agenda between 1945 and 1951 that “broke Britain.”

That’s how far right the NDP’s record in government really is, in multiple jurisdictions across Canada. Economically, they are conservative, and because they have secure contracts in the public service, they are more likely to be protected from market forces and the cuts people who are unemployed or homeless will.

Despite fiscal conservatism being the default for nearly every NDP government in history, it is inevitably greeted with surprise, then praised by conservatives as being “pragmatic,” “populist,” “sensible,” or centrist. It is not. It is not even Keynesian; it is fiscally conservative - and that is why their policies never fulfill their promise.

Remember: this is party that people in Canada think is left wing, who are accused of being “communists” and “socialists” when they are fiscal conservatives.

So, just how far to the right are these conservatives who think the NDP are “communists?”

There’s also a mistake in thinking caring about the environment makes people left-wing. It doesn’t. The Greens are also still fundamentally neoliberal, which is the same thing as fiscally conservative. In Manitoba, the Greens campaigned on the abolition of the education property tax- one of the most progressive taxes there is, and the hardest to avoid. The concentration of property ownership is much worse than income, and when you cut property taxes, it drives up property prices. We have tax on property because property is valuable. Taxes make it harder for people to gamble on the price of land going up. When taxes are lower, investor/speculators - afford to borrow more, gamble more, and drive-up prices more. So Conservatives, Greens and NDP have all pursued property tax cuts that drive up real estate prices.

In support of this there is an entire network of think tanks that exist basically to promote and reinforce these ideas, by putting out information that is blatantly manipulative propaganda. In Canada, the Fraser Institute, and the MacDonald Laurier Institute are just two of many. These think tanks are not academic research with peer review and other safeguards to ensure the quality of the information. They put out information that is distorted, misleading, and manipulative, that give people a fundamentally false picture of the country they live in.

Again - not on ideology - but on issues of fact. And it is being done to manipulate public opinion - and it does. The Fraser Institute “tax Freedom Day” is based on socialist fantasy that pretending you have an income- and tax-sharing agreement where every billionaire and corporation is splits their revenue and taxes with you. They are not.

And again, when I say facts and evidence, I am talking about black-and-white, written on the paper-in-front of your face, auditor’s reports, cancelled cheques. Actual evidence, actual history, basic math, basic reasoning, court rulings - all ignored.

This is not a new problem. I will forever quote Keynes on this, from the conclusion to his book “The General Theory of Employment, Interest and Money”:

“… in the field of economic and political philosophy there are not many who are influenced by new theories after they are twenty-five or thirty years of age, so that the ideas which civil servants and politicians and even agitators apply to current events are not likely to be the newest.” (Emphasis mine.)

The Private Crisis Causing Public Headaches

The reaction to mere criticism or disagreement or questioning fiscal conservatism is often scorn, abuse or a spittle-flecked display of righteous indignation.

It is a “taboo reaction” designed to drive the questioner away because they have challenged a sacred idea (if sincere) or an attempt to deflect blame.

Philosopher Paul Feyerabend noted in his book Against Method that attacks on the central presuppositions that are the basis of a human community's belief systems evoked the same "taboo" reaction whether the community beliefs were theological, philosophical or scientific in nature.

According to Horton, the central ideas of myth are regarded as sacred. There is anxiety about threats to them. One 'almost never finds a confession of ignorance' and events 'which seriously defy the established lines of classification where they occur evoke a 'taboo reaction'. Basic beliefs are protected by this reaction as well by the device of 'secondary elaborations' which, in our terms, are a series of ad hoc hypotheses. [Horton's view is that] science, on the other hand, is characterized by an ‘essential scepticism’; when failures come thick and fast, defence of the theory switches inexorably to attack on it... We can see Horton has read his Popper well. A field study of science itself shows a very different picture.

Such a study reveals that, while some scientists may proceed as described, the great majority follow a different path. Scepticism is at a minimum; it is directed against the view of the opposition and against minor ramifications of one's own basic ideas, never against the basic ideas themselves. Attacking the basic ideas evokes taboo reactions which are no weaker than are the taboo reactions in so-called primitive societies. Nor is science prepared to make theoretical pluralism the foundation for research... The similarities between science and myth are indeed astonishing.

There is such thing as “Market failure”

If you were to imagine a “domino effect” of contagion, it’s clear the problems start in the private sector. The private growth of a boom, where debt is being used to drive up the costs of existing assets, raises the cost of living and doing business for the rest of the economy.

People buying and flipping real estate have been making vast sums of money. Canadians are borrowing hundreds of billions of dollars that are going into real estate - but it is not growing supply. It is pushing up prices of existing housing stock. That tells us this is a broken market.

Sometimes markets fall apart, not because there is too much government or regulation, but because there isn’t enough structure and regulation to ensure it functions properly, and that people get paid. There is an economic term for this - “market failure” - that seems to be completely alien to Canadian commentators.

So, let’s get to the point.

The Bank of Canada and private sector lenders caused the crisis in affordability and housing

I do have a litmus tests for the credibility of economists and commentators.

Did they predict or foresee that there was a threat to Canada’s economy that could collapse our banks?

After the collapse happened, did they learn any of the lessons from these catastrophes?

If the answer is “no” to one or both, I have to question their credibility, and why they may be treated as experts. For example, former Bank of Canada Governor David Dodge, who has been making alarming predictions about the 2024 federal budget.

On January 31, 2008, Dodge wrote in the Bank of Canada 2007 Annual Report:

Within months of that statement, Canada’s banks were technically insolvent, and required an injection of $114 billion to keep afloat. GM needed bailouts, and there were job losses and austerity for years. Dodge had been Governor for eight years, and did not see it coming.

When the collapse hit the UK, it was Queen Elizabeth who pointed out the economic emperor had no clothes, when she asked why no one had seen a massive crash coming. For years, no one could explain.

As Central Bank experts will tell you, it’s central bank policy that has gotten us in this scrape, and it is people with these broken ideas who are still, to this minute, making the situation worse by relying on economic theories whose assumptions and conclusions are both delusional and, when implemented, cruel.

All that mortgage debt is what is fuelling both Canada’s economic challenges as well as its political fury, because the very people who have created the problem - the fiscal conservatives who have set fire to the Canadian economy - insist that the government should not intervene to put it out.

All that debt - everyone’s mortgage debt - is preventing prices from going down. Because people can’t afford to sell at a loss.

What we need to do to make lower housing prices possible, without crashing the economy, is to reduce that debt. How can we bring down housing prices when it means that bank assets will shrink? How can we pay for it?

The Bank of Canada and CMHC and the banks created this problem, the Bank of Canada and CMHC and the banks can fix this problem. That is what they were both created to do: to help fix the economy when it’s broken.

Canada had no central bank until 1935, and when it was brought into creation, it helped finance an incredible recovery in Canada.

If there is another crisis, why wouldn’t we consider doing something different, since the other solution of QE and interest rates clearly have not been working?

Canada needs a Two-Step Monetary Correction to fix its economy: debt relief + new investment

We can say there are three fundamental problems with Canada’s private economy, all linked:

Excessive private (household) debt

A housing and affordability crisis driven by that household debt

An economy that is not productive enough

These are all linked, because the Bank of Canada and private lending policies have poured trillions of dollars into inflating the price of real estate, not into other types of investment. Private industry has lost out, and so has public infrastructure and health care modernization, energy efficient infrastructure, transportation and more.

What we need to do is:

Deflate (not pop) the housing bubble by reducing people’s personal debt. We should be keeping people in their homes & farms. Debt doesn't have to be wiped out, just reduced to a manageable level.

Reinflating the productive economy by:

Improving access to capital (especially patient money) for entrepreneurs and innovators, with a focus on “real economy” businesses.

Making public investments (supporting Canada’s federal, provincial and municipal governments) to support the change

This is what a Marshal Plan is, and was - debt reduction on the one hand, reinvestment on the other.

We need to reduce people’s monthly debt payments, significantly. The focus is on individuals, not businesses or investment properties. It should also include individual family farms. It is does not have to involve complete eradication of debt, except in special circumstances.

However, let’s be very clear: this is something that the Bank of Canada can do. It is entirely within its power to finance this.

Structured debt reduction has been a long-standing recommendation by William White, who has consistently warned that developed countries are not only in danger of debt crises, but they do not have adequate means to deal with it.

“Recently, the OECD, the IMF and the Group of Thirty have drawn attention to serious inadequacies in the legal framework for restructuring private sector debt in many countries. Laws are poorly drafted and the judicial framework is inadequate. There are not enough «out of court» deals, nor specialized judges, nor adequate flows of information, nor adequate enforcement. All of this could and should be dealt with.

The defaults are going to happen: they are inevitable. The challenge, as White says, is that people do not want to lose money - and the people who lend the money tend to have a lot of it.

This is the essential step in addressing Canada’s housing and affordability crisis. If mortgage debts and payments can be reduced, people can sell without fear of a loss. This actually lowers the price of housing and makes it more affordable, while helping to preserve the owner’s equity.

This is something the Bank of Canada, CMHC and lenders can work out: both the BoC and CMHC have had no trouble finding hundreds of billions of dollars to bail out banks, which has contributed to the crisis.

If the Bank of Canada is going to be independent - and stay independent - it must nevertheless have some kind of mechanism for accountability when it makes mistakes and does harm.

Otherwise, the result is what we have: an economy across the OECD that’s a casino where the high-rollers never lose, even when their bets go against them. But the rest of us - workers, other businesses, and democratically elected governments, all must pay the price.

A better economy means rebuilding the public and private sectors

Lots of people who are freaking out in this crisis - pushing towards the extreme right and left. Both extremes take the “simple” solution, which they think the “other side” is the problem, so they react by wanting to get rid of them.

The right blames government or “the state” and want to tear it down. This will not fix the private sector. We need more stability and law enforcement with justice, and it must serve the public interest, not just private interests. That means taxes and government.

The left may blame “capitalism” and want to tear it down. There is lots to criticize, and may be very compelling. Both the right and left may point to terrible things done by states and corporations alike.

Radicals and activists may be excellent advocates and at describing the ills of a society, but falter on solutions.

Further dismantling government or taking over the private sector are truly violent disruptions.

Questions like “How will you enforce the law fairly”, and “How will people make and pay for things,” or “How will you actually get things done?” go unanswered. Too often, the answer is the assumption that the problems will disappear, because the government or the market will fix it on their own. They won’t.

In 2022, White co-wrote a piece with Sunil Sharma:

“What is needed are structural reforms that rebalance power between capital and labour, reverse the concentration of market power, redefine the role and operation of corporations, restructure debt where needed, make production systems and consumption preferences more nature friendly, redesign the social contract to benefit the majority, make our governance mechanisms more accessible and transparent, and incentivise politicians to work for the common good. The urgency of beginning this transformation must be emphasised. We could be only one serious economic crisis, whether inflationary or deflationary, from significant political turmoil.

Solutions: New Investment & Debt-for-Equity Swaps

The key to success is, ironically, to create what neoclassical assumes happens, but doesn’t. If we use debt relief to deflate the value of mortgage debt, housing and the financial sector, we need to a complementary investment in rebuilding both public institutions as well as the private economy.

An effective debt restructuring regime will relieve the burden of debt from consumers, which means that their spending will go to more productive purposes, because Canadians and investors are massively over-invested in overpriced Canadian real estate. Lowering debt costs would allow people to spend more in their local economy. It would relieve inflationary wage pressures. It could make housing more affordable.

Making investments in renewal, is the second, critical part of this, to return to a more dynamic market, that is more productive has more Canadian ownership and better jobs and more competition. (Governments should consider breaking up monopolies and oligopolies, and not approving more mergers.)

The Need for a National Plan for New Growth

For decades, the search for growth to get out of recessions - and pay for debt - have been “free market” and fiscally conservative ones. Tariffs around the world have been dropped. There are no tariffs at all between provinces in Canada.

Canada has many taxes that are lower than the U.S. and other countries. Canada’s corporate tax rate has been reduced from 30% to 15%. The small corporation tax rate is 9% federally and in some provinces, it is zero. The federal goods and services tax was reduced from 7% to 5%. Under the Harper Conservatives, the size of the federal government was 15% of GDP, the smallest it had been since the Depression.

The result of this was not investment in productivity, or new businesses. These policies increase returns for existing businesses, not new businesses and innovators. Their challenge isn’t paying taxes: it’s getting access to capital and paying bills while getting off the ground.

We can get Canadian pension plans involved in investing, but the reality is that funding business development by having the Bank of Canada support the Business Development Bank is also reasonable and feasible. This is not about “inflating” prices - it is about the creation of new and lasting value.

We need a national plan in three senses of the word:

First, it needs to apply across Canada, and

Second, it should be Canadian capital,

Third, it should be Canadian owned businesses.

What is required is access to capital through business development, especially “patient capital” in the form of equity, not just debt. Here, too, the Bank of Canada could play a role.

Local Canadian headquarters means a higher wage footprint in the local economy. The CEO and executives make more money and pays more taxes when they live in Canada. That is better for the private market and public finances.

The pandemic showed us, we need to be more self-reliant. Canada has vast resources, but we don’t add value to enough of them before export. We also badly need to rebuild industrial capacity across a series of sectors.

We need to have greater economic security when it comes to health, (including pharmaceuticals) food, and energy. This is also an opportunity to make a meaningful shift when it comes to climate change.

Three points here:

First, people sometimes make the mistake of thinking that this is a call for uncontrolled money creation. It is not. It is about allocating new money to new value creation, which is not inflationary, and it has its limits.

This is about bringing the private economy back to a place where it is creating more good jobs, we’re more productive with, with greater shared benefits for everyone, and with less of an environmental impact than right now.

Now is the time to act, because the longer we wait, the harder it will be to undo the damage. Central banks and governments have proven one thing in the last 25 years: it is impossible to run out of money. The constraints we face are not financial. They are whether we can get rally enough people, machinery and energy behind a plan, and get the work done. And if anyone doubts that, we have to ask - if we can’t afford this, why can central banks always find the money to bail out the financial system?

This is what Keynes meant when he said, “Anything We Can Do, We Can Afford.”

• DFL

We live in the same country. Swap out Canada for Australia, oil for gas, coal and iron ore, change the party names; the rest of the story is exactly the same, and our First Nations both know it. Except for The Greens - the Australian Greens are not neoliberal. Most sit somewhere in a scatter plot between Keynes, socialism, and ecological economics, which of course means being pilloried in the corporate media for being “lightweights on economics” or “watermelons”. Meanwhile, our Labor federal treasurer - economic lightweight Jim Chalmers - is being congratulated by the likes of the IMF for his fiscal rectitude, running a surplus while ordinary Australians go down the toilet. Or, down 3 toilets since one is not enough if you’re borrowing a million bucks for it. Amusingly, Treasurer Chalmers is quite a fan of Mariana Mazzucato, whom I suspect is now trying to “save” capitalism.

My reading of Keynes was that he was trying to save capitalism from itself, and from Marxism. But after trudging through some “New Keynesian” literature it is clear that the capitalist “mainstream”, our new version of what Marx called “vulgar economics”, has done him in. If capitalism can’t accept Keynes’ gift, I doubt it can be saved from itself. The false reality of Economics can’t be saved from itself either.

LOL. Hayek, Friedman, Popper et. al, are my favourite enemies. Their brilliance at creating an ideology that has conquered the world cannot be denied, yet in entirely rejecting Marx’s method of analysis they blinded themselves to its consequences. They deny the “social” is a valid unit of analysis, yet what did they call themselves? The Mont Pellerin Society! Trotsky was right too. Changing the owner from the capitalist to the state just replaces one ruling class with another, and fixes nothing. As we have seen more recently in Russia, changing the ownership back to capital didn’t give people back their “freedom”. Collectivisation should mean ownership of the enterprise by its workers, not the state. 1 share and one vote, which cannot be sold, an equal share of the profit, and they vote for their CEO and board.

Yanis Varoufakis, amongst others (including The Greens in NSW), proposes something like this, and I think it is interesting. Part of the puzzle at least.