Keybernomics: A New Economics for the 21st Century Based in Science & Human Value

Uncertainty, Information, Control & the Money Economy + Microfoundations of MMT

I’ve written a manuscript that explains some ideas around money, and the money economy, being information.

I’ve tried to distill my ideas from many years of work, including a couple of conference papers, a Master’s thesis, lectures I delivered, and this blog.

The power and flexibility of information are so great that we can use it to make models—machines made of information that interpret and process information, send commands, and get feedback.

It’s clear that money is a kind of information.

What is notable is that the incredibly successful field of information theory, developed by Claude Shannon and Norbert Weiner in the 1940s and 1950s, describes all the details of these information processes.

Communications theory, cybernetics and game theory can be thought of as increasingly complex dimensions of information theory. Our senses are information, we communicate through technology, effective medication is information, our DNA is information and rules, laws and regulations are all also information.

There is no energy free lunch. All information and systems have a real cost in energy and work to keep running, and all the atoms and molecules still follow physical, chemical and biological laws. Information behaves differently.

There are a number of important consequences of recognizing that money and the money economy is informational, including the central importance of uncertainty, or missing information.

My Master’s thesis was in English Lit, but it focused on the application of information theory in the humanities as a basis for discussing language and meaning.

I’ve called it “Keybernomics” - combining “Keynes,” “cybernetics,” and “economics”. However, it is not a particular ideology or political arrangement.

The goal here is to provide more rational and evidence-based foundation explanations for pricing, inflation and distribution, and because the evidence is different, so are the possibilities.

The point here is that it does not describe the way a system must run. It describes how a system does run. It describes how the “mechanics” of economic interactions function differently when we correctly recognize the way informationinteracts.

This means there are different explanations for commonly understood economic phenomena, including supply and demand, inflation and interest rates, money creation, and the distribution of wealth and income.

Prices are not about supply and demand, they are about the buyers and sellers control over supply and demand. This explains power imbalances in bargaining as well as monopoly / monopsony pricing.

Inflation and interest rates are clearly related to uncertainty. When uncertainty goes up, so do prices and interest rates

Information can be created and destroyed (or deleted) and so can money

Uncertainty, risk taking and distribution of reward are all linked. High risk gambles mean many losers, and few winners. Moderate risk ventures result in more winners and less concentrations of wealth and income.

Here is the Introduction..

Keybernomics

Uncertainty, information and control are key to every aspect of the mechanics of how Money, interest, inflation, debt, lending, borrowing, buying, selling, renting, trading and governing all work.

“J.M. Keynes and F. von Hayek had completely different views about the meaning of the term “uncertainty” as it was related to the concept of knowledge. Keynes viewed uncertainty through his concept of the weight of the argument, V, (a logical operator) and weight of the evidence, w (a mathematical variable). Uncertainty, U, is an inverse function of w so that one can write U=f (w). The existence of complete, relevant knowledge requires that w=1, where w is defined on the closed unit interval [0,1]. A degree of uncertainty occurs if w<1. A w<1 means that the relevant knowledge is not just incomplete but is missing and/or not available to any decision maker. A w=0 means that there is no relevant knowledge. Keynes viewed the case of 0 Hayek’s definition of uncertainty is that relevant knowledge is completely dispersed into small or tiny bits and pieces. All of the total information/knowledge is divided up among the set of decision makers. However, this dispersed knowledge, while scattered, is complete. Market prices concentrate this dispersed knowledge into a form that alert, savvy, knowledgeable entrepreneurs can understand and act on efficiently. Market prices concentrate the relevant knowledge so that uncertainty is eliminated for savvy, smart, alert entrepreneurs. This is equivalent to arguing that w =1 for alert entrepreneurs.

Keynes’s and Hayek’s definitions of uncertainty directly conflict with each other. Keynes argues that, especially in the case of producer goods, w, while w is not equal to 0, is little, flimsy, vague, ambiguous, small, fluctuating, and tiny. The prices of producer good DO NOT concentrate the knowledge so that savvy, alert entrepreneurs can act on it efficiently. Hayek argues that they do. The conflict over the meaning of uncertainty is insurmountable. The Hayekian outcome is not possible in a world of Keynesian or Knightian uncertainty.” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1751569

This was one of the major disagreements between Keynes and Hayek. Keynes is correct both in his definition and his conclusion, and Hayek is in the wrong.

Hayek’s mistake is in thinking that uncertainty can be avoided, or that the missing information that is creating uncertainty can be found or accessed collectively. Uncertainty is a fundamental obstacle in our experience of understanding the universe.

Uncertainty is missing information; it can never be made entirely certain.

Because human beings cannot experience perfect knowledge and we live in time, not knowing what the future will bring.

If total uncertainty = zero, and total certainty = one, we cannot reach one.

Assuming that we can amounts to an assertion of omniscience: that someone can see all and know all including the future. No human can. Uncertainty is missing Information. We are always missing information, and therefore are always in a state of some uncertainty.

It’s been said that the goal of economics as an understanding of human interactions and self-organization is that it can eventually be linked to biology or another hard science.

There is a unifying link, at a deep level, around understanding and coping with the consequences of living with uncertainty - defined as missing information, and the remarkable consequences of seeing money and the money economy entirely as an information and information processing system.

All that value is human value. The value is related strictly to human appetites, and the capacity or willingness of other human beings to satisfy those appetites.

Money is a kind information we use to control other people.

What we are dealing with are societal structures - cultures and habits - that are themselves made of information.

On the one hand we have the real world, where every day every human needs oxygen, and food energy, and water to live, as well as shelter, warmth, defense, medicine to survive. We deal with the seasons, other people, and all the threats and opportunities that face us, where there are physical and real-world limits that cannot be overcome.

Next to the real world, we have communications, and interpretation, interaction and control with feedback.

Information and Entropy: Order has a Cost

Two of the most fundamental implications that information theory has for economics are that

1) There is a link between information and entropy, and

2) Maintaining order has a cost.

Entropy is the degree of organization in a system. While it is generally accepted that entropy, or disorder always increases, that is only in a closed system: in an open system, with energy flowing into it, order can continually increase. One way of thinking about this is that you can fight decay through continual maintenance and effort. For systems to be stable or self-healing - whether artificial or biological - there is a cost in energy, effort or work.

Philosophers have given considerable thought to issues of freedom, and the broad definition of a free market is one that is free from outside regulation, self-regulated by its members. In this context, regulation or order may seen as being in opposition to freedom. However, entropy and information run on a continuum between total order at one end and chaos at the other. The maximum amount of “freedom” - the number of possible messages that can be sent by a code in a given communications channel - is found at the midpoint, between chaos and order. This is because the goal of information theory was to send a message over a noisy channel. Too much order or too much noise both restrict the number of possible messages that can be sent.

Another way of thinking about the two poles of entropy and information is that total order is the same as total certainty, and chaos means total uncertainty. Total certainty and order might, at first glance, seem desirable, except that it achieves total certainty by relying on total inflexibility, because it means you can only ever send one message, no matter the circumstance. A message that is always the same fades into the background as noise - the same as the noise of chaos, because it cannot communicate anything “new.” Information is about resolving uncertainty. A message that is always the same has no uncertainty to resolve.

So, on the continuum between chaos and order, the maximum number of possibilities are in centre - but the number of possibilities still depends on the structure of the code. There can be multiple codes that are at the middle of the continuum, but not all will offer as many possibilities, or “freedom”: it depends on the codes’ specific design, or shape. (Campbell, 1982).

Weiner and Shannon realized that sending a message was linked to the idea of entropy by uncertainty. How could a listener know what message the sender was conveying? Sender and receiver each have the same code, which sets out all of the possibilities, providing a matrix of likelihoods. There are many possibilities, but the actual message that comes through reduces uncertainty.

In information theory and cybernetics, greater certainty and order is achieved through redundancy. The redundancy and order that is required to make a coherent message possible requires both structure and energy.

Wiener’s insight in cybernetics was that information can send a command, using the same language you would use to convey any other kind of information. The only difference between “the ball is in the yard” and “go get the ball in the yard” is that one is in the “imperative mood” — it is an order.

Weiner coined the term cybernetics “from the Greek word kubernetes, or “steersman,” the same Greek word from which we eventually derive our word “governor” and “government.” (Weiner, 1954). The Greek steersman would lean on a rudder like an outsized oar - he not only controlled the direction of the ship through continual shifting movements, but the oar was also a source of information about the speed and movement of the ship in the water. Weiner wrote:

“In giving the definition of Cybernetics in the original book, I classed communication and control together. Why did I do this? When I communicate with another person, I impart a message to him and when he communicates back with me, he returns a related message which contains information primarily accessible to him and not to me. When I control the actions of another person, I communicate a message to him, and although this message is in the imperative mood, the technique of communication does not differ from that of a message of fact. Furthermore, if my control is to be effective, I must take cognizance of any messages from him which may indicate that the order is understood and has been obeyed.” (Emphasis mine).

The very first words spoken over a telephone, by Alexander Graham Bell to his assistant, Watson, were both communication and command: “Watson, come here. I need you.”

Cybernetic processes mix information and physical intervention - an order or command that triggers an action, as well as a process that controls the execution of the command by feeding information back to the controller - feedback.

It should go without saying that human beings are informational, from the information in our DNA which governs cellular development, to the information from our senses - chemical information for taste and smell, light waves for sight, sound waves for hearing, heat, cold, pressure and more for touch. Our nervous system, language, communications and interactions are all mostly informational. Even our reproduction is one set of genetic instructions combining with another set of instructions. Viruses take over our cells and command them to make copies. Our bodies and our societies alike are complex systems regulated by feedback loops that depend on countless types of information.

The bonds between humans - the ties that bind - are informational: they are interactions of communication, and control with a feedback loop, and the bonds that tie us to our property are likewise informational: owning land usually requires a record of ownership backed up by a rule - property rights.

All of this self-ordering requires incredible amounts of structure which has a real, continual cost in energy for all living organisms. It is an existential need. What is more, living beings engage in the strategic pursuit of resources in order to ensure they don’t run out of energy.

Engineering and material science offers an analogous situation.

While diamond is the hardest material, it is not the strongest, because it has carbon atoms locked in a tight, regular matrix. This makes it brittle, because its highly ordered structure means that when struck, energy can pass readily down planes of atoms, separating them smoothly. The strongest substances tend to be tough: they combine hardness with flexibility: composite materials, for example, that have fibres of hard material embedded within a flexible matrix. (Gordon, 1991)

Just as the specific design of a code matters when it comes to maximize the number of messages, so too does design matter when it comes to the transmission of failure and cracks in structures. As engineer and author J.E. Gordon noted, it is possible to design very strong structures with enormous holes in them that do not weaken the structure at all, while very small holes of the wrong shape, in the wrong place, can lead to concentrations of stress that can travel and pose a threat to a structure as a whole.

In engineering, design, and in indeed, in biology - there are structures and designs that act as barriers to risk, or shock absorbers. This is also necessary for information systems in order to preserve stability and order: informational structures also require, and set out, boundaries. Files on computers are separated into distinct entities, even though they may be 0s and 1s next to one another on a memory chip. In the economy, land and territory is subdivided into different properties, even though they may share borders, the money in banks is separated into different accounts and ownership of corporations is separated into shares.

Information and structure

A code can be extremely compressed, and it is also consists of information. It can be thought of as a set of rules and instructions.

Take the example of the game of chess. The rules of chess can be written on a single page that describes the board, players, and rules for how each chess piece can move, and how the game is lost and won.

That can be thought of as “the code” of chess. Imagine that code expanding and unfolding itself into every single combination and permutation of chess moves. That is “the matrix” of chess. It is a matrix in the sense of a mathematical table, like a spreadsheet where the outcomes of every move in every combination of chess games are listed.

Another example is DNA. At conception, a single fertilized egg has all the genetic code that that eventually shapes which ever human or animal is born.

The ovum is the code, the living breathing human is the full expression of that code.

However, humans are unique in being powerfully cultural, in ways that are also defined by information and how we experience the world. Language, ritual, interpretation, meaning, learning, ideology, are all cultural.

One of the defining features about certain human beliefs is that they are fundamental beliefs that are the basis for a shared values and commitments around which communities organize themselves.

These are the codes that comprise a human worldview, where certain statements and guiding principles define what has meaning.

For example, human communities may organize themselves around a body of knowledge - physics, chemistry, medicine, or on the basis of faith or economic organization.

A worldview has two important aspects in that it can be imagined as the “lens” or coda of how people experience the world. People experience the world differently both as a matter of physical differences as well as cultural interpretations.

This code is how people interpret the world. Each experience is unique, and some interpretations may be idiosyncratic, or at odds with but this is how people are experiencing the world, so it is how they will react to the world.

By changing the worldview, you change how that person interacts with the world, both on a day to day, as well as how they expect the world to work, and what they will accept as real or relevant.

To compare a worldview to the rules of chess, the unfurled matrix of a given person or culture’s worldview establishes not just what is meaningful, but it the defines the contours of their reality.

This is true whether people embrace spirituality or science.

It’s also important to note that one of the reasons that humans are so adaptable, and flexible is that we have a whole bunch of automatic systems in our bodies that adapt to a changing environment so that we feel the same internally, even though there have been major changes in our experience.

The term is homeostasis, and simple and basic examples include our body temperature staying the same despite outside changes, or our eyes adjusting to changes in brightness without us thinking about it or noticing.

We are built to continually adjust to our environment, to adapt and to change.

While the information in our DNA is hard-coded, culture, by its nature, is information. The human beings that we become is from the language, the beliefs, the music, the recipes, the laws, the political values, the political actions, the contracts, the organizations. Our social bonds are bonds of information.

While there will be people who are find this notion uncomfortable at first, consider how many formative experiences or ideas you have experiences that were cultural, or based on lessons from a great book or other work?

Thinking of these profound aspects of our identity as being informational can be uncomfortable, because as an explanation it seems reductive and insufficient. People don’t want to accept it, because people will think, “Is that all there is?”

I think the reverse is the case, because we need to consider that if life is information, and information is life, what are the implications about a universe where information comes to life?

We need to re-evaluate the way we think about information, and not dismiss it as something embarrassingly material when life itself is an information process.

When we start to grapple with the full implications of the way information works, we still cannot explain the subjective experience of consciousness. We can describe the chemistry and information of pleasure and pain, but we cannot explain how we experience pleasure and pain.

There is a mystery there that we should not shoo away. We have to be humble enough to acknowledge that there is no explanation for feeling and consciousness as a phenomenon.

When I say there is no explanation, that means we don’t have to fill it with an explanation. It means it’s something we can never, ever be certain about.

This mystery is larger than all of life. The question is “What are the implications that life is informational is a fundamental aspect of the universe?”

The other aspect of information is that it is not just about communication, and interpretation. It is also about control and feedback.

You can write Instructions, orders and rules in the same language you use for communicating facts or news. The difference is this information controls what you do. The only difference is that it’s in the imperative tense.

Commands are also a type of information, and they can include orders and signals that trigger a physical action. Pushing a button, pulling a trigger - any deliberate action, and autonomous ones, too.

When you combine the command of an action with a feedback loop, you have a self-regulating process that automatically adjusts itself in pursuit of a particular goal. That’s what cybernetics is. It was coined by Norbert Weiner, in his book with its singularly unpleasant title, “Cybernetics: The Human Use of Human Beings.”

The word cybernetics comes from the Greek Kubernetes, or “steersman”. Greek ships had a single long oar as a rudder, which the steersman would lean on, moving the oar in response to the feedback from the ship, the water while aiming for the destination. It’s the same origin of the word “government.”

Information Theory and Cybernetics gained yet another dimension with the development of game theory, by John von Neumann.

Von Neumann asked what happened when you had cybernetic processes with different strategies competing against each other. Who wins?

Well, whoever wins, we all know it’s never just a question of the players. It’s the rules of the game, if any. And if there are rules, whether they’re enforced.

The challenge of life is coping with uncertainty - the unknown.

The significance of understanding the many ways in which human organization itself is based on information, control, feedback.

You would think that looking at money and economics as being explained by information would be clarifying, because the entire economy is money, rules, organization and enforcement. It always has been, but it’s particularly clear today, when all banking is digital and electronic. It is all information, commands and controls and automated terms, like interest generation or fees.

We should be able to model the entire economy as information much better than we do, because the entire economy already runs on information technology.

We are still relying pre-information revolution scientific ideas to model economics. Models have been created based on science from other disciplines, like 19th century civil engineering, or 19th physics and thermodynamics, or steam engineering. All of them still valid in their disciplines, but they have been used as mathematical metaphors as people used those worldviews to try to explain the economy, when the economy itself was informational.

That has important consequences because money, capital and debt, as information, can be both created and deleted or erased.

It also has important consequences because the rules that govern the way information actually works are counterintuitive to the way we tend to think.

As an example, we naturally think of the Newtonian idea “for every action there is an equal and opposite reaction.” That idea that there is a direct relationship between effort and results, which is usually a fact of life in the physical world - the world described by physics - is not the case when you’re dealing with information.

With information, a very large amount of information may have no impact, and a small amount of information may have a huge impact. It’s like finding the right code to unlock a safe.

Because information is about more than just communication. You are also dealing with interpretation and control and self-adjusting behaviour in response to external changes in pursuit of a goal.

That describes human beings as individuals as well as operating collectively or in a corporation.

Because money and the entire structure of any given society is based on information and knowledge and belief, information doesn’t face the same constraints or limits that the real world does.

Constraints like health, and natural disaster, and bad crops, or outbreaks of disease, or running out of supplies of raw materials, water, energy.

Once we better understand the information and, information systems in all their forms, both natural and human-made, it sheds light and understanding on many problems that appear paradoxical or inexplicable intractable because our assumptions about the way the economy should work are based on physics models. With technology, changes in innovation change lives, sometimes for worse.

The real economy has to contend with the real world of weather, accidents, and illness, as well as the real benefits of innovations in health that have saved countless lives.

The money economy is much more driven by changing rules.

The difference between the structure of information as opposed to physical structure is illustrated by the paradox of the Ship of Theseus. Imagine a wooden ship whose parts are replaced as they wear out until, over a period of years, every part of the ship is gradually replaced with a new part.

Is the ship still the same ship? As far as its informational form, yes. In terms of physical pieces. no.

If instead of a ship, you come up with something that is informational - a book for example. If take words out of a story and replace them with the same words, it’s still the same book.

Information includes patterns, designs, codes, structures, formulas and instructions as well as senses, sensors, rules, strategies, and goals.

Living with Uncertainty

When we consider the factors that indicate and drive the economy, the fundamental issue of uncertainty as missing information - and human efforts to cope with and reduce uncertainty pervades all aspects of the economy.

The fundamental issue is one of uncertainty.

The goal for humans is to reduce uncertainty, and increase control.

At the level of biology and non-rational response, anxiety and fear are due to missing information. Anger and violence are often a response to disorder and are an attempt to assert control.

Money is a form of information as point system that we use and negotiate to get other human beings who use that currency to coordinate and perform tasks.

At the level of community and society, laws, regulations, contracts and reliable enforcement increase certainty.

Prices are related to control over price and control over demand, both of which are subject to uncertainty for partners in a deal.

Interest rates and inflation are both affected by uncertainty. When there is less information and more uncertainty, both interest rates and prices go up.

Fiat money and legal tender are informational and can be created and deleted by government, which has a monopoly on its creation in forms that are accepted everywhere. By law, governments are the originators and source of money.

Other forms of money can also be created. Any individual can create an “IOU”.

Mortgages and loans are generally a form of IOU where the loan contract is a promissory note. The customer’s promise to pay, backed by an asset, is the basis for a commercial lending institution to extent private credit.

This too is information. It is an extensions of bank credit in the form of loans. These extensions of credit are possible because there is a continuous cycle of payments back as well as security against an asset, usually property.

This is also a reflection of the informational quality of money. It is software, not hardware, and part of the reason its functions as effectively and flexibly as it does is due to its dynamic and flexible nature.

That is because money is something we use to get other people to do something, and situations change and vary, including the number of people.

Too much order and too much chaos reduce the number of possibilities, which are at their maximum with a system that combines enough certainty through structure, and enough freedom to maximize potential responses. This is one of the core aspects of information theory.

Uncertainty is related directly related to probability, and the assumptions about an expected likelihood of an event occurring that are baked into expectations of economic returns. If there has been a period of stability, prices at that point are based on certain assumptions, and when an unexpected event occurs, it creates uncertainty, whether it is conflict, disaster, or an accident, and whether it is a human or natural disaster.

When circumstances change, there is greater uncertainty. The number of “unknowns” has increased.

This is the reason crises regularly lead to inflation. The association between government deficits and inflation is not causal. If governments maintain spending and revenue drops because the private economy is shrinking, that is a deficit is not due to increased spending.

Governments have introduced many unfunded tax cuts, which increases the deficit but does not increase government spending. If there has been no increase in the money supply - the government is spending the same amount that was budgeted, by what mechanism does that create inflation?

If the tax cuts are regressive, then deficit is because the wealthier a person is, the less tax they are going to have to pay. If government runs a deficit and borrow money that will have to be paid back with interest to finance cuts for folks who have more money and property than 99.9% of the entire population, will that be inflationary?

The answer is yes, because it will further increase the concentration of wealth and ownership for a few, because market dominance is a factor in the power to set prices. The closer a company’s share of a market is to monopoly, the greater their control price setting.

What is actually happening is that there is some kind of failure in the private sector. For example, a collapse in the price of a commodity, which leads to immediate layoffs, defaults on personal and commercial debt, and a drop in economic activity.

This results in a drop in tax revenues and a deficit for the government. Inflation is driven by uncertainty, which can drive a hoarding response in both buyer and seller. This is routine in emergencies where the uncertainty affects everyone.

This is a problem for the entire concept of “inflation targeting.”

Inflation is a response to uncertainty. Interest rates going up are a response to uncertainty. They are the market’s response to an unexpected event.

It could be said that inflation is a market indicator of uncertainty. It’s like inflammation.

So, by targeting 2% inflation, and by adjusting their monetary policy to make inflation stable and moderate, central banks have been manipulating the indicator of uncertainty in the economy, so it won’t warn us.

Uncertainty about repayment is quite clearly what determines the rate of interest on loans, based on a borrower’s creditworthiness. The more collateral, the lower the risk, the lower in the interest rate and the larger the loan offered. A larger loan can be financed with a smaller debt servicing fee. The more uncertain, the higher the risk, the higher the interest rate.

This uncertainty is also a function of the pre-existing distribution of income wealth.

Uncertainty is the reason there is no “natural rate” of interest, and that it should not be zero.

There are some further extremely important consequences of money being created by government, without the need for prior collection of taxes.

Yes, deficits and taxes collection all still matter. However, a government that lends in its own currency cannot default in its own currency. This is not a policy endorsement of endless money creation. It is a recognition that this is a rule that means that this money is more certain. This is something that is 100% possible, legal.

The reason most government finances are paid for with taxes is to provide structure and certainty to the economy, which keeps inflation down.

There is also an important difference in fiat money from government, which is certain, while private money extended in the form of credit with interest is always less certain.

Cash is more certain than credit.

There is also a relationship between the certainty and uncertainty of risk-taking and the distribution of reward by random chance. More certain systems will distribute a payoff more evenly, with the payoff of high-risk systems will be concentrated.

Government money is certain, because it is fiat money and it is not, and does not have to be created as interest bearing debt.

Corruption also thrives from a lack of certainty and in the absence of enforcement.

Take the example of “asymmetrical information” - which is usually thought of as one party to a transaction knowing more than the other - with the result that the person who is in the dark gets ripped off. The information asymmetry is more specific than knowing something: it is asymmetrical information about risk. When a seller passes off a defective automobile as if there were nothing wrong with it - a “lemon” - what is being concealed is the risk of failure and costs that are associated with it. Insider trading also involves asymmetrical information about risk, except that insiders know that an investment is lower risk, and will have a higher return, than the public does.

Many types of unethical, immoral and criminal behaviour are defined by unequal access information: dishonesty, deception, withholding information.

These can be modelled through game theory.

When we accept that money is information, it offers important insights and has very profound implications.

Implications and new constraints of money as information, because ideas drawn from physics and engineering that apply to the real world - or are assumed - do not apply to a financial system that is information.

It means the entire system works differently than we apprehend.

Some of the challenging consequences of treating money, economics as informational include:

• No equilibrium: at the level of the economy, there is no mechanism by which a market will return to equilibrium it less it is deliberately engineered.

• Information does not “flow” like a liquid and does not automatically “find its own level”. It can create permanent and growing asymmetries, which are shaped and determined by money, debt, interest, property, all of which have always been regulated and written by human society.

• Money does not “flow”. The representation of all human value is just that: a representation. Moving money from one account to another means you are deleting tokens from one account and adding equal tokens to the other.

• “Supply side” or “trickle down” economics is invalid, because no “savings” are required to create money for investment

• The things that are the most valuable in life and in any economy are not money. We deem them to be property.

• Ownership and property are also informational. They are described and defined legally, as rules and with legal descriptions.

• Because money is information, it can be created from nothing and destroyed as well. This is the reason it does not “flow”. It has always been digital, not analog. It has always been point to point, person to person.

• This ease of creation makes the potential abuse of the creation of money extremely easy. Because money is a universal instrument of social control is the reason it has always been so tightly regulated. It has always required multiple levels of oversight, justice and controls because it is so useful and powerful as a technology for human organization and control. The purpose of the oversight is supposed to be to ensure the integrity of the system. There is risk, as in any human organization, of corruption and of bad practices becoming standard.

• Our laws and government exist to ensure to enforce, regulate, and limit the power and abuse of money, in order to preserve order and value. The benefits and use of money as a way of making organization possible are matched by the risk of harms from the potential for corruption and crime and abuse of power.

• This is why the law also establishes that some things that are not supposed to be for sale, or infringed on by government: individual rights. Allowing individual rights to be preserved carves out a space for freedom, where money is not supposed to play a role in undermining those rights.

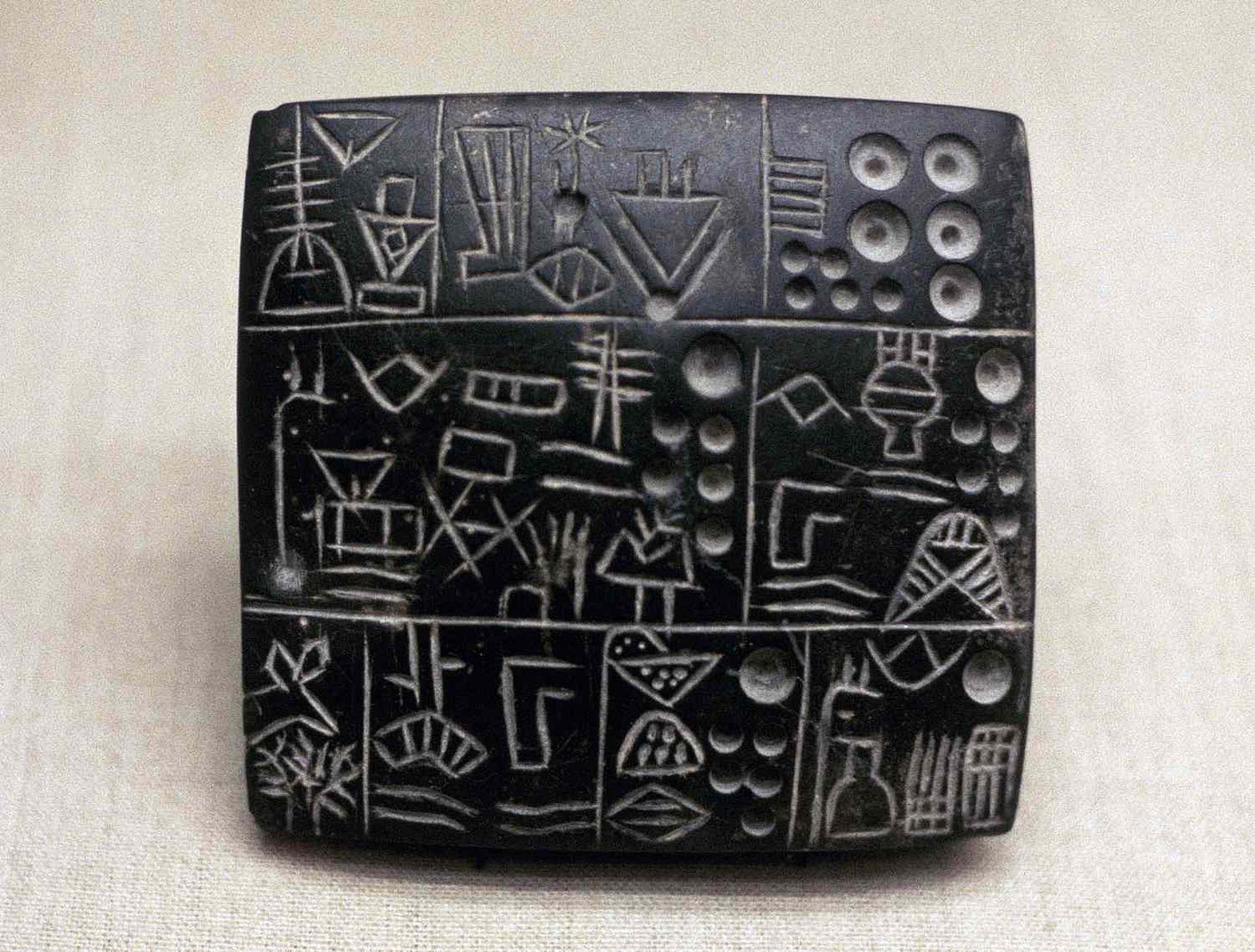

• For the concept of theft to exist, a concept of property and rules in place that make it the law of the land must be in place. There are many ways in which agreements and communication may be established. Ink and paper are just one example of records and languages. Cuneiform clay tablets, or records of accounts in the form of knots on string have all been used.

• “Efficiency” as currently economically defined is not related to efficient use of resources or labour or even of money. Economic efficiency, including Pareto and financial efficiency, are not related to real-world physical and engineering concepts of efficiency relating to the maximum output with minimal waste. Instead, Pareto efficiency is a distributional scheme that defines all increases in the concentration of wealth as efficient, and any reduction as inefficient.

• All value is human value, and human value is both individual and collective, because we are talking about transactions and markets we are also talking about collective endeavours.

We use money, to structure our societies, in every sphere of life - private, public.

The sheer power of money requires extraordinary regulations and oversight, both to minimize or reduce harm from its use, as well as to ensure stability in its value so that people can keep using it.

Money has never been intended to get human beings to do absolutely anything. The fact that it can be used for anything - including the worst acts that human beings can imagine, we put legal and regulatory limits on its use. We have banned slavery, which is owning people. We have banned child labor. We have criminal laws. We have civil laws.

We also have laws and regulations in place to ensure the integrity of money. We have contracts with enforcement, backed up by the power of the state. We have auditors, compliance and more. There are also insurance and other schemes that are crafted to deal with hedging risk.

The fact that money can be created “out of thin air” and erased again, with the stroke of a pen, or on a keyboard, have the potential to make it incredibly volatile. That is why strict societal controls around the amount and authenticity of money, auditing and verifying transactions are essential.

The system still runs on trust. However, the practical reality is that there is no reason for an economic collapse, because every country that has its own currency and central bank has the capacity to make changes to deal with financial crises denominated in their own currency.

Central banks have the capacity to do this. They do not do it.

However, if we were to imagine that a computer virus destroyed a country’s banks and all the money was burned, but fortunately everyone had just printed out a copy of their balance, the central bank could, technically, replace it all, and put the system back to where it was.

Now, would that cause inflation? No, it would not.

When it comes to the price of a transaction, it is a matter of differences in control of supply and control of demand. Factors that contribute to differences in control over supply and control over demand include access to savings, collateral, distribution of income and wealth.

Concentrations of wealth, money, debt and access to resources are distributed unequally across the population. They are also concentrated geographically, including within nations.

And in all of that: the money system reflects a particular way we have chosen to understand and run our economy.

While everyone may complain about what they do not like or accept about our current economic arrangements, whether they want moderate change or revolutionary change, the question of what to do with money needs to be at the centre of the discussion. It never is.

Because money is the key to power and control. It’s not just a question of capitalism or socialism or communism or libertarianism. Extremists and fundamentalists are defined by their refusal to tolerate dissent from their core beliefs, which justifies the destruction of their opponents even within the same economy.

It has to be said, that the no matter what kind of political ideology or economy you have, so long as you are using some kind of money - an abstract symbol you use to get people to work or make exchanges among your countryfolk - there has to be oversight and recognition of damaging imbalances or rip-offs.

The more complex the society and the more social, political and moral impacts from technology and innovation, which is sometimes the result of massive collective effort, and sometimes the result of a high-stakes gamble paying off. Unleashing new technologies and tools also creates new and unexpected hazards and harms.

The greater the challenges, the more oversight and management may be required to maintain order and keep people from starving - examples would be the kind of sacrifice demanded of a war effort.

It doesn’t matter what kind of economy you have, because money, as a human invention, has been around a lot longer than communism, socialism, capitalism, or modern democracy.

The simple distinction between interactions based on money is that markets don’t resolve disputes. If an economy is working properly, and both of the participants in a deal are benefitting, it can be said to be preventing disputes.

Money is a token for exerting control over others. That means if you don’t have any money, you can’t get anyone to do what you want or need. You are powerless. And people are shamed for their powerlessness.

It is a colossal benefit of money economies that you can get what you want peacefully and legally.

Market participants are players are all acting within a set of rules. But if there’s a problem and money can’t or won’t solve it - and there are lots of those cases - then there needs to be a higher authority that can fairly address the dispute, which everyone involved will respect. That’s the government and the courts.

Governments and courts enforce the rules. If they do not, no one will.

This is essential for the meaning of money. Confidence and trust are both related to information and control.

***

That’s the beginning - here’s the full document, which sets out arguments - and solutions - in more detail.

DOWNLOAD »

-30-

Thanks for this excellent article! You have found a very useful way to describe and explain both information and economics.

wonderful analysis about the complex multi-ordered causes and effects of inflation. using game theory to understand complex systems is a breath of fresh air every time i see it <3 Its always interesting to see economics says things have to be specific ways despite only being that way for a impossible short period, like inflation, like wage growth, like housing supply when they are entirely socially imposed methods of handing information designed in manner to provide advantages for the existing powerful groups