No, Scott Bessent is not a Good Pick for Treasury, or for the American Economy

If Bessent's hyperpartisan speech to the Manhattan Institute is any indication, Bessent only understand his slice of the business - betting on bets - not building an economy.

Scott Bessent is Donald Trump’s pick for Treasury Secretary. He’s considered to be one of the “better” picks because he has Wall Street credentials, and because he ticks the boxes of what has been defined as “centre-right liberals” for a long time - “fiscally conservative, but socially liberal.” Bessent worked with billionaire George Soros - and is gay and married. He also supported Trump in 2016, so he can be described as an “early adopter.”

Bessent being seen as a “fiscally conservative, socially liberal” formulation is a triumph of political sleight-of-hand, because to the layman is sounds both sensible and sensitive. When you actually drill down into the specific meaning of the words, however, it’s something else.

In layman’s terms, “fiscal conservatism” just sounds like you’re being careful and measured with money. However, it actually describes a very specific economic ideology that is pre-New Deal. It is an ideology of minimal government and maximal private sector. No matter what the problem the answer is always the same - cut taxes, reduce regulations, shrink government, and run a balanced budget. If that means firing people and selling off government property, so be it.

While this is an ideology that is presented as being grounded in economic ideas, these ideas are not grounded in facts. It really just is a set of rules and obligations for how people think the economy must be run, whether it’s realistic or not. As J. K. Galbraith said, “The modern conservative is engaged in one of man's oldest exercises in moral philosophy; that is, the search for a superior moral justification for selfishness.”

That same ideology drove the stock and real estate mania of the 1920s and led to the crash of 1929, and austerity policies that helped turn it into a recession. In the 1930s, Franklin Delano Roosevelt redefined “liberal” when he brought in the New Deal, rejecting the classical liberal economics that insisted on liquidation and letting the market bottom out until it somehow reached a new price equilibrium. The New Deal was, of course not just

People who wanted to stay classical liberals renamed themselves fiscal conservatives, then in the stagflation period of the 1970s, threw Keynes overboard and brought in a new version of fiscal conservatism on steroids, branded as “neoliberalism” whose specific economic formulas were “neoclassical”. The basic premise of these “Supply-side” economics is that the economy as a whole should be aligned to direct all profit to owners, who would use the surplus to reinvest and create more jobs and spread the wealth. This does not happen for a number of reasons, the most foundational being that the economy does not actually work in the way these individuals claim.

By not-so-strange non-coincidence, as soon as that happened, labour and management incomes started to diverge, creating ever-greater concentration of wealth and income in the U.S. as wages stagnated and as financial engineering in asset prices took the place of investment in real-world engineering and industrial capacity.

A quick note about the above graph, because it relies on a very important term that is seldom used - “typical” - not “average”. “Typical” means looking at the real-world impact on a large group of people in similar circumstances, while “averages” are not useful, because the distribution of wealth and income in society tends to follow a power law, like 80/20, a mathematical average does not

This also brings me to the term “socially liberal.” This is generally seen as a measure of tolerance and freedom on what are considered “hot button” social issues around a culture war clash of values, usually around sexual morality, but this definition of being socially liberal does not apply to the economic sphere, including jobs, poverty or being homeless.

The fact is that that our current neoliberal / fiscally conservative / trickle down / supply-side economics are fundamentally concerned only with only one set of stakeholders and constituents in the economy - a surprisingly small number of people who own the majority of all property and assets.

It is an ideology designed to continually transfer wealth and money upward and into the finance sector of the economy - or “FIRE” - Finance, insurance and real estate, at the expense not just of workers, but of industrial capital in the “real economy”.

There is a key difference between what we call the “real economy” and the “financial economy”.

One of the reasons for describing trade and exchange as mutually beneficial is that in the real economy, each side gets something they can need and use they didn’t have. It is a win-win. When you buy an apple (the fruit, the computer, or a disc from the Beatles’ record label), the vendor gets money they can use, and the buyer gets a product or service. The exchange is money for something that is not money. Same thing with work. It is a mutual benefit.

However, in the financial economy, it is money for money, and it is a zero-sum game. It is (in pretty much every sense) more like gambling. If you have gained a dollar, it is because someone else lost one. It is not win-win, it is win-lose. If the game is crooked, rigged, or people are lying, that’s a problem. It’s also possible for people to make a high-risk bet that they can’t afford to pay if they lose.

The result in the last five decades have been a string of massive financial crashes and crises, from 1980 onwards. That includes the crash of 1987, Asian and Russian currency crises, the Long Term Capital crash, the dot-com crash, the global financial crisis of 2008, the Euro crisis of 2010, and continual instability at least since 2019, where central banks have intervened to float markets with trillions of dollars.

Drinking the Kool-Aid & Not Learning From Your Mistakes: Bessent

After the 2008 Global Financial Crisis, Bessent’s old boss, George Soros wrote in the June 11, 2009 New York Review of Books:

“The financial system as we know it actually collapsed … of its own weight. That contradicted the prevailing view about financial markets, namely that they tend toward equilibrium, and that equilibrium is disturbed by extraneous forces, outside shocks. Those disturbances were supposed to occur in a random fashion. Markets were seen basically as self-correcting. That paradigm has proven to be false. So we are dealing not only with a collapse of a financial system, but also with the collapse of a world view.”

It’s notable that around this time is when the profoundly anti-semitic campaign painting Soros as Jewish financier who was to blame for economic problems started, as part of a political campaign in Hungary in the shameful tradition of scapegoating Jews, which has metastasized and been used around the world to justify the election of far-right (and centre-right) governments who have persisted in that world view, instead of embarking on some kind of fruitful reform.

Bessent delivered a speech to the Manhattan Institute, The Fallacy of Bidenomics: A Return to Central Planning at a conference “Toward a New Supply-Side: The Future of Free Enterprise in the United States”

He starts his speech by saying

President Reagan had a unique political talent for explaining complex matters of policy and strategy in simple terms. In 1986, he summed up the state of the U.S. economy under the Carter administration:

“Back then, the government’s view of the economy could be summed up in a few short phrases; if it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

Over eight years, the Reagan administration successfully rolled back excessive government interventions of the Kennedy, Johnson, Nixon, and Carter administrations, unleashing the productive capacity of the U.S. economy.

… the Obama administration featured a return to heavy government intervention in the private sector, particularly through its turbocharged expansion of the regulatory state, delivering an economic constipation similar to that which plagued the U.S. before the Reagan revolution.

I just want to make a point here about politics, propaganda and history.

Our sense of history has been completely warped by political partisanship, and treating soundbites as if they are facts.

The 1979-80 global recession occurred when the price of oil soared related to the Iranian revolution, at the end of a decade where the U.S. had abandoned the Gold standard and OPEC was waging financial warfare through price hikes. The price of oil had been $2 a barrel for a decade when OPEC turned off the taps, and sent a price shock through oil-dependent economies.

The U.S. Federal reserve knew that the price of foreign oil was the problem, but it was beyond their control, so they used the tools at their disposal to wrestle inflation to the ground (Bryan 2013). Paul Volcker at the Federal Reserve hiked interest rates, sometimes as high as 21.5%.

The UK and Canada (among other countries) had to hike interest rates as well to prevent their currencies from being crushed. In the midst of this recession, governments - including Pierre Trudeau in Canada and Thatcher and Reagan in the UK and US - were borrowing billions to run deficits at 20% interest, laying a base of public debt at colossal interest rates, as did businesses and individuals.

Manufacturing was decimated, especially in the UK, but around the developed world as well. There were global repercussions, including the third world debt crisis.

Hindsight being 20/20, Volcker is seen by some as the greatest Federal Reserve Chair in history for ‘defeating’ inflation. While Volcker may get the credit for fighting inflation, prices also dropped because oil prices kept dropping – the very thing that was out of the Fed’s control – reducing the cost of everything. From a peak of $30 a barrel at the beginning of the 80s, oil started to slump, turning the oil boom into a bust.

However, Bessent is relying on not one, but two political myths about Reagan and Obama.

The size of U.S. government grew much more under Reagan’s first term than it did under Obama’s after 2008, which helped drive a recovery that led to his re-election in 1984. Reagan’s Keynesian big-spending is ignored by both his supporters and his detractors, since it is at odds with his mythic reputation as a hero to conservatives and villain to liberals.

On the fiscal side, after initially cutting taxes, Reagan introduced the largest tax increases (yes, increases) in U.S. history and increased spending, while Volcker relaxed monetary policy. (Dick Cheney’s takeaway was that “Reagan showed us that deficits don’t matter.” (!).)

This is one of the biggest problems with the political mythmaking that surrounds political and economic history, and is a reflection of a partisan and ideological divide.

The cartoonish “branding” of a political figures means that people focus on surface, not substance.

The higher pace of growth under Reagan was because he put a larger effort into stimulus after the 1980 recession and crisis, than Obama did after 2008, which was one of the worst financial crises in decades.

When confronted with the fact that in his first term, Reagan raised taxes, grew the size of government and ran a larger fiscal stimulus compared to Obama’s first term, people experience cognitive dissonance. Instead of looking to history and actions, they being sucked in by their own PR, which routinely paint “moderate” “centrist” efforts to “keep government and the market from collapsing” as being “socialist”.

It has to be said, that the growth in the U.S. economy in the 1980s was not being driven by capital investments in productive industrial capital - investments in new factories, for example.

The shift was to having consumers and households go into debt to finance the economy, which they did through credit cards, and through a real-estate boom that drove up the price of more unproductive assets, namely housing.

In 1987, the U.S. had experienced “Black Tuesday,” a severe market crash which required the first-ever “Greenspan ‘put’” which was effectively a federal reserve bailout of the stock market.

The last thing this is the free market, and given that Greenspan was quite literally a disciple of Ayn Rand, it is hard to understand just what kind of economic system this is, at all. Some have suggested “financial communism”.

More such interventions followed in the 1990s with Long Term Capital and in the 2000s with the Global Financial Crisis, with trillions of dollars in money being printed in order to maintain the price of assets that are collapsing in value. During the pandemic, in March 2020, the Chair of the federal reserve committed to “unlimited” support.

So, when Bessent talks about the “constipation” of the Obama economy vs the Reagan economy, Reagan increased government spending and investment after the 1980 crisis, which was bad, than Obama after 2008, it skips over the fact that during the Global Financial Crisis (GFC), the Obama administration bailed out Wall Street.

The fundamental problems in the financial sector were never addressed. They were ignored, and not a single person ever involved went to jail, because the argument was that the “economic harm” would be too great, so fines were paid instead.

What was required was a some kind of New Deal, with economic measures, investments in industrial policy, jobs. Despite the continual histrionic accusations calling Democrats “central planners” or accusing them of being far left, parties of the so-called “centre” and centre left have been on the centre right for years. To the right of Ike Eisenhower on taxes, to the right of Ronald Reagan on fiscal stimulus.

As I’ve written, people become much more divided after a financial crisis. That happened in Canada and the U.S. after 2008. While the political focus is always on us-vs-them, people need to recognize that economic distress in itself changes people. It ruins lives. It ruins people’s mental health. They have no control in their own lives. It radicalizes people.

Because very often, people are in real distress, and they are ignored or get no sympathy, or may be told they deserve none.

Trump was elected in 2016 because the economy wasn’t fixed. He was defeated in 2020 for the same reason - the economy wasn’t fixed. Trump won again in 2024 for the same reason - the economy wasn’t fixed.

There have been warnings that because the basic problems have not been addressed, that another financial crisis as large as, or larger than 2008 could occur. The economist William White, who worked at the OECD and the Bank for International Settlements and warned Alan Greenspan starting in 2003 a crisis was coming, has been calling for a structured approach to preventing the next crisis.

In the fall of 2019, overnight interest rates started to spike, and the U.S. Federal Reserve stepped in because of concerns in the REPO Market. That’s a particular concern because if there isn’t enough money to lend in the overnight market, it can result in defaults and contagion.

There were signs things were starting to unravel as this “interest rate cycle” drew to a close. Defaults were rising, unemployment and stagnation were setting in, along with growing political craziness, and meme stock investment. There were signs a bubble was breaking, when the pandemic hit.

The economic interventions of the pandemic postponed the day of reckoning, but have added further debt bubbles on top of it. It is not fiscal policy that has been the problem in deepening the crisis. Government actions during the pandemic saved jobs, saved industries from collapse - very notably, the financial industry, who were promised, "‘unlimited” funds in bailout.

The consumer inflation that occurred was not just in the U.S. around the globe after the invasion of Ukraine has been shown to have been driven in large part by a price-fixing scheme on the part of OPEC, exposed by the FTC. Inflation went up everywhere.

However, the cost of living and global housing crisis - which is happening in the U.S., Canada, the UK, New Zealand, Australia and other countries - is directly linked to the policy decision to use a monetary stimulus, by dropping interest rates with the stated intention of having individuals and households borrow to invest and spend to fix the economy.

That means an absolute explosion in personal debt that drove up the price of housing, and a global cost of living crisis, which is not primarily an inflation crisis: it is an insolvency crisis.

I mean - the two sides of the coin when it comes to monetary stimulus are that public central banks, which are presumably the property of a nation’s citizens,

Publicly committed to printing unlimited quantities of money to bail out private financial institutions and corporations, to ensure they had cash to pay their bills for the assets that were dropping in value.

Expected public institutions and governments and private individuals to either cut, or to borrow in order to pay for the economic recovery by taking out a loan for their house, car, school, consumer purchases and business.

This has been what the Federal Reserve has asked Americans to do since the 1980s, and it has created bubble after bubble, including the one that the U.S. economy is in now, with AI being the latest bubble.

Having deliberately encouraged people to go into as much debt as possible by dropping interest rates near zero, resulting in astronomical mortgages as well as cheap debt for more and more mergers and acquisitions, the central banks then panicked over a surge in inflation that was created by war, plague, supply chain shocks, consolidations and business bankruptcies because so many people and businesses were already on the edge in the pandemic.

There was also coordination and price fixing and abuse of market power from monopolies.

However, it meant that central banks and all the other fiscal conservative economists across the developed world then pulled a 180, and hiked interest rates at some of the steepest rate in history.

Most of private debt that individuals and companies have taken on did not go into new investment in real economy industries. It went into rapidly bidding up the price of existing assets to record highs: stocks, real estate for the purpose of short-term speculation - buying to flip, not buying for long-term.

It has created the entire market for cryptocurrency and created more billionaires than ever. Not only did central bank policy create the economic problems that helped elect Trump, they also helped enrich the people who funded his campaign.

I mean, people say let your money work for you. The monetary policy run by supposedly independent central banks keeps bailing out investors, while deliberatly creating conditions that bankrupting other players in the economy, allowing the people who’ve been bailed out with printed central bank fiat currency to pick up even more quality assets at distressed prices.

This is complete madness, and these policies are creating absolutely mindboggling and impossible choices when it comes to the economy.

This is the problem with the economy. This is what caused the problem with the economy.

There is a simple way of explaining it that is basic economics. The more you pay for an asset, the harder it is to get a profit from it. So it you pay top dollar for commerical real estate, housing, rentals, or a company, it is going to be hard to make a lot of money from that. So of course rents and prices will go up, while companies try to cut costs at the same time.

What people need to do is recognize that developed economies are being hollowed out by a bursting asset bubble, and that the ultra intense froth of mania at the top, currently in the form of the AI bubble, is concealing the serious distress underneath.

I also say this, because while there are plenty of people who are feeling hopeless, or afraid, or that the economy will collapse, people should know, no, violence and conflict is not necessary, yes there are reforms and measures people and governments can always take.

The reality is that financial crises are caused by money being destroyed, because hoped for streams of revenue dry up, permanently - as when a borrower defaults.

It would possible for governments to replace money that has been destroyed in order to restore people’s capacity to trade or pay their bills. There is no necessary connection with inflation, because replacing something that was lost is not an increase.

The impact of these central bank policies, which were executed in similar fashion around the world, has been largely ignored, or treated as neutral, when they are the direct cause of all of our current political and economic crises.

Are we seriously supposed to believe that the tens of trillions of dollars in quantitative easing over the last 15 years, and the tens of trillions in new private debt for households isn’t supposed to matter?

These sums dwarf the public debts and deficits of the nations where they live.

And the fact that the prices of assets - especially housing, which is in a global bubble because of these policies, which are as divorced from reality as you can imagine.

This is why the economy is not working properly. People and investors were encouraged to take on debt by central banks, and then central banks pulled the rug out from under them.

Ironically, no one knows this better than Donald Trump. That’s what happened to him in the 80s. There was a massive real estate bubble, driven by low interest rates, and when it burst, Trump was caught, along with millions of others.

The market has been distorted by all of this, which actually makes it harder to make productive investments, because employees can’t afford a house on what you pay them.

The price of real estate has to come down, and no one knows how to make that happen without a crash. I’ve argued that since the problem is too much debt, what is required is a fiscal injection of equity in the form of capital for real economy entrepreneurs and U.S. companies to start up and scale up.

The ideas of tariffs within an existing free trade zone don’t make sense.

Bessent’s idea that low fuel prices are good for the economy is, in principle, correct. His solution is to ask oil producers, who all have finite resources, to expand production and flood the market now, which would require oil companies to work more to make less money. It’s asking an entire industry to be less efficient.

The economic reality is that there is far greater deadweight overhead on the entire U.S. economy in the form of accrued interest and private debt, which is directly the result of the federal reserve’s policies.

This is especially true for farmers, especially new farmers, because the price of farmland is also part of the bubble, and that destroys the land’s value for producing food, or forests.

If any industry could be asked to endure a little hardship for the sake of real investments in re-industrializing and reviving the U.S. and other developed economies, surely the financial industry could play its part and give back. That could even help with the price of oil and gas.

You could see if some bigger farms would be willing to split up and put their land up for sale to let people go back to the land and revive small towns.

If you want people to be actual capitalists, make sure that entrepreneurs can get access to patient capital looking for long-term returns.

I’ll finish with a comment about the kind of deals that happened in the lead-up to the 2008 financial crisis.

Michael Lewis, in his book “the Big Short” wrote about John Paulson, whose deals were an important example of the problem with “Assymmetrical information.”

Paulson is one of the Trustees at the Manhattan Insitute where Bessent delivered his talk.

“Asymmetrical information” is a way of saying one party to a deal knows something the other does not. Joseph Stiglitz has pointed out that it is a problem that causes power imbalances in the market. The information assymetry is often that one party knows something about how risky a deal is that the other doesn’t.

Sometimes we will make a bad deal and pay more than we have to. That’s why contracts come up for renewal and we have to renegotiate once in a while: it allows for the safe dissipation of risk. When markets work properly they provide an ongoing feedback mechanism between buyer and seller about the risks and rewards of a purchase: what other people are paying for the same or similar transactions lets us know whether we are paying too much or too little in our own purchases.

There’s also an expectation of trust and honesty. For the market to work properly, everyone in the deal is supposed to be well-informed and have access to the same information.

That is why disclosure is important. Take two examples of market rip-offs: insider trading and a used car that’s a lemon.

Insider trading is based on people in a company or financial industry using knowledge only they have access to buy up something they know is underpriced. An investment firm is helping to broker the purchase of Company X, which the market thinks is in trouble. Company Y is about to buy it, put it on a firm financial footing, and build new facilities. The deal will be announced on Monday. The stock price is low, because most people think it is a risky investment, but the insiders know better. They can buy the underpriced stock on Friday and sell it for a big profit on Monday, when it is revealed that it is lower risk after all.

That’s insider trading, and back it is illegal. Or it’s supposed to be, anyway.

If someone sells a lemon — or a house, or car or anything with a hidden defect, they too have lowered their risk while passing on the risk to the buyer.

When it comes to financial engineering, and deal making, this is one of the way a lot of money is made. The deal enriches one side by shielding them from costs and shifting them to another player.

An example provided by Roger Martin, is the formula known as “2 & 20” which is used for calculating what certain investment dealers get paid:

“... a 2 percent fee on assets under management [and] 20 per cent of the upside generated on their capital. This 20 percent surcharge became known as the carried interest or simply the carry.” The formula became so pervasive that, “any firm that didn’t use this structure suffered in the eyes of investors and the media... In the public’s view, all of the real players in the market charged 2 & 20.”

It worked:

“Of the richest four hundred Americans on the 2010 list, fifty got there thanks to 2 & 20... Flat out, 2 & 20 is the greatest wealth producer of our time.”

The idea behind 2 & 20, like executive compensation based on stock options, is that it aligns the fund manager’s interests with the investors better than other kinds of compensation.

Martin wrote, “It doesn’t take a terribly sophisticated analysis to determine that it most certainly does not. The 2 & 20 formula fails to align the interests of investment managers and their clients for the same fundamental reason that stock option incentives fail to align the interests of executives and shareholders — both structures align interests only on the upside, and so encourage rampant risk taking on the part of agents at the expense of principals.”

In other words, it is a formula that shields fund managers completely from risk while shifting it to all to investors (and other companies) instead.

This becomes even more clear in the case of short selling, or betting that a stock’s price will fall. This is seen (and promoted) as a kind of insurance against the price of a stock going down: but if you can profit from someone else failure, it creates what might well be called a perverse incentive. Martin argues that:

“Hedge funds are entirely different — and dangerously so. They invest in publicly traded instruments or derivates thereof, so they are entirely creatures of the expectations market, rather than the real market ... when there isn’t an available security tailored to their investing interests, they hire investment banks to create custom investment vehicles for them [including] investments that produce value for the fund if they go down in price. That is, they can place a bet against investments — shorting them. John Paulson, for example made billions by shorting subprime mortgages (with the help of investment bankers at Goldman Sachs, which created the now-notorious Abacus mortgage-derivative vehicles purely to help Paulson bet against the mortgage market.).”

In that case, Paulson asked Goldman Sachs to create a fund made up of 90 mortgage-backed securities, which he expected to fail, although the fund would be rated “AAA” — the same as buying government bonds.

It resulted in Goldman Sachs being charged by the SEC:

“The SEC charge[d] that Goldman illegally withheld material information when it did not tell the Abacus buyers that mortgage bonds underlying the CDO had been selected with the help of Paulson & Company, one of the world's largest hedge funds. Paulson wanted to bet that the housing and mortgage markets would collapse. To do that, Paulson needed a CDO based on mortgage bonds likely to fall in value when homeowners stopped making their payments. Paulson was not included in the SEC complaint and has not been accused of any wrongdoing.

A synthetic CDO transaction requires two parties taking opposite views. The "long" party profits if the underlying securities rise in value; the "short" party profits if they fall. Each side places a bet and, in effect, the loser's losses become the winner's gains.

In the Abacus deal, completed in April 2007, Paulson took the short side and two major investors took the long side: IKB, a large German bank, and ACA Capital Management, a New York-based investment firm. Paulson worked with ACA to choose the 90 underlying mortgage-backed securities. But there is dispute about Paulson's exact role. The SEC claims Goldman led ACA to believe that Paulson was taking the long side -- that he would bet the securities would rise in value -- when Paulson was actually taking the opposite view. This, according to the SEC, led ACA to believe Paulson thought the securities were safer than they were, and that its interests and Paulson's were the same. Goldman, however, says it "never represented to ACA that Paulson was going to be a long investor."

In the end, Goldman Sachs settled and paid a fine of $550-million and “acknowledged that its marketing materials for the subprime product contained incomplete information”.

The fact that the investments were rated as triple AAA when they were being packaged to fail is a like one of those cop shows where a briefcase full of cash is exchanged and it turns out only the top layer of bills were real while the rest was newspaper.

“Information asymmetry” and “incomplete marketing materials” are one thing, and what mattered here is that the buyers didn’t realize that Paulson was betting against them. He knew the investments were risky - he had picked them for that very reason. The other investors bought them because they thought Paulson thought they were safe.

It should be abundantly clear that whatever the actual economic policy of the Trump administration ends up being, it seems clear by the noises they are making that they believe drastic measures need to be taken to shake the economy up.

I understand the logic people may feel when the population goes up. More people around, and all of a sudden you can’t afford a house. People think it’s just supply and demand - so if you have fewer people looking for a home, the prices will go down. But it’s not just a housing market. It’s a debt market - mortgage debt. And the mortgage debt market is directly affected by central bank interest rates.

The problem is fundamentally a financial and economic one, but because our rules around finance and specifically neoclassical economics, are so blinkered. At this point, they are a set of social rules to be followed, not a description of the macroeconomy, and these rules are enforced as a state ideology.

There has been an enormous amount of really valuable work that has gone into studying what went wrong during the global financial crisis of 2008, the Euro crises of 2010, especially with the goal of either preventing a future crisis, or having a better response to the next one.

There are other serious concerns for this administration. One is cryptocurrency, an investment that is a known and confirmed favoured way to launder the proceeds of crime, and for people to finance drug trafficking, human trafficking, terrorism and agents operating on foreign soil. Many are deeply implicated and used by organized crime in other countries.

Aside from those risks, the other is that if cryptocurrency were to be recognized as some kind of equivalent to the U.S. dollar, it would be a disastrous and collossal mistake which would put the economy at risk of true hyperinflation, because it would be doing exactly what caused the German hyperinflation of 1923. As the IMF wrote, it was not government money-printing, it was that banks were allowed to extend credit that could be turned in at the central bank for actual currency.

Finally, the suggestion that cutting regulations will improve the situation means taking a market that is already white hot and overvalued, and adding oxygen to it, because risks to the system can be hidden in secret deals.

There is an underlying fragility to the U.S. economy, because so much of the current boom is concentrated in a few huge companies - the “Magnificent Seven”. Warren Buffett is selling stock and going to cash.

David Rosenberg has said he “feels sorry for Trump” because he thinks there will be a recession and a market crash on his watch.

Both interest rates and inflation go up when uncertainty goes up. With interest rates, this is self evident: the higher the risk of default, the higher the interest - because there is less information about the real capacity to repay.

Trump’s announcements and picks increase uncertainty. Markets expect inflation to go up, they expect interest rates to go up, so they already are. We’re still in a bubble so there is market euphoria which is triumphalist. (Trum-phalist?)

So, there are three risks here. The first is that the policies this government is talking about will trigger a crash sooner, and the second is what the response can be. The risk of a crash and credit seizing up, and so on is very significant, and it would affect everything from housing to pensions.

So you need a plan to protect people from losing their houses, keep farmers on farms, keep real economy businesses in business. A Marshall plan of debt structured debt relief while injecting new spending and providing access to capital for real economy businesses.

You don’t want lots of people going broke, but you cannot do the same thing that happened every single other time the stock market crashed. Don’t inflate the stock back up, put money into something new.

So, for a country like the U.S. the federal reserve could fund fiscal measures through precise monetized deficits. This is a technique that other countries could use, to invest in long-term infrastructure projects.

It also has to be said that the current bubble bursting and reverting towars market norms would have a seismic impact on the US and global economies. It could threaten the US position as a global reserve currency, which is currently being challened by BRICS.

As it stands, having the U.S. dollar and New York as being bankers to the world means that money is always being recycled through wall street. It makes everything for the U.S. cheaper.

The U.S. was not always the financial centre of the world. Previously, it was London, the capital of the British Empire. The shift happened during the First World War.

The possibility of the U.S. dollar suddenly losing its place as the global reserve currency after a market crash might be impossible to recover from. It would literally affect every U.S. company and citizen, no matter who they voted for.

If the ideas of several of current crop of advisors are followed through on, they risk doing incalculable and sometimes permanent damage to the economy, and therefore to American corporations and therefore to Wall Street and every other market and community.

That is because in many instances, while the U.S. has some significant challenges, they have some of the best doctors, scientists and health care specialists in the world, right now. The most brilliant researchers in many different practical fields - physics, chemistry, engineering, agriculture, medicine. Developing new varieties of crops. The military is the most powerful on earth.

These people are all Americans, and they do incredible work for Americans, and they are part of America that is already great. They are not the problem. If you lose these people, or drive them out, those really are people who are just trying to do their duty to their profession as best they can, and they are unbelievably valuable contributors to the economy. These are people, when you put money into them, they make money for you.

And I think if I can offer a final insight into our current state of economic affairs, it seems that we’re all screaming at each other to stop doing something, and we won’t stop, because we’ll use every possible means to get that person to change, except pay them.

If we want things to change, we need to put the resources into the change. And we should all be able to negotiate our way out of åvoidable disaster together.

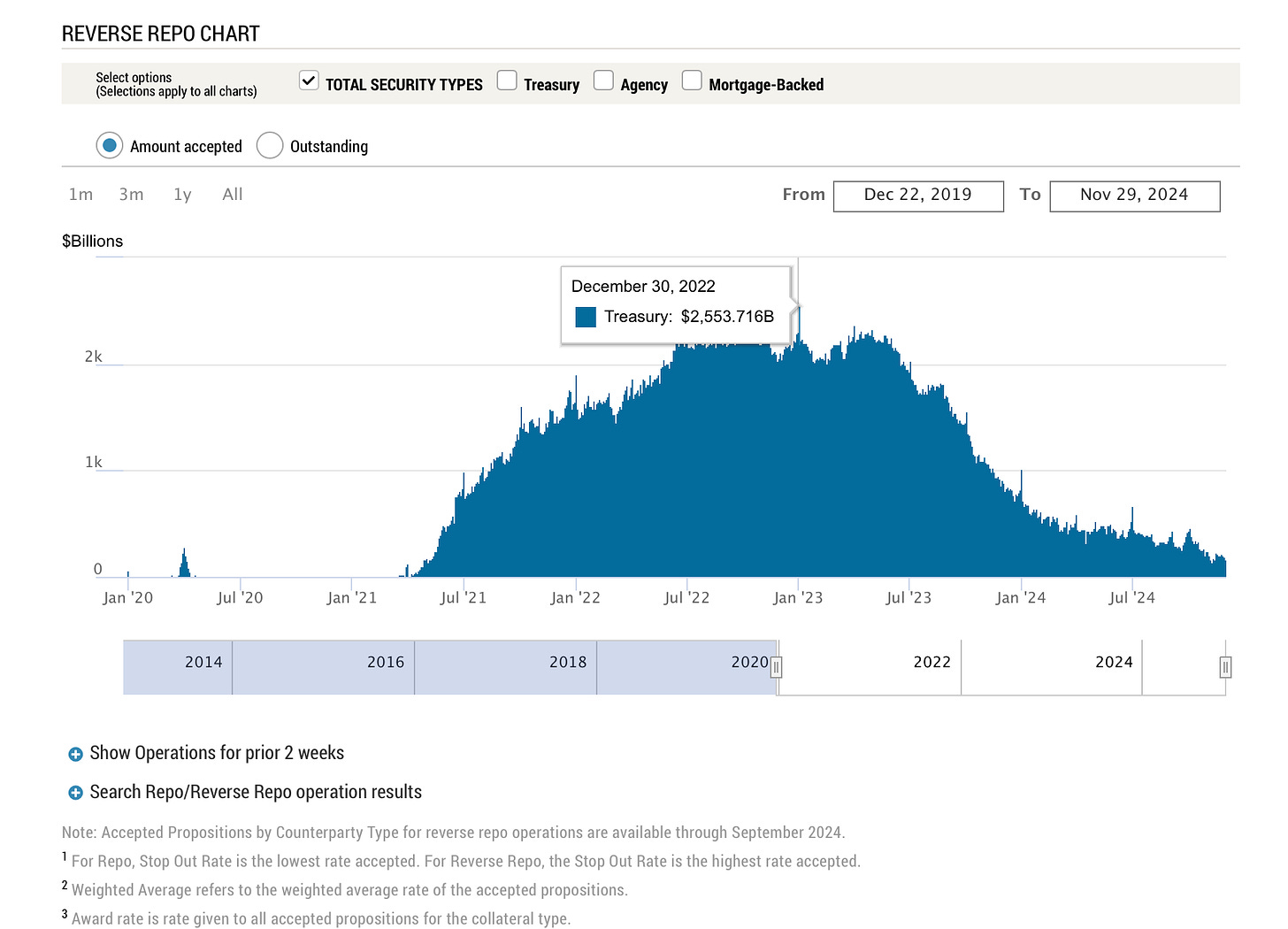

To return to this chart. In order to ensure that institutions would always have access to credit, this is a chart of the amount of money the U.S. Fed was creating to cover borrowing and suppress interest rates.

On December 30, 2022, it was US $2.553-trillion.

Today, on November 29, 2024, it is US $197-billion.

The reality is that despite everyone’s political efforts, it’s indepedent central banks whose robotic and medieval policies have royally bollixed up both national and global economies, as I wrote in my first post.

Central banks independent, but they are not accountable, which means that someone else always pays for their mistakes, often with their livelihoods.

If central banks wanted, they could act independently to address the situation by reducing the burden of debt overhead, and improving access to capital for national industrial investment. That would improve competitiveness and growth.

If we acknowledged this, central banks could make up for their mistakes by paying their debt to society.

-30-