Peter Nygard, Kevin O'Leary, and how Tax Havens are Used to Hide Money Offshore in Divorces

The Surprising Targets of Tax Havens: First Wives

In 2016, the International Consortium of Investigative Journalists broke a story, based on massive amounts of leaked banking information, that painted a picture of the trillions of dollars that are kept “offshore” by corporations, billionaires, oligarchs. Some of it is legal “tax avoidance” and some of it is illegal, and criminal tax evasion. The criminal end of things includes money laundering from criminal activities - human trafficking, illicit narcotics, washing money for drug cartels or the funding of terrorists, as well as political and other corruption.

As ICIJ notes, you cannot assume that just because someone has a business registry in tax haven that they’re doing anything wrong. Whether it is in the Bermuda or the Barbados in the Caribbean, Luxembourg, the Isle of Man, Malta, Cyprus, Canada or Costa Rica (tax havens all), there is a presumption of innocence.

However, it’s not just the taxman that the wealthy are trying to hide their money and wealth from - it’s also from their wives and children.

Kevin O’Leary, Peter Nygard & How Not to Pay Taxes (or your ex-wife)

In 2016, the New York Times ran an article called “How to hide $400-million” - the story of how a Finnish-Canadian entrepreneur, Robert Oesterlund going through a divorce suddenly made his fortune disappear, as his wife, Sarah Pursglove found out:

When the investigations began, in 2009, Pursglove was living with the two children in Boca Raton, but Oesterlund lived on Integrity in the Bahamas, unable to join them. He had overstayed an earlier visa, and the United States denied him a green card. The denial and the investigations enraged him, Pursglove told me. He employed dozens of people in Florida, he fumed, and had provided the United States millions of dollars in tax revenue. He told his wife their businesses were being unfairly harassed by bureaucrats. Going forward, Pursglove explained, “he wanted to pay as little taxes as possible to the U.S.”

In 2011, they went into contract on the penthouse in Toronto, hoping to unite the family eventually in Canada and establish residency for Oesterlund there. While it was being renovated, they bought yet another boat, the 165-foot yacht they named Déjà Vu, and spent a year sailing around Europe and the Caribbean, with tutors for the kids. But their relationship would soon grow strained. Oesterlund later testified that their marriage was a “rocky ride ever since the start,” but Pursglove blamed their new lifestyle. Somewhere along the way, she told me, Oesterlund had fallen in with a tribe of wealthy globe-trotting nomads and minor celebrities. He befriended Kevin O’Leary, a judge from “Shark Tank,” she says, and partied at the Maya-themed Lyford Cay estate of Peter Nygard, the Finnish-Canadian retail mogul. Oesterlund’s money and his boat attracted hangers-on and women, Pursglove says.

By his wife’s account, some of Oesterlund’s new friends also began tutoring him in how to minimize his taxes. (Oesterlund himself declined to comment for this article, as did most of the lawyers, accountants and financial advisers named in court records.)

He traveled constantly, Pursglove says, in part to reduce the amount of taxes he would be required to pay to any of the countries where he owned a home. At the time, Pursglove told me, she regarded these efforts — spearheaded by a well-known Florida accounting firm, Daszkal Bolton — as aboveboard “tax planning.” But court records suggest that Oesterlund had begun exploring how to structure his business to insulate himself not just from taxes but also from future civil litigation.

(Emphasis mine)

One of the ways to do that is to effectively re-create the entire business structure outside of the jurisdiction the person wants to escape (the U.S., Canada, the UK), using a technique called “transfer pricing” - which means “shift[ing] their costs to high-tax countries and their profits to low-tax countries.”

A brief history of tax rates

It has to be said that when we talk about “high-tax” and “low-tax countries,” we need to make a point about what we mean. Income, corporate and small business taxes all used to be much higher.

After the Second World War, income tax rates were much higher in Canada, the U.S. and the UK. In the 1950s, into the 1960s, the marginal income tax rate for the highest earners was around or above 90%. This was the case when Eisenhower, a Republican, was President and Richard Nixon his Vice President; when the Diefenbaker Progressive Conservatives were in power, and when Harold MacMillan was Conservative Prime of the UK.

When George Harrison wrote the song “Taxman” (from the taxman’s point of view) “There's one for you, nineteen for me” it’s because that is the income tax rate the Beatles were paying - 95%.

It also has to be said that the reports of tax rates can be greatly exaggerated.

There is a difference between the “sticker price” for taxes, and what individuals and corporations actually pay, and despite what the Fraser Institute may claim, tax rates for other personal income tax brackets (low and middle) have generally been lowered:

Since the 1960s, the top personal federal tax rate in Canada has been reduced by more than 50%, from over 80% to 33%.

Only 2% of Canadians actually pay that amount. The basic personal exemption has risen from $6,456 to in 1998 to $11,138 in 2014, and over $15,000 today.

The tax rate for corporations also been reduced from 28% in 2000 to a net tax rate of 15% today. For Canadian-controlled private corporations claiming the small business deduction, the net tax rate is 9%.

The tax rate for small businesses (privately owned Canadian corporations with fewer than 500 employees) has also been lowered, and there is an exemption on the first few hundred thousand dollars of income. (In Manitoba, the tax rate was lowered from 9% to zero.)

One of the arguments is that when tax rates get so high, people flee to avoid paying them - and the argument is sometimes that if only we lowered taxes, that they would start paying them.

This can charitably be described as optimistic.

It could also be argued that some of the people who are avoiding taxes are actually greedy tax cheats, and will never pay taxes, no matter how much you lower them.

Avoiding taxes through financial engineering creates profit without all the hard work of creating any new value.

According to Canadians for Tax Fairness, “Tax havens cost Canada between $10 billion and $25 billion every year,” and the amount of assets from Canada flowing into tax havens has been increasing, not decreasing.

When people talk about “Capital leaving Canada” it’s not mentioned that it is flowing to offshore tax havens, not going into a new factory or business somewhere. As Canadians for Tax Fairness reported, in 1987 only 10% of Canadian direct investment overseas went to the top 12 tax havens. In 2011, it was 24%.

Tax havens of the Barbados, Cayman Islands, Ireland, Luxembourg and Bermuda were five of the top eight national destinations of total Canadian investment abroad. Canadian investments in these tax havens totalled $130 billion in 2011 alone.

Barbados - $53.3 billion

Cayman Islands - $25.8 billion

Ireland - $23.5 billion

Luxembourg - $13.8 billion

Bermuda - $13.2 billion

Keep in mind - this is only the top five havens:

Increase in Canadian "Investments” in the British Virgin Islands between 2002 and 2011 has been 899.5%

Banking and financial services sector now accounts for 51% of Canada’s total direct investment offshore, more than double its share from 1987

Percentage of *ALL* Canadian foreign investments directed into Tax Havens - 24%

To get an indication of how absurd the situation, the amount of profits claimed by U.S. Companies in some jurisdictions is many times higher than their entire GDP. As a report by

Kevin O’Leary on Money, Marriage and Mattel

O’Leary recently made headlines claiming that enforcing a fraud judgment of $355-million against former President Donald Trump was a “victimless crime,” and that enforcing it would be bad for the “brand” of American capitalism.

The nature of Trump’s crime was that he overvalued properties to get loans he didn’t qualify for, and undervalued them to avoid paying taxes, enriching himself by the amount of the fine.

It has to be said, that if enforcing the law is bad for Kevin O’Leary’s favoured form of financial capitalism, what does he think having a jurisdiction where then court won’t enforce the law or contracts will do?

On the Daily Show, Jon Stewart tore into O’Leary, with a segment that included the many times O’Leary tore into supplicants as a judge on Shark Tank.

To its credit, Shark Tank accurately depicts the ritual humiliation and suffering that people with actual talents have to endure in order to secure investment in the real economy: publicly debase themselves.

O’Leary is a high-profile “stock promoter” whose business failures have generally been papered over.

O’Leary has a long history and fondness for financial schemes, which had him testifying in front of congress for his role in promoting a Crypto scheme, FTX, that collapsed like a house of cards, costing users billions.

Sam Brinkman Fried, the CEO of the Company, FTX, was convicted in November 2023 of all counts of all seven charges of fraud and conspiracy.

At the peak of the dot.com boom, O’Leary sold “The Learning Company” (TLC) to Mattel for $3.8-billion. People mistakenly believe that this made O’Leary a billionaire. He wasn’t, because he only owned some of the shares. But also because immediately on the purchase, the company started losing hundreds of millions of dollars - as it had been doing for several years prior.

Mattel didn’t do its due diligence:

TLC suffered net losses of $376-million in 1996, $495-million in 1997 and $105-million in 1998. Moreover, TLC’s accumulated deficit topped $1.1-billion by the end of 1998.

That same year, toy giant Mattel Inc. made a takeover bid for TLC, without doing proper due diligence.

… In 2000, Mattel handed over its multi-billion-dollar acquisition to another firm for a mere $27-million and a share of its future profits.

Mattel’s purchase of TLC was later labeled by Businessweek magazine as one of “the Worst Deals of All Time.”

O’Leary’s appears in the Offshore leaks in “The Paradise Papers,” where O’Leary’s name shows up as Vice-President of “TLC Bermuda”. You can see the O’Leary’s records here: https://offshoreleaks.icij.org/nodes/80108560

O’Learly was also quite outspoken about the financial consequences of marriage, arguing that you should only get married if you are going to have children.

“The risks you take forming a legal union if you're not planning on having any children are very, very heavy. You're going to lose half your assets; you're going to force liquidation of your assets in a break up of a marriage. You better make sure what you're doing when you form that bond. That's a legal bond, and it's no different than forming a corporation.”

While the act of a civil marriage is, in very real terms, a series of legal contracts and obligations to one another, to compare it to a corporation is, shall we say, demeaning to the institution. Corporations are about making money. Marriages are not, even though spouses, including ones who don’t bear children, can play an important role in the financial success of their husbands.

This paper in the Saint Louis University School of Law Journal by Khrista McCarden details the fact that “high net worth spouse used offshore tax havens as a way of hiding money during a divorce”:

I will bring this back to Peter Nygard’s Lyford Key, which is where Robert Oesterlund was hanging out with Kevin O’Leary.

in 2011, the Canadian Broadcasting Corporation’s investigative journalism series, the Fifth Estate released a program on with extremely serious allegations against Nygard.

While Nygard had long successfully suppressed stories and used hush-money and NDAs to silence employees. In 1996, Nygard had successfully persuaded the largest daily newspaper in his home province, the Winnipeg Free Press, not to publish a story in which a women said she had been sexually assaulted by him.

It’s entirely possible O’Leary was unaware of the allegations against Nygard, but it should be noted O’Leary was working at CBC at the same time, as co-host of the “Lang and O’Leary Exchange.”

Last year, Nygard was convicted of multiple counts of sexual assault in Toronto, Canada. He is still awaiting trial on further charges in Quebec, Manitoba and the U.S., as well as for a civil suit by dozens of accusers, whose chilling and disturbing details can be read here.

The Bahamas itself, where Nygard lived, is a tax haven - and Nygard also appears a number of times in the Offshore Leaks database, in two separate data leaks in two separate countries: the Bahamas and Barbados.

This website boasts about the advantages of the Bahamas as a tax haven.

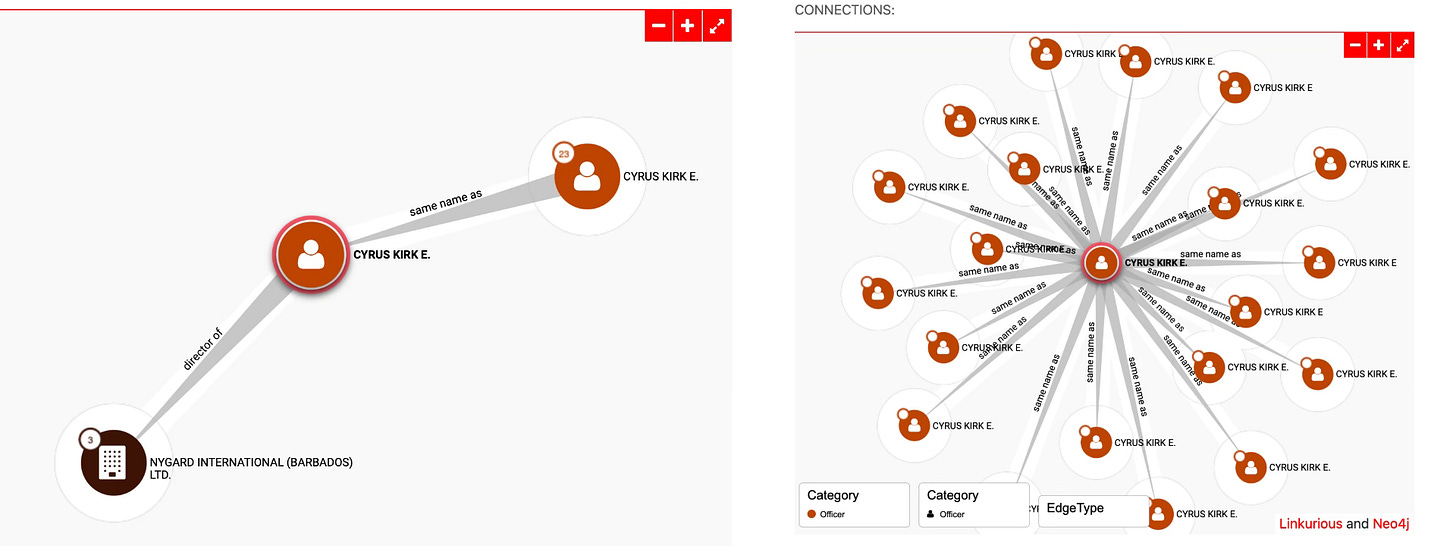

That’s why “Nygard International (Barbados) Ltd.” is interesting, in part because you can see the basic structure of how it works.

After all, Nygard’s home and business were centred in the Bahamas, not Barbados, but he set up a corporation there anyway.

One of Nygard International (Barbados)’ directors is Kirk E. Cyrus, who sits on the boards of many companies, and who works for “Strategic Risk Solutions.”

SRS brands itself as “the world’s leading independent insurance company manager.” What SRS does is set up what are known as “captive insurance companies” which allow companies to “self-insure.”

This means a company can charge itself premiums, and use the premiums it pays itself as a way of reducing their taxes - by creating their own, internal insurance companies.

While there are certainly legitimate reasons for a private (closely held) corporation to self-insure, these arrangements have been flagged by the US Internal Revenue Service as being one of a “dirty dozen” of abusive tax avoidance schemes, especially if the company already has insurance or is charging itself excessive premiums. The IRS notes “Despite being labeled as insurance, these arrangements lack many of the attributes of legitimate insurance.”

While tax evasion is criminal, tax avoidance is legal Everyone legally avoids some taxes. Any deduction that you can take is a form of “tax avoidance”, but it’s a question of degree.

People may argue that there’s nothing wrong in doing everything you can to reduce your “tax burden”, but can absolutely be abused.

It’s superficially attractive, because it aligns with everyone’s self of individual self-interest, but if everyone does it, it collapses the system. Like austerity, if everyone stops paying taxes, we lose the real benefits that come with public investment.

Even legal tax avoidance is, ultimately, profoundly unfair - because these legal tax breaks are only available to people with higher income and wealth. People with lower incomes can’t afford to reduce their tax bills this way.

It’s a huge problem, and wealthy people trying to get out of contracts they legally signed and agreed to - whether it is business or marriage. It’s dishonest, it’s unethical and in many cases it’s illegal, because there are real harms.

One of the reasons we can’t get other countries to close these loopholes is that Canada is a tax haven too. What makes a tax haven? It’s easy to start a corporation, and it’s hard to find out who owns it. The result in Canada is an estimated $47-billion to $100-billion in money laundering a year, because provincial governments won’t share information about who really owns networks of shell corporations either. Public, searchable electronic databases of beneficial owners must be legislated into existence. All of that has to happen at the provincial level, and it’s not happening.

Paul Krugman, (with whom I don’t always agree) has said government is like an insurance company with an army. By contrast, if taxes are seen as insurance premiums, one of the reasons people who are wealthy pay more is because they have more property to insure, and because their prosperity is connected with all the other things that government spends its money on that make prosperity possible - a legal system that enforces contracts and makes sure bills get paid, infrastructure, law enforcement, health care, as well as military security.

Part of the reason for our current economic crises and political turmoil is that people really are suffering, and one of the reasons they are suffering is that they’re being ripped off. All those taxes people refuse to pay help train doctors and nurses and engineers. They pay for hip replacements, chemotherapy and heart surgery, as well as ERs, roads, schools, R & D, and a hell of a lot more that are all the things that really are long-term, forever investments in the improving the future.

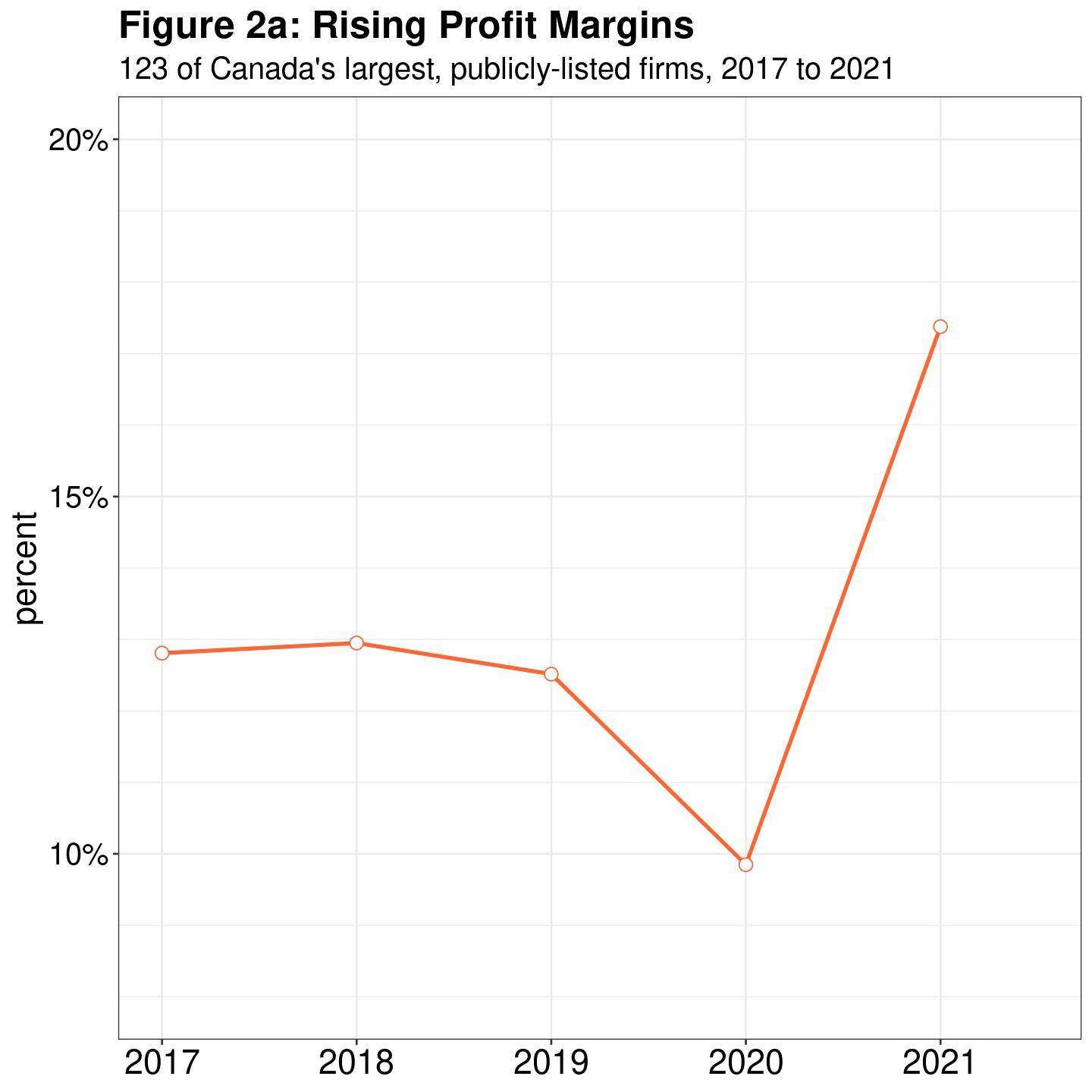

Companies are currently evading and avoiding taxes and using it to add to profits, bonuses or stock buybacks for a very few. It’s not just a question of governments losing tax revenue, it means we’re not investing in new productive businesses. What if those funds went into investing in private Canadian start-ups or scaling up existing firms, and creating new jobs in Canada?

All of this contributes to genuine suffering, which affects people in every aspect of their lives. We need meaningful government action on this, at all levels within nations, because the harm is clear. We are talking about the financial machinery that enables abuse, and often, crimes and injustice, especially against women.

As for Kevin O’Leary, as someone who visited Nygard in the Bahamas, he is in a unique position to lend his support to the women who are suing Nygard.

In fact, if he recalls seeing anything untoward, perhaps he could be called as a witness for the plaintiffs in the class action suit.

-30-

Superb ...The tax revolt has only ever helped those who have. The Fraser Institute inadvertently proved tax cuts are a bad idea - 80% of the population would be worse off - because 80% pays less in tax than they get in benefits.

https://www.fraserinstitute.org/sites/default/files/measuring-the-distribution-of-taxes-in-canada.pdf