Psychonomics: What Argentina's "Libertarian" Crackdown has to do with the U.S. Supreme Court

How a U.S. Supreme Court Decision Contributed to the political and economic desperation in Argentina

Argentina is the just latest country to elect a far-right leader, Javier Milei to cope with that country’s disastrous and ongoing financial and economic crisis. While Milei presents himself as a “libertarian”

Milei, a social conservative with ties to the American right, opposes abortion rights and has called climate change a “lie of socialism.” He has promised to slash government spending by closing Argentina’s ministries of culture, education, and diversity, and by eliminating public subsidies.

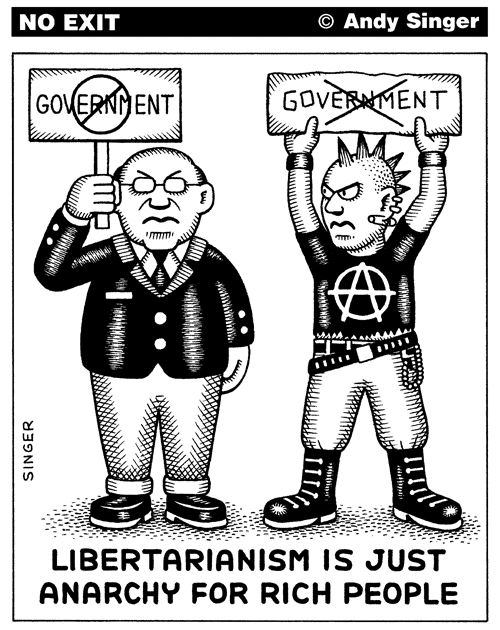

As policies, these are all doomed to fail, and it shows how libertarian promises really have nothing to do with liberty.

Financial crises drive people rightward, and Argentina’s problems are incredibly serious - out of control inflation, economic crises, and debt.

The hyperinflation in Argentina is happening because the country has too much debt in another currency - and Argentina has been struggling with massive government debt to the U.S. for decades.

In 2001, Argentina defaulted on its debt - one of the largest defaults of its kind.

Prior to the crisis, Argentina was suffering a deep recession, large levels of debt, twin deficits in the fiscal and current accounts, and the country had an overvalued currency but devaluation was not an option .

Here’s the problem that happens when you are Argentina, and you owe the U.S. money. You need to pay your debt in U.S. dollars. Countries and their central banks around the world have “foreign reserves” which means they have U.S. dollars, or Euros, or Chinese Reminbi on hand to pay their bills or buy from those countries.

If you’re Argentina, and you don’t have enough of those U.S. dollars, you have to buy some. And if the value of your Argentine currency is dropping, it means your imports get more expensive (inflation) and it takes a lot more of your own dollars to pay those debts (hyperinflation).

There is a point where paying the debts becomes a mathematical impossibility.

Argentina may have thought it was the end of the story.

But some U.S. investors bought up the defaulted bonds:

“…billionaire Paul Singer’s NML Capital Ltd…. snapped up the debt left unpaid when the Argentine economy crashed in 2001-02 and went to court seeking payment in full,” and at the U.S. Supreme Court, and in 2014, they won.

The Supreme Court decision had extraordinary consequences: an entire country, Argentina, was once again facing possible default, and faced a massive drop in the value of its currency as a consequence.

This is one of the reasons for Argentina’s ongoing political and economic stability.

The Billionaires and the U.S. Supreme Court

This June, ProPublica published a series of investigative pieces on the fact that U.S. Supreme Court justices were being entertained by several U.S. billionaires, receiving gifts for family, trips on private planes, donations, and more. What’s more, the justices were hearing cases at the Supreme Court, being brought forward by those same billionaires or their business interests, and did not recuse themselves.

For more than two decades, [Supreme Court Justice Clarence] Thomas has accepted luxury trips virtually every year from the Dallas businessman without disclosing them, documents and interviews show. A public servant who has a salary of $285,000, he has vacationed on Crow’s superyacht around the globe. He flies on Crow’s Bombardier Global 5000 jet. He has gone with Crow to the Bohemian Grove, the exclusive California all-male retreat, and to Crow’s sprawling ranch in East Texas. And Thomas typically spends about a week every summer at Crow’s private resort in the Adirondacks.

The extent and frequency of Crow’s apparent gifts to Thomas have no known precedent in the modern history of the U.S. Supreme Court.

These trips appeared nowhere on Thomas’ financial disclosures. His failure to report the flights appears to violate a law passed after Watergate that requires justices, judges, members of Congress and federal officials to disclose most gifts, two ethics law experts said. He also should have disclosed his trips on the yacht, these experts said.

Thomas was not the only Supreme Court Judge to do so. Samuel Alito did, as well - and the billionaire he went on luxury trips with was Paul Singer.

One of those disputes was with Argentina:

Singer’s most famous gamble eventually made its way to the Supreme Court… He launched an aggressive legal campaign to force Argentina to pay in full, and his personal involvement in the case attracted widespread media attention. Over 13 years of litigation, the arguments spanned what rights foreign governments have in the U.S. and whether Argentina could pay off debts to others before Singer settled his claim.

If Singer succeeded, he stood to make a fortune.

In 2007, for the first but not the last time, Singer’s fund asked the Supreme Court to intervene. A lower court had stopped Singer and another fund from seizing Argentine central bank funds held in the U.S. The investors appealed, but that October, the Supreme Court declined to take up the case.

On July 8 of the following year, Singer took Alito to Alaska on the private jet, according to emails, flight data from the Federal Aviation Administration and people familiar with the trip.

Alito then went on to vote with the 7-1 majority.

The Supreme Court’s Decision had an immediate impact - Argentina had to pay back US$2.4-billion, immediately.

Market by Diktat?

There are lots of contradictions and ironies in this case. Quite aside from the questions of a billionaire hedge fund owner treating a Supreme Court Justice to luxury fishing trips to Alaska, and then having a case before him of international import, consider why this case might be unfair.

The Hedge Fund in question never loaned any money to Argentina at all. Other people and institutions had loaned money to the Government of Argentina. Then, during an economic panic, they sold the bonds off for pennies on the dollar. So the hedge fund was never making a direct investment: it was speculation.

When Argentina then tried to negotiate a default with creditors, Singer demanded payment for the full amount, plus interest. All other creditors were willing to negotiate a different price - one that they were willing to accept. It is still a market transaction - and it would appear that the price has been re-set by market realities.

Instead, Singer and his hedge fund appear to be using the law not just to enforce a contract, but to enforce a price and a value. Is this using a branch of the Government, the judiciary and the Supreme Court to set the price and value of an economic transaction, when the market has deemed it is worth far, far less?

So, there is a contradiction here, especially for anyone who might think of themselves as a libertarian economist, who thinks that prices should be decided by the private market.

The Associated Press ran this article, which talked about the enormous debt owed to the IMF, as well as inflation.

It's also interesting, and alarming, to see just how far-right opinions and what are really extreme right-ideas are presented as being what Argentina needs. The headline reads “Why Argentina’s shock measures may be the best hope for its ailing economy” treats repeating what the extreme political opinions of far-right economists and think tanks as if they are reporting facts.

“It was a good start,’’ said Ivan Werning, an economist at the Massachusetts Institute of Technology.

Werning studied under prominent members of the Chicago School, including Robert Lucas, who developed neoclassical economics that Paul Romer said in 2016 were so disconnected from reality they were “post-real”.

One thing notable about sado-economic policies is that the shock treatment is never evenly inflicted on a population. We keep asking the same people to take the hit, over and over again. There’s no shock treatment for investors or corporations when their investments go bad. What are called “market corrections” - implies that market pricing was incorrect.

However, what keeps happening is that everyone is being forced to pay the price for market mistakes. We aren’t sharing in the benefits, but are expected to pick up the cost.

Everyone else is having to undergo shock measures while the institutions and individuals whose reckless risk-taking created a dangerously unstable market are protected, and are bailed out so they can keep doing the same thing.

Milei îs himself an economist, also from the Chicago school. There’s more than a little irony, that, given that Milei is close to U.S. right-wing politicians, that the crises facing Argentina - were made worse by some of the U.S. Republican party’s biggest donors.

The reason for the domestic economic crises in Argentina and in so many other countries around the world, right now, is debt - countries, debt borrowed in another country’s currency, and private debt, which is sky high due to more than two decades of bad monetary policy.

Beneath the political crises, natural disasters and conflicts that are escalating across the world, is a crumbling global financial infrastructure that is driving desperation everywhere.

We need to recognize that this very real desperation is a threat to democracy, to domestic security, and to the international order in ways that no one should welcome.

The pandemic created massive disruption because it broke so many vital bonds. There are many kinds of bonds that keep us together, and that divide us, and some are cultural, spiritual, and political.

But it is the economy beneath all that - the financial ties - that have also been shattered, affecting the economic security of millions and millions of people - that has been shaken and often shattered by job losses, disruptions, and debt, and all of that leads to desperation.

The world needs a plan for the kind of world we are going to be, and the kind of countries we want to have. Coming out of the pandemic, we need a Marshal Plan, not just for peace and prosperity, but to defuse the desperation and preserve democracy.

For that we need to reject psychonomics, and get a more humane, effective reality-based economics instead.

That means freedom based on rule of law - not anarchy.

And remember: libertarianism is just anarchy for rich people.

DFL

Excellent analysis. Connections to inflation, and supreme court are terrific. I think austerity and the Paradox of thrift will also be the result of this political change.

Hi Dougald,

Irrespective of how we classify Milei, the economic analysis you offer is, with all due respect, rather superficial. Argentina has a perennial problem with debt, because most of it is used to finance government operating expenses and not capital investments that would support the economy. The tax to GDP ratio is out of whack, Argentina's government debt accounted for 80.3 % of the country's Nominal GDP as of March of 2023 (Canada sits at 68%), import payments were frozen, and there were at least 4 differential exchange rates in an attempt to enforce capital controls.

A pragmatic approach would reduce the debt-to-GDP, shift government spending from a bloated civil service to core services (health, education, food security for citizens below the poverty line), unify the exchange rate, and hopefully stabilize the Peso.

The lawsuit with Singer and others was the product of a giant default, not many countries around the world issue debt in whatever currency and then decide to ask for a deep haircut. While Argentina has a solid track record of disappointing everyone, let's see if Milei can reign in spending and start retiring debt.

Have a great Christmas!