Screwball Economics: Why Trump Thinks other Countries Pay Tariffs

Also: Elon Musk is Ballot Box Poison

First things first: there are a variety of reasons to believe that things are starting to go sideways for Donald Trump and Elon Musk, due to the outcome of a Supreme Court election in Wisconsin.

Elon Musk spent millions of dollars in order to try to influence the outcome of the election, and lost. This matters for a very simple and important reason, which is that the reason Musk was being given so much leeway was that

1) he was incredibly rich

2) he helped Trump buy the election and

3) he and Trump would defeat any Republican who defied them.

Musk is now half as rich as he was a few weeks ago. None of his companies has ever turned a profit, and he’s driving customers away from every one of them. Musk shared a random tweet that falsely accused Mexican billionaire Carlos Slim of a crime to which Slim responded by cancelling a $7-billion contract with Starlink.

Musk and the Trump team backed the AfD in Germany. It’s a party that harbours Neo-Nazis and Holocaust deniers. When J.D. Vance flew to Germany, he met with AfD, not other parties - but AfD and Musk lost.

In Canada, endorsements of Conservative leader Pierre Poilievre by Trump, and Musk and that party’s connections to MAGA have resulted in what is being considered an historic collapse in polling and resurgence by the Liberals.

Musk is no longer a credible threat. That means he is of no use to Trump. But it also means Trump suddenly doesn’t have the cards anymore.

People often complain that too many politicians are selfish, cowardly, insincere and self-interested. Well, we may suddenly see the benefits of such venal opportunism as Republicans start reining in this rampant lunacy, and it really is completely insane.

Donald Trump has announced significant and damaging tariffs on countries around the world, including the single biggest trading partner the U.S. has - Canada.

Four Republican Senators have joined the Democrats in challenging the tariffs, pointing out that the President doesn’t actually have juridiction over tariffs. A welcome intrusion of reality. Better late than never.

These is not the 4D chess of a grand strategist looking to reshape the world order. These are the ravings of one of the least qualified people ever to become president, surrounded by cranks and grovelling yes-men. Trump’s pathetic self-regard is driven by his massive insecurity, which demands respect instead of commanding it.

The purges of the ranks of so-called “DEI” hires is also about profound insecurity on the part of mindblowingly dumb jocks like Pete Hegseth and RFK Jr. Trump has to make sure he’s the smartest, bravest most honest guy in the room, and he does so by surrounding himself with a collection of the lowest wattage, craven and spineless truthbenders in the US.

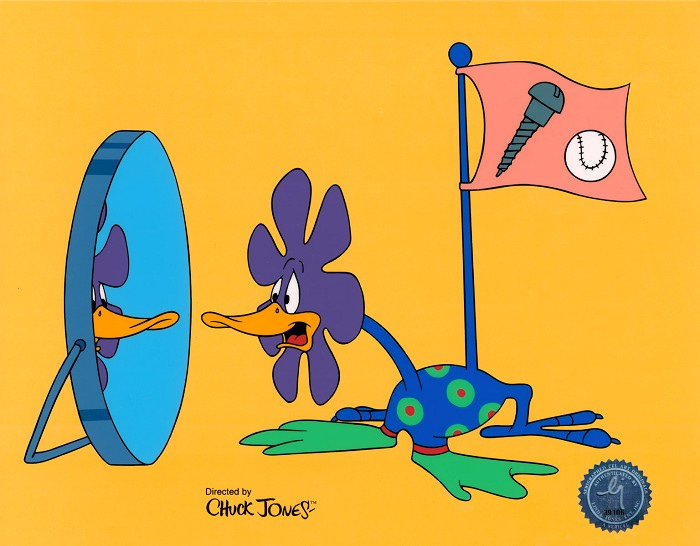

If you cast these people as stupid characters in films, they would seem unrealistic because they are so stupid. They are like nightmarish dark comedies about idiotic supervillains, or a Saturday Night Live sketch that comes across so heavy-handed you think they’ve gone too far.

Consider these true facts:

The only two countries not facing tariffs are Russia and North Korea.

The tariffs themselves even applied to two uninhabited volcanic islands near Antarctica.

Trump even argued in a post that his tariffs would apparently apply to illegal fentanyl smuggled over the border.

It’s not clear why Trump thinks drug cartels and smugglers would be more diligent about declaring their taxes than he, himself is.

The fact that there is no one around doing the basic fact checking on this stuff speaks to the grade school level work being done here.

Michel de Cryptadamus is a really interesting writer on the horrors, criminality and corruption related to cryptocurrency. He just shared this hypothesis on the method Trump and his team are using to calculate tariffs.

“Some dude appears to have reverse engineered the formula Trump is using to determine each country's tariffs:

trade_deficit_of_country_X / imports_from_country_X

The trade deficit of a given country is just imports minus exports for that country, so substituting that in you get:

(imports_from_country_X - exports_to_country_X)

imports_from_country_X

example:

US Imports from Vietnam: $136.6 bn

US exports to Vietnam: $13.1 bn

US trade deficit w/Vietnam: $136.6 - $13.1

= $123.5 bn$123.5 / $136.6 = 90% tariffs

This is one of the dumbest things l've ever seen, though I guess on the plus side the United States now officially recognizes Taiwan as an independent country, something it has avoided doing for almost a century.

The tariffs are being calculated to bring in something like $6-trillion in revenue, which is an absolutely insane shock to deliver to the economy. As people who actually the way tariffs work at the micro level, they are an US government import tax paid by the US importer.

As other economists have pointed that tariffs can either encourage new investment in the U.S. or generate revenue, but not both. If the tariffs are generating tax revenue, it’s because importers are still buying foreign goods. If the products are being made in the U.S., there won’t be tariffs paid.

A lot of this is happening because there are a whole bunch of people involved in this project who have one important thing in common. Yes, many are unpleasant white balding cryptofascists. Some are tech bros like Peter Thiel, Marc Andreesen, Elon Musk, or any of those charmless wads. Some are god-botherers like Steve Bannon, Stephen Miller or Russell Vought.

They one thing they all share?

Completely screwball economic theories.

If you’re wondering where Trump got the idea that other countries will pay the trillions of dollars in tariffs, some of the very bad arguments are laid out in this document -

A User’s Guide to Restructuring the Global Trading System by Stephen Miran of Hudson Bay Capital.

During his campaign, President Trump proposed to raise tariffs to 60% on China and 10% or higher on the rest of the world, and intertwined national security with international trade. Many argue that tariffs are highly inflationary and can cause significant economic and market volatility, but that need not be the case. Indeed, the 2018-2019 tariffs, a material increase in effective rates, passed with little discernible macroeconomic consequence. The dollar rose by almost the same amount as the effective tariff rate, nullifying much of the macroeconomic impact but resulting in significant revenue. Because Chinese consumers' purchasing power declined with their weakening currency, China effectively paid for the tariff revenue. Having just seen a major escalation in tariff rates, that experience should inform analysis of future trade conflicts.

Now, there is a lot that is alarming about this analysis, which breezily suggests the impact of previous tariffs was no big deal in the grand scheme of things, when they were destructive and inflationary to specific sectors of the U.S. economy, especially agriculture.

The idea that other countries will “actually” pay for tariff revenue because it affects exchange rates is explicitly a strategy of “beggar-thy-neighbour,” where other countries are “paying” because their economies are being undermined.

This is the opposite of a “win-win”: the entire premise is that the U.S. is in a better position to starve its trading partners to the point they will have no choice but to submit.

It should go without saying that no one wins a starving contest.

The breezy idea that “this wasn’t a problem last time” ignores that there have been seismic changes to the economy as a consequence of the massive distortions associated with every aspect of the Global Pandemic, including the creation of multiple market super-bubbles in asset prices, supply chains, soaring debt.

The economy is orders of magnitude more brittle than it was just seven years ago, which makes these tariffs much more destructive and disruptive.

Judging by their pronouncements, many of Trump’s investor advisors - Howard Lutnick, Peter Navarro, Scott Bessent are diehard ideologues who define inflation as only being caused by central bank monetary policy to support deficit spending, which, unfortunately for them, is fictitious.

Because their definition of inflation does not include massive price hikes brought on by tariffs, their argument amounts to saying that what everyone else is experiencing as inflation is not actually inflation.

The other is that the diagnosis of what has driven the de-industrialization of the “developed” world, which the Hudson Bay paper (and others) argue is the strength of the U.S. dollar.

The destruction of industry in Canada and the U.S. is partly a result of market forces - that it is much cheaper to produce in other countries where workers can be paid a fraction of a developed world wage.

It is not just that workers may be underpaid or exploited (which they may be) but because the private overhead costs of the economy to workers and industry alike are lower.

It was possible for finance and owners to make colossal short-term gains through trade by shipping production overseas, keeping the head office in a developed country, and then avoiding taxes in offshore tax havens.

In the 19th century, one of the reasons for the explosive growth in wealth of the U.S. as compared to Europe was that Europe’s economies were weighed down by the cost of their aristocracy - of rentiers who, in the words of John Stuart Mill, made money in their sleep. They don’t work for a living - they own for a living.

It’s not the power of the U.S. dollar that makes it hard to compete - it’s the dead weight of its plutocrats and monopolists, who use their monopoly power to extract higher prices and higher rents from the vast majority of the population.

Austerity Caused the Depression, not the Smoot-Hawley Tariffs

What really strikes me about the current debates is that Trump’s critics - from financial commentators on Bloomberg to liberal and progressive critics - have effectively been indoctrinated with what amounts to a state ideology and an official version of history that has been challenged,.

It wasn’t tariffs that caused or extended the Great Depression following the Wall Street crash of 1929: austerity did.

Markets collapsed, and so did the price of commodities, creating waves of bankruptcies and defaults that collapsed hundreds of banks.

Treasury Secretary Andrew Mellon famously said

“Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.”

That is what caused the Great Depression, and years of austerity drove the rise to power of ultranationalist governments in Germany and Japan.

People keep saying that the “Smoot Hawley” tariffs introduced in the Depression made it that economic disaster much worse, when austerity following the crash was to blame.

By the time the US stock market crashed in 1929, the economy was already failing for the majority. The “Roaring 20s” were driven by easy money and cheap credit that was used to drive up real estate and stocks and commodities, all of which collapsed.

While the economic activity ceased, the debt that was taken out to pay for all of this was still exterting a massive drag on the economy. The entire classical liberal / Austrian notion that you just need to let prices hit a new, lower equilibrium ignores the role of “debt deflation”.

Unlike present-day Trump tariffs, which are going from zero to 25% overnight, when in the 1920s and 30s, U.S. tariffs had already been high for a century.

“One influential view, propagated by neo-liberal economists, is that this large but totally manageable financial crisis was turned into a Great Depression because of the collapse in world trade caused by the 'trade war', prompted by the adoption of protectionism by the US through the 1930 Smoot-Hawley Tariffs.

This story does not stand up to scrutiny. The tariff increase by Smoot-Hawley was not dramatic - it raised the average US industrial tariff from 37 per cent to 48 per cent. Nor did it cause a massive tariff war. Except for a few economically weak countries such as Italy and Spain, trade protectionism did not increase very much following Smoot-Hawley. Most importantly, studies show that the main reason for the collapse in international trade after 1929 was not tariff increases but the downward spiral in international demand, caused by the adherence by the governments of the core capitalist economies to the doctrine of balanced budget.'

That is explained in a BBC article here.

After a big financial crisis like the 1929 Wall Street crash or the 2008 global financial crisis, private-sector spending falls. Debts go unpaid, which forces banks to reduce their lending. Being unable to borrow, firms and individuals cut their spending. This, in turn, reduces demands for other firms and individuals that used to sell to them (e.g., firms selling to consumers, firms selling machinery to other firms, workers selling labour services to firms). The demand level in the economy spirals down.

In this environment, the government is the only economic actor that can maintain the level of demand in the economy by spending more than it earns, that is, by running a budget deficit. However, in the days of the Great Depression, the strong belief in the doctrine of the balanced budget prevented such a course of action. As tax revenues were falling due to reduced levels of economic activity, the only way for them to balance their budgets was to cut their spending, leaving nothing to arrest the downward demand spiral. To make things worse, the Gold Standard meant that their central banks could not increase the supply of money for fear of compromising the value of their currencies. With restricted money supply, credit became scarce, restricting private-sector activities and thus reducing demand even further.

One of the reasons people have struggled to combat Trump’s screwball economic ideas is that his critics have all been marinated in the same ideas.

“We’re all Keynesians” and “We’re all Friedmanites” has been replaced with “We’re all screwball economists now.”

1989 & Reasons for Optimism

Now, I will finish by saying why I am an optimist. One is that I am aware of successful measures and policies in the past to get us out of this mess. There are an incredible number of economic policy levers that could be pulled in order to address, defuse, and escape the current crisis, instead of prolonging it - I’ve written about them many times on this platform.

All the doom and gloom about collapse and pain is being driven by the belief that we have no choice and no options, because we don’t know our history.

It’s also rooted in a fundamental mistake in the way we think about economies. Our thinking about trade is still fundamentally colonial - which is no accident.

The language we use to talk about business development is always about “attracting” investment and jobs or the oft-repeated conservative slogan about a jurisdiction being “open for business.”

The premise is that jobs and investment are something that you can only import from another juridiction, and that you can only grow the economy in this way, and that “attracting investment” is achieved through continual economic debasement: increased exploitation of workers and the environment, along with reduced oversight and enforcement.

The result, no surprise, is not something we have to put up with.

-30-

PS - I’ve written an e-book that explains what Canada could be doing differently. Hope to have it in hardcopy soon.

You can buy it here on Apple Books

I’m sure you realize that Trump’s public facing comments provide little insight as to why his admin and puppeteers implement seemingly absurd policies…

The tariff situation works for a variety of nefarious influencers. Intentional economic seppuku is just one outcome they desire.

I have seen relatively little discussion on the fact that tariffs, in real effect, are simply a camouflaged path to the most regressive tax structure that the US has ever implemented. People actually “paying” the tariff tax (both in highest percentage of income AND in absolute amounts by class) will be the lowest in income. Hence the “conservatives” can continue to bark about being economic populists while shifting the bulk of taxation to those least able to afford it. The rich, conversely and by design, skate easily away from the effects of this insane policy.

Thanks for your efforts and insight. Best of luck.

It never ceases to amaze me how some people once they are in charge, they cannot see the forest for all the trees.

Economics 101 should include the analogy that different parts serve different functions, the simplest being that the economy functions are a lot like the suspension on a car or truck.

You have an inflated wheel, a spring and a shock absorber. The vehicle above is the society/political economy.

The inflated wheel is the active part of the economy, representing the business community, farmers, fishers, manufacturers, etc…. As loads are added and taken off, the tire pressure goes up and down. Pot holes cause pressure spikes, damage to the sidewalls, and the occasional blow out.

The laws, regulations and government policy act like the spring, connecting the wheel to the body. They allow the wheel to move more than what just a solid axle would, relying on just the tire pressure.

The shock absorbers are the central banks and government. When you hit a pot hole, you need to over-damp the system to prevent repeated oscillations. Without the damping, you can’t steer a vehicle bouncing all over the road.

Now if you replace the air pressure with money, you get a feel for what the different parts do. It’s a bumpy road, but a system that can roll over and through the bumps ensures a repeatable drive without crashing.

Now to get better mileage, you increase the tire pressure and the shock absorber pressure to get a firmer ride. But more of the road vibration is transmitted to the vehicle, and you risk a blow out that takes tire off the rim.

Soften the tire, and your ride is smoother, but you do not have the handling, your mileage goes down, and you risk a damaged wheel or sidewall cut at the next pot hole.

There is a limited range or sweet spot depending on the road conditions. That’s what Finance departments, Central Banks and working economists are supposed to maintain.

Now if my under-educated brain can figure this out, WTF is wrong with economists in the US? What is wrong with the billionaire brain trust advising Trump. To throw in tariffs is like putting curbs in the middle of the road.

The last time I hit a curb while driving, it dented the wheel rim, sliced almost all the way through the tire sidewall, and forced me to limp home from gas station to gas station refilling the tire until I was home. A 20mins drive took me 4 hours.

So this is what it looks like they are creating for the US economy. A rusted out beater on bald, under inflated tires, with no shocks and a smoke belching V8 that doesn’t fire on all cylinders.

And if Russia and China have their way, they won’t even put it up on blocks after stripping the wheels, battery and radio. And then the oligarchs will swing by and offer to take it off your hands. If you pay them to take it away that is.

Let’s hope it doesn’t come to that: if you think we have an immigrant oversupply problem now, what would we do with a few million Americans coming north for shelter, food and water?