Solidarity? Whatever! Part 2: Canada's Problematic Union Pension Plan Properties:

Private ports, airports, water and energy systems, luxury apartments, shopping malls, real estate and care homes. Union pension funds in Canada make money from seeking rent.

In part 1 of this series, I mentioned the current crisis facing the largest water authority in the UK, Thames Water, which provides water to over 15-million people, including the City of London.

Privatized in 1989 by the Conservative Government of Margaret Thatcher, Thames Water’s owners are saying they can’t meet debt obligations, and will not invest new money into aging and leaking infrastructure that is resulting in millions of tons of sewage being dumped into rivers and streams, and that ratepayers may have to see an increase in their water bills by 40% by 2030.

As CNN described it, Thames Water is “‘Uninvestible’: Britain’s biggest water company left in the lurch by shareholders”

It may now be “nationalized” - returned to public ownership. The largest single external investor in Thames Water, with over 30% is OMERS, the Ontario Municipal Employee Retirement Service.

Canada has some of the largest public pension funds in the world, with more than $1-trillion in assets under management, with year-over-year returns close to 10%, and while they ensure high returns for retired unionized workers in Canada, their investments include privatized energy, water, and transportation networks around the world, as well as assets sold by Canadian governments, like land registries.

This is all happening as Canada is undergoing a productivity crisis.

As Edward Chancellor said

“By aggressively pursuing an inflation target of 2% and constantly living in horror of even the mildest form of deflation, they not only gave us the ultra-low interest rates with their unintended consequences in terms of the Everything Bubble. They also facilitated a misallocation of capital of epic proportions, they created an over-financialization of the economy and a rise in indebtedness. Putting all this together, they created and abetted an environment of low productivity growth.”

That is the problem with so many of the investments made by Canada’s public sector union pension funds - they are contributing to the “everything bubble” and have benefited from central bank monetary policy in Canada and around the world that has encouraged investment and boosted returns in rent-seeking.

The bulk of the investments are not going into manufacturing, or value-added processing, or improvements in industrial effiency start-ups, scale-ups and innovation that that improve productivity.

It is going into “rent-seeking” - a private investment in necessary but non-productive assets - like real estate, roads. In the long run, it raises the cost on all the things that households and businesses need, because it sets up private premium “toll booths” that drive up private overhead costs - banks, debt, and water, oil gas and electrical power, and private roads, private airports, private ports commercial and residential real estate, land and agricultural production.

Alberta Investment Management Corporation - AIMCo

“AIMCo is one of Canada’s largest and most diversified institutional investment managers with more than $150 billion of assets under management. AIMCo invests globally on behalf of 32 pension, endowment and government funds in the Province of Alberta.”

You can see a list of many AIMCo’s partners and investments here:

“AIMCo’s Infrastructure & Renewable Resources team manages a global portfolio of more than $20 billion. Notable investments include Howard Energy, sPower, London City Airport, Puget Energy and Forestry Investment Trust. We’re an active direct infrastructure investor with a focus on strong corporate governance.”

Real Estate: “The domestic portfolio consists primarily of direct investments with joint venture partners in high-quality industrial, retail, office, and multi-unit residential properties in Canada’s major cities.” That includes Scotia Tower.

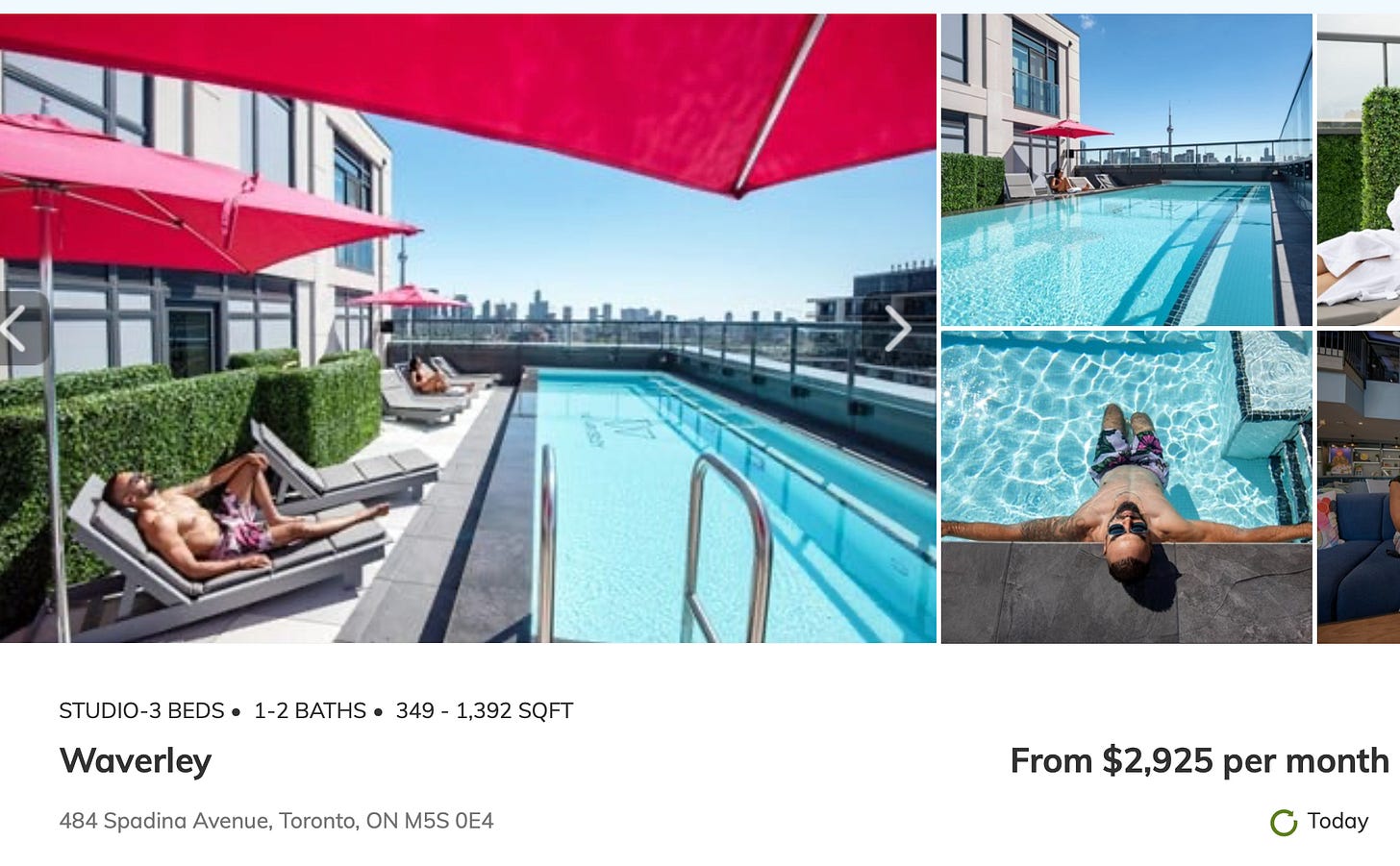

The Waverley by Fitzrovia, a luxury multi-unit housing complex in Toronto that “spared no expense” and charges rent starting at about $3K per month - but if you pay more in the $4,000-$6,000 range, you can get the “Feist” or the “Lightfoot” Suite - according to this online guide:

https://www.rentcafe.com/apartments/on/toronto/the-waverley/default.aspx

Caisse de Depot et du Placement de Québec

The CDPQ was created to manage funds deposited by the Québec Pension Plan (QPP), a public insurance plan similar to the Canadian Pension Plan (CPP).

$434.2 Billion in assets under management, as of December 31, 2023.

“The weighted average return on its depositors’ funds was 7.2% in 2023, in line with its benchmark portfolio’s 7.3% return. Over five years, the annualized return was 6.4%, outpacing the 5.9% of the benchmark portfolio, which represents close to $12 billion in value added. Over ten years, the annualized return was 7.4%, also higher than its benchmark portfolio which stood at 6.5%, producing over $28 billion in value added. As at December 31, 2023, CDPQ’s net assets totalled $434 billion.”

Paid $355-million “to acquire 50% of the A25 Concession, a 7.2-km network comprised of a toll road and bridge on the A25 in Montréal from Transurban, an Australian company.”

Real estate holdings: Ivanhoé Cambridge and Otéra Capital: Ivanhoé Cambridge holdings are here. These include commercial real estate (office buildings, malls) as well as residential real estate - apartment buildings, and luxury real estate.

“Vertically integrated in Canada, Ivanhoé Cambridge invests internationally alongside strategic partners and major real estate funds that are leaders in their markets. Through subsidiaries and partnerships, the Company holds interests in more than 1,000 buildings, primarily in the residential, office, retail, industrial and logistics sectors. Ivanhoé Cambridge held more than C$60 billion in assets as at June 30, 2018.”Examples include 210 West 89th Street “Stonehenge Tower” in New York City, where a Studio apartment will cost you $3,885 a month, and a 3 bedroom with 2 bathrooms will cost $9,295 a month.

This is from a Boston Consulting Document from 2015, Some properties have been sold, and others have been bought.

That is how they can continue to maintain returns of 5-9%, even as the rest of the economy shrinks or stalls.

But as people rail against “late capitalism” “capitalism” “financialization of the housing market” and inequality, or tax cuts and subsidies, it’s Canada’s public sector pension plans that are profiting.

They are not individual billionaires. They are not Bay Street Fat Cats. They are the pension funds for unionized public sector workers.

And while I am a strong believer in the public sector, and in unions, the interest of public sector union pension funds is not the same thing as the public interest.

Once you see the problem, it becomes clear.

The solution, unfortunately, is not.

It is incredibly difficult, and what to do about it is an enormous challenge, because we have created an economic and political trap for ourselves.

No matter what, all those pensioners really are depending on those returns to pay for their retirement.

With the CPP, (Canadian Pension Plan) is for all Canadians outside of Quebec, and the QPP is for all Quebecers, the other pension funds are for a private group of individuals.

We need to make sure people can have pensions in old age, but we can’t pretend that this investment strategy is good for the whole economy, because it’s not. There is no question that some of these investments are harmful. The covid deaths in Revera care homes in Canada and the Thames Water crisis are just two examples. No one wants to talk about it, because it might kill the goose that lays the Golden eggs.

Getting out of traps is hard, but as they say, recognizing that you have a problem is the first step to solving it.

Three quick points about privatization, which is also a fundamental tenets of business and investment:

Private financing for public projects isn’t cheaper: governments can borrow at lower rates than the private sector.

One of the arguments for selling off systems is that they require investments in infrastructure, and governments can claim that they are being fiscally prudent by getting the private sector to borrow instead. That is a false economy.If you’re looking to save on costs, you sell off liabilities, not assets.

Private companies and pension funds are looking for investments that will pay a steady of stream of income. They want guaranteed, secure money-makers, not fixer-uppers. So the idea that a government can “save money” by selling off a necessary service or even a revenue generating corporation is a mistake.

Often privatization is just a fire-sale on public assets, and when a private investor picks up a public asset for less than it’s worth, it’s easy to turn a profit on it.There is a critical distinction between investing in private “toll booth properties” that add to the cost of the entire economy vs investing in public infrastructure that lowers the cost for the entire economy, and another difference still with investing in productive “real economy” businesses.

Recognizing that public investments like roads, bridges, water, energy, transportation and even energy and health care are factor in making the private economy work better. So does making sure people can pay to own their own properties, and not just spend their life renting.

The point here is what mix of public and private investments will have the best results for the economy as a whole: it’s what the mix should be, because, I would argue, the current mix is not working.

Canada has an affordability crisis - inflation, housing and rent, we need investments in new and renewed infrastructure, as well as in renewing Canadian industry with new capital and new businesses, so we can improve our productivity.

If we want different results, we need to change what we’re doing.

But when you’re pulling in 9% annual returns of billions of dollars, that can be hard to do - because no one wants to risk being worse off.

However, these returns have also been driven by distortions and responses to financial crises.

One of the things that has been distorting our economy over the last 30 years is that investors keep getting bailed out as the focus of both central banks and governments generally has been to try to keep asset bubbles going. Investors have made bad bets - but when they crash, instead of taking the loss, there have been colossal interventions - in the trillions of dollars of public money from central banks - to keep these asset prices up.

We need a plan that focuses on building high-quality public Canadian infrastructure, with the best financing, so that we are keeping costs down for the rest of the economy - but as with so many other obvious problems, if a response comes at all, it will require another crisis to get people to act.

-30-

DFL

With 90% of investment funds being 10 year closed end the argument of ‘steady income’ to investors is laid bare. 10% returns are earned by sub5 year asset churn of Rentier assets. Those funding these returns are the users of water, energy systems, parking, housing, trains, planes and roads ie the rest of us