Stephen Harper's Revisionist History of the Great Financial Crisis in Canada

The Conservative Prime Minister wants to credit his own Finance Minister for "saving" the Canadian Economy, not Mark Carney. He shouldn't.

In a fundraising letter, Stephen Harper, Former Conservative Prime Minister of Canada is joining his party’s attacks on Liberal Party of Canada leadership hopeful Mark Carney.

Harper claims that Carney is either taking - or getting - too much credit for protecting Canada’s economy from collapse in 2008 during the Global Financial Crisis when other countries, including the UK, U.S. and countries across the EU suffered badly, and that Finance Minister Jim Flaherty should get the credit, not the Bank of Canada.

Political fundraising letters can hardly be expected to pass peer review, but the revisionist history on display is nonsense.

The Globe and Mail reported that

“In a hard-hitting fundraising letter issued Monday to Conservative party faithful, Mr. Harper said the former central banker is not the right leader to handle U.S. President Donald Trump and his threats of punitive tariffs”

Harper wrote:

“I have listened, with increasing disbelief, to Mark Carney’s attempts to take credit for things he had little or nothing to do with back then,” he said. “He has been doing this at the great expense of the late Jim Flaherty, among the greatest finance ministers in Canadian history.”

“Let me be clear: The hard calls during the 2008-2009 global financial crisis were made by Jim.”

The article did cite some log-rolling, mutual-admiration society comments that Flaherty and Carney made about each other and the great job they did on Canada’s economy.

Central Banks (and central bankers) are independent from elected government. This was action by central banks, and central bankers - not Finance Ministers or elected officials, and therefore it is entirely reasonable for Mark Carney to get credit for it.

There are lots of reasons why bank failures are a disaster and the really big surprise about Canada’s economy at the time was that, unlike the U.S. and the UK, Canada suffered no bank failures. This led to a lot of boasting from the Government about how safe Canada’s banks were, which was not entirely accurate, because they had required over $30-billion in support from the Bank of Canada and tens of billions more from CMHC & the U.S. Federal Reserve.

The actual events and history show that the Harper government’s initial response to the Global Financial Crisis was an unmitigated disaster that nearly cost Harper his government, and that his policies showed consistently poor judgment.

In the lead-up to the crash, the Harper Government loosened lending requirements to encourage Canadians to take on more risky debt, which then had to be reversed after the crash. They extended mortgage amortization from 30 to 35, then 35 to 40 years as well as zero-down-payment mortgages and self-employed borrowers.

Having increased the risk in Canada, the Conservatives certainly did not see the crisis coming.

On September 7, 2008, Harper called an early election. That very day in the U.S., Treasury Secretary Hank Paulson placed the US Government’s two government-sponsored housing initiatives “Fannie Mae” and “Freddie Mac” in conservatorship. On September 15, 2008 Lehman Brothers failed.

Throughout the election Harper and his Finance Minister Jim Flaherty continually denied that there was any serious problem with the economy or that there would be any risk of deficit.

In October, Harper failed to secure a majority, and after eking out another minority he pledged on election night that he would work more cooperatively with the other parties.

According to the Toronto Star, of Oct 17 2008, “During the campaign, Harper repeatedly denied the need to go into deficit. He also ruled out tax hikes, leaving analysts to presume if government revenues fell significantly, his only option would be program cuts.”

This is exactly what Harper and his Finance Minister Jim Flaherty proposed. For weeks they continued to deny the problem even existed, then in November introduced a brutal “fiscal update” that contained no stimulus at all. Instead, they proposed a series of harsh measures to cut spending, suspend civil servants’ right to strike and sell off Crown assets to raise capital.

Instead of the cooperation he had promised on election night, Harper offered brinksmanship and a slap in the face. The fiscal update was a “confidence” bill - if it were defeated, the government would fall and Harper there would be another election - just six weeks after the last one. Harper and his team calculated that the opposition parties would have no choice but to vote for it, or face the wrath of Canadians.

In order to avoid a non-confidence vote, Harper postponed the vote, then went to the Governor General to prorogue parliament - an issue that caused enormous controversy. “Proroguing” parliament can be done for a variety of reasons - but avoiding a confidence vote the next week is generally not one of them.

On Dec 21, 2008, Harper - who had promised never to appoint any Senators - appointed 18 in a single day.

The entire reason for the Conservative’s “successful” economic response that that Harper only agreed to it because he wanted to keep his government alive. after pressure from, and meetings with Liberal MPs.

Harper was not alone in his opposition to stimulus for Canada’s economy. Marc Lavoie, a Keynesian economist, wrote that Canada’s left-ish party of labour, the NDP was embracing austerity - again. In 2015, NDP leader Thomas Mulcair promised “better cuts” as Canada’s economy faltered when Saudi Arabia launched a price war that resulted in the worst oil price crash in history. Lavoie wrote in the Globe and Mail:

In fact, the Conservative’s stimulus was one of the smallest on record. Total Federal stimulus in 2009-2010 was $24.9 billion, and leveraged $8.5 billion more from provinces and territorial governments.

Was the stimulus the right thing to do? Actually, yes. But Harper didn’t do it because he thought it was right, he did it to save his own neck, and as soon as he won a majority, he proceeded with massive cuts including imposing significant spending reductions on provincial governments as well.

As Armine Yalnizyan noted, the Federal Government played a smaller role in this “recovery” than after other major recessions, and the Canadian economy was getting a boost from record high oil prices, which were over $100/barrel for years. The economies of Alberta and Saskatchewan were so overheated that they created the illusion of “prosperity for all” when they weren’t even generating prosperity for all in Alberta and Saskatchewan.

Instead, having bailed out banks, Flaherty and Harper started dumping the cost of recovery onto provinces, municipalties, and individual Canadian households who, as usual, were expected to go into debt to reinflate the economy by paying more for tuition and real estate or cut.

The province of Manitoba, where I reside, had its federal transfers capped and frozen for six years, despite a growing population and inflation. The total per-capital increase per Manitoban was $8.50 over six years. Eight dollars and 50 cents.

The Conservatives unilaterally cut health transfers from going up 6% a year to going up 3% a year. In February 2014, Jim Flaherty told the Premiers, if they have a problem paying their bills, they should raise taxes.

Canada’s new formula for health care funding cut funding for every province but Alberta, which got $800-million more.

Federal contributions to infrastructure spending were cut by 87% on April 1, 2014.

The Federal Government announced they would not bail out Canada’s banks if they get into trouble: instead, banks will have to resort to the Cyprus Model of a “bail in”: banks they will take money out of depositors accounts instead. Canada’s banks were downgraded as a result.

Ratings agencies like Moody’s and S & P have downgraded the credit rating of Canadian provincial governments like Ontario & Manitoba. As a result, municipalities in those provinces also faced higher borrowing costs.

Financial Crises Start in the Financial Sector

These were all catastrophic, useless and painful cuts that had no benefits at all, without ever learning any lessons from the financial crisis, one lesson being that Financial crises start in the Financial sector.

I will write an up-to-date account of the 2008 financial crisis, because there are major parts of the story that have been completely left out of most popular accounts.

The most basic lesson is an insight tied directly to NDP Leader Jack Layton’s rejection of Keynesian economics, which he tied to fiscally conservative NDP governments running balanced budgets or surpluses for years.

In fact, governments all over the world had been running balanced or even surplus budgets - the US, the UK, Canada, as well as countries in Europe. In the lead-up to the catastrophe of the GFC, governments at all levels had been running surpluses, cutting personal and corporate taxes, and reducing regulation. That included US Clinton/Gore Democrats, Chretien/Martin Liberals in Canada and Blair/Brown New Labour in the UK.

Several countries had not been raising taxes, or running deficits, or ramping up spending, or causing moderation. Robert Lucas, who played a key role in the neoclassical economic revolution of the 1970s, gloated in 2003 that the issue of depressions was a thing of the past.

Yet, one of the worst financial crises in decades occurred, and there has been no reckoning for the economists or theories who utterly failed to see it coming.

One of the first, vitally important lessons from this is that financial crises start in the financial sector, and that private mortgage debt can bring down the global economy.

Banks and mortgage companies persuaded (and sometimes swindled) people into taking on mortgages they didn’t have the money to pay. These mortgages were put into bad investments, which were graded AAA (the same as US Government Bonds) by ratings agencies. Then, people sold bad insurance (credit default swaps) against these investments, which the insurers didn’t have the money to pay, because they weren’t regulated, and it all created a pathway for risk and failure to rip its way through the entire economy.

Joe Nocera of The New York Times tells a story about the Chairman of the Federal Reserve, Alan Greenspan’s first meeting with Brooksley Born, who had been appointed to the Commodity Futures Trading Association (CFTC) in the 1990s. “[Greenspan] said something to the effect that, "Well, Brooksley, we're never going to agree on fraud." And she said, "Well, what do you mean?" And he said, "`You probably think there should be rules against it." And she said, "Well, yes, I do." He said, you know, "I think the market will figure it out and take care of the fraudsters."

After the 2008 financial meltdown, Greenspan testified before congress and basically said that the world didn’t work the way he thought he did: “I discovered a flaw in the model that I perceived is the critical functioning structure that defines how the world works.”

No surprise, Greenspan’s “honour among thieves” theory of the economy didn’t work out, and in fact the crisis was driven by rampant, systematic fraud and forgery on an industrial scale, none of which was punished.

One mortgage company, Countrywide, had an “art department” dedicated to modifying contracts. Many Black and Latino borrowers who had good credit and qualified for prime loans were told that they didn’t qualify, and were told they only qualified for riskier, higher interest mortgages instead, which failed.

In 2008, one of the hedge fund managers who made over $2-billion was John Paulson. He did so by betting against an investment that was filled with mortgages that were likely to fail. Paulson was aware they were likely to fail, because he had selected them himself.

“Going long” on an investment means buying it with the expectation that it will succeed: you buy and hold. When you “Short” an investment, it means you think the investment will fail. When you go short, you have to keep paying in, like insurance. It’s argued that shorting is an insurance or “hedge” against failure.

However, it can also create incredible hazards. For example, if you own your own house, it makes sense to have fire insurance for your own property. You don’t want a fire, but if something goes wrong, you can replace it.

The thing about short selling is that it’s as if you’re buying fire insurance on someone else’s house. If the house burns down, you get paid. And you’re not using that money to rebuild the house after the damage. You’re collecting on a bet. And it’s a bet that lots of people can make. So lots of people can buy fire insurance on one house that none of them own.

In Paulson’s case, it was even worse: he worked with Goldman Sachs to create a mortgage-derivative backed investment known as Abacus. Paulson selected the fund’s 90 mortgage-backed securities, which he expected to fail.

Goldman Sachs was charged by the SEC:

The SEC charge[d] that Goldman illegally withheld material information when it did not tell the Abacus buyers that mortgage bonds underlying the CDO had been selected with the help of Paulson & Company, one of the world's largest hedge funds. Paulson wanted to bet that the housing and mortgage markets would collapse. To do that, Paulson needed a CDO based on mortgage bonds likely to fall in value when homeowners stopped making their payments. Paulson was not included in the SEC complaint and has not been accused of any wrongdoing.

A synthetic CDO transaction requires two parties taking opposite views. The "long" party profits if the underlying securities rise in value; the "short" party profits if they fall. Each side places a bet and, in effect, the loser's losses become the winner's gains.

“In the Abacus deal, completed in April 2007, Paulson took the short side and two major investors took the long side: IKB, a large German bank, and ACA Capital Management, a New York-based investment firm. Paulson worked with ACA to choose the 90 underlying mortgage-backed securities. But there is dispute about Paulson's exact role. The SEC claims Goldman led ACA to believe that Paulson was taking the long side -- that he would bet the securities would rise in value -- when Paulson was actually taking the opposite view. This, according to the SEC, led ACA to believe Paulson thought the securities were safer than they were, and that its interests and Paulson's were the same. Goldman, however, says it "never represented to ACA that Paulson was going to be a long investor."

In the end, Goldman Sachs settled and paid a fine of $550-million and “acknowledged that its marketing materials for the subprime product contained incomplete information”.

It has to be said that most countries have not recovered adequately from these events - including the UK, Canada and the U.S. because the failure was papered over.

While everyone talks about political polarization, there is an enormous focus on culture and values. No wants to accept that economics or the economy plays a role in twisting people’s political views or radicalizing them, despite ample historical evidence for radicalization after financial crashes. Economies don’t just recover on their own, because money is a matter of human organization, and in its absence there is chaos.

In a study of 140 countries, researchers found that populations became bitterly divided and often more nationalistic. Austerity makes this worse. Throughout history, countless wars have been preceded by economic collapses, where people are borrowing money to speculate. When the bets, and bets on bets, and insurance on bets all start going bad, the debt hangover still remains - with lenders making money in their sleep, and everyone else sinking deeper into poverty trying to service debt when their incomes and revenue have evaporated.

Our current global crisis is because, in many countries - especially developed countries - the crisis has not been resolved, and it has deepened. What was genuinely required after 2008 was a New Deal - new laws, new regulation, and a sustained multi-year investment in jobs, infrastructure and industrialization.

Instead, the U.S. today is trying to double- and triple-down on turning its economy into a mob casino, to the point that they are essentially removing all oversight, consumer protection and law enforcement, while seeking to immediately balance the U.S. budget by cutting hundreds of billions of dollars in Medicaid. All while providing trillions of dollars in regressive tax cuts.

This won’t expand or supercharge the economy, it will explode it. It’s creating a deliberate recession, and even risks causing a financial crisis in the U.S.

As to why Trump would pursue policies that would blow up the U.S. economy, we should recognize that aside from bad actors - both foreign and domestic - there are lots of people, including politicians, economists, business and lay people who are absolutely certain these ideas will work.

There are certainly hostile foreign players who would cheer this on. It’s certainly Vladimir Putin’s goal - to see the USA collapse the way the USSR did. There are also plenty of people on Trump’s team - the techbros, like Peter Thiel, Elon Musk, Marc Andreesen and others who have talked about dismantling government and democracy. The idea is that they could escape government entirely, end taxes, and just be private governments themselves - replacing nation-state currency with cryptocurrency.

What’s interesting (yes, interesting) is that is all based in an elementary misunderstanding about the economy.

Government Deficit = Economic Surplus

What Harper, and Layton and just about everyone else fail to recognize is the absolutely basic accounting relationship between public and private deficits and surpluses, nor do they understand the importance of monetary sovereignty.

All spending is someone else’s income. If you cut spending, you are cutting someone’s income.

Private sector spending is someone’s income - it’s either someone’s wages or it is a business’ revenue.

Public sector spending is also someone’s income. When the government spends, it goes into the private sector economy.

Private spending + Public spending = Total Income.

When a government runs a deficit, it means that the government is putting more money into the economy than it is taking out in taxes. The government will generally cover the gap by issuing bonds.

When a government runs a balanced budget, it means the government is taking the same amount out of the economy as it’s putting back in

When the government runs a surplus budget, it means the government is taking more money out of the economy than it is paying back in.

One of the things that people don’t recognize is that public debts are private assets, and vice versa. There is a 1:1 correlation that when governments take on debt and spend, private sector debt is reduced, and when governments cut to lower their debt, the private debt goes up - including households.

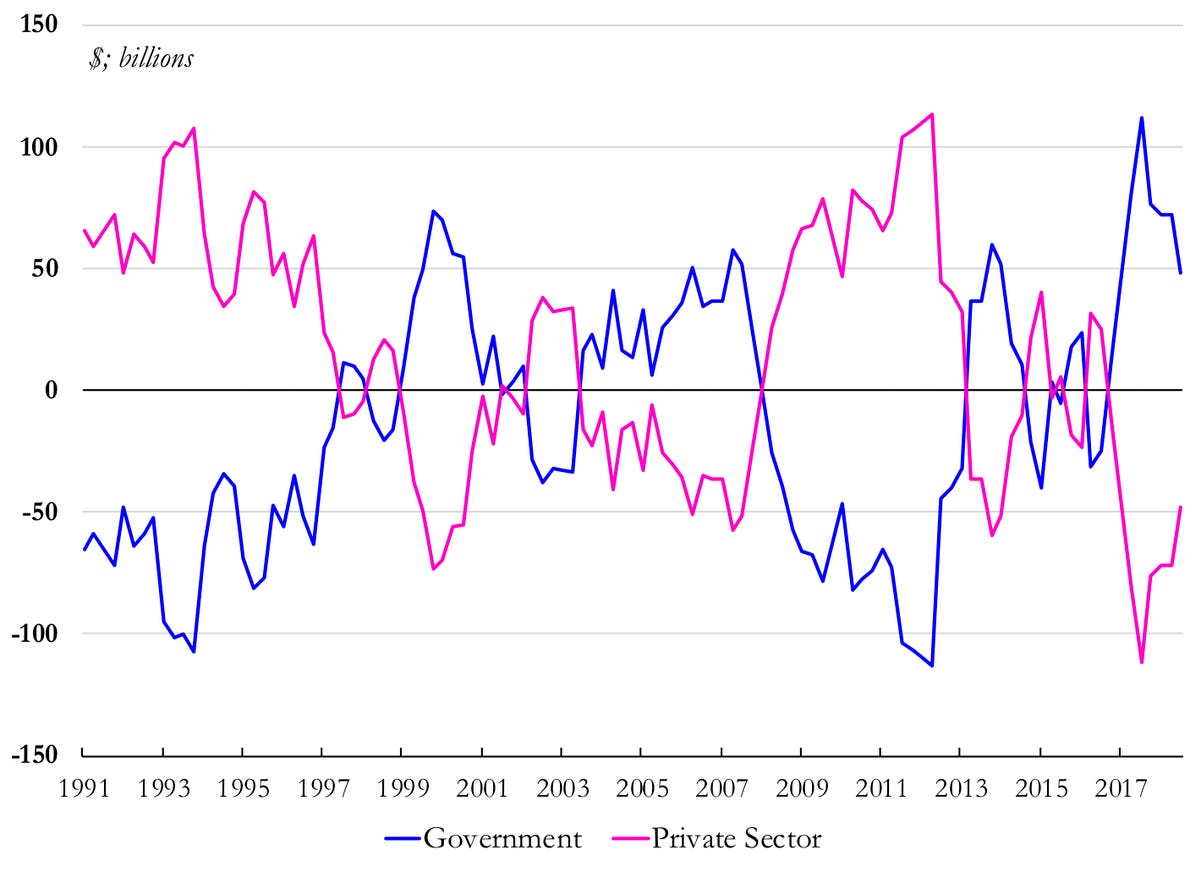

The correlation could not be more clear - this is a Government of Canada Chart, and public debt to private debt is a mirror image, and the same relationship holds in other countries as well.

Part of this is because when central banks lower interest rates, the larger loans translate to higher real estate prices and increased government tax revenue, without increasing the productive capacity of the economy.

Annual Change in Financial Assets, 1991-2018

Source: Cansim table 36100580. ‘Private sector’ aggregates data for ‘Households and non-profit institutions serving households’, ‘Corporations’ and ‘Non-residents.’ ‘Governments’ is ‘General governments.’ Note: Series is the year-over-year change in quarterly values.

These are just some of the many, many misconceptions about government debt, especially when a country has monetary sovereignty.

Governments are fundamentally different from businesses and households, because one very clear origin and role of government is as a court - regulating disputes. Elected officials make laws, and governments are considered courts of competent jurisdiction. That’s why there are so many rules and decorum.

Governments are also financial institutions. They create, collect and lend money as well as financial instruments.

When investors buy government bonds, they are using the government as a bank. They’re putting their money in, and in 5, 10, 20 or however many years, the government returns the money, with interest.

The fact that governments can do this is an important part of the financial system, because it means that people have a place to put their money and be sure they will be paid back. In the case of Canada, the government issues debt in Canadian dollars.

For this reason, government debt is not remotely like a mortgage or a credit card, Because the total debt actually consists of many different individual bonds of differing amounts, terms, interest rates. These bonds are continuously being paid off, while new bonds are issued.

The federal government and its central bank are not like commercial banks, and were never supposed to be. Whether the federal government has a central bank or not, it is the mother bank for the entire country.

That’s part of a federal governments job in ensuring that there is an economy.

This is what the clowns in Silicon Valley don’t understand: without government, they would never have amounted to anything. Aside from the fact that all the technology they use was created at public expense, so it money. It demonstrates clearly that they have only ever been money men who have never had a new idea in their life - if they actually understood information technology or the economy, they would recognize that money has always been an information technology. But they don’t, because they are in a money-worshipping cult.

The entire association with money-printing and inflation is based on gold standard economics, which ended for the U.S. and other countries over 50 years ago. Except for about 18 months, Canada was never on the gold standard.

Even when economies like the U.S. or the UK or anyone else had money pegged to gold, the price of gold in a given currency was was also set in dollars by the government, and could be changed at will.

The entire quantity theory of money is based on the idea that it’s the total amount of money in the economy that matters, not who has it, or how it’s spread around, or who specifically is getting more or less of it. This is the basis for GDP as well.

The elementary failure of this theory is that treats money as meaningless, because the theorists have no framework to explain meaning. They keep thinking of money as a material object when money, especially in combination with contracts and laws, really operates much more like a prompt to an algorithm, like the correct password that unlocks a series of actions to be performed. The fact that so many financial and economic processes translated effortlessly and accurately to run on information technology tells you that money itself is an information technology.

The first mention and instance of money was a clay tablet. The first “killer app” for the personal computer was VisiCalc - a spreadsheet.

The failure to grasp these basic facts is why we’re seeing the planned demolition of the US economy under Elon Musk and the tech bros, along with Donald Trump, and many libertarian and far-right conservative economists and politicians.

It is perfectly possible to create and destroy money and debt in very strategic and targeted ways that create positive benefits, that have to be limited to prevent abuses of power that have the potential to destroy order.

Trump & Co’s knowledge of the history and functioning of government, the law and the economy are so distorted that they essentially conspiracy theories. They have accepted economic propaganda at face value, and despite the fact that it has failed and is failing quite literally everyone in the world, people try to enforce it as if it were state religion.

This is unfair to religion, because actual religions tend to have scholars who have made profound philosophical contributions to the world, which cannot be said of a single neoclassical economist.

But they are not alone: one of the reasons why it’s so difficult to muster opposition to this madness is for more than a generation, everyone has been told that government deficits are to blame for inflation. They’re not.

But everything they’ve been taught, including in business schools, are ideas that are widely shared across the entire political spectrum in Canada and the U.S. where there are no political parties whose economic ideas are fundamentally different on this issue, even including the radical right and the radical left.

While socialists, communists and progressives all blame “neoliberalism,” they fail to recognize that economic formulas of their opponents are no different than the classical economic formulas that Marx used.

That’s why everyone keeps screaming at each other about the national debt, and how they did a better job of balancing the budget, when all of these policies are what have been leaving successive generations poorer, as more and more income and wealth gets concentrated in fewer hands.

They all fail to realize that all money is a kind of information, and it always has been. The question of barter is completely irrelevant to a money economy, because with barter, you cannot just print more food, and there’s no compound interest that causes cars and houses to grow.

For very good reasons peopls want to be absolutely certain of the value of their money, so they treat it as if it is an object that has intrinsic value in the world outside of human value and interaction, when it does not. If money had intrinsic value, other species would compete with us for it. They don’t. We don’t have money-eating bacteria. Animals other than humans don’t seek it out for its special use in mating. It is like a language, and it is a tool that human beings use to get each other to do things. Instead of conflict, there can be a transaction.

When people talk about the “horseshoe” theory of the political spectrum - that if you go far enough left and right, they meet, it’s absolutely true economically, because capitalism and communism both demand that government run like a business.

All those rabid self-proclaimed free-market capitalists who rail against socialism, communism and collectivism don’t realize that Marx modelled the centrally planned state on the model of the corporation. One of the things that struck Marx when he looked at the economy in Victorian England, at the heart of the Industrial Revolution and the British Empire, was that in the middle of market chaos, corporations themselves were highly ordered.

The Communist State would run the entire country as a single corporation being run, supposedly, for the interests of all. It wasn’t just the model of corporation, either: it was also the same supply-side trickle down economics as capitalism.

Communism, capitalism, socialism, libertarianism all become dystopian because their ideas for organizing society are all based around the idea that government’s role is to enforce a particular economic arrangement.

The idea that Keynes was a “left” or “socialist” economist is pure propaganda. He was a liberal, and liberalism is not about economic ideas, it is the idea that that, in order to ensure personal freedom and accountability, both individual and collective rights must be respected and enforced by government and the private community alike. It is about the rule of law - the idea that no one is above the law. It is also about liberal democracy, which means individual rights as human beings are protected.

Keynes, like FDR, wanted to save democracy, and capitalism, not for the economy’s sake, but for the preservation of democracy and the rule of law, where division of powers is also essential to that freedom. Limits on executive power. Protection of rights as well as enforcing responsibilities, that are based on recognizing each person as a living, breathing human being. Having a “mixed” economy with private ownership and businesses and markets, as well as a strong public sector and an independent judiciary.

This liberalism is not about elevating the individual as hero: it’s about protecting individuals or a vulnerable minority from being killed by an angry mob, and ensuring that individuals are free can speak truth to power without fear of retribution.

I say all of this to remind anyone who is concerned about the state of politics and how to make things better is to remind everyone that this is the actual purpose of government, and these are the ideals and guiding principles that define human rights, freedom and democracy.

Silicon Valley has a habit of trying to reinvent things that have already been invented - like buses and trains. This time, they’ve reinvented communism. What’s happening to the United States is that it people are trying to convert it into an economy that is not liberal, or democratic, or free, or free market, or capitalism. It’s more like financial communism, and it’s most definitely the absolute opposite of everything that America was created for.

There are many reasons why Federal governments, quite appropriately, intervene to ensure the stability of the financial system. It’s not just that jobs or profits depend on it: lives do, too.

Private financial systems and markets aren’t self-governing. The state provides the entire legal and financial infrastructure of the system, as a statement of fact - markets and money have only ever existed within a legal and regulatory framework, and both markets and money fall apart and lose their use when there are no rules and no enforcement. This is what the anarcho-capitalists in Silicon Valley and around the world don’t grasp, and they are a danger to themselves and others. Markets and the economy can be strategic and free and its success does not depend on believing in neoclassical economics. There are modern Keynesian ideas that support markets and business without demanding that you deny reality.

-30-

Another superb report. How do you research and articulately report so much information, so rapidly after such misleading comments like those of Harper??

Well done!!

Harper….. He's the guy that sold the Canadian Wheat Board along with all its assets to a Saudi oil billionaire for one (1) dollar.