The Numbers Don't Lie: the Carbon Tax Isn't Behind Surging Prices and Inflation. Price Fixing Is - Including the Price of Oil.

250 years ago Adam Smith warned of cartels conspiring to raise prices. It's still happening, but we're being gaslit into believing it's not.

In Canada, everything wrong with the economy is being blamed on the “carbon tax” with parties of the left (the NDP) and parties of the right (Conservatives) buying into, and repeating the claim that it is a burden on working people or individual households. Canada’s independent Parliamentary Budget Office put out a new report today that showed that for individual Canadians and households, they are actually more likely to get more back in a “carbon rebate”.

“Considering only the fiscal impact of the federal fuel charge, in 2030-31, we estimate that the average household in each of the backstop provinces will see a net gain, receiving more from the Canada Carbon Rebate than the total amount they pay in the federal fuel charge (directly and indirectly) and related GST. See Table 1 on page 13.

• Moreover, in 2030-31, for all backstop provinces, we estimate that the average household in each income quintile will see a net gain—except for the average household in the highest income quintile in Prince Edward Island, Nova Scotia and New Brunswick—when only the fiscal impact of the federal fuel charge is considered.”

Notably - as some observed, the actual costs of ignoring climate change are completely ignored. That is because the PBO completely downplays or ignore those impacts as “outside” the market.

Now, I am not particularly interested in justifying or defending the carbon tax, but it needs to be explained.

The carbon tax was conceived as a fundamentally conservative “market” solution to fighting climate change, because of the baked-in ideology idea that government intervention won’t be as efficient or effective.

There are two parts to the tax.

First, on is that the tax is there because the current price of oil, gas and coal has not reflected the negative costs. The same way that cigarettes didn’t include all of the negative costs of people getting sick and dying.

Science has recognized over more than a century, we have burned over a trillion tons of carbon-based fuels out of the earth and set them on fire, adding more CO2 to the atmosphere than plants and the ocean can re-absorb. It’s like adding extra insulation to the atmosphere, and hotter air holds more water.

That is why we now have more massive and destructive storms with intense downpours. There are costs and benefits to this energy, and we haven’t been taking account of those costs - which we all still end up paying, just through other means, like higher insurance rates.

Second, some people will ask, if if the money being collected is not being spent directly on fighting climate change, what difference it is supposed to make? One is that makes other options more competitive. The idea is that itts a gradeal shift over.

The thinking is that if you tell people you’re goint to keep increasing the levy slowly, people and companies have time (and an incentive) to switch to other types of energy.

WHICH IS BIGGER - CARBON TAX or PRICE HIKES?

If we’re going to have an informed debate about the impact of the carbon tax, we can start with the most basic of questions - how much is it costing per year?

Finding the answer to this question can be annoyingly difficult. Search engine results produce so much hay that’s it tough to find the needle. Fortunately, the Parliamentary Budget Office report of today, October 10, 2024 lays it out.

The argument is that since the carbon tax is a tax on energy, it’s a “tax on everything,” and that therefore it is somehow this $13-billion tax is supposed to also be causing inflation and driving up food prices, housing and everything else.

By comparision, in 2022, Canada’s GDP was $2.16-trillion. In the entire economy, $13-billion is 0.006%. Out of ten dollars, that is six cents.

The annual increase in the carbon tax is about $2-billion a year.

It’s important to recognize that conservative economic macroeconomics essentially define inflation as being caused by government. Milton Friedman said as much, many times, including in this speech “Inflation Is Created by Government and by No One Else.” As a consequence, if you provide actual evidence of price-gouging - even of people jacking up prices to profit from a crisis - it will be rejected because the theory says the evidence can’t be true.

As Richard Adams wrote nearly 20 years ago, in 2006, “The great economist's career was full of heated controversy but achieved almost nothing of substance in setting public policy… very few of Friedman's most cherished proposals were ever put in to practice. Of those that where - such as monetarism - almost all turned into failure… Friedman's ideas of directly targeting the money supply were tried and rejected as a failure, in both the UK and the US, and Friedman himself backed away from his dogmatic earlier positions.” Friedman is said to have come up with the “world’s dumbest idea” and his views on monopolies have also been questioned.

This is a problem for conservatives - and it’s also a problem for the Parliamentary Budget Office and it’s predictions.

The Other Explanation for Inflation - Cartels

The idea that government is to blame for prices going up also contradicts Adam Smith, who observed “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.”

There is plenty of evidence - including in courts - that collusion and price fixing, and concentration of monopoly or oligopoly market power all lead to higher prices.

As Matt Stoller writes at his substack BIG, which focuses on U.S. antitrust and monopoly cases (In Canada it’s anti-combine).

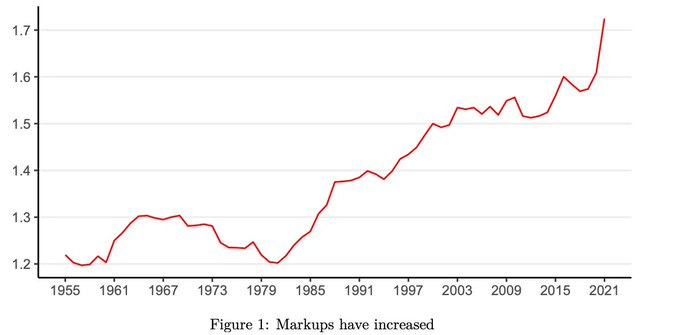

One thing that’s really striking about the graph is that inflation and markups have been going up for more than forty years.

Why is pricing such a big deal right now? One answer is that it’s an election season, and voters are very mad about the high cost of living, consistently listing inflation as their number one concern. But it’s not just politics. Corporate markups have increased for decades, skyrocketing during the pandemic.

Something real is going on. In individual markets, CEOs have been braggingpublicly that they are restraining production to increase prices. Profit margins in the food industry jumped during Covid and haven’t come back down. Or take rent. There’s a company called RealPage that works with the biggest corporate landlords to hold apartments empty so they can increase prices, which jumped up 11% in 2022. There’s some evidence of conspiracy around pricing in virtually every industry. Turkey, poultry, and pork. Frozen french fries. PVC pipe. Anesthesiology. Oil. Ammunition. Pharmaceuticals. K-Pop. Credit bureaus and FICO, Verisign, industrial gasses, architectural software, locks, entertainment data. Homebuilders. Garden chemicals. Defense and aerospace. Ticketing. Estate Sales. Gaming. Drug wholesaling. Work ID information. Seeds and chemicals. Etc.

The impacts of these private price hikes on the economies of Canada and the U.S. were sometimes huge- particularly oil prices.

As Stoller wrote back in May, the Federal Trade Commission allowed Exxon a merger but barred a U.S. oil executive, Scott Sheffield, from sitting on the board, because of evidence that in hundreds of private text messages as well as in public statements, had worked with OPEC to keep the price of oil high.

Stoller calculated that the oil price fixing efforts accounted for all of “27% of All Inflation Increases in 2021” in the U.S.

In late 2021, I noticed that the increase in corporate profits in aggregate was responsible for 60% of inflationary increases, using this chart and doing a bunch of rough calculations that have since mostly been borne out. The jump in profits in 2021 was about $730 billion, or $2,100 per person.

How do you aggregate just the oil industry? Well, it’s pretty clear that in 2021 and 2022, the industry did fantastically well, with the “the top 25 companies [making] more than $205 billion in profits in 2021,” and an “even more astounding” amount in 2022. Of course, not all profits are due to price-fixing, but $205 billion is just the top 25, not the whole industry. And profits got much much better the next year.

In Canada, most of the major oil companies are all owned by U.S. companies, and exactly the same pattern happened here. Companies did not invest in new production, and chose to reward shareholders instead, as this CBC article reports:

The industry currently faces a bit of a conundrum, said Jeremy McCrea, managing director of energy research with financial services firm Raymond James: The world's energy consumption is rising, but companies are reluctant to ramp up spending to dramatically boost oil and natural gas production.

And from Statistics Canada:

In 2021, oil prices reached their highest level since 2015. As a result, the industry looked to recover the losses that were incurred during the COVID-19 pandemic. Total gross revenue in the oil and gas extraction industry increased 85.7% to $174.0 billion in 2021 from $93.7 billion in 2020. According to the Raw materials price index, the price of crude oil and bitumen increased by 70.8% from 2020, while the price of natural gas increased by 15.8%. Total production for crude oil rose by 6.2%, while total natural gas production increased by 3.9%.

In 2022, total revenue for the Canadian oil and gas extraction industry rose 53.6% to $269.9 billion, following an 87.5% increase in 2021. The 2022 increase was attributable to increased economic activity and increased demand for energy products.

According to the Raw materials price index, the price of crude oil and bitumen in 2022 increased by 49.0% from 2021, while the price of natural gas increased by 25.6%. Total production for crude oil rose by 2.3% in 2022, while total natural gas production increased by 7.3%.

Just to recap:

Canada’s oil industry gross revenue was:

$93.7 billion in 2020

$174.0 billion in 2021 (increase of 87.5%)

$269.9 billion in 2022 (increase of 49.0%)

From a CBC report August, 2022

In January, the oilpatch was expected to produce record-high after-tax cash flow of $99 billion this year, according to a report by the ARC Energy Research Institute. That same organization is now expecting the Canadian oilpatch to rake in $147 billion.

During the latest quarterly earnings, Imperial Oil posted a $2.4 billion profit, which was a six-fold increase compared to the same three-month period a year ago. Suncor Energy had a $4 billion profit, which was a four-fold increase. Cenovus Energy and Canadian Natural Resources both also collected billions in profit too.

This is biblical, what's happening- Canoe Financial's Rafi Tahmazian

"Suncor, CNRL, Cenovus — wow. Big, big windfall," said Rafi Tahmazian, a senior portfolio manager at Canoe Financial in Calgary.

"Imagine a bank machine that's broken and it's spitting out $100 bills and there's not enough people to pick them up and there's $100 bills gathering on the ground. This is how profitable these businesses are right now," he said.

Even if you were just to take the increased projection in annual profits mentioned above by the ARC Energy Research Institute - from $99-billion to $147-billion in profits.

That increase in profits of $48-billion is 24 times more than the impact of raising the carbon tax. It’s a fact that a fair bit of the carbon tax actually went back to Canadians. The record profits from high oil prices went only to shareholders and bondholders.

Did have an impact on inflation? You’re damn straight it did, both in direct and indirect costs. Energy is an overhead cost for the cost of living as well as the cost of doing business. But higher prices, including in oil and gas, were not being driven by the carbon tax. The oil and gas was being driven by an alleged US Oil price-fixing conspiracy with OPEC - including Saudi Arabia, Russia and China.

These are based on StatCan data.

The chart with one line on the left is overall inflation according to the consumer price index. The change in the price of food is low compared to the big spikes in oil, gas, fuel, and mortgage payments. Sizeable chunks of inflation in Canada is because oil companies jacked up prices and because the Bank of Canada jacked up interest rates.

This is a problem everywhere. That doesn’t make it better.

I say all of this because the problem with Canada’s economy, and that of the U.S. UK, France, Germany and other developed nations is not an inflation crisis - it is a personal insolvency crisis, and we can’t diagnose or cure it because we have been trapped into believing Milton Friedman’s nonsensical explanation for inflation, which is not backed up by evidence. Inflation is not caused by fiscal stimulus. It’s private prices that are going up, as profits are as well. Prices go up, profits go up, governments get more taxes. The government isn’t driving the price increase.

If anyone thought facts would pour oil on troubled waters and settle this debate, it will naturally have the effect of pouring oil on a raging fire.

There is no genuine interest in having a reasoned, fact-based debate, because the misinformation and falsehoods have been part of a deliberate campaign, driven by oil industry propagandists and the politicians they support (see above). A colossal amount of money is being poured into think tanks and third party groups to push junk information, funded by various oil concerns.

Often, they simply play the role of being “merchants of doubt” - they basically act as it’s all no big deal. It’s been done for big tobacco, big sugar, big oil for years.

What we need is a 21st Century New Deal and Marshall Plan.

Part of the New Deal was that it looked at a lot of the crooked practices that had contributed to the catastrophic financial crash of 1929. They determined certain crooked and harmful practices would be either outlawed or regulated to the point of safety.

With a New Deal you look at practices that are broken, unfair, or making it harder than it should be for Canadians to compete and make a buck, and you work to address it. You focus on building Canadian ownership and Canadian jobs, because we need to reindustrialize, and fast.

The goal is full employment, but we’re trying to engage everyone in moving to a better place economically. It’s about progressive reform that respects business and entrepreneurship and investment, and respects workers and their rights. It’s about everything we can to keep things that are critically important to all of us.

With a Marshall Plan, there are two broad efforts. The Marshall Plan after the Second World War helped invest in rebuilding Europe. It also had an important role in restructuring debts across whole economies, including Germany in 1948. There was a recognition that debts that had arisen because of the Depression or the War, as well as farmer’s debt, could all be negotiated down. Reducing the dead weight of excess debt improves the viability of new investments. This has been done before, It is how Canada, the U.S. invested and built their way out of the Depression during and after the Second World War.

So, that’s what you do. And it’s how you achieve what you want to do. Everyone needs to stop freaking out and making stuff up. Oil companies, you’ll be around for a while. But we need to commit to doing a better job of putting people to work, and investing in the things that are really are going to make our country better.

The limit is not financial - it is limited only by whether it is possible or not. This is important. If it’s not possible, all the money in the world won’t make it happen. But if it can be done - and the people, technology and resources are all available, then it can be paid for.

-30-