The Fraser Institute is Deliberately Misleading Canadians About the Way Our Country Works. Voters Deserve Better.

The Fraser Institute's "24 facts for voters" lays the bovine scatology on thick

In recent Canadian elections, there has been growing concern about misinformation, foreign interference, and attempts to deceive Canadians. For decades, the Fraser Institute - as well as various other think tanks - have issuing misleading reports with the purpose of manipulating public opinion. It’s what George Orwell called “political writing” - crafted to “provide the appearance of solidity to pure wind”

The function of these “think tanks” is to crank out misleading propaganda using cherry-picked data, deceptively presented, which are then presented as fact - as their latest “24 facts for 2024” was, in a column, by Conrad Black, originally published in the National Post, and which can then serve as talking points for Conservative politicians.

One of the techniques that is used, is “paltering” - which is carefully combining a string of technically true statements to convey a completely false impression.

Given the blatant misrepresentation it presents of the lives of Canadians, it needs to be challenged.

“With a better understanding of the impact of government policies, Canadians will be better able to hold politicians accountable and make informed decisions at the ballot box. With the calendar now turned to 2024, here are 24 facts for Canadians to consider.

Canada’s Economic Crisis

Average per-person incomes in Canada have stagnated from 2016 ($54,154) to 2022 ($55,863). Meanwhile, the United States has seen an increase from $65,792 to $73,565. The average Canadian now earns $17,700 less annually than the average American.”

The Fraser Institute starts with three deceptions here - cherry-picking data; taking an average of people with massively different income concentrations for a meaningless average, and ignoring global events that drove crises.

First, income stagnation: In 2011, an economist determined that adjusted for inflation 99% of people living in Calgary and in Edmonton are no better off than they were in 1984. That was in the middle of the most recent energy boom, in a province that had one political party running it for over 40 years..

Second: cherry-picking data. The second data point is in 2022 - a year when Canada was still in the middle of the pandemic.

The pandemic was a global event - a widely predicted natural disaster, of the kind that has been occurring for millons of years. Waves of disease and death running through a species. No one with any credibility on the issue thinks the pandemic was anything but naturally caused. The fact that Donald Trump is promoting the idea tells you everything - the idea that China is “to blame” for an event that is a natural biological disaster.

In 2014, Canada’s economy and especially its oil sector were thrown into turmoil when Saudi Arabia launched a deliberate and sustained price war. The collapse in the price of oil was historic, and it was not random market forces or some kind of technology shock. It was an act of financial and economic warfare by Saudi Arabia on the North American oil industry. Oil went from hovering at $120 USD a barrel for years, before collapsing in 2014, to actually being negative at the beginning of the pandemic.

It is completely insane that neither of these two historic disruptions to Canada’s economy occurred. But this is a perfect example of the lying by omission in the Fraser Institute’s reports. This is not scholarship or political economy in any sense of the word.

This is critically important historical context for the economy, without which you can’t possibly understand many impacts on Canada’s economy - private sector and public sector alike. ,

Using names for indicators that are deceptive - like “average”

The word “average” is one of the most commonly abused words when it comes to deceiving voters,

For a reader, the idea being communicated by the word, “average” is probably “someone who has a lot in common with me,” which is not the case, at all.It’s not a casual sense of the word “average” - “just an ordinary average guy. It is the specific, mathemathical meaning:: “the result you get by adding two or more amounts together and dividing the total by the number of amounts”

For example, to calculate average income of a group, imagine everyone pooling their money in one pile, or account, and dividing it evenly among the entire group. That is the mathemathical fiction of the average. I would go so far as to say the term average, and applying averages to distrubition where the disparities between “typical” - and the top of the distribution can is in multiple thousands, it is not a useful indicator.

The Fraser institute is labouring under the mathematical delusion that in Canada, and in the other countries Canada is being compared to, all income, taxes, and property ownership are perfectly equally divided among the population.

It is odd, to say the least, that a libertarian think tank would hallucinate that every country in the world is some kind of communist fantasy.

Actual distribution is nothing like an average, or a bell curve.

We need to talk about real “typical” families, not phony “average” ones.

Using averages is deceptive because it misleads people into thinking that the Fraser Institute is talking about someone in their situation.

However, if the Fraser Institute wanted to describe the situation that most people live in, the accurate word is “typical”.

Because the Fraser Institute uses the term “average,” that just means equally dividing among everyone, no matter how extreme differences might be.

It’s Billionaire-in-a-bar logic: If you and your friends are out at small bar, and Bill Gates walks in, on average, everyone in the bar is a multi-billionaire. When he walks out again, that ends. The same thing is true of income: lumping you in with someone who makes more money doesn’t make you richer.The U.S. is home to more billionaires than any other country in the world. This really does “pull up the average”.

2 Canada ranks just below Louisiana ($57,954) in average per-person income and slightly ahead Kentucky ($54,671). This is not exactly the bar Canadians should be aiming for.

This is a meaningless comparison, for the reasons above: it is based on averages, and the data is being cherry-picked. Louisiana has five billionaires, and so does Kentucky.

According to the Organisation for Economic Co-operation and Development, Canada will be the worst-performing advanced economy from 2020 to 2030 and from 2030 to 2060.

No one should take an economic projection for more than 30 years from now seriously, and as Christine Lagarde noted, “economists are a tribal clique” and warned against their models as being useless.

Let’s look at 4, 5 and 6 together.

Canada’s economic growth crisis is due in large part to the decline in business investment. Business investment per worker in Canada declined by 20 per cent since 2014, from $18,363 to $14,687.

In 2014, Canada invested about 79 cents per worker for every dollar invested in the United States—in 2021, investment was 55 cents for every U.S. dollar.

We’ve witnessed a massive flight of capital from Canada since 2014, to the tune of more than $285 billion.

This is such a blatant case of cherry-picking, it is shameful. It takes investment at its 20-year peak (2014), then compared is to a year into the pandemic, 2021 - just before the price of oil soared again - because OPEC and some U.S. producers were collaborating to restrict production and keep prices and profits at record highs. This is all a matter of the public record.

This is what the chart for investment looks like, and it’s all about one thing: the price of oil. In 2014, the price of oil had been at or above $120 a barrel for half a decade. In June, 2014 the price of oil hit $135.61 and started to plunge - while Conservative Prime Minister Stephen Harper was still Prime Minister. That’s why all the capital flowed into Canada - and why it all flowed out again. It is all about the global price of oil.

In fact, most of the collapse in investment occurred under the Conservatives, and it was steadily recovering upwards until the pandemic - when it resumed climbing again - driven by the global price of oil.

7 . From the onset of the COVID recession in February 2020 to June 2023, the number of government jobs across the country increased by 11.8 per cent compared to only 3.3 per cent in the private sector (including the self-employed).

This is a perfect example of the ways in which the Fraser Institute is completely divorced from reality. The crisis of the pandemic was the single largest public health crisis in a century, and massive disruptions that occurred in order to prevent the complete collapse of the health care system, which nearly happened in several provinces.

Fiscal Crisis: Imprudent Spending and Massive Deficits

8 The Trudeau government has increased annual spending (not including interest payments on its debt) by nearly 75 per cent since 2014, from $256 billion in 2014-15 to a projected $453 billion in 2023-24.

Here too, this is a pointless comparison, because after the 2008-09 financial crisis, the Harper Conservatives engaged in austerity budgets, cutting federal direct spending as well as transfers to provinces. The province of Manitoba had no increase in federal transfers in 6 years.

The Harper Conservatives shrank the Federal Government to its smallest size as a share of GDP since the Depression. As a percentage of GDP, Military spending under Harper half what it was when Pierre Trudeau was Prime Minister in the 1970s.

During the pandemic, the Government of Canada’s interventions prevented a total collapse of the Canadian economy, and it was the federal government that did the heavy lifting. Over 80 cents on the dollar in relief was from the federal government.

With federal spending at nearly $11,500 per Canadian, the Trudeau government is on track to record the five highest levels of per-person spending in Canadian history.

Again, this is a meaningless figure, because more than 60% of the federal budget is transfers to provincial governments and individuals.

A large portion of government spending in Canada goes to pay for the 4.1 million federal, provincial and local government employees. Government employees across Canada—including federal, provincial and municipal workers—are paid 31.3 per cent higher wages (on average) than workers in the private sector. Even after adjusting for differences (education, tenure, type of work, occupation, etc.) government employees are still paid 8.5 per cent higher wages.

This is colossally misleading. The Fraser Institute is lumping together all private sector jobs in one pot and all public sector jobs in another, which the statement half-concedes. They admit that when you compare apples to apples instead of comparing fast-food worker inceoms to a brain surgeon’s, the difference is not 31.3% as first claimed, but 8.5%.

There are many public sector jobs that have no public sector equivalent - like the justice system, health system, most of the education system, police, fire paramedic, emergency and safety inspectors, engineers, clean water experts. They need to be independent, and not political, because they are all people who are supposed to be making sure that one person doesn’t die because they are less socially important than another.

This is the first critical point.

Most people fail to realize that, at all times, all three levels of government are involved in decisions that can affect whether people in their community get hurt or die,or not. Health care, emergency services, police, health and safety and workplace regulations, public health measures.

That’s why the “business of government” is fundamentally different from most private businesses. When businesses fail, the harm is usually more contained. The reasons governments need to be robust is that when they fail, they fail the public - not just customers, or owners.

The private sector in Canada generally pays people at the bottom less than public

The people who make really astronomical pay in Canada are in the private sector. not the public sector.

The people at the executive level in in government generally make far less than their private counterparts - as they should, and the people in lower-paid positions tend to be paid more.

The Trudeau government has used large increases in borrowing and tax increases to finance this spending. Federal debt has ballooned to $1.9 trillion (2022-23) will reach a projected $2.4 trillion by 2027/28.

This is deeply deceptive, even in its phrasing. By saying “large increases in borrowing and tax increases” a reader might reasonably think that the both the increases in borrowing and the tax increases were “large".”

In fact, the federal government cut income taxes and modestly raised others - which is part of being fiscally responsible.

It’s incredibly important to recognize that Canada was left in a structural deficit that was the result of Harper Government poliicies, made acute by the plummetting price of oil.

Instead of using high oil tax revenues to save for a rainy day, the Conservatives cut taxes in good times. When bad times hit because the price of oil had collapsed, there was nothing left in the coffers. In 2015, they did the fiscally responsible thing, which was to increase tax revenues on the people with the highest incomes, and running deficits that helped finance the Canada Child Benefit, which lifted hundreds of thousands of children out of poverty.

The really significant borrowing was because of the pandemic, where the federal government stepped in to prevent the collapse of government finances and the economy as a whole. The pandemic was incredibly destructive and we clearly have yet to recover economically. Acting like nothing happened, or there is nothing to recover from after lasting damage to the structures of the economy and services, is denial.

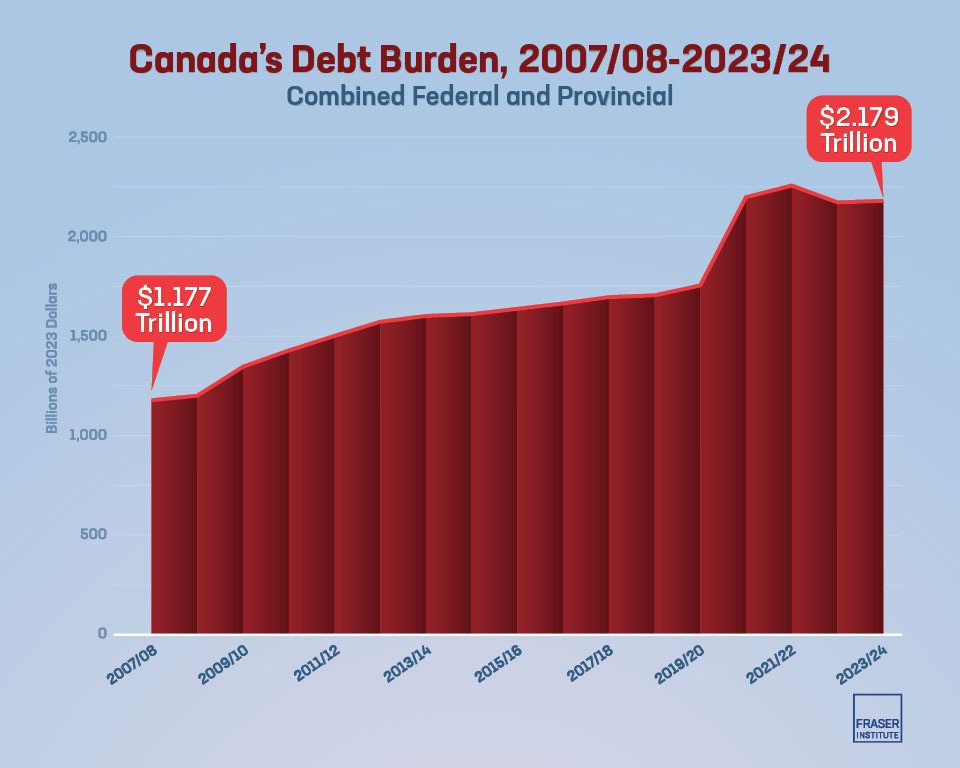

Combined federal and provincial debt in Canada has nearly doubled from $1.18 trillion in 2007/08 (the year before the last recession) to a projected $2.18 trillion this year.

This chart is deceptive, notably because it combines all federal and provincial debt, and therefore conceals the colossal surge in federal debt added by the Conservatives under Stephen Harper, after the Global Financial Crisis.

What it also doesn’t show was an unexpected effect of the federal spending under Trudeau: provinces started to balance their books or run surpluses.

Conservative Premiers used this revenue windfall as an opportunity to once again engage cut taxes, instead of using the money to invest in services. A huge part of the reason for debt and deficits is that tax rates are much lower than they once were. Premiers who were on the way to a balanced budget or surplus chose to keep cutting taxes and keep borrowing. This is true in most provinces, including NDP-governed provinces.

I’ll answer 13 and 14 together.

Tax Increases and Canada’s Affordability Crisis

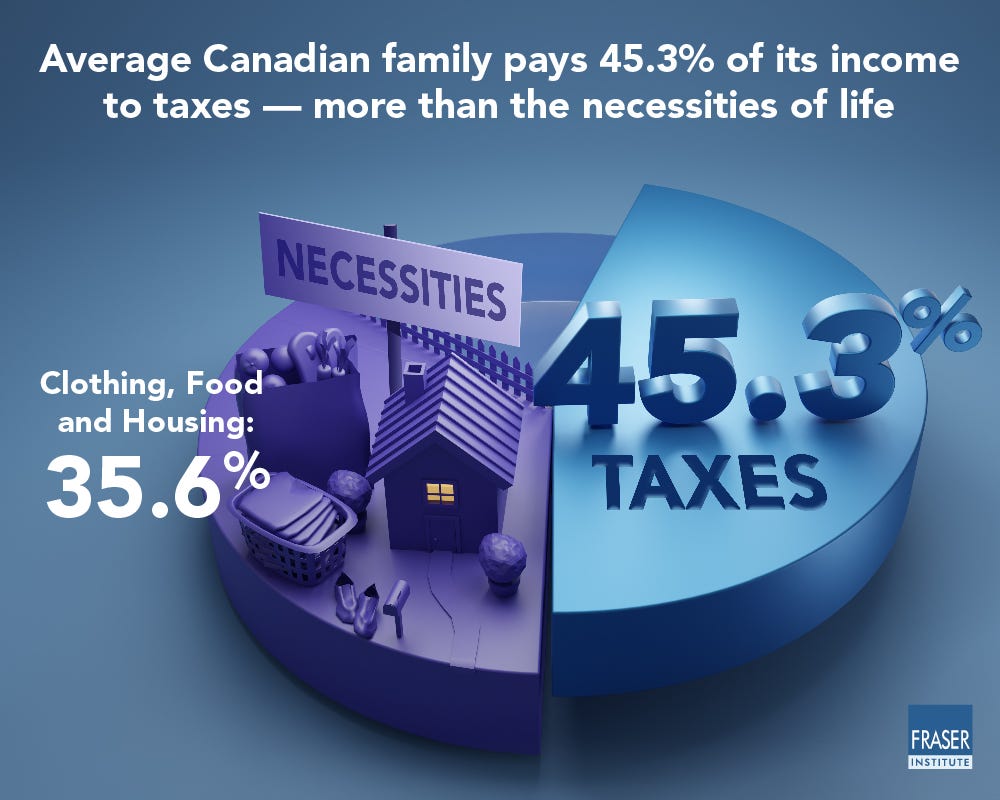

To pay for all this spending, the total tax bill for the average Canadian family was $48,199 or 45.3 per cent per cent of its income—more than what the average family spends on housing, food and clothing combined.

Housing and grocery costs dominated the news last year but in 2022 the average family spent $1,452 more on housing and $996 more on food while governments extracted an extra $4,566 from the average family in taxes.

This bogus claim about taxes is one of the Fraser Institute’s most shameful distortions - and its based on the same fallcy of “average” again. This time, distortion of taces is even greater than with income.

In this case, to calculate taxes, the Fraser Institute is taking all of the money paid in tax, including by billionaires and the biggest corporations in Canada, and pretening that they are being paid for by Canadian families.

The argument for this is that everyone is “ultimately” paying for corporations’ taxes, but that’s not true. It is not true politically, economically or legally. There is important reasons why corporations are considered persons under the law. One is so that they can be taxed and held liable for their actions.

The claim that “you’re really paying these other taxes” just isn’t true. It ignores all the real, specific and separate transactions taking place. .

This false idea isused to claim that corporate tax cuts for someone else will benefit you - because they’ll pass on the savings, and not pocket them. The very wealthiest people tend to own entire constellations of corporations, both to generate wealth and to minimze taxes. Many corporate tax breaks diretly benefit the very wealthiest people in society who can afford to set up corporations and pay lawyers and accountants.

The Fraser Institute is also looking at what the “sticker price” of a tax is, but not the effective tax rate - what people actually paid.

This is what a study of what Canadians actually paid in taxes showed:

Note, that they emphasize the typical Canadian family, not the average.

While the federal government has claimed it “cut taxes for middle-class Canadians everywhere,” in reality 86 per cent of middle-class families in Canada are paying higher income taxes under the government’s personal income tax changes. And that doesn’t account for carbon taxes, etc.

More than 60 per cent of lower-income families (those in the bottom 20 per cent of earners) in Canada now pay higher federal income taxes because of the federal government’s tax changes.

At this point, I’m certainly not going to take their word for it. There are two points here - first - when the Fraser Institute says 86% of middle class families - how do they define middle class? Where do they get the 86% number? Are they only looking at one side of the ledger? Expenses only. or revenue and net as well?

Most carbon taxes are paid by people who are much higher income, and by energy companies, who have been making record profits.

When the Fraser Institute complains about all the spending the federal government does, one of the the big new programs was the Canada Child Benefit, which is progressive, tax-free and has lifted hundreds of thousands of children out of poverty. Other programs coming up are a national dentistry program, and national pharmacare.Seventy-four per cent of Canadians surveyed believe the average family is being overtaxed by the federal, provincial and local governments.

That is because the Fraser Institute has been making the same misleading claims about taxes for decades, being repeated uncritically.

Damaging Energy and Environment Policy

In the federal government, there’s a common belief that the Canadian economy is undergoing a fundamental and rapid transition towards “clean/green” industries. Yet despite massive regulations and subsidies, Statistics Canada data shows that Canada’s “green” economy amounts to only about 3 per cent of gross domestic product (GDP) and directly employs roughly 1.6 per cent of all jobs.

This is copy-pasted from oil industry lobbyists, which is kind of funny. First, if you want to talk about subsidies, let us be honest about the fact that the oil industry has received enormous support from government over the decades. The research that helped make mining the Alberta oilsands possible was provided by the Liberal Federal Government of Pierre Trudeau.This is an incredibly partisan political and ideological series of accusations that aren’t based in fact or evidence. Part of that inaccurate belief is the idea that the problems facing Canada’s oil industry are because of Canadian-made obstacles, when the problem is that that projects have not been feasible because the price of oil has been too low - because OPEC had been trying, deliberately, to bankrupt our oil industry.

It’s not clear what “massive” regulations there are for the environment to be removed, and I have seen first hand the way corners have been cut by provinces.Under the Harper Conservatives, environmental regulations dating back to confederation in 1867 were removed.

When it comes to jobs and growth, the oil industry is pumping a lot more oil with a lot fewer people. Automation - self-driving trucks - have replaced six-figure driver jobs. The trajectory of the “green” economy is for growth, and there are good strategic reasons to do so.

Energy security is critical, and overreliance on a single energy source - oil - is a vulnerablilty. It exposes the entire Canadian economy to greater shocks and volatility because of something global and international having a profound effect on our economy. This is about having a backup power supply.

Second, there are real costs that come with the damage of burning trillions of tonnes of coal and oil for decades to the point that it changes the amount in the atmosphere so it becomes a better insulator We’re all having to pay the costs.

And stop pretending the science is uncertain or new. We have been talking about climate change for a long time.The recent United Nations climate change conference pushed for a "transition away from fossil fuels." Despite significant spending on “clean energy”, from 1995 to 2022, the amount of fossil fuels (oil, gas and coal) consumed worldwide actually increased by nearly 59 per cent.

There is one word for this: China. China’s economy and industrial capacity exploded as they massively expanded their energy capacity. It has absolutely nothing to do with Canadian policy.

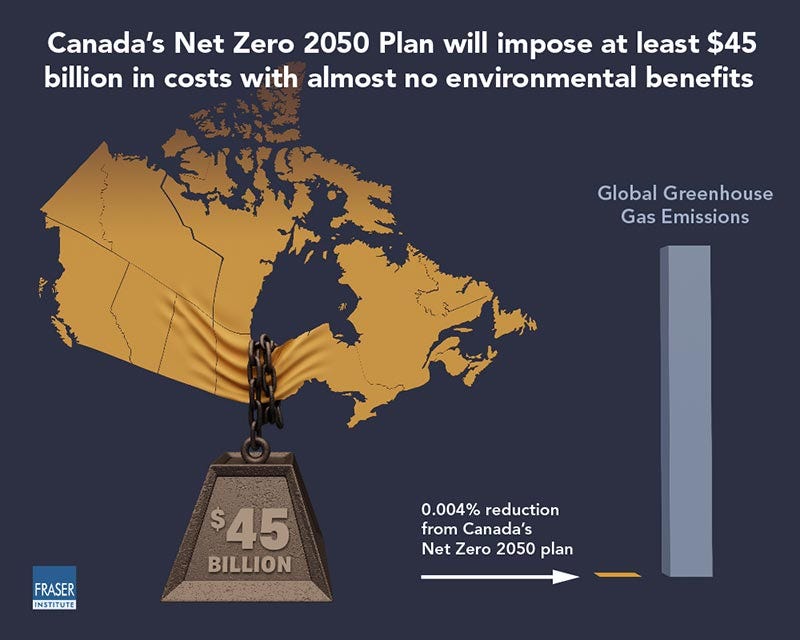

It’s also the case that Canada, under the PCs and Brian Mulroney and under the Liberals, continually led international efforts to fight for emissions reductions - agreements which were opposed and delayed by both the NDP and Conservatives, in and out of government.Canada has an opportunity to serve the world with its energy and resources and, in doing so, benefit our allies and improve both world energy security and the environment. But the federal government doesn’t see it that way. How else could one explain the latest singling out of Canada’s oil and gas sector through an arbitrary cap on greenhouse gas emissions, even though the sector only represents 26 per cent of Canada’s total GHG emissions? Even if Canada eliminated all greenhouse gas emissions expected from the oil and gas sector in 2030, the reduction would equal only 0.004 per cent of global emissions while imposing huge costs.

This is not a fact, it is a rant that includes imaginary scenarios. “Even if Canada eliminated all greenhouse gas emissions?” No one is talking about doing that. And it’s even less clear because while the text refers to 2030, the graphic refers to 2050, twice.

Does the “weight” of $45-billion mean that is the total from 2024 to 2050? $1.8-billion a year for the next 26 years?

One of the reasons for this is that even if the Fraser Institute wants to downplay the severity of climate change, other countries around the world take it seriously.

It’s also an example od leadership by example, You can’t ask other countries to follow suit unless you’re willing to do it yourself.As a result of new federal energy efficiency regulations, the cost of a newly constructed home in Canada will increase by $55,000, on average, by 2030 because of the federal government’s stricter energy efficiency regulations for buildings. Rather than increasing the costs of new homes, governments should help close the gap between supply and demand.

It’s would be worthwhile to know where this claim comes from. It reads as if a consortium of corporate lobbyists came together to craft it.

Any evidence for this claim - a link tracking back to an industry website would be appreciated.

However, opposing energy efficiency on the basis of cost is a classic “false economy,” because the short term savings in having a house that’s not well insulated is that it will cost you much more in energy bills. Building all new houses to that standard means that over time, we’ll be able to run houses at much lower cost.

Why is the Fraser Institute pro-waste?

Our Failing Health-Care System

How good is our health-care system? Canada’s average health-care wait times hit 27.7 weeks in 2023—the longest ever recorded and nearly 200 per cent longer than the 9.3 weeks in 1993 when the Fraser Institute began tracking wait times.

With a few exceptions, health care in Canada is a provincial responsibility. That includes funding for health care systems, as well as regulation, for everything from hospitals to public health.

When it comes to Health Care, the Federal Government has direct responsibility for First Nations and Inuit, the military, and refugees.

Among a group of 30 high-income countries that have universally accessible health care, Canada spends the most money on health care as a percentage of GDP.

Again, health care is run by provinces - and those provinces have overwhelmingly been conservatives who have cut and frozen health care provincially and federally, the last time they were in power.

There’s another factor which comes with cost: without even seeing the list of 30 countries, my geography is good enough that I can tell you exactly what makes Canada unique. We are the only country on that list that shares a language and a border with the United States, which has the highest expenditures on health care in the world.

All of the other countries are separated from each other either by language or geography. When you train in something that is as focused and specific as nursing or medicine, you generally do it in one language. That means language barriers in Europe. Other countries, are islands - the UK, Australia, New Zealand.

That has real consequences when it comes to health professionals being able to move back and forth - so they can may pay them less. In Canada, we have a border where nurses and doctors can generally move back and forth, so we have to pay more to compete.

Despite this high spending, we are a poor performer. Among this group, Canada had the longest wait lists and ranked:

28th (out of 30) for the number of doctors

23rd (out of 29) for the number of hospital beds available

23rd (out of 29) for the number of psychiatric beds available

25th (out of 29) for the number of MRI machines

26th (out of 30) for CT scanners

Not one of these is a federal decision. Every single one of these is entirely provincial jurisdiction.

On doctors: Provinces are constitutionally responsible for health care, including professional certification as well as funding for universities for the number of seats available in medical schools, for nursing, etc.

In the 1980s, it was determined Canada had too many doctors, so univeristies scaled back class sizes, and left them there. Around 2000, people warned that a shortage was coming and that they needed to expand training again, but it was ignored by provincial governments, who did not fund the needed expansion of post-secondary medical training - and still haven’t.The same criticism applies for hospital beds, psychiatric beds, MRI machines and CT scanners. These are all provincial jurisdiction, and as mentioned above, in the last years. provincial governments chose to borrow to pay for tax cuts - sometimes major tax cuts. Since 2016, BC, Alberta, Saskatchewan, Manitoba, Ontario and Quebec were all asking for more money for health care while they were running deficits and cutting taxes. They did so all while the current federal government restored equalization payments and introduced side health accords to increase health funding.

At the federal level, the Harper Conservatives unilaterally slashed provincial health transfers from 6% a year to 3%, and froze Manitoba’s total transfers for six years straight. They also introduced a new funding formula that took $1-billion away from every other province and used it to increase Alberta’s transfers instead.

That’s it.

If you’re keeping score, most of these facts crumbled under scrutiny. That should not happen. Taken as a whole, these statements present of profoundly, provably false, and distorted picture of Canada, all while claiming to inform voters.

“Think tanks” were created in the 1970s to give a veneer of academic or intellectual credibility to far-right ideas, pushed by zealots, which aim to dismantle decades of economic and social progress, and undermine democracy and elected governments. The fact that Fraser Institute routinely picked Hong Kong - which is not a democracy - as the freest jurisdiction in the world - should tell you a lot about its priorities.

If the Fraser Institute really has a case to make for its policies, why can’t it be straight about it? Because they are operating in the public interest, rather as John Kenneth Galbraith said “The modern conservative is engaged in one of man's oldest exercises in moral philosophy; that is, the search for a superior moral justification for selfishness.”

DFL

Misleading Canadians is their entire purpose.

The part that amuses me is that the Fraser Institute is just one of *eleven* sister organizations staffed by Conservative activists that function as a group to promote their stated goals of free markets & conservatism. I'm guessing most Canadians would agree that a network of think tanks set up to propagandize citizens about free markets shouldn't be allowed to receive tax-free donations, but here we are. Especially since the Fraser Institute got caught taking donations from a Conservative dark money scheme in the past.