How Think Tanks Gaslight Canadians About Their Taxes And the Economy

Contrary to the Fraser Institute and the MacDonald Laurier Institute, bleeding is not the answer to every problem.

There is an old Saturday Night Live sketch from the 1970s

featuring Steve Martin as “Thedoric of York, Medieval Barber.”

Theodoric is both doctor and barber. Whether people need a haircut or medical treatment, there is one treatment: bloodletting. When Bill Murray is dragged in, playing a drunkard whose legs have been crushed by a cart, Thedoric tells him, “Well, you’ll feel a lot better after a good bleeding.”

This brings us to the MacDonald Laurier Institute which is, once again, claiming that Canada’s taxes are too high and that the answer to reviving Canada’s economy is tax reform.

It was quite a misleading piece, because quite aside from presenting a deeply misleading interpretation of figures, it makes basic errors in fact, and relies on a lot of assumptions about taxes (and more) rather than facts.

So, let’s start with some corrections.

“The portrait painted by this new evidence shows today’s high-income Canadians are paying a higher share of income taxes than during Pierre Trudeau’s flowering of progressivism.”

This is a highly deceptive sentence, which leans on an assumption - that Pierre Trudeau, whose Liberal government introduced Medicare, old age pensions, and a series of other programs to support health and post-secondary education.

“Recall that his prime ministership was marked in large part by his vision of a “Just Society.” It was a powerful message about how greater wealth redistribution would ensure that all Canadians “fully shared in the country’s affluence.” Higher taxes and government spending in the name of social progress and opportunity were his government’s touchstones.”

On taxes, this is totally false. In 1971, Trudeau and the Liberals introduced substantial reforms to the tax code. It was one of the largest tax cuts in history. The top marginal Federal rate, which was over 80% at the top level was cut roughly in half, to the mid-40s, and the estate tax was eliminated and replaced with the capital gains tax instead.

Source: https://www.fcf-ctf.ca/ctfweb/Documents/PDF/1995ctj/1995CTJ5_02_Smith.pdf

The reason higher-income Canadians are paying more is not because tax rates have gone up, but because since the 1970s, almost all economic growth in Canada has gone to the top 10%.

At the same time, there have been regular tax cuts at all income levels, as well as introductions of substantial tax breaks only high-income earners can take advantage of. By 2015, the size of government had shrunk to the smallest as a percentage of GDP in decades.

This was nearly a full decade before Thatcher in the UK and Reagan in the U.S. would reduce tax rates for high income earners. Because it doesn’t fit in with the narrative of Trudeau as a pinko commie, it is completely ignored. And the higher spending was not just on the “Just Society” - defense spending under the Trudeau Liberals was twice as high as a percentage of GDP as it was under Stephen Harper and the Conservatives.

“The era is often considered the height of Canadian progressivism by his supporters or the end of a failed socialist experiment by his detractors.”

The Liberals ushered in programs like Medicare, the CPP and the OAS. The number of seniors living in poverty plummeted.

The economic problems facing the 1970s Trudeau Liberals were global in nature. Two of the most significant events were totally beyond the control of the Canadian government: a global energy crisis engineered by OPEC, an oil cartel, that wreaked havoc with the global economy, and a response to inflation by the U.S. Fed that hiked interest rates to economy-crushing, massive-debt-inducing levels of 15-20%.

You might therefore be surprised to learn that as a “soak-the-rich” guy, Pierre Trudeau was a piker compared to his successors.

This is doubly false, as we shall see.

“Consider that when he left office the top one percent of income earners paid about one out of every eight dollars collected in income taxes in Canada. And then it started to climb, reaching just over one dollar in every five in 2014. That’s more than a one-third increase in 30 years.”

This is a supremely misleading statement for what it leaves out.

Let’s be clear about what it says: the share of tax dollars paid by the 1% has been increasing. This is what it leaves out: the size of government has been shrinking.

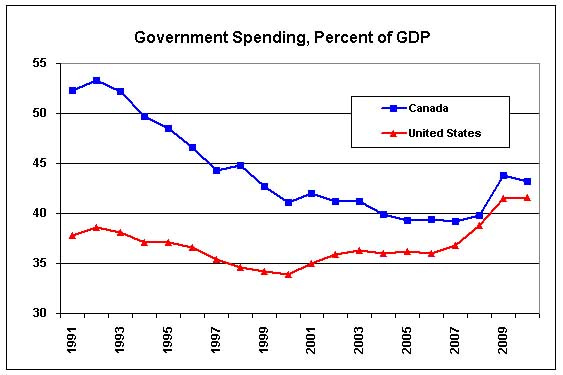

Here is total government compared to the Canadian economy (Federal and Provincial) (pre-pandemic).

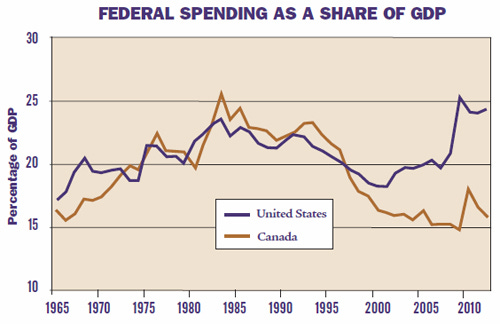

The size of the federal government as a percentage of the economy shrank from a peak of 25% in 1984, to about 15% of GDP.

In 1984, this followed 20% interest rates and global recession, that crushed manufacturing. Then the price of oil, which had supported the Canadian economy and revenues, started to drop. It is worth noting that in this time in the 1980s, Canada’s late 80s recovery was driven by dropping oil prices, lower interest rates, and a major monetary and fiscal stimulus under Ronald Reagan in the U.S., who raised taxes after cutting them too deep in the early 80s.

The other is that there is a general shift away from corporate and business taxes and towards personal taxes.

So what does this mean? The 1% are making a larger percentage contribution to a shrinking government, while their incomes have been rising and their taxes are generally being cut. The reason they are paying more is that, as inequality grows, and as wages and incomes have stagnated for most Canadians, the growth that has taken place has gone overwhelmingly to the top. Edmonton’s Chief Economist found that, adjusted for inflation, wages in Edmonton had stagnated for 99% of the population since 1982, and in Calgary, they had actually declined.

The reason the top 10% are paying 50% of the taxes is because, in some cases (prior to the oil slump) - the top 10% were making 50% of the income, as was the case in Alberta in 2014.

We need to understand the actual levels of concentration of wealth and income in Canada. It is not a bell curve: it follows an approximate “80/20” power law.

So first: let’s talk about income distribution in Canada, because it is an issue few understand, (perhaps few want you to understand) - we can call it “income concentration” and we need to understand just how concentrated that wealth and income are.

It looks like this:

What it means is that (roughly)

0.1% of the population will own 40% of the wealth

0.64% owns 11%

3.2% owns 13%.

This means that more than 60% of all wealth will tend to be owned by the top 5%.

16% owns 16% of wealth

80% owns 20%.

But what people do not realize that wealth and income climb so fast the higher you go, there is a far greater difference in income and wealth within the 1% than there is in the rest of the 99%.

This is individual incomes in Canada.

Within Canada’s 1%, the “poorest” will make about $200,000. The poorest person in Canada makes zero, a difference of $200,000.

We don’t know exactly what the richest person in Canada makes - but with bonuses, some CEO’s make $10-million or more. So from 0% to 99%, there is a difference in incomes of $200,000. Within the 1%, there is a difference of millions.

There is also a critical distinction between income and wealth that the authors blur, especially when they say that the government is “redistributing wealth.” Tax on income is tax on income - not on wealth.

Most of what government spends its money on is social insurance programs. Some of this is direct payments to individuals, but a huge amount of it is paying people to deliver services in health, education, policing, construction. People are paid to do work - some of them are paid well, and are in the top 10% - where they end up paying taxes.

If the goal is the redistribution of wealth, it is clearly not working. Between 1999 and 2012, the net worth of the bottom 20% of Canadians fell, from an average of $1300 per person to $1100 per person.

In total, this represented a drop in net-worth of $6-billion to negative $10.8-billion. During the same period, the top 20% saw their net worth rose, by $2.9-trillion to $5.44-trillion.

Taking an average isn’t good enough

One of the simple errors is that the Fraser Institute makes is that they look at the “sticker price” of taxes, but not what people actually pay. In 2005, the CCPA pointed out many problems with the Fraser Institute’s calculations.

The other is that the Fraser Institute treats everyone as “average” which leads to ludicrous conclusions like this one

the Institute has the average family receiving $1,703 of interest income, $661 of dividends, and benefiting from $2,623 of corporate retained earnings.

This chart is based on Canadians actual tax filings - what people’s incomes are and how much they are paying, once all the deductions are in.

It shows that only 2.1% of Canadians pay over 30%

10.9% of Canadians pay zero

20.2% of Canadians pay 1%-9% in taxes

0.1% of people who make over $116,900 pay between 1%-9%.

Where’s the redistribution?

We might well ask, if income tax cuts are such a boon for the economy, why didn’t the deep Liberal cuts of 1971 have miraculous effects?

Since the 1980s, there have been income tax cuts at every income level, the basic deduction has increased. One exception is that this top rate rose to 33% - which is still lower than historic levels. The corporate tax rate has been halved. The small corporation tax rate has been lowered.

So why isn’t everyone better off? Because the economic models are wrong. There is plenty of empirical evidence that austerity doesn’t work, that government contributes positively to economic growth and innovation, that inequality and high private debt both lead to economic stagnation.

Neoclassic macroeconomics and its practitioners received a well-deserved thrashing after Global Financial crisis, which it utterly and totally failed to predict. In September 2016, World Bank Economist Paul Romer described the current state of macroeconomics as a “pseudoscience” and Steve Keen has compared the defense of neoclassical ideas to “faith”, despite the grotesque failures of these models, that, have failed in prediction as well as in application.

Freshwater and Saltwater Think Tanks

There’s a point that should be made about the ideology of many think tanks.

In the U.S., there is a division of schools of macroeconomic thought into “Freshwater” and “saltwater” economists. Freshwater economists are in midwestern universities and tend to be libertarian, Friedmanite free-market economists. The “Chicago School” is a perfect example. “Saltwater” economists on the coasts tend to be more “Keynesian.”

(This division doesn’t work as well in Canada, where the right-wing Fraser Institute is in Vancouver, B.C. on the Pacific Ocean.)

The names [freshwater and saltwater] refer to the geography of key combatants in that period, when economists at the University of Chicago, Carnegie Mellon University and the University of Minnesota spearheaded the “Rational Expectations Revolution.” They believed that people are very, very smart and sensible in their economic decisions. Taken to its logical extreme, the idea of economic rationality led the Nobel-winning Freshwater pioneer Edward Prescott to argue that recessions are not economic failures, but instead are inevitable, healthy outcomes of economies responding to the uneven pace of technological progress. In other words, Prescott and the economists who followed his lead said that the government shouldn’t try to fight recessions.

However, as Slate reported in 2013, when it comes to the mathematical models being used by the market — by investment banks and companies who actually rely on those mathematical projections to make investments and generate revenue — the models they use are “broadly Keynesian.”

“If you knew—really knew—how changes in federal budget policy or changes in the extent of Federal Reserve Quantitative Easing programs would impact the economy, you could make a lot of money with that knowledge. And for precisely that reason, investment banks do in fact do macroeconomic analysis. And specifically they do broadly Keynesian types of analysis even though it would be easy to hire people who have a different approach.

The irony is that governments of all stripes in Canada have been listening to these right wing think tanks, and cutting taxes, regulation, and spending for decades - governments of all stripes, including Liberal, Conservative and NDP. The result has been higher deficits and debt due to lost revenues, crumbling essential infrastructure, and degrading public services because of cuts.

The basic economic measures and ideas that are at fault for the current crisis - and for every economic and financial crisis for the last 40+ years - are conservative ideas that came in in the 1970s. Not left, not liberal, not Keynes. Conservative. Conservative became the new centre. Conservative, neoclassical economics became the default, both for central banks and for governments. People have tried to make Keynesian policies illegal, including the EU.

And we have had crisis after crisis, including the global financial crisis and the housing crisis. And after 40 years of inequality and generations like mine being told it will only ever get worse, and watching crisis after crisis happen, these think tanks are still saying to do keep doing it. You just haven’t bled enough.

Enough. We need to recognize the magnitude of the risks facing us, and start immediately putting in serious measures to stabilize the economy and unwinding this crisis, in new ways. I’ll deal with some in a future post.

DFL

Fraser does this report annually. It unintentionally proves that it's silly to promote tax cuts when 80% of the population would be hurt by the loss of benefits and only 20% would gain.

https://www.fraserinstitute.org/sites/default/files/measuring-progressivity-in-canadas-tax-system-2023.pdf

Great article. Came here from your recent tiktok to read more about it. For a long time I have argued with people that income tax in Canada isn't that high for majority of people and cutting taxes would just help the 1%. Coming from someone who earns in the 1% according to this article