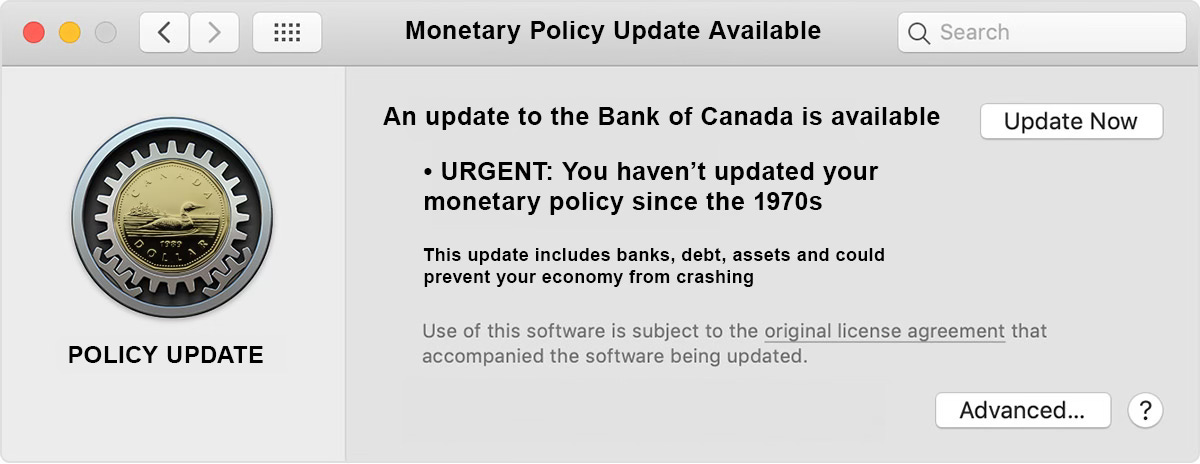

The Single Most Important Thing We Can do to Address Canada’s Economic Challenges

Follow William White’s Advice, and Modernize the Bank of Canada’s Monetary Policy

While some economic indicators in Canada are ripping higher, the struggles Canadians are facing are undeniable, and the current policies of the Bank of Canada massively adding stress to Canadian businesses and families alike, in the name of fighting inflation.

The Bank of Canada is punishing Canadian borrowers who are being crushed by inflation that’s being driven by international factors like energy and supply chains, as well as by an asset bubble and a domestic debt crisis here in Canada.

That explains articles like this - https://apple.news/A6bcCqJqSR-iOAp6yXoBkBQ

In July 2022, Edward Chancellor warned

“It will turn out to be largely impossible to normalize interest rates without collapsing the economy,”

– not because of the actions of elected governments and officials, but because of two decades of monetary policy pursued by the Bank of Canada and other central banks, which are independent and are supposed to be free from political influence.

https://themarket.ch/interview/edward-chancellor-central-banks-delayed-the-day-of-reckoning-ld.7051

Says Chancellor

“By aggressively pursuing an inflation target of 2% and constantly living in horror of even the mildest form of deflation, they not only gave us the ultra-low interest rates with their unintended consequences in terms of the Everything Bubble. They also facilitated a misallocation of capital of epic proportions, they created an over-financialization of the economy and a rise in indebtedness. Putting all this together, they created and abetted an environment of low productivity growth.”

One of the first steps we need to take to deal with the issue is to immediately reform of the Bank of Canada’s monetary policy, because the current practice of cranking interest rates up and down is not only ineffective, it is actively harmful.

That is the recommendation of economist William White, from August of this year.

“[S]timulative monetary policy has had a variety of unintended and unwelcome consequences that can only worsen; credit “booms and busts”, potential financial instability, fiscal unsustainability, a progressive loss of central bank “independence”, growing inequality of wealth and opportunity and a slower growth rate of potential output. Fourth, as the threat posed by these unintended problems have cumulated over time, “exit” and the “renormalization” of policy has become ever harder to achieve.

To sum up, the current monetary system has trapped us on a path we do not wish to follow because it leads inevitably to ever bigger problems. This is why fundamental reform is needed.”

White’s Paper can be read here:

https://www.ineteconomics.org/uploads/papers/WP_210-White-Monetary-Policy.pdf

White says central banks need to focus more on the financial system and debt, and not just on inflation targets. As he points out, because of the tools central banks are using - “solving today’s problems also makes tomorrow’s problems worse”

The reason the Bank of Canada, and other central banks are doing this is because the economic models they are using are crude and terribly out of date. We can’t keep stimulating the economy by turning interest rates up and down like a volume knob, as politicians are still asking to do.

People may think of low interest rates as making debt “cheap, but so-called “easy money" drives up prices.

Low interest doesn’t mean lower cost debt. Instead of taking out the same mortgage with a lower rate, low interest rates mean a massive increase in debt across the economy:

Borrowers who already qualified can borrow even more. Corporate borrowers can use debt to finance mergers and acquisitions, resulting in the greater concentration of ownership and less competition.

At the lower end of the borrowing scale, ultra-low interest rates and “easy money” mean that debt penetrates further and more deeply into the economy.

The same payment that financed a $275,000 mortgage will now finance a $550,000 home, and people who couldn’t obtain loans at all start getting them.

For example, if a borrower can make a $2,000 monthly payment, a 30-year mortgage at 8 percent will finance about a $275,000 home.

With a mortgage rates of 4 percent, the same payment buys a $550,000 home.

The fact that the mortgage is secured against the “asset” doesn’t change that you are borrowing twice the money on the same income, and that nothing has gone into property improvements to make it worth more. You are just competing against other people’s borrowing.

As White put it, “Financial bubbles have created ever larger bubbles which threaten future growth prospects.”

One of the defining features of a bubble – or a financial mania - is that the asset being traded can’t actually be used for its intended purpose anymore. This has been true for centuries for everything from Tulip Bulbs, to Beanie Babies to Baseball Cards to Crypto. And in housing, it means that homes and condos sit empty in a housing crisis.

This is a huge problem, in multiple ways, also because it is outside the realm of democratic political decision-making.

The Bank of Canada makes its decisions completely separately from the Government of Canada. No elected official is allowed to call the shots – to keep the power from creating money through monetary policy, away from the people who spend it and fiscal policy.

So, the good news is, that if Central Banks change their policies as White recommends, we’ll at least be be able to start responding to the crisis we’re in. There are lots of policy measures we could be taking, but they won’t work unless the Bank of Canada, which sets interest rates for the whole economy, changes tack and follows White’s suggestions.

Not only does White know what he is talking about, there is arguably no one in the world who knows more about central banks than he does.

Currently a fellow at the C D Howe Institute, White was born in Kenora, Ontario in 1943. He worked “for various central banks for 39 years, most recently serving as chief economist for the central bank for all central bankers, the Bank for International Settlements (BIS)”. His time included working at the Bank of England and the Bank of Canada.

For several years, as economic advisor, White warned Alan Greenspan and other central bankers starting in 2003 - for five years - that there was a financial crisis coming.

I think you would be challenged to find anyone else in the world who has more credibility on these issues than White.

There are other economists who have been outspoken critics of the current state of macroeconomics, because they utterly failed to predict the 2008 crisis.

One of the highest profile is Paul Romer, the former Chief Economist of the World Bank, wrote a paper in 2016 called “The trouble with Macroeconomics” In it, he condemned the total failure of our mainstream, orthodox economic to predict complete disasters, like the Global Financial Crisis, when previous economic models had been tossed for much smaller failures of prediction - like getting rid of Keynes in the 1970s.

Romer wrote:

“The noncommittal relationship with the truth revealed by these methodological evasions and the “less than totally convinced ...” dismissal of fact goes so far beyond post-modern irony that it deserves its own label. I suggest "post-real."

https://paulromer.net/the-trouble-with-macro/WP-Trouble.pdf

So we have a critique by the former Chief Economist for the World Bank, saying the economic formulas used by central banks are disconnected from reality.

You also have the former advisor to the Bank of International Settlements who warned of the global financial crisis when no one else did, offering up some very sensible recommendations and reforms.

It is impossible to imagine people with better credentials, and the fact that William White predicted the single most important and disruptive economic event in a century, when virtually no one else did, only adds to the cachet.

We cannot have a repeat of what the Bank of Canada did, starting under the Harper Conservative Government in 2008-09. The entire story about strong bank regulation saving the banks was false: there was a bailout of $114-billion dollars. Comparable in size to the bailout in the U.S.

And it established the practice, which is that when banks get into trouble for lending carelessly because interest rates are so low, they don’t face consequences of their risk gone wrong, the way any other business in the free market would. Instead, the banks can take all the mortgages that are going sour because people are missing payments, and sell them to the Bank of Canada or possibly CMHC. The banks get newly created government money, the people lose their house.

The banks can sell the troubled mortgages to the central bank and get new money in return to lend out again. In 2008-09, the Bank of Canada and the Conservative Government of Stephen Harper guaranteed a $200-billion backstop. This set a pattern that kept real estate speculation- not housing, but real estate speculation - making life completely unaffordable.

This is the new model for Central Bank intervention - it is not just adjusting interest rates, it has been for central banks to print hundreds of billions of dollars - trillions worldwide which has gone to banks to lend more.

Our housing crisis is not being driven by supply or demand, it is being driven by speculation in real estate due to what is known as “easy money” – when interest rates are low, the amount of loans go up. Banks start going for quantity instead of quality.

It is this debt from easy money that is driving all the economic anxiety, from inequality and joblessness, the housing crisis, inflation, and lack of economic competitiveness. Workers can’t afford housing, so they demand raises. Companies can’t afford the overhead.

This is much more than a matter of monetary policy alone, because monetary policy underpins the entire economy.

We are talking about the stability of the Canadian economy at a time of multiple crises. Our economy is being deliberately destabilized by Putin, with higher energy prices because of the war in Ukraine, to drive inflation, and disrupt global food markets.

During and after the Great Depression, Canada and other countries ensured that we would always have the capacity to stabilize the economy in times of national or international crisis, by having the Government of Canada and the Provinces work together with the Bank of Canada and the private sector. This is not a zero-sum game where for one Canadian to win, another Canadian has to lose.

We already have the legislative tools to stabilize and reinforce Canada’s economy. The issue is ideology and policy whose models are so bad that they essentially demand human sacrifice;

It used to be recognized that inflation was, at least, a double-edged sword. In The Big Trade-Off, Arthur Okun wrote that, ‘The crusade against inflation demands the sacrifice of output and employment.’ Even more important, it should be recognized that inflation affects different constituencies and parts of the economy very differently.

Ha-Joon Chang elaborated:

a tough control on inflation is a two-edged sword for workers — it protects their existing incomes better, but it reduces their future incomes. It is only the pensioners and others (including, significantly, the financial industry) whose income derive from financial assets with fixed returns for whom lower inflation is a pure blessing.”

And that’s why William White’s recommendations for reform are so important, and why they need to be acted on with all due speed.

It will take time and enormous energy and ingenuity to unwind the multiple crises we are in, which is why its so important to get started right away.

If I were advising the Prime Minister and the Finance Minister, I would suggest that, they take a meeting with Mr. White, because he holds the keys to unwinding the crisis over which we have the most control – Canada’s financial system. It’s an opportunity for Canada to be a leader among developed countries in adopting these changes.

Dougald Lamont. October 10, 2023

Hello, Dougald,

I was sent here by a Canadian friend for your presentation of Dr. White - with a focus, sort of, on monetary policy reform and how to fix for Canada - (Could it EVER be MORE needed ?) I'm still trying to get a clear framing for Dr. White's recommendations.

But I also wanted to share, in case you or your readers may have missed it, Dr. White's interview at The Cobden Center back in (I think) 2015.

https://www.cobdencentre.org/2015/03/interview-with-dr-william-white-former-head-of-the-monetary-and-economic-department-at-the-bis/

Sorry for not a live link there.

Here the highest praise is given to Dr. White's candor regarding the failures of the debt-based money system of modern day central banking to deliver a workable society in total. And his critical analysis runs deeply into the fabric of being among the central bankers of the globe. They're scared.

Says me.

Thanks.

The Money Apprentice

In rereading this excellent post, I think you should produce a second post on the White Paper you have linked.