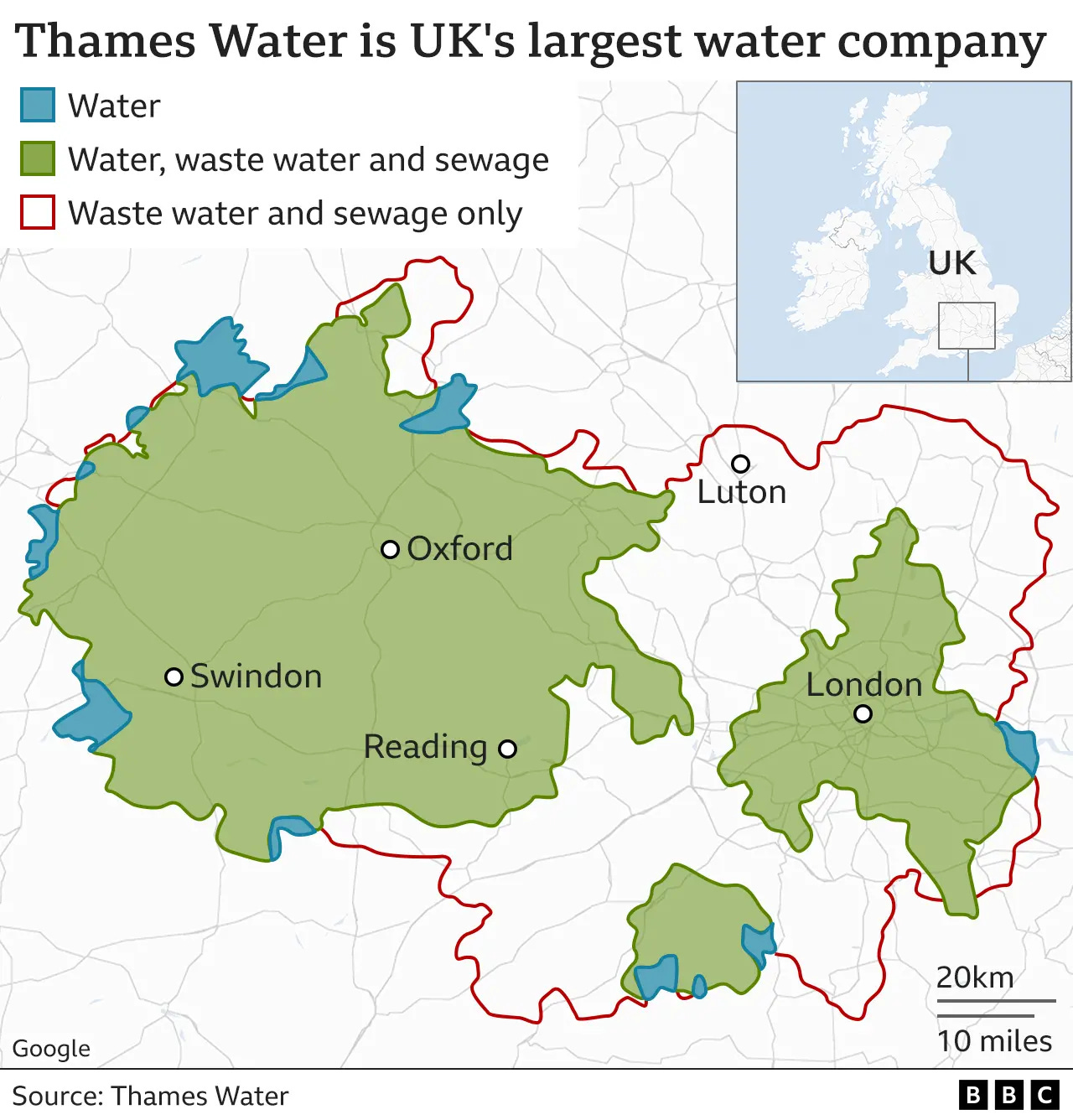

The UK is facing a water crisis due to a private company. The biggest shareholder is a Canadian public pension fund.

From private seniors' homes to energy, unaffordable housing, and privatized infrastructure, Canada's union pension funds are everything the unions say they oppose. Solidarity, whatever!

Customers of the UK’s biggest water company, Thames Water, are facing a 40% increase in rates and the company itself may be “re-nationalized” - returned to government ownership and control, 35 years after being privatized by the Conservative Government of Margaret Thatcher in 1989. One of the reasons for Thames Water’s financial state is that for years, shareholders extracted billions of pounds in dividends while running up debt - and failing to invest in infrastructure and upkeep.

It’s been mentioned that a “Canadian pension fund” is one of the investors - in fact, OMERS - the Ontario Municipal Employees Retirement System - is the single largest external investor in Thames Water, with 31.7%. of the shares, acquired in 2017-18. The British Columbia Investment Management Corporation, owns 8.7% of Thames Water, and has owned the shares since 2006.

As Reuters reports,

The utility is struggling under a 15 billion pound ($19 billion) debt pile and a worsening environmental record. It wants the regulator to allow it to raise customers' bills by 40% to fund investment.

As CNN notes,

The indebted utilities have struggled as interest rates have soared over the past two years, and as their aging, leaking infrastructure has required billions of pounds of investment.

These investors - the owners - who said in December they are unable to pay their debts, and will not invest to make improvements.

In Canada, the left-ish party of labor, the New Democrats, are usually outspoken opponents of privatization, as are affiliated unions, who have released statements opposing privatization.

The reality is that Canada has some of the largest public pension funds in the world, with more than $1-trillion in assets under management, with year-over-year returns close to 10%, and while they ensure high returns for retired unionized workers in Canada, their investments include privatized energy, water, and transportation networks around the world, as well as assets sold by Canadian governments, like land registries.

This report from 2015 by the Boston Consulting Group points out that Canada’s public pension funds are among the largest investors in real estate and infrastructure. they are “7 of top 30 global infrastructure investors, 5 of top 30 real estate.”

Ontario Teachers

A press release from a year ago - March 29, 2023 says

With offices in Hong Kong, London, Mumbai, San Francisco, Singapore and Toronto, our more than 400 investment professionals bring deep expertise in a broad range of sectors and industries. We are a fully funded defined benefit pension plan and have earned an annual total-fund net return of 9.5% since the plan's founding in 1990.

With nearly $250-billion in assets, Ontario Teachers’ portfolio is huge - a selected list:

Highways in India, Mexico, the U.S. and Ontario - : “own[s], operate[s] and maintain[s] a portfolio of eight toll roads in the Indian states of Gujarat, Karnataka, Maharashtra, Madhya Pradesh, Rajasthan, Telangana and Uttar Pradesh.” and a 224 km toll road in Mexico.

Private Health and Dental Care Providers

Airports: Birmingham Airport, Bristol Airport, the Brussels Airport, the Copenhagen Airport

Caruna, (the largest electrical company in Finland), Corio Generation, Cubic Sustainable Developments,

Teachers’ has a majority stake in four water companies in Chile

The Cadillac Fairview Corporation Limited, “one of North America's largest investors, owners, managers and developers of commercial property. A wholly owned subsidiary of Ontario Teachers', it manages our global real estate portfolio, which includes our equity investments in real estate companies and a large portfolio in Brazil.

Along with its affiliates and partners, Cadillac Fairview owns and manages a number of iconic Canadian properties, including the Toronto-Dominion Centre, the Toronto Eaton Centre, the Pacific Centre in Vancouver and the Chinook Centre in Calgary.”

Last year, despite running a deficit, the Manitoba Government chose borrow $500-million in order to deliver property tax rebate in the lead-up to an election. One of the properties that benefited was Polo Park mall, owned by Cadillac Fairview - which received a cheque of over $1-million, which Manitoba taxpayers will have to pay back with interest.

Ontario Municipal Employees Retirement Service (OMERS)

OMERS “manages pension funds and works for front line workers including nurses, fire fighters, and paramedics.”

“Net assets at December 31, 2023, were $128.6 billion, up from $124.2 billion in 2022, and the Plan reported a smoothed funded status of 97%, up from 95% last year.

Looking back, OMERS has earned a 10-year average annual return of 7.3%, achieving our long-term benchmark and adding $66.4 billion to the Plan.”

You can see OMERS’ portfolio highlights here. They include

The Toronto Maple Leafs Hockey Team (5%)

The Land Titles Offices of the provinces of Manitoba and Ontario (Teranet)

Associated British Ports - “ABP is one of the U.K.’s largest ports groups, owning and managing 21 ports across England, Wales and Scotland, and handling approximately 25% of the U.K.’s seaborne trade by volume.”

Bruce Power, “the largest operating nuclear power facility in the world. Its eight units provide approximately 30% of the province of Ontario’s electricity.”

Ellevio, “Sweden’s second-largest electricity distribution system operator.”

Exolum, “an international refined oil products transporter and storage operator, with a network of pipelines and storage facilities located across Europe, and in other countries.”

IndInfravit, “an interest in IndInfravit Trust, which holds a portfolio of 13 operational toll road concessions in India. The roads operate in some of India’s most economically vibrant states and support the country’s growing economy.”

Bangalore International Airport in India

BridgeTex, “a crude oil pipeline providing critical market access to growing crude oil production in the Permian Basin in West Texas, with approximately 440,000 barrels per day of capacity delivered into the Gulf Coast refining and export markets via Houston, Texas.”

Private medical services, like Forefront Dermatology “delivers medical dermatology, fully integrated surgery and pathology services through more than 130 clinics across 16 U.S. states.” and “Gastro Health”

Oncor “the largest transmission and distribution company in Texas, providing electricity to more than 10 million customers via more than 122,000 miles of transmission and distribution lines.”

The Port of Melbourne, “one of Australia’s largest container and multi-cargo ports by throughput, handling approximately 36% of Australia’s container traffic.”

Quite aside from the Thames Water Fiasco, there was also controversy over the sale of Manitoba’s Land Titles System to Teranet. It was privatized by an NDP government.

Canada Pension Plan (CPP)

The Canada Pension Plan is Canada’s pension fund - with 21-million contributors.

“As of March 31, 2023, our 10-year annualized net return was 10.0%. At $570 billion today, the Fund is projected to reach one trillion dollars by 2031.”

One of the features of the CPP is that far more is invested outside of Canada than within it - and honestly, its holdings are too many to mention.

The Canadian Publicly Traded Equities include banks, insurance, oil and Canadian real estate, and much, much more.

PSP

“The Public Sector Pension Investment Board (PSP) is one of Canada’s largest pension investment managers. We invest funds for the pension plans of the Public Service, the Canadian Armed Forces, the Royal Canadian Mounted Police and the Reserve Force.”

The Globe and Mail wrote in June of 2023 that

“PSP Investments’s $29.4-billion infrastructure portfolio, which invests in assets such as toll roads, utilities and communications systems, generated a 19-per-cent return. And its $26.1-billion credit portfolio, which invests in debt issued to companies by non-bank lenders, gained 13 per cent. Both results beat PSP Investments’s benchmarks by wide margins.”

During the pandemic, one of the PSP’s investments was tied to tragedy: Revera, one of Canada’s largest private care home operators for seniors.

In the first wave of Covid, in the spring of 2020, Canada had one of the highest care home death rates in the OECD. A Canadian Institute for Health Information report said that :

“While Canada's overall COVID-19 mortality rate was relatively low compared with the rates in other DECO countries, it had the highest proportion of deaths occurring in long-term care. LTC residents accounted for 81% of all reported COVID-19 deaths in Canada, compared with an average of 42% in ther DECO countries (ranging from less than 10% in Slovenia and Hungary to 66% in Spain).

In fact, Revera and other care homes are being sued for not taking steps to protect residents. Provincial governments and private care homes alike have known about serious problems with underfunding, understaffing and care leading to tragedy.

TriSummit Utilities : “natural gas distribution utilities in British Columbia, Alberta and Nova Scotia, as well as wind and hydroelectric power generation in British Columbia.”

in selected regions in Latin America ($466 million).

Significant investments in new agriculture joint ventures, alongside mostly new partners, include acquisitions in:

• Latin America: ~5,000 hectares of permanent crop operations (mainly coffee, blueberries and avocados) in Brazil and Chile;

• North America: ~16,000 hectares of irrigated agriculture land in Maui for re-development into a diversified farming operation; and

• Australia: ~44,000 hectares of cereal farms in New South Wales, supported by an in-house logistics and trading business and 840 hectares of avocado orchards

in Queensland, with an integrated marketing and distribution business.”

Azelis, a leading distributor of specialty chemicals and food ingredients with a global presence in more than 40 countries.

Spark Infrastructure, which, “invests in essential energy infrastructure businesses within Australia, which serve over 5 million homes and businesses, and are deeply involved in supporting the transition of Australia’s electricity grid to one that is increasingly reliant on renewable energy.”

The list goes on - but is hard to find. The PSP does not appear to list all of the properties in its portfolio on its website, at least not in a readily accessible manner.

BCIMC

“British Columbia Investment Management Corporation (BCI) is amongst the largest institutional investors in Canada with $233.0 billion in gross assets under management, as of March 31, 2023. Based in Victoria, British Columbia, with offices in Vancouver, New York City, and London, U.K., BCI manages a portfolio of diversified public and private market investments on behalf of its 32 British Columbia public sector clients.”

As BCI itself puts it, “Over 725,000 pension plan beneficiaries and 2.5 million British Columbian workers depend on our clients’ returns.

Some examples from their needlessly complicated site, they list what they invest in.

utilities providing essential services such as water, electricity, gas, and wastewater treatment services.

Energy - “We invest in energy assets including pipeline transmission, distribution, and storage.”

“We invest in roads, railways, airports, and port terminals.”

“We invest in telecommunication towers.”

“We invest in timberlands, agribusiness, hydroelectricity, solar, and renewable energy and storage.”

And many more.

The list of properties - and the overall problem with the nature of the investments - is so long that I can’t fit it in a single e-mail, so I’ll be following up shortly with Part 2.

-30-

DFL

Pension funds seek out ROI that will protect asset values over the time horizon needed to pay out their obligations to pensioners, so the actual investments are not at all surprising. The problem with Thames water is the decision to privatize it in the first place, and the lack of regulatory oversight. That is true for all of the privatized infrastructure, which is a direct effect of the upside down economy that you have documented in your economic analysis.

Your point being…