These Maps Show Why Pierre Poilievre and the Conservatives are Ahead in the Polls

With Canadians drowning in debt, instead of life preservers, the Bank of Canada is handing out anchors, bankrupting swing voters in the suburbs.

Four years ago, in 2019, the Globe and Mail ran an important article “How Canada’s suburban dream became a debt-filled nightmare” It was published in the first days of the General Election, and didn’t get the attention it deserved.

It showed maps of Canadian cities, showing how much take-home income people were spending on mortgage interest. In many suburbs - especially around Vancouver and Toronto, but in other cities as well, people are paying up to 20% of their income on mortgage debt.

"Fifteen are on the fringes of Vancouver - places like Langley, Surrey, Coquitlam and Richmond. Two are in Calgary's northern outskirts, and four are in Edmonton, clustered south of the highway that rings the city. Just two are in a city's downtown core: one in Montreal and one in Vancouver.”

That was in 2019.

In 2023 Canadian Household debt hit $2.9-trillion.

First, a point about mortgages, personal debt, and the housing market, and the extraordinary, unrecognized role they play in shaping and deforming the economy.

In 2008-2009, there was a Global Financial Crisis. People may remember - the root cause was mortgages - bad mortgages.

Lenders were handing out bad mortgages. While borrowers were blamed, there was outright fraud - people were swindled into taking on mortgages at terms worse than they deserved. Those bad mortgages were bundled up into bad investments - “mortgage backed securities,” which ratings agencies said were as good as U.S. governments bonds. Then those bad investments had bad insurance sold against them. The system crashed the entire global economy.

And the biggest, broadest part of this house of cards, were mortgages. Trillions of dollars worth. Investment banks and retail banks that had been around for decades collapsed, and the economy has never recovered.

According to the Harvard Business Review in 2018:

Measured by decrease in per capita United States GDP compared to the pre-crisis trend, by 2016 the crisis had cost the country 15% of GDP, or $4.6 trillion. Such numbers are too vast to be understood in any meaningful way, but one on a smaller scale may be even more powerful. A 2018 study by the Federal Reserve Boardfound that the crisis cost every single American approximately $70,000. Just in dollar terms, the crisis was arguably the most significant event of the 21st century so far, and the largest single economic downturn since the Great Depression.

Today, nearly sixteen years later, the global economy has still not fully recovered. As Wharton management professor Peter Cappelli explains:

One in five employees lost their jobs at the beginning of the Great Recession. Many of those people never recovered; they never got real work again…

A generation of young people entering the job market had their careers disrupted by it. The fact that this age group continues to delay buying houses, having children, and other markers of stable, adult life is largely attributed to this.”

Financial crises lead to political extremism - as I wrote here: A study of 140 financial crises showed that there was a strong move to elect far-right governments after a financial crisis.

We never resolved the last financial crisis - we didn’t even look into what happened.

How Financial Collapses drive Extremism and War

Above: the 30 Years’ War in Europe "Those who fear for democracy’s future should remember Roosevelt’s 1944 words. “People who are hungry and out of a job are the stuff of which dictatorships are made” In their paper Politics in the Slump: Polarization and Extremism after Financial Crises, 1870-2014

The global financial crisis really hit when an overnight lending market locked up. It was usually considered a supremely safe, low-risk market, where companies would go for an overnight loan (for payroll, for example) and pay back the entire amount shortly thereafter. In September 2019, that market started to show signs of difficulty. The U.S. Federal Reserve started to pump billions of dollars money into that market, to prevent contagion and interest spikes. Because of the chaos associated with Donald Trump being U.S. President, and there was a Canadian election, not much attention was being paid. It was undoubtedly a concern, as economists like William White had been arguing that since the last crisis had been papered over, an even larger crisis was possible.

So Canadians were already in severe economic and debt distress prior to 2019 - especially in Western provinces like Alberta and Saskatchewan, where a booming oil economy had turned to bust. The boom had been going for a while - so many young workers bought overpriced houses only to find themselves unemployed and on the hook for a huge mortgage worth more than the house. They were “trapped underwater” - selling the house wouldn’t cover the debt. This is a recipe for powerlessness, frustration and political rage.

This was all before Covid 19 hit. When Covid struck, the debt markets locked up completely - though governments didn’t say it. In March of 2020, no one was willing to lend to governments, because everyone was in a panic. The Bank of Canada and other central banks’ answer was to buy government bonds back from investors who already had them, to prop up their value and bring down interest rates.

In his 2017 book, “Can We Avoid Another Financial Crisis?” Professor Steve Keen warned that private debt levels built up even before 2015 would lead to a slowdown and possible financial crisis for Canada. He makes the point that the seeds of the Global Financial Crisis - which was brutal in the UK - were sowed years earlier by Conservative Governments, only for the Labour government to pay the price.

[Thatcher’s] 'reforms' were supposed to unleash the creative forces of capitalism, but instead they unleashed the credit-creating capacity of the City of London, and set off a leverage bubble that drove asset prices skyward while starving British industry of development capital.

However, the political opprobrium was worn not by Thatcher, but by the incumbent at the time the debt bubble burst - the Labour Party's Gordon Brown.

The government deficit that political spin blamed for the crisis was in fact a consequence of it, and it attenuated the downturn rather than causing it. But this reality was to no avail in the political cycle:

Labour lost the 2010 election, and was humiliated in the 2015 campaign when it naively accepted its opponents' spin as fact.

A similar fate is likely to befall the new prime ministers of Canada and Australia, Justin Trudeau and Malcolm Turnbull. Both countries will suffer a serious economic slowdown in the next few years, since the only way they can sustain their current growth rates is for debt to continue growing faster than GDP, as it is doing now: a 3.8 per cent annual growth rate for Canada and 5.7 per cent for Australia, versus nominal GDP growth of zero in Canada and 2 per cent p.a. in Australia.

The risk that Keen points to is in the “Danger Zone,” the “right-hand quadrant of the graph, where personal debt is more than 150% of personal income, and credit is of the order of 10 per cent or more of GDP for the preceding five years.” This is from 2007, on the cusp of the Global Financial Crisis.

He writes that

Consequently, both countries [Canada and Australia] are very likely to suffer a severe economic crisis before 2020 - and possibly as early as 2017. This crisis will be blamed on the incumbents and the economic policies they follow - and in Canada's case, it will mean that Trudeau's decision to run a government deficit, which he flagged during the electoral campaign, will be blamed for the crisis.

Far from being the cause of the crisis, Trudeau's deficit will in fact soften the blow of collapsing credit, when it comes (while Turnbull's swing towards austerity will make Australia's crisis worse). But the peculiar dynamics of debt mean that casual observation supports the proposition that a politician who either triggers or benefits from a debt bubble is a good economic manager - capable of delivering good times and also running a government surplus - while the politician who wears the aftermath of the bubble stands accused of being an economic incompetent who presides over a serious recession and runs a government deficit.

During the pandemic, the Bank of Canada and other central banks created trillions of dollars in new money and lowered interest rates.

When you lower interest rates, it increases the size of the loan - and expands eligibility as well. The pandemic saw a frenzy of real estate speculation - with prices soaring and properties being snapped up, and the prices being bid up. The pandemic interrupted the crisis - and delayed it, because of massive outlays of money, especially in the form of debt - not elected government fiscal measures, but the Bank of Canada’s monetary measures.

Canada’s private debt is now nearly 220%. For context - in the 1990s, it was 89%.

https://www.ceicdata.com/en/indicator/canada/private-debt--of-nominal-gdp

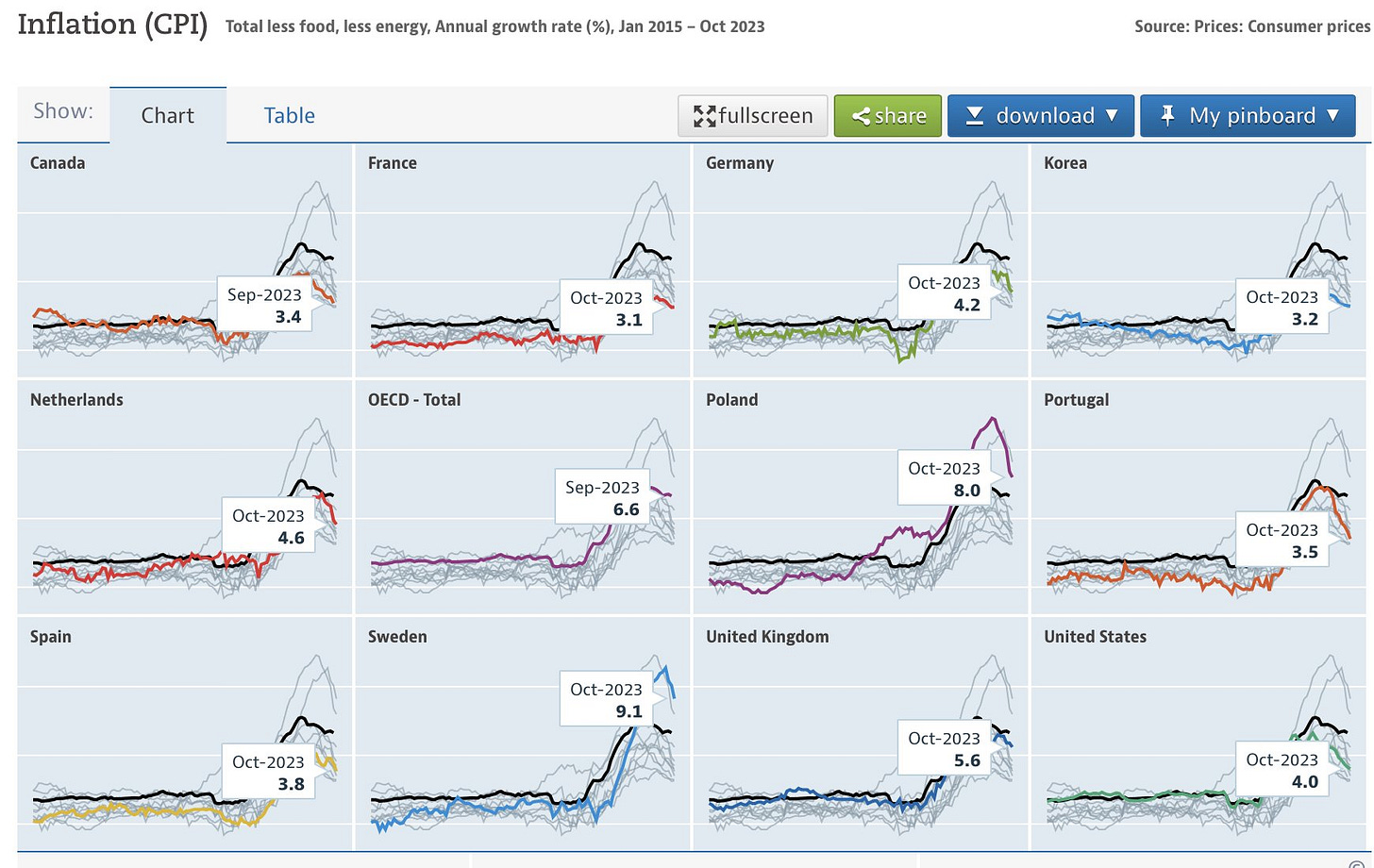

The Bank of Canada and the U.S. Federal Reserve have blamed other factors on inflation - but not their own policy.

Because of the Bank of Canada’s policies, Canadians are now facing a debt crisis - an insolvency crisis. It is not a “liquidity crisis” where banks need some quick cash on hand to prevent a bank run. It is an insolvency crisis. It is a financial problem that needs a financial solution, in order to provide real relief to citizens - not just in Canada, but around the world. The housing crisis is not limited to Canada - and neither is inflation.

Solutions:

For every politician demanding that we just go back to normal, we need to recognize that there is a hell of a lot of work to get there. We had a global pandemic, broken supply chains, and we have a hot war in Ukraine, and global popular discontent.

We need to recognize and accept that we are still in a crisis, and still in a state of emergency, and that we have rebuilding and retooling to do, and that the economic pressures facing Canadians are real, and terrible: they just aren’t measured.

First, the Bank of Canada needs to revisit its monetary policy,

following the recommendations of William White. It is the most important thing we can do to start fixing Canada’s economy, because we need the Bank of Canada to have policy that doesn’t demand human sacrifice for inflation. Their policy is worse than bad: it is counterproductive and dangerous.

He is not alone. In the UK, the House of Lords has called for the Bank of England to be more accountable. Ironically for a government body made up entirely of unelected appointees, the Lords’ Committee criticized the bank as having “a perceived lack of intellectual diversity” and expressed their concerned “that a democratic deficit has emerged, which risks undermining confidence in the Bank and its operational independence.”

Second, Canadians need bold solutions for debt restructuring.

That is another recommendation of William White. We need better ways for people to restructure their debts when their debt is spiralling due to circumstances completely outside their control. Governments, lenders, regulators and the Bank of Canada need to get to work NOW doing what they can to make sure that people can stay in their homes, that owners stay in their business etc.

Third, Fiscal and Equity Investments in “Real Economy” Jobs.

As the Bank of Canada hikes interest rates, The Government of Canada is currently trying to find savings because they are trying to fight inflation, instead of the root cause of inflation - the debt. We need employment programs and we need access to equity for entrepreneurs. We also need to invest in bolstering military defense, and cybersecurity capabilities. We need to focus on economic security, food security, and health security - including pharmaceuticals.

Does Canada have the resources for this? Yes.

This is the problem. The people urging restraint and cuts are ignoring the magnitude of the real crises we face.

We are arguably in a Second Cold War, with authoritarian governments in power and being elected around the world. There is a war in Ukraine that threatened Europe’s energy supplies and the global food supply. There have been multiple close-calls with China in the pacific, and India, Russia and Brazil are all trying to set up a competing monetary system to reshape the world order. We are barely emerging from a pandemic that killed tens of thousands of Canadians, and broke health care systems across Canada, and we are lagging on fighting climate change.

Our economy has been massively distorted by decades of bad central bank policy that has left Canadians massively in debt with an overpriced housing sector and not enough jobs in other industries.

There’s a reason why people are voting for extremists, and it is because people are in pain, extremists are telling them that that pain is all someone else’s fault, and that voting for them will get rid of the pain in their life. It’s not true, but the message works.

Different messaging is not enough. They need to be heard, but most of all they need real relief, and that means getting creative and innovative. That includes reforming monetary policy, and to recognize the economic reality on the ground, and pushing back against the propaganda and misinformation being pushed in Canada by both domestic and foreign “disruptors”.

Canadians of all ages are being eaten alive by debt. As William White, has said, we need “better procedures to facilitate orderly debt restructuring would be required for an emerging “era of shortages.”

This is the challenge across the developed world, and it is a threat to our democracy. We need stand up for the renewal of liberal democracy and the rule of law, because the extremism we see rising on the left and right is being driven by desperation.

Desperate times call for thoughtful solutions, delivered with all due speed and efficacy.

DFL