Yes, Andrew Coyne, inequality is much worse than it used to be

In July 2023, Statcan said the "Gap between rich and poor widens at fastest pace on record"

Andrew Coyne recently posted on Twitter arguing that inequality is getting better in Canada, and I want to share both his argument and why I disagree.

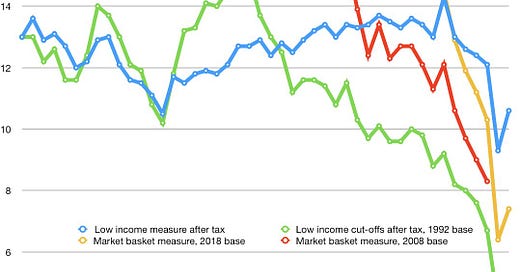

There is some good news - there have been really big changes when it comes to poverty thanks to new government of Canada programs.

You can read the whole Andrew Coyne thread here:

Coyne’s Argument

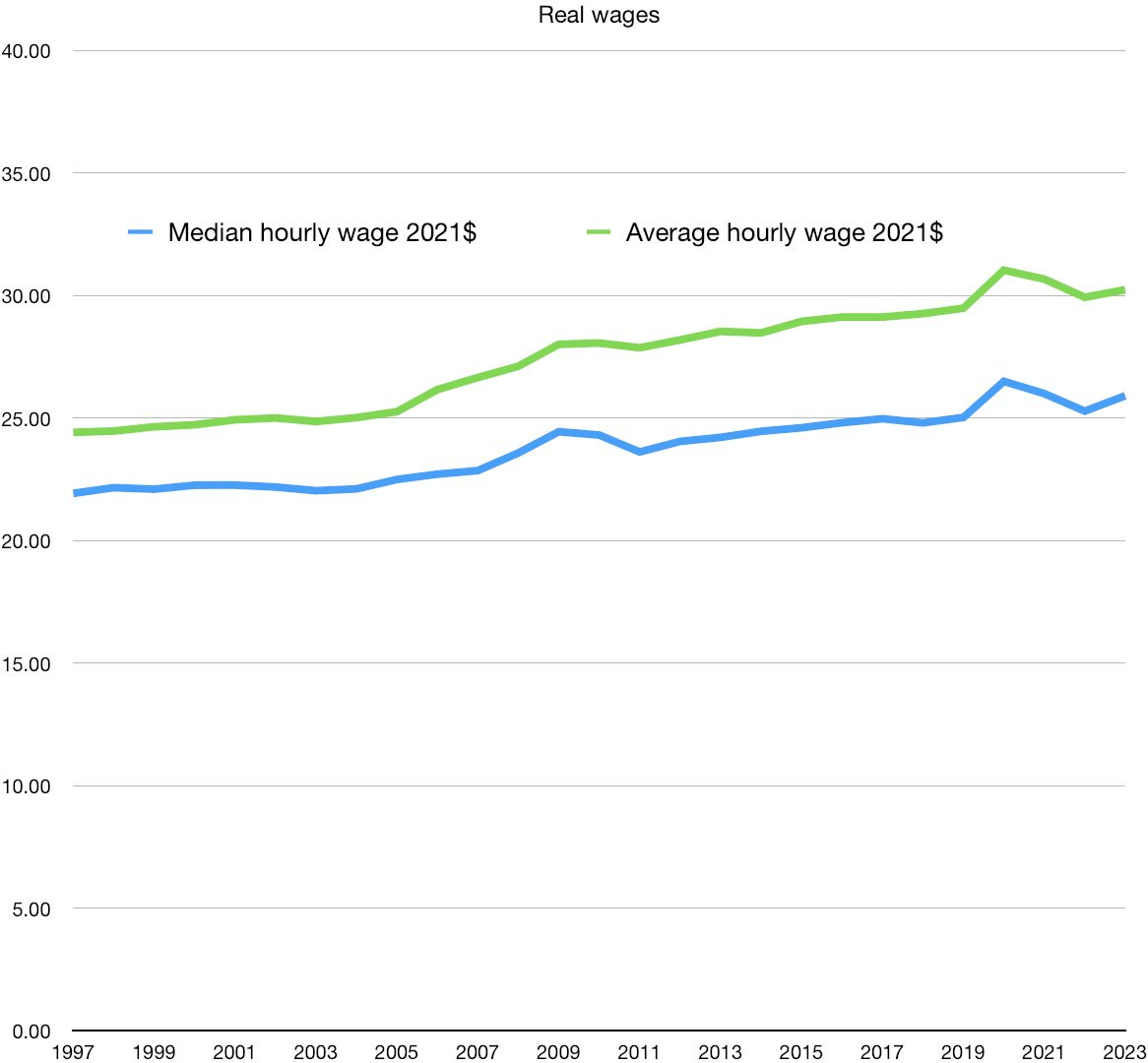

“So how are we doing? A few years back all you'd hear was: the rich are getting richer, the poor poorer, and the middle class are spinning their wheels. Rising inequality, stagnant incomes. It wasn't true then, as some of us tried to show. But what about now? Some charts...

Poverty, first. By any measure, by any standard, poverty in Canada has fallen to *historic* lows. It's been falling since the late 90s, but in the last few years, thanks to the Canada Child Benefit, it's dropped like a stone (slight rebound in '21 most likely due to pandemic)...

Yeah, but what about at the top end? The notorious 1 per cent. Making out like bandits, aren't they? Taking a larger and larger share of the pie? Nope. Top 1 per cent share in Canada has been falling since 2006...

Same picture if you look at quintiles. Share going to top fifth falling, the rest stable or slightly rising.

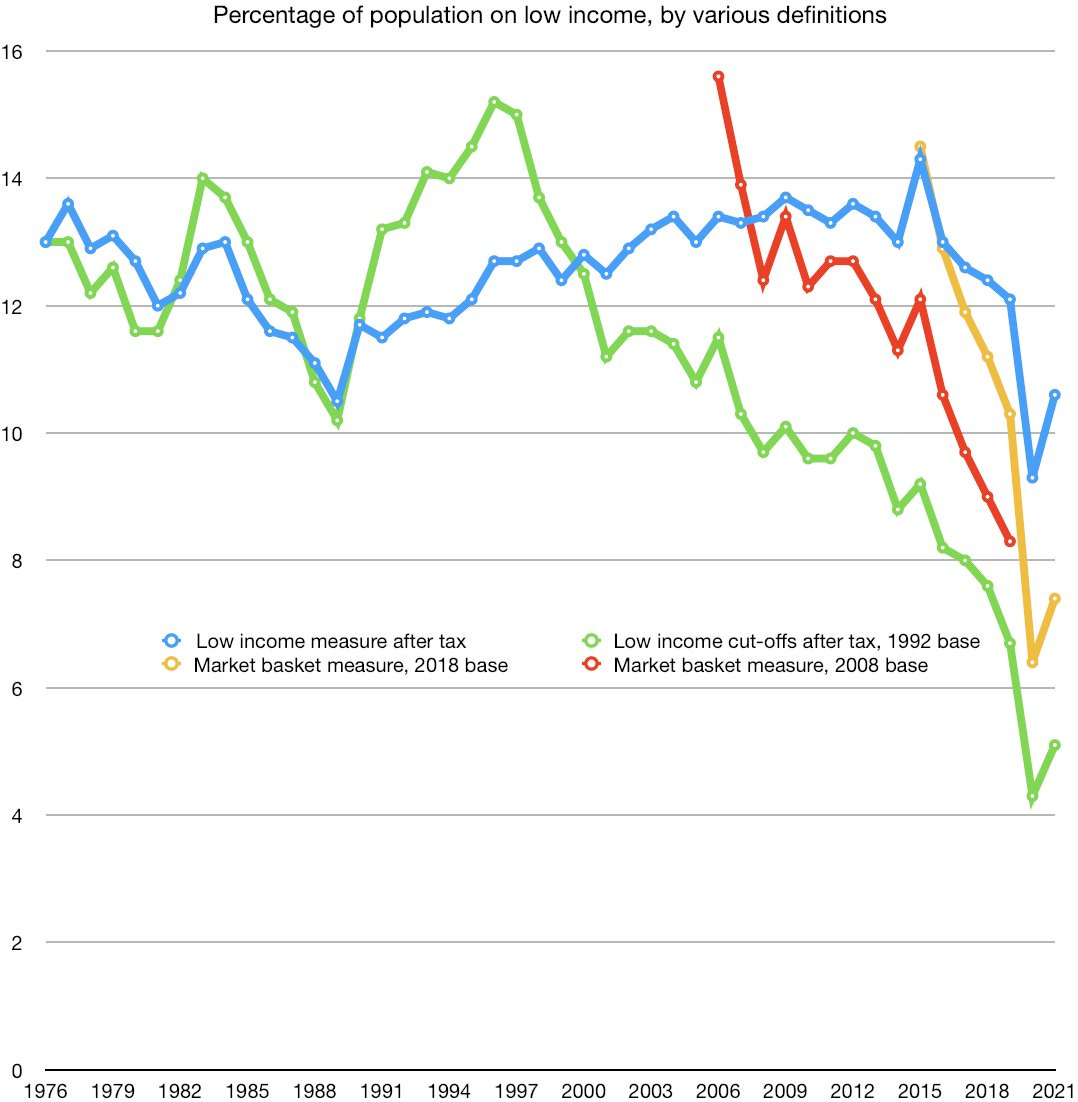

What about those stagnant incomes? The struggling middle class? Here's median after-tax income, all households: after accounting for inflation, it's up 40 per cent since 1997 (as of 2021, the last year for which Stats Can has figures).

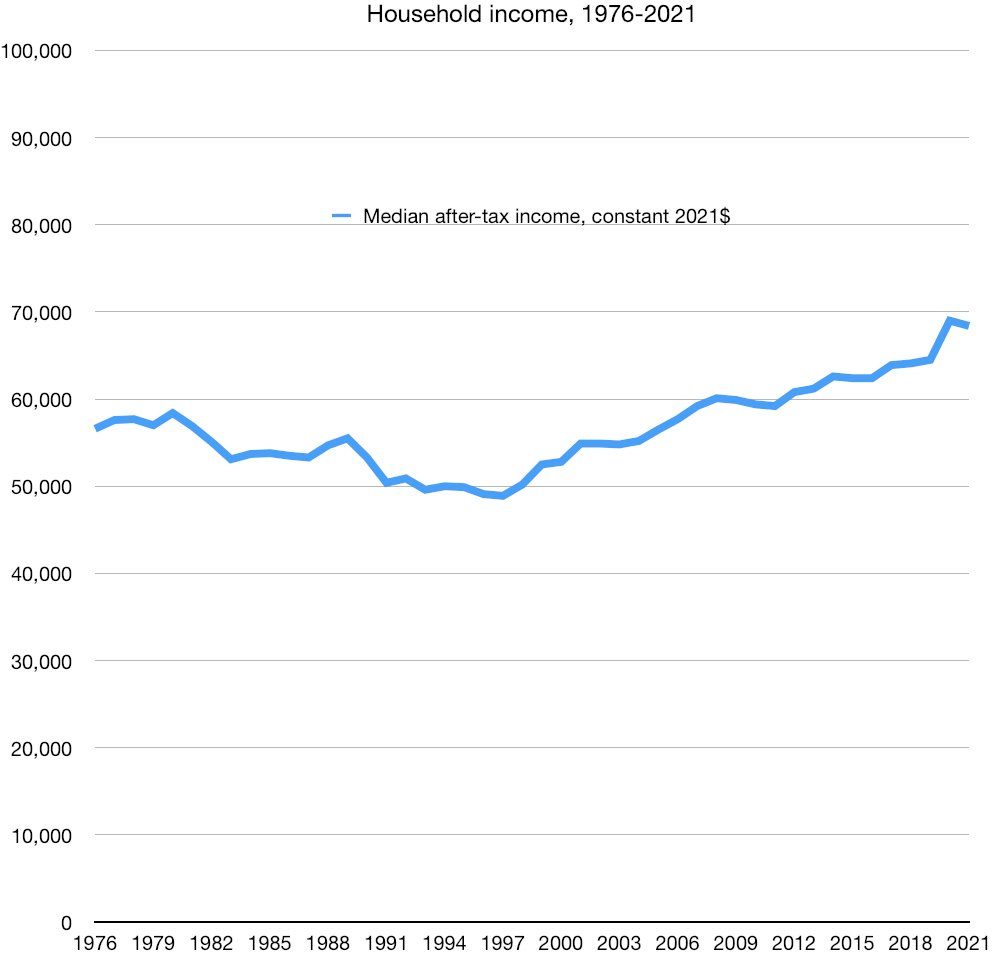

Real wages, likewise, are rising, up about 25 per cent.

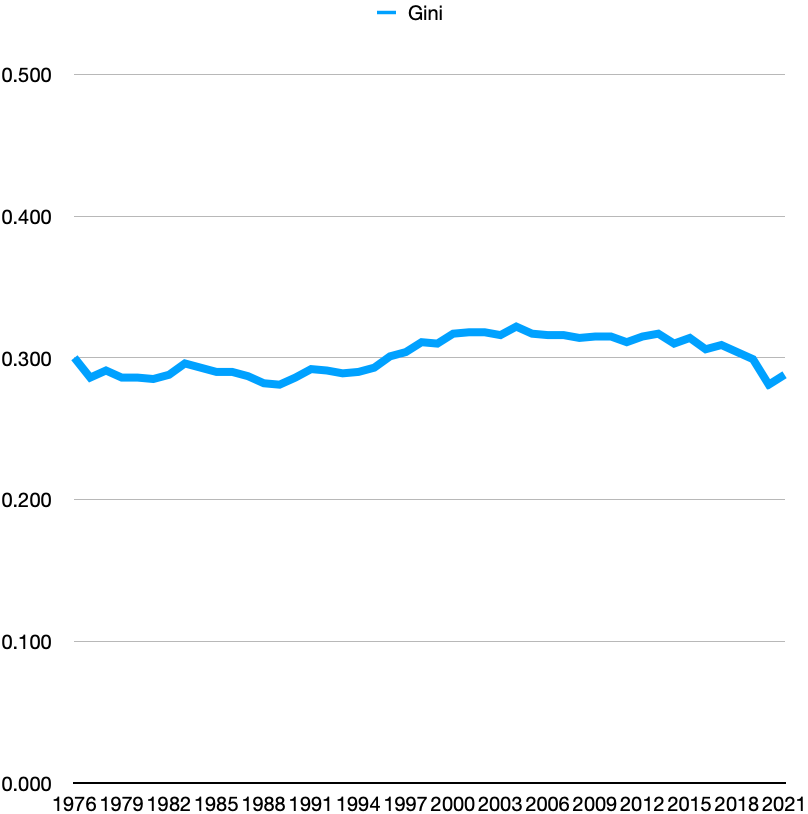

One more: the Gini coefficient, a measure of inequality. Rising until the mid 2000s, has been falling since (lower Gini score = lower inequality). As of 2020, lower than at any time since 1976 (the year time began, according to StatsCan)...

Of course, the question is how long any of this can last, if productivity and output per capita continue to stall or fall. But we’ve been getting by until now...

What’s impressive is how we’ve been able to get inflation back down w/out — knock on wood — having to endure a recession/high unemployment. Why did real household incomes fall from late 70s to early 1990s? Because of 2 awful recessions: the price of stifling the Great Inflation.

My response

“If you want to measure the difference between rich and poor, which is distribution, then median, averages and quintiles don't work.

Income and wealth concentration in Canada follow a "Pareto's power law" - not a bell curve or a line, but 80/20 type ratio as in the family. The rough estimate is that 80% of the income / wealth will go to the top 20%, and it applies to itself.

In Canada, 67% of all assets are held by the top 20% - but the higher you get to the top, the more people hold. Concentration of ownership is much higher than concentration of income.

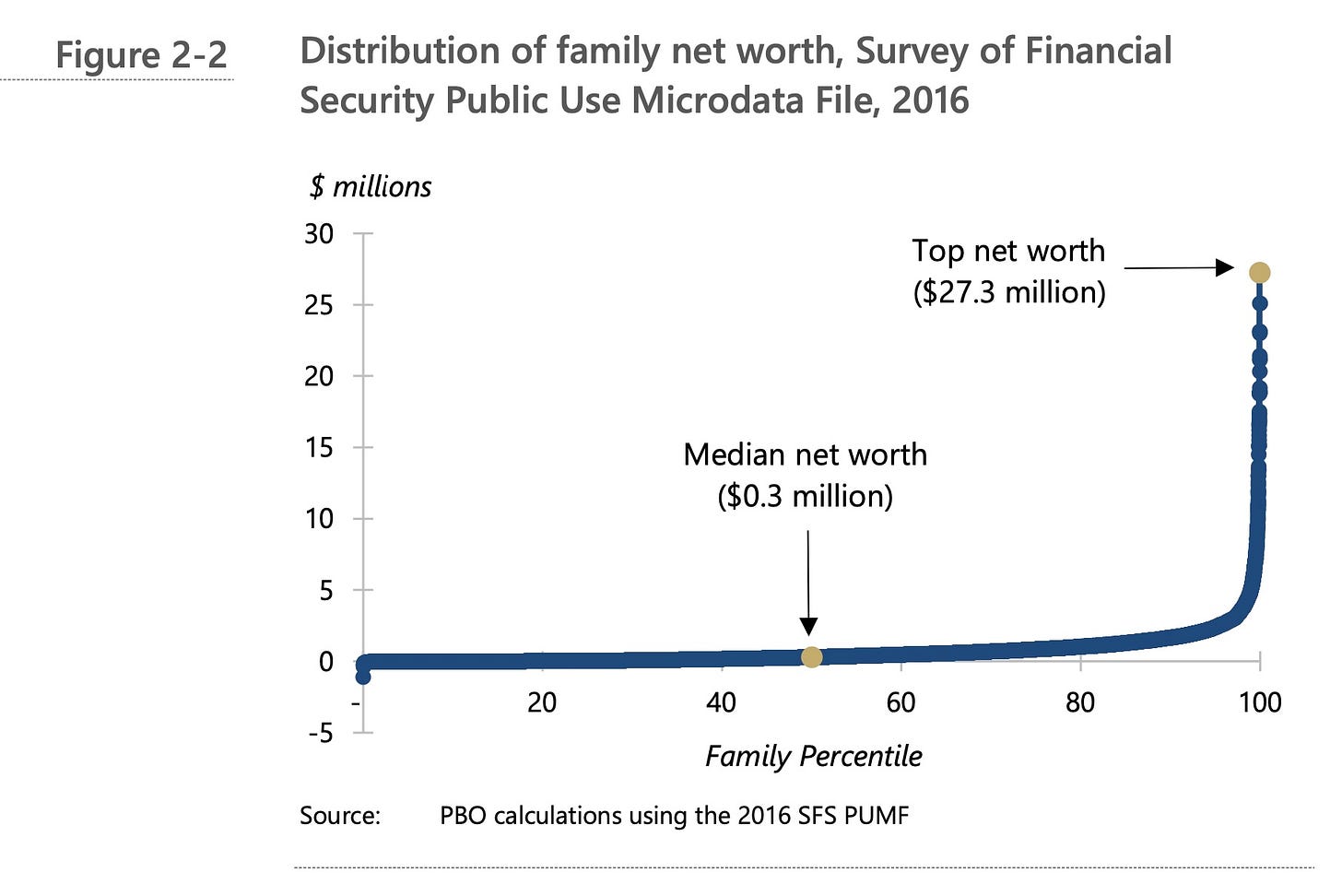

As you can see from this PBO chart (2016), the median net worth for a family is $300,000, and the vast majority of Canadians will are worth under $500,000 . But the highest net worth family is $27.3-million, which is 82 times higher than the median.

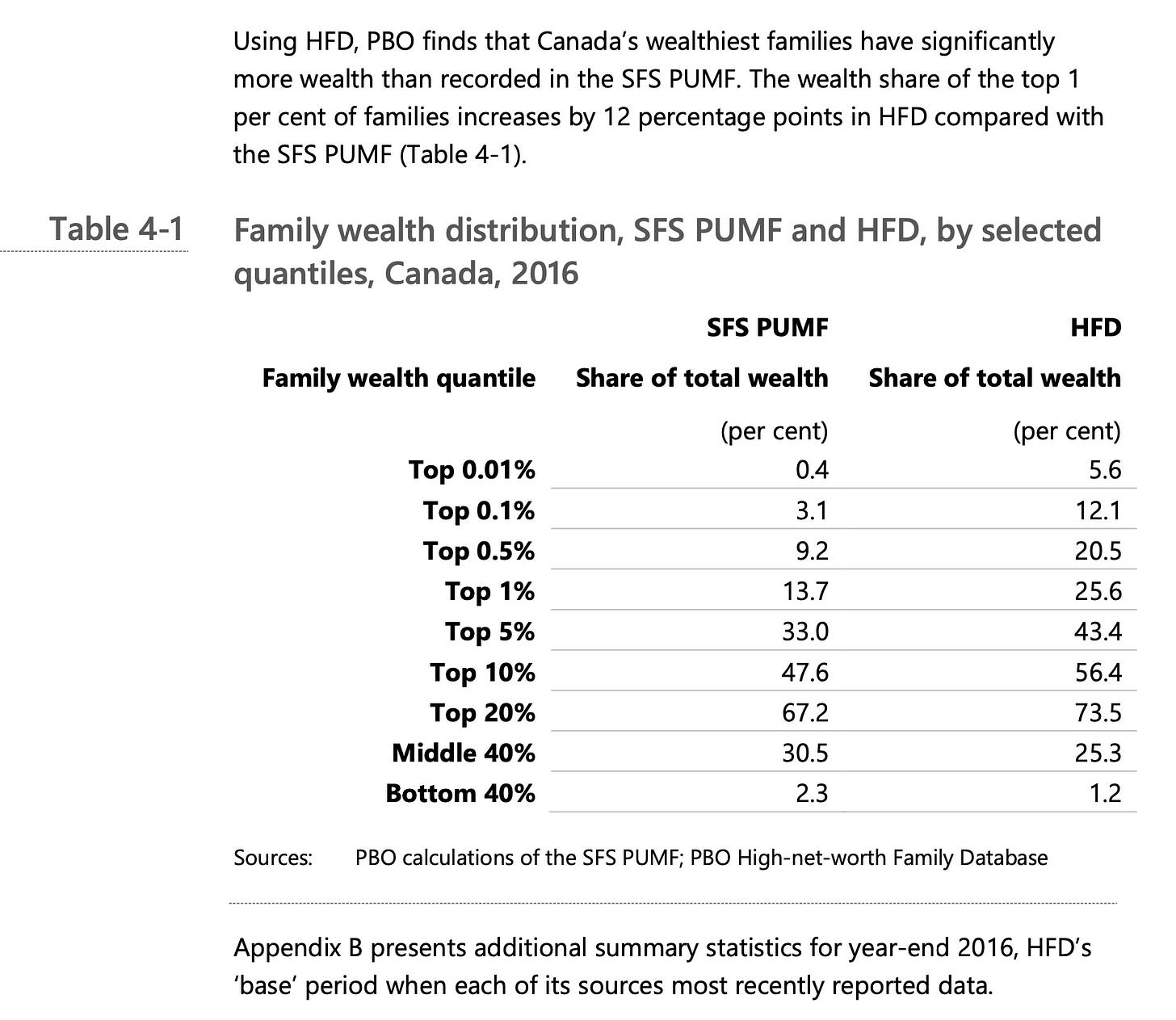

When you look at percentages (Table 4-1) the top 0.1% of Canadians own 5.6% of all assets.

This 4.6 x more than the bottom 40% of Canadians combined, who own 1.2%.

The other is the issue of changes in wealth, as well as debt.

Unless you measure personal debt, you don't have a sense of economic distress. In the last five years, over 50% of Canadians in some surveys report that they are $200/month away from insolvency.

Personal debt as a percentage of GDP has doubled from just over 53% in 1990 to over 100% in 2016.

This is a reflection of a long and gradual drop interest rates and the inflation of Canada's housing bubble, at the personal expense and debt of the middle class, working class - just about every class.

That debt has inflated assets in Canada, and you can see that the assets have grown.

From 1999 to 2012, they grew most for the people at the top, and people at the bottom lost ground. Since one of the defining qualities of the very wealthiest Canadians with the highest incomes is that they can pay themselves through asset sales (like shares and share options) their income is taxed differently than tax from work, and people of very high net worth often use Canadian Corporations to shelter income.

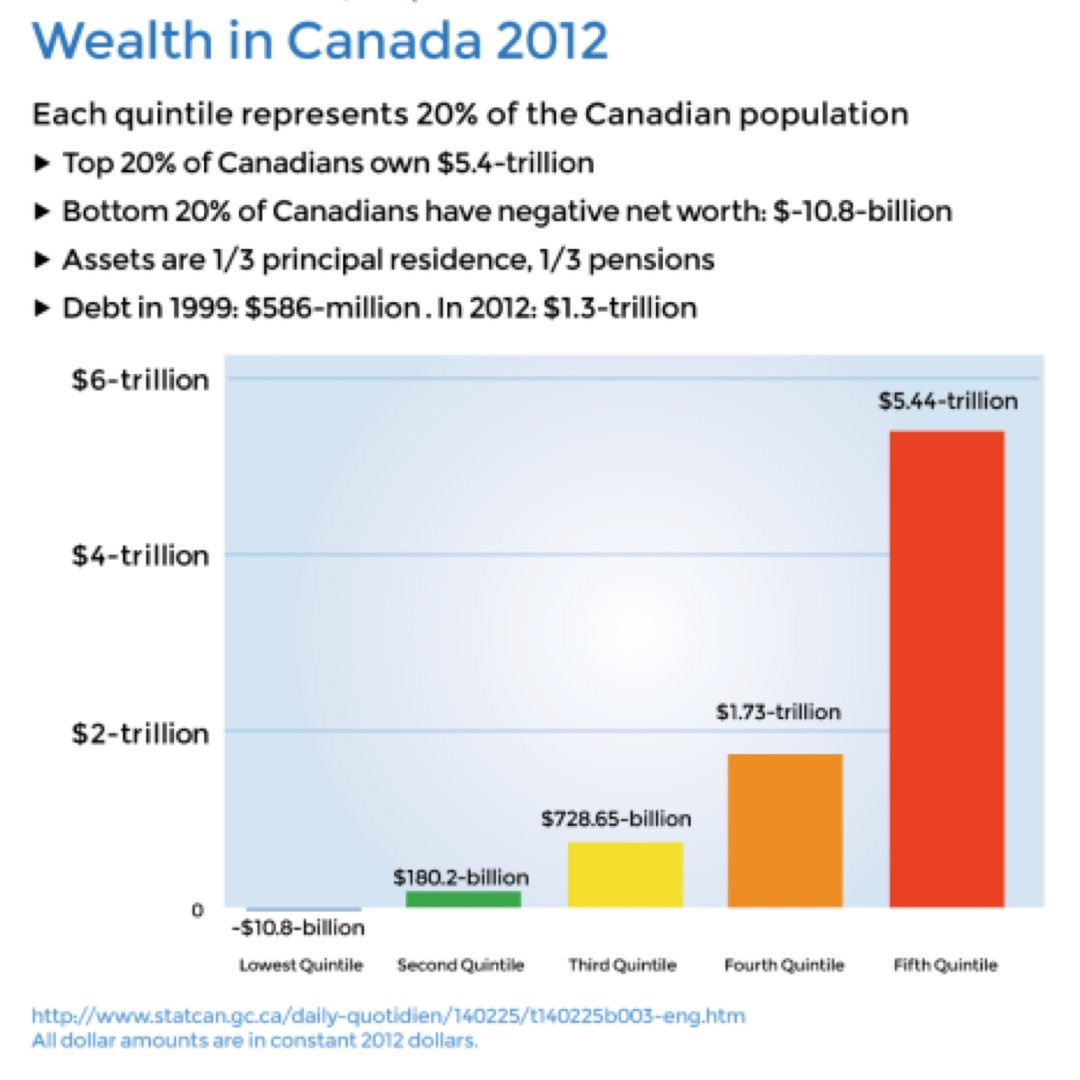

The difference with wealth inequality is so great you can see it in quintiles. The top 20% owns more than the other 80% put together.

Between 1999 and 2012, the net worth of

Top quintile increased by $2.9-trillion, nearly double

Fourth quintile up by $950-billion

Middle quintile up by $383.2-billion

Second quintile up by $79-billion

First quintile down by $6.7-billion.

Canada's househeld debt is over 107% of Canada's GDP, and the highest in the G7. It is mostly debt against a housing bubble, and it is due to the Bank of Canada's multi-decade efforts where most bank issued debt has gone to inflating and speculating on the price of existing assets: our housing market, which has crowded out countless other investments.

As economists like the brilliant William White and others have argued for years, we are facing a personal debt crisis, and it is due to monetary policy.

These booms and busts of debt, mortgages and housing are what have come to define both recessions and financial crises since about 1980. The global financial crisis of 2008-09 was caused by mortgages going bad. Bad mortgages that had been bundled into bad securities, labeled as safe investments, against which bad insurance was sold. As well as a fair bit of unprotected criminal activity, including forgery and fraud.

None of the economic policies and formulas in place at the time that failed to predict the crisis have been replaced. Overrelying on monetary policy to manage the economy is bound to amplify inequality, because as an individual, the worse off you are, the higher the interest rates you face, and the better off you are, the lower.

Lower interest rates mean bigger loans. But the loans are going into driving up the price of unproductive assets, not into productive investment. This scenario is true in Canada, the US and other countries.

There is a reason our politics are so bitter, divisive and extreme, and why authoritarians are rising into power. It's because orthodox neoclassical economics from the 1970s doesn't model or predict the economy properly, and that means ignoring the very thing that is driving people to desperation, which is debt.

There are people losing their businesses, losing their homes because central banks think that is how you fight inflation.

But neoclassical economics doesn't recognize "distribution" and acts as if everyone is an average. Some of the inflation in your regular bills is from crisis costs, but the housing crisis is due to the decision on the part of central banks to keep interest rates low for so long.

There can be no question that the levels of debt we have in Canada is as a result of the Bank of Canada's monetary policy. It can't be denied - they set the interest rates.

It also has to be said, that when the Bank of Canada. or any other central bank lowers interest rates to encourage "investment" they should ask why it is that when banks lend out trillions of dollars, why does so much of it go into housing and not into productive business investment.

PS - It’s worse now

In my twitter response I haven’t yet updated those figures, but they are actually much worse now than they were in 2012.

This is from July, 2023.

https://www150.statcan.gc.ca/n1/daily-quotidien/230704/dq230704a-eng.htm

“Top income earners gain from high investment earnings and self-employment

The highest 20% of income earners increased their average disposable income in the first quarter relative to a year earlier at a faster-than-average pace (+1.9% vs. -0.2% for all households). While interest charges for the highest income earners grew, these increases were more than offset by gains in investment earnings, mainly from dividends and bank deposits, which grew at almost double the average pace (+22.7% vs. +13.4% for all households).”

It’s significant that this is how top income earners are paid, because both of these are methods to legally avoid taxes - huge loopholes that have been set up, especially by provincial governments. In Manitoba the tax for small corporations is zero, which makes them a popular vehicle for legal tax avoidance - people simply turn themselves into many small corporations, and flow their money through them.

These are not mom and pop shops, or small businesses that hire employees - they are strictly non-productive tax shelters for the purpose of lowering taxes.

Incorporated small businesses are all Canadian Controlled Private Corporation (CCPC), but the ones we are talking about are created for one purpose, which is to legally avoid taxes.

At the time of the debate, while the general corporate tax rate in Canada is 15 per cent, CCPCs could use a lower 11 per cent rate for the first $500,000 of active business income.

If you are a high-income individual, you can set up a corporation or numbered company, and your spouse and children can become shareholders (not employees). If they were employees, they would have to pay income tax. But if it is a small corporation, it can pay a much lower tax on income than an individual or a large corporation would, and it can also pay “dividends” to shareholders, which can also be taxed at a lower rate than income taxes.

As Michael Wolfson, an Economist at the University of Ottawa reported, a teenaged child with no income could receive up to $40,000 in dividends tax-free.

Jack Mintz at the University of Calgary found that “60 per cent of the small business deduction goes to households with more than $150,000 in income.”

“[CCPC] is used a lot as a method of tax avoidance by upper income Canadians.”

Wolfson wrote a paper on high-income Canadians - it is surprisingly hard to come by good statistics. It is possible for high-income Canadians to use corporations to cut their tax bill in half - in Ontario, from nearly 50% to about 25% - even before the small business deduction applies. In this chart - which breaks down the top 1% in detail, you can see that in the top 0.01%, that 80% of those individuals owned multiple private corporations. That is many times more than 99% of the individuals who own and run private corporations.

That’s another reason why this is happening:

“Gap between rich and poor widens at fastest pace on record

Most wealth is held by relatively few households in Canada. The wealthiest (top 20%) accounted for more than two-thirds (67.8%) of net worth in the first quarter, while the least wealthy (bottom 40%) accounted for 2.7%.”

And the important thing - critically important - is that this is not due to government fiscal spending or deficits, expanding “the money supply”. Governments rely on taxes they collect, and on borrowing money that already exists.

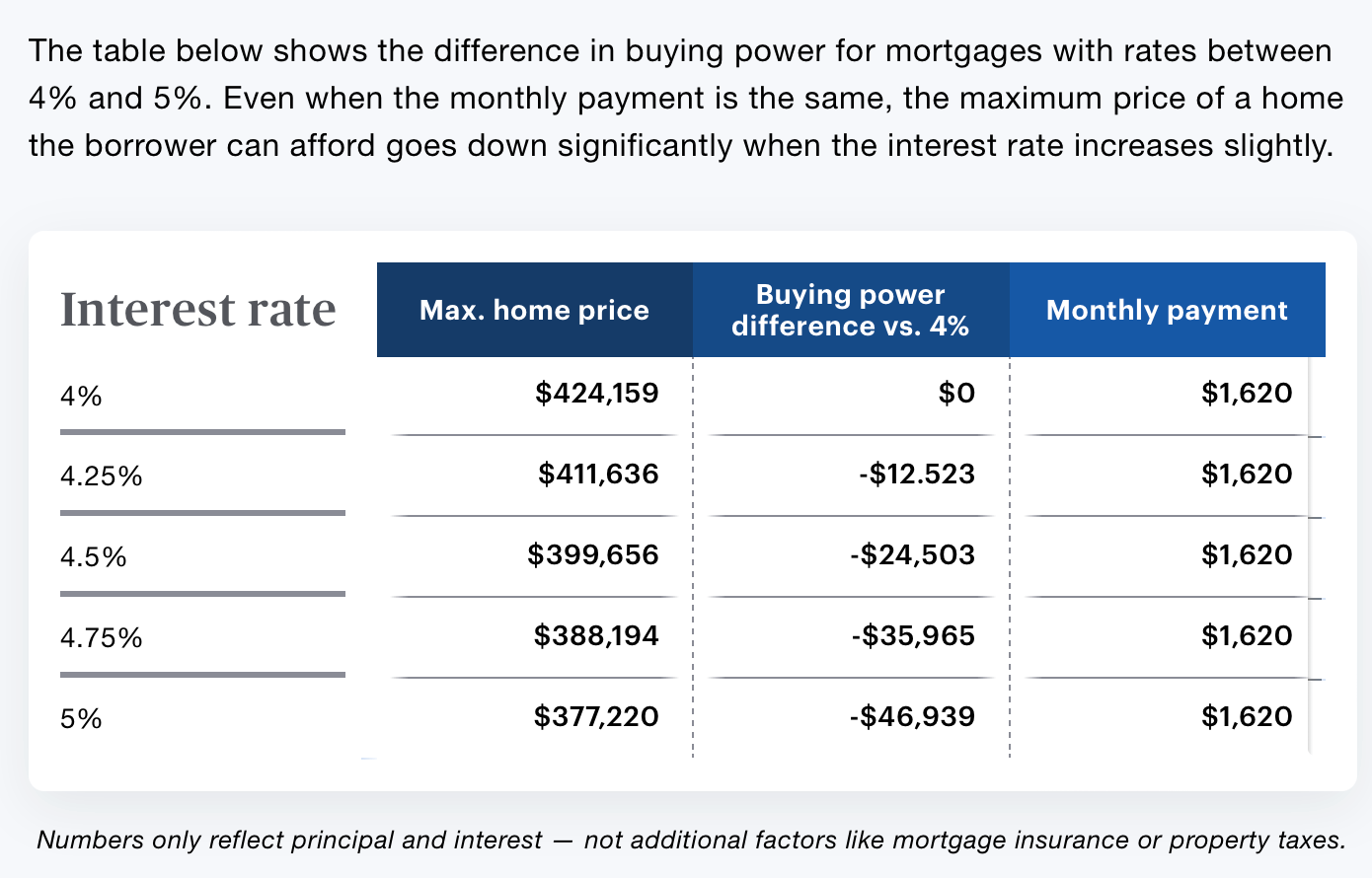

The expansion of private debt, and higher housing prices, is because banks because banks keep issuing bigger and bigger loans - extending more and more credit - because interest rates are low. A single point change in interest rates makes a difference of tens of thousands of dollars, up and down, in the size the loan that can be serviced.

A 5% increase in interest rates means that the amount of private credit extended in a mortgage will drop by $225,000, and the inverse is true: drop interest rates by 5%, and the credit extended will increase by $225,000. Multiply that across a population and a housing market of millions of homes, and it makes a difference in the trillions of dollars.

It is not being used to build or develop new productive assets: it is being used to bid up the price of existing assets, either homes or shares, using the expansion of private credit - not fiat money from government.

It creates a feedback loop of a housing and asset bubble, but boosting the price of assets with debt, while guaranteeing the debt against those same assets. It’s a circular self-reinforcement.

This is why, with the Bank of Canada’s increase in interest rates, Canada is now seeing the sharpest increase in personal insolvencies in 14 years (after the last global financial crisis) and more business insolvencies in 36 years - after the market crash of 1987.

What keeps happening, however, is that while borrowers may lose everything, the lenders are able to collect “insurance” because central banks in particular keep trying to preserve the value of overpriced investments paid for with debt, by giving investors cash for their “toxic assets” in the form of quantitative easing. The economy has turned into a casino where the high-rollers never lose.

Because our politics are so toxic, people want to blame and punish people for their mistakes, when we have to recognize that people have different ideas.

This is what Keynes meant when he wrote.

“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back. I am sure that the power of vested interests is vastly exaggerated compared with the gradual encroachment of ideas. Not, indeed, immediately, but after a certain interval; for in the field of economic and political philosophy there are not many who are influenced by new theories after they are twenty-five or thirty years of age, so that the ideas which civil servants and politicians and even agitators apply to current events are not likely to be the newest. But, soon or late, it is ideas, not vested interests, which are dangerous for good or evil.1

DFL

Superb post.

Most importantly we need to aim our political energies at creating a series of economic rights which ensures everyone has a chance to reach their potential as per the proposal of FDR and later ML King https://en.wikipedia.org/wiki/Second_Bill_of_Rights and https://www.youtube.com/watch?v=vruxsZdfPKI&t=4s