Everything sucks because no one knows what they are doing

Neoliberal economics is a superstitious, secular, totalitarian religion. It's past due time to nail some theses to the doors of Central Banks. It's all based in rules, and rules can change.

On Ignorance

I don’t know when in my life it’s been clearer that people have absolutely no idea what they are doing or talking about.

I often think of this classic sketch from Saturday Night Live, classic in both senses of the word. It’s called “Theodoric, Medieval Barber” where Steve Martin plays Theodoric, and no matter what people ask for, he always recommends more bleeding.

Haircut? Bleeding!

Crushed legs because you were run over by an oxcart? More bleeding!

I think of this sketch, because it perfectly sums up the answer to every economic problem, which is more bleeding.

If times are good, cut spending and cut taxes and shrink government.

If times are bad, cut spending and cut taxes and shrink government.

If there’s inflation, cut spending and cut taxes and shrink government.

If there’s deflation, cut spending and cut taxes and shrink government.

If there’s a surplus, cut spending and cut taxes and shrink government.

If there’s a deficit, cut spending and cut taxes and shrink government.

You’ll notice that some of these situations are the opposite of one another. In every instance, elected government is blamed, and the solution is the same.

Now, there are several reasons why people love simple solutions that are always the same.

They are very reassuring because they offer certainty, which relieves the anxiety of doubt.

It’s less mentally taxing: you don’t have to go to the trouble or mental effort either of paying attention or gathering and weighing evidence, or making an argument.

However, when circumstances change drastically and there is an unexpected event or emergency - or many, piled one on top of the other - it’s extremely distressing when the old solutions don’t work anymore. At all.

What is happening today, as a series of unexpected events and crises have unfolded, is that people have been unable to cope in an emergency - especially an extended one. It drives people around the bend. Uncertainty means fear eats away at hope and reason.

Complications of ignorance

There are a few other pithy quotes I often think of:

“When you find yourself screaming, it’s because you don’t have a plan.”

“Everything is a conspiracy theory when you don’t understand how anything works.”

“A little information is a dangerous thing,” and the internet is the greatest source of a little information in history.

An important insight from a friend:

“The less people know how things work, the more they try to control everything.”

This is especially true of people in positions of power who don’t understand how things work. They depend on others to get it done, but they don’t want to lose face by looking weak or foolish, so they use bluff and bluster, threats and worse to get their way.

Why everything’s messed up: on the economy, no one with authority knows what they are talking about

In the mid 1970s, there was an intellectual revolution in economics.

These fundamentally libertarian ideas - which include assumptions and mathematical models of different parts of the economy, that claim to describe how the mechanics of the economy work. They don’t.

The fundamental assumption that neoclassical / neoliberal economics gets wrong is related to the creation of new money in an economy.

If you were to ask the chicken-and-the-egg question “which came first, government spending or taxes” neoclassical / neoliberal economics would suggest taxes - that all wealth and value creation is private, and that government is dependent on gathering this money to support itself.

However, if you were to imagine the very first year a government starts operating under a new currency, how would anyone pay their taxes without any money? Where did the money come from?

The answer is that in the first instance, the currency is created and issued by government. Governments do not go out and gather different kinds of taxes first, and then issue a currency. They issue a currency, and then collect taxes.

(If people ask, “then why do we pay taxes at all” it is because that is that it makes the economy stable and predictable. It moderates the economy to everyone’s benefit.)

The fact that money is created by government first is of utmost importance, and there is plenty of empirical evidence for this.

As an example in the last 50 years, and especially in the last 20, central banks have created trillions of dollars in “quantitative easing” to give it to the financial sector to encourage more lending and private sector investment.

Since 2008, the financial and banking sector have received multiple multi-trillion-dollar injections of newly created money to prevent their bankruptcy and collapse.

If the private sector was the source of money, this would not have been necessary.

What this means is that the private sector is dependent on government for reliable money, which is the opposite of what people generally think.

Government spending is blamed for creating inflation, because of the idea that money is being “diluted” or devalued.

There are two important challenges to this mistaken idea.

The biggest one is that we think of money as something solid, when it is essentially a system of points. Bills and coins have those points on them - but as the economy runs, those points are not just created, they can be destroyed as well.

Inflation, as Adam Smith pointed out, is quite obviously caused by people raising prices.

Governments create “fiat” money, including cash and coins, banks create “credit” money - which is virtual - by extending credit in the form of debt, the most common and largest of which is mortgages.

It is this money - privately extended credit money - which “dilutes” the money supply, because it has been used overwhelmingly to drive up the price of existing assets - property and stocks.

The concentration of ownership of assets is intense, and by boosting the value of existing assets at the expense of productive investments that would increase wages or create new businesses, the result is stagnation and ever-growing inequality.

The 2008 Global Financial Crisis: Completely Ignoring Catastrophic Failure

In 2008, those neoclassical economics failed to predict a Global Financial Crisis.

The crisis resulted in hundreds of bank failures, millions of people losing their jobs and homes, people going hungry, and massive cuts to government programs, and not one person being held to account for it.

We have just kept doing the same things that we did before the crisis. Nothing was learned. Nothing changed. No one was fired. No one went to jail, despite widespread fraud and industrial-scale criminality.

It was treated as a “near miss,” not a problem to solve.

While there are people who did try to learn from these lessons, and develop alternate theories - they can’t get a hearing.

A fundamental aspect of the neoliberal / neoclassical ideology is that government is to blame for everything, because the market left to itself will be perfect. Given that humans are involved, this is a ridiculous assumption.

Governments are always to blame - not private sector failures, even when there is blatant crime and fraud taking place. Government gets the blame even for private sector crime.

It’s routine to see bankers or investors tut-tutting about how would be better if the government were just behaving itself, or accommodated them.

These statements are as purely political as any soundbite you’ve heard gaggles of politicians and pundits repeat ad nauseam.

Neoclassical / Neoliberal Economics are not ideas. They are rules.

Neoliberal and neoclassical ideas do not accurately describe how the economy works: they are prescriptive inflexible rules about how the economy must work, that are enforced like a secular religion.

These are not ideas, or theories about how things do work. They are rules for how they must work,

Neoclassical economics dictates that we see and running financial capitalism as a secular religion.

If the economy is doing poorly, it must be because people have lost their way and are being punished - or should be - for not following the economic dogma of neoliberalism.

When people suggest that the way the economy is described is incorrect, as, say, Modern Monetary Theory (MMT) does, orthodox economists do not see it as a different way of seeing the economy: it’s assumed that it is a set of rules, or policies.

It must be said, that rules matter.

People like to say these things are a “social construct” which makes it sound like a group project of little importance, when the rules that we create and follow are often in response to things going horribly wrong and killing a lot of people. All safety rules are written in blood, because they are all brought in after the fact.

This is the difference between evidence-based, scientific descriptions of how something works, and ideologies, where the rules dictate both perception and action.

This is true of ideology, and ideologues more generally: the rules are reality.

The explanation comes before the evidence.

When people challenge neoliberal orthodoxy, they are branded heretics, excommunicated, banished and subjected to abuse, and accused of being stupid, naive, Marxists, Communists or Socialists - which are also ideologies based on rules.

It is not based in reason, or evidence. It could honestly be said there were times when the medieval Catholic Church had a greater commitment to critical thinking, evidence and scientific inquiry than current economics and far-right anarcho-libertarian political philosophies.

For 50 years, governments have been doing exactly what conservatives want

The reason the economy and the world are so incredibly messed up, and that people are so angry, and divided and desperate, and that nothing seems to change no matter who gets elected is not because governments haven’t listened to neoclassical rules, it’s because they have.

The idea that the problem with the economy is the government’s fault for spending too much ignores the fact that for 50 fucking years, politicians have been doing exactly what businesses, and conservative voters have been asking them to do.

Governments have cut taxes.

Governments have cut spending.

Governments have reduced investments in infrastructure.

Governments have eliminated regulations and laws.

Governments have privatized and sold off government owned businesses, services.

Governments have enacted austerity and laid off government workers.

Economic decisions have been handed off to the private sector at the request of the private sector.

Most governments did abandon Keynesian economics. Instead of having elected governments run deficits to stimulate the economy, independent central banks were supposed to manage the economy with interest rates instead.

The same people who clamour for freedom of expression and decry government overreach have called for, and succeeded, in having Keynesian economics outlawed.

Laws punishing politicians who don’t balance budgets have been passed. Constitutional balanced budget amendments have been proposed. In the Maastricht Treaty that created EU, Keynesian economics are outlawed.

How libertarian! What freedom! Centrist economic ideas that supported the Pax Americana and the Golden Age of Capitalism were rendered illegal.

The promise - the explicit promise - of economic propagandists like Milton Friedman - was that this would result in greater freedom and prosperity for all. Instead, we have the worst inequality and greatest concentration of wealth in history.

There are housing and cost-of-living crises around the world. The majority people are making the same as they were years or decades ago, and people are everywhere deep, deep in debt.

We are not working and investing for growth or to build savings. We are working and investing to finance the continually growing debt that underpins the entire economy.

Every single one of these measures has driven greater and greater concentrations of wealth and income, mergers and acquisitions and less competition, and have fuelled an affordability crisis in real estate around the world.

Because if we treat the last 50 years as a big economic and political experiment where Milton Friedman and Robert Lucas and some other Chicago Boys all convinced us to try doing it their way, that is what has been happening for the last 50 years.

That is why we’re where we all are, right now.

“We’re all Friedmanites now.” That is the problem.

The brilliance of neoliberalism isn’t in its effects, which are a disaster, but in their use as political propaganda, because it’s a model that treats the market as perfect and the government as the spoiler.

Political parties of all stripes seeking election will blame each other, and accuse each other of wasting money (correctly).

It overlaps with real religion, with the so-called “prosperity gospel” - and it is all linked to the idea that if you follow the rules and are virtuous, you will be rewarded, and that if you break the rules, you will be punished.

It is directly tied into ideas of social morality, which worships wealth and the wealthy as being a reward for purity, virtue or talent, and hates poverty and the poor, associating it with vice and filth.

Higher prices and inflation aren’t blamed on monopolies and cartels colluding to jack up prices: they’re blamed on the idea that the government somehow gave people so much money that customers are in bidding wars over the price of groceries.

It defies evidence, reason and common sense, but it is taught and taken as gospel in Economics, government departments and boardrooms around the world.

In the 1970s, we were all convinced to bring back the ideas that created the stock and real estate mania of the 1920s, the crash of 1929, and the Depression.

That’s what we have been set up for by these economic charlatans. Milton Friedman’s ideas, when tried, have failed again and again, because they are bad ideas that don’t work.

Milton Friedman said “We’re all Keynesians now” and Larry Summers, who has wrought incredible damage as an evangelist for the church of neoliberalism, presumably thought he was being clever, and not a stooge, for saying “We’re all Friedmanites now,” in 2006.

We’ve been lied to, and the lies are ridiculous, but lots of people have believed them, with the result that no matter who gets elected, they are all neoliberals.

In the U.S., that means that Democrats and Republicans use the same 1970s economic formulas. In Canada, the Liberals, NDP, Greens and Conservatives all use these formulas. So do the Conservatives and Labour in the UK. The list goes on.

As Carl Sagan wrote,

“One of the saddest lessons of history is this: If we’ve been bamboozled long enough, we tend to reject any evidence of the bamboozle. We’re no longer interested in finding out the truth. The bamboozle has captured us. It’s simply too painful to acknowledge, even to ourselves, that we’ve been taken. Once you give a charlatan power over you, you almost never get it back.”

The reason none of it works is because the fundamental economics are wrong.

Solutions stink because people are getting the problem wrong

I will forever quote John Maynard Keynes’ conclusion to his general theory, where he makes the point that

“in the field of economic and political philosophy there are not many who are influenced by new theories after they are twenty-five or thirty years of age, so that the ideas which civil servants and politicians and even agitators apply to current events are not likely to be the newest.”

People naturally interpret things based on what they know. Instead of understanding present events on their own terms, we see them through lens of old conflicts.

People associate the miseries of the present directly with the sins of the past, so old and bitter rivalries, conflicts and grievances are renewed, between competing “-isms”: imperialism, communism, capitalism, socialism, colonialism.

Just as an explanation is not a solution, a diagnosis is not a treatment. When you have a headache and you take an aspirin to get rid of it, your relief is not because you needed more aspirin in your system.

The correct diagnosis is that the private economy is falling apart, because central banks created the current situation, including the massive “everything bubble” in assets that has been slowly bursting across the world, leaving the U.S. as the last man standing.

The housing and affordability crisis, the loss of good jobs and good industries, the overconcentration of ownership, billionaires being minted as people go homeless, anti-immigrant and anti-refugee sentiment, famine and war.

There are too many oligopolies and oligarchs, and too many people who are being sentenced to a lifetime where all our rents and debt payments will support a neo-aristocracy who own everything for a living.

The increased financial stress leads people to close ranks, which deepens societal divisions and mutual resentment.

The sense of financial deprivation creates and deepens a sense of living precariously and under continuous threat without prospect of relief.

Financial deprivation, even amid material plenty, makes people fear for their survival, which tap into motivations and drives that are primal and pre-rational. Especially after a pandemic, where at some point, every single person was faced with a total lack of control in their lives, from a natural disaster that is a pandemic, to the response to it.

The problems in the private sector need to be resolved, and so does the damage done by damaging neoclassical / neoliberal central bank policy.

The Utter Disaster of Central Bank Monetary Policy: Making the Rich Richer and Bankrupting the Rest

The destructive role of neoclassical / neoliberal central bank monetary policy can barely be understated.

It must be said that the sheer amount of money affected by the impact of central banks changes in interest rates on personal debt and the private sector dwarfs the fiscal policies of any government.

For a typical person, when the government cuts taxes for them it might improve their finances by few hundred dollars in a year.

By contrast, when a central bank “stimulates” the economy with a change in interest rates of 1% it can add $50,000 or more to a mid-sized mortgage that millions of working- and middle-class North Americans might pay, or it can reduce an owner’s equity in their home by dropping prices by $50,000, which will require finding $100,000 to repay once interest is factored in?

Imagine if an elected official’s decision had the effect of increasing costs by $50,000 in a single year, and $100,000 in a lifetime?

This what Central banks have done to “stimulate” or cool off the economy for decades.

The private economy is too distorted by overpriced assets that aren’t worth it and record levels of private debt.

These pre-existing disparities in concentrations of income and wealth means that both monetary stimulus, and monetary austerity and even more damaging.

When debt levels and inequality are high, central banks do damage whether interest rates are being raised or lowered:

When a central bank lowers interest rates, it drives up existing asset prices, when ownership is already concentrated, so it makes the rich much richer.

When a central bank hikes interest rates, it bankrupts individuals and businesses, so it makes people poorer.

This has been happening since the 1970s. Central bank policy is directly responsible for this, informed by neoclassical economics which insist that governments should avoid fiscal measures and leave fixing the economy up to central banks futzing around with interest rates.

These rules have created one of the fundamental crises in developed countries around the world: too many people are on the brink of debt default.

They have been impoverished over the years as more and more of their income goes to debt, which flows to a concentrated number of shareholders, increasing their wealth.

This is why inflation has been so unbearable - it is happening on top insolvency crisis.

Private debt is the mechanism in the private market of the upward transfer of wealth. It is driven by every aspect of neoclassical economic policies, in both the private and the public sector.

At the level of central bank monetary policy - Instead of, say, full employment, the sole focus is on fighting inflation, not to keep everyday prices down, but to preserve and inflate the value of existing assets.

If inflation threatens asset prices, central banks will step in to “moderate” the economy and raise interest rates, which slows the amount of money being loaned into the economy, and leads to business and personal defaults and job losses.

These harsh anti-inflation measures suppress future earnings for workers. Central banks intervening in the “free market” economy to keep investors’ financial assets from dropping in value.At the level of elected government policy:

Going into debt to run a fiscal stimulus through spending and investment is taboo.

Going into debt to cut taxes in ways that amplify inequality is promoted

Increasing “labor mobility” by making work, wages, and benefits less secure.

Public services and public businesses are sold off for private profit.

At the level of corporations, the concept that the only concern of the corporation should be maximizing profit and return to shareholders. In some jurisdictions, this has been enshrined in law. Aside from being what GE CEO Jack Welch called “the dumbest idea in the world” after he used it to hollow out his own company, there is a fundamental reason why shareholder value is unjustifiable.

Ownership implies liability - but in a limited liability corporation, shareholders are legally exempted from liability.

The private economy is not working properly, and just changing government won’t fix it

The problem with the fantasy of neoliberalism is that since it pretends that the government is to blame for everything that might go wrong in the private sector, that everyone assumes that changes in government alone can fix it.

This includes the left. The “moderate left” will suggest higher income taxes, higher wealth taxes, or a universal basic income.

So long as the deeper problems with the private economy are not addressed, these policies won’t achieve their goals.

The far left will suggest socialism or communism, but here, still, there are issues of how these economies would work, because they are as profoundly ideological and rules-based secular religions as neoclassical economics.

While taxation and regulation and law and rights enforcement and government investments can all make a difference to improving the situation, under neoliberalism, the state is relegated to the position of someone forever relegated to compensate for the mistakes of the market and cleaning up after the fact.

What we need to do is address the broken private market which is dysfunctional and out of balance.

The global problem today is a broken and failing private market, with predatory monopolies and oligarchs.

It is a direct negative consequence of a policy of overreliance on private debt to float the economy that is at the core of neoclassical and neoliberal economics. It cannot be sustained and will inevitably fail because the debt grows inexorably until it breaks the economy’s capacity to pay.

For 50 years, the expectation has been that everyone will go deeper into personal debt to keep the economy going by taking out bigger student loans, bigger mortgages, bigger car loans, bigger lines of credit and limits on credit cards.

This has created our economic, housing and affordability and productivity crisis.

The Big Lie about “Printing Money”: It’s Bank Lending, not Government Spending

It is routine for economists to complain that governments have messed with the economy by “printing money”.

What economists call “money printing” is central banks lowering interest rates.

No government money is being printed. The money isn’t being spent by government. It’s not going to health care or education or roads and bridges or school lunch programs, or defense or anything else.

This “money printing” or expansion in the money supply is all the new debt that people are going into. When central banks lower interest rates, banks and financial institutions will lend everyone more money than they did before.

Its considered “easy money” or “cheap debt” but banks make up for quality with quantity: they offer larger loans to more people. It flood the market with billions in new, lower-quality debt.

Ultra-low interest rates means that people with “no income, no job, no assets” will qualify so-called “NINJA loans” of the kind that banks were making to people in the lead-up to the 2008 Global Financial crisis.

It also means multi-billionaires and corporations can borrow huge amounts of money as well. Instead of using it the way “job creators” are supposed to, by investing in new factories, jobs, start-ups and scale up, they can access multiple billions in ultra-low-interest debt, which is used to increase their own wealth, through bidding up the price of real estate or for mergers and acquisitions of other corporations, or stock buybacks.

The effect is that across the economy, equity is being destroyed and replaced with debt, including within corporations. Buybacks can be used to ensure that company executives meet their price targets for stock.

This is the “money printing” that has created the housing and affordability crisis and stock bubbles.

It’s all about borrowing money to buy up existing properties with the hope of making money by selling it at a higher price, not about creating new value or investing to improve ongoing returns.

It is quite literally what Keynes and Minsky say create stock market bubbles and crashes: debt-driven speculation.

It means the entire economy is based on people borrowing more and more money to gamble that prices will go up forever, when it is the borrowing and gambling that is driving the price gains. That is why it can’t be sustained, and it will not come back to balance in the event of collapse.

This is why the concept of money as “points,” not something physical, is so important.

When people speculate, they are taking a risk. It may be a calculated risk, and just as hoped-for gains can exceed what you put in, so can unhoped-for losses. That is the nature of risk-taking in an uncertain world.

If the risk goes bad, you can wind up owing more on paper than there is money available. When risks go bad across the entire economy, it destroys money. The “points” are wiped out.

This is why the laissez-faire idea that an economy will recover on its own after a financial crash is mistaken, because it assumes that there is a fixed amount of money flowing around, when money is gone.

Central bank “monetary stimulus” distributes all this “printed money” as investments in personal debt, in the most inequitable way possible.

It amplifies inequality.

The people who need the most help in a downturn can access the least amount of money at the highest interest

Those who already have the most means, and may be highly profitable in the crisis - or are profiting from it - borrow the most money at the best rates.

This skews the risk profile and outcomes for the entire economy.

You can make a much bigger short-term gain (or so you’d think) by borrowing money at 0.25% and buying up existing real estate and stocks to flip them, or by buying existing companies, merging them, and laying people off for “efficiencies” and more pricing power.

These central bank policies drove mergers and acquisitions, so we have even less competition and more inequality, more billionaires, and more reckless gambling on dubious and unregulated investments like cryptocurrencies.

These are unregulated digital currencies that are favored by criminals, terrorists and nation-states to launder and transfer funds for all the worst crimes you can imagine.

When we talk about growing concentrations of wealth and income, we are talking about 10 percent of the population owning well over half of all the property in each country - Canada, the UK, the US and many others.

The great driver that has been ratcheting up inequality year after year for the last five decades is private debt. It’s created the housing crisis, and the crazy stock market, and all the money that went into that didn’t go into roads, bridges, factories, health care, or good jobs.

All this private debt is a forbidden thought: neoclassical economics does not even model it. It doesn’t model money either.

The reflexive response to hearing about anyone’s debt is an assumption that it was due to a lack of self-control on the part of borrower, and that they deserve punishment - as if they have squandered one’s own money, not their own. This is the morality of the neoclassical/ neoliberal as a secular religion.

For 50 years, we have expected and demanded that people go into debt. As governments cut back, consumers have been expected to pick up the slack.

Stagnating wages mean that when costs go up, people have gone into debt to maintain their way of life, and often to stay alive.

People use their credit cards to pay for groceries, or medications, or private health care. You cannot put a roof over your head without a mortgage. You cannot earn and save enough money to pay for education, you need a student loan.

In every case, the loan is an investment from which creditors are going to get back twice what they put in. The creditors are few and wealthy; the debtors are many and not.

It’s not just individuals who have lost out.

The same policies that have hugely increased debt to buy non-productive assets (personal cars, personal homes, etc.) have undermined industrial capital and the real economy with local ownership and good jobs.

Instead of investing in new factories, or businesses, we’ve invested trillions in driving up the price of existing assets. These policies have helped finance the de-industrialization of developed countries.

Identity politics and neoliberalism

It’s been said that “identity politics” is “the left wing of neoliberalism” - it’s a corporate marketing department’s conception of diversity, based on market segmentation, not actual communities of shared values. The demographic aspect about marketing is about division and discrimination - which customers will make you the most money, and the customers you want to shun and avoid.

While the media will often cover differences in income between demographics groups, emphasizing divisions, but usually neglecting to point out that wages have stagnated or even dropped for years for everyone.

For example, it is very common to compare women and men’s incomes, and point out that women routinely make less than men.

There have been times when “improvements” are reported - that it is getting more equal, when the overall story is worse: the depressing reason women are catching up is not because their incomes are getting better, but because men’s incomes are getting worse.

In some cases, incomes have collapsed or stagnated even amid record growth. A Canadian example: in 2014, after years of record oil prices the economy of the Canadian province of Alberta was growing at a pace faster than China.

Investment, jobs, wages were soaring, but it was not evenly shared. In 2012, 50% of all income in Alberta was made by the top 10% of earners.

And an economist in Edmonton found that adjusted for inflation, 99% of the people living in Calgary and Edmonton were no better off than they were in 1984 - 30 years before. That is before the revent price crash.

This is the reason for the “crisis” that people talk about around male identity, because it is hard to get a good job, period. People are making less at the same job than their parents did, and good jobs have been outsourced.

Entire generations are being forced to pay the price for the economic incompetence of central banks and the church of neoliberalism - and we are being told we will all have to pay for it.

Civil unrest often follows economic crises, which make existing inequalities in society worse. Marginalized communities are hit harder, but there are often impacts that are not as hard but are still very destabilizing.

Structures break at the weakest point first, which are communities with fewer resources.

The political and economic reality is that no country has properly recovered from the 2008 financial crisis, and the shock of the pandemic was equally colossal.

The reason for ongoing frustration and powerlessness on the part of so many citizens across the political spectrum is that no matter who gets elected or what programs they bring in - even if they are great and effective and deliver real, positive results - it’s not enough to overcome the deeper problems of private debt.

This is why the hoped-for change never comes, even when governments do invest billions in “Keynesian” fiscal stimulus - the distortions and dynamics of private sector debt flows are too great to have an impact.

People have also suggested that we have some kind of Universal Basic Income (UBI) to ensure everyone can pay their bills and compensate for inequality or job losses due to technological change.

There are two problems here. One is that unless we deal with the excess debt, the UBI will be going to service debt instead of helping the person live.

So UBI will flow straight through the people who need it to their lenders. Without debt relief, a guaranteed “universal” income creates a guaranteed income for lenders.

The other is that unless the colossal distortions in the market are addressed, UBI will just provide an “economic floor” that more and more people will drop to.

The Negative Impact of Central Bank Manipulations on Public Finances

Central bank interest manipulations also have colossal impacts on public debt as well as tax revenues.

With public debt, lowering interest rates and creating asset bubbles means higher short term tax revenues for governments, in ways that are very significant.

In the early 1990s people were projecting that Canada, the UK and the US were all in deep trouble when it came to deficits and debt. It was projected that they might not balance the budget for decades.

By the end of the 90s, however, all the parties that used to be considered centre left - Liberals in Canada, Clinton Democrats in the US and Blair’s “New Labor” in the UK were all neoliberal, all focused on balanced budgets - and they were succeeding.

In fact, one of the major reasons for the simultaneous improvement in public finances was that central banks were lowering interest rates.

https://wowa.ca/banks/prime-rates-canada

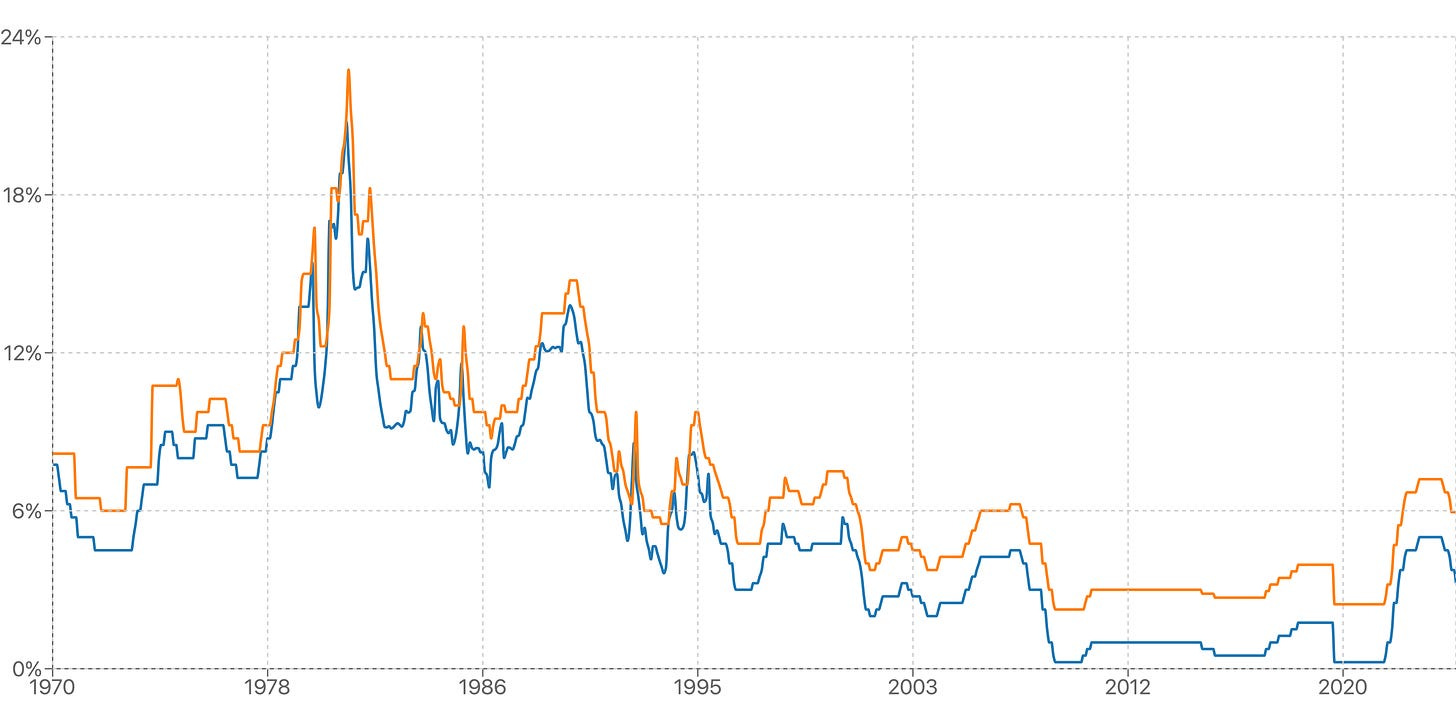

As interest rates dropped from over 20% at the beginning of the 1980s to 12% at the beginning of the 1990s to under 5% by February 1997.

This released billions of dollars into the economy through lending, creating speculative bubbles instead of investing in the real economy. In the 1990s, that included real estate, the dot-com bubble, as well as “crazes” like Beanie Babies and Baseball Cards.

When the central bank wants to fight inflation, it does so by cranking interest rates back up again.

This “cools off” the private economy by engineering a recession: driving people out of business, and driving homeowners and business owners into default, increasing unemployment.

This drives down government revenues.

When that happens, people demand more cuts, because of a crisis created by monetary policy. This is madness.

What We Need to Do: Reduce Private Debt, Break Up Monopolies, & Invest in NEW Value

What has been happening over the decades is that equity has been replaced by debt.

The result has been a transfer of wealth and income from workers and industry to the FIRE sector - finance, insurance and real estate, with lots of massively overvalued companies whose business model is to “share” other people’s intellectual property with little or no compensation while paying themselves a fortune.

This is the process that needs to be reversed - we need to replace uncertain debt with certain equity.

That is, replacing debt with equity to clear away old debt, as well as investing with equity in the creation of new value.

How to calculate how much debt should be restructured?

Excess debt is clearly attributable to the specific actions of central banks in adjusting interest rates.

It should be possible to calculate how much more debt was issued because of interest rate changes, and could use that as a formula to reduce debt owed down to a level that is manageable.

Reduction of liability on an asset is the same as injecting equity injection for the owner.

When this occurs for mortgages, the housing market could drop in price in a way that has been eased by debt restructuring, instead of a catastrophic crash.

Deb restructuing eases a reduction in house prices, and provides people with more equity in their home, so they can afford to sell at a lower price, without selling at a loss. This is the best way to defuse a housing price collapse.

Under neoclassical economics, they believe somehow that money is like matter and energy in physics that can neither be created nor destroyed.

They don’t really recognize bankruptcy. It’s assumed that the capital flows in “sunsetting industries” flows into new ones. This is nonsense. If refrigeration technology replaces ice harvesters, the ice harvesters can’t get their capital out of the business, because it no longer has value.

This is why new equity has to be targeted to productive investments.

Because those mortgages are also bank assets, reducing their value would also mean reducing the value of those assets. That is why creating equity funds which will drive new productive value can ease a transition out.

However, the debt trap illustrates the entire problem with an investment system that is built on whether working- and middle-class folks can afford to keep paying their mortgages. The answer is: they can’t, and we shouldn’t.

So the answer is to make a second injection of equity which is to create a fund that provides access to capital in equity form to create more local private competition.

In addition, federal governments should run a high-pressure economy with monetized deficits to put people to work.

This is all completely the opposite of what is being proposed for the U.S., and not what most OECD countries, including Canada and the UK, and everyone else has been doing. They’ve been following the same terrible advice based on the same terrible economic models.

We are in a colossal debt bubble that has inflated the cost of housing and stocks. There has been greater and greater concentration of wealth and ownership, leading to monopolies, oligopolies and oligarchs trying to run the economy for their own good, and governments have been co-opted or shoved aside and actions in the public economic interest are considered taboo.

This is the reason the economy is messed up, and that people are so angry and despondent. People are increasingly being driven by desperation and panic, which is directly related to their own financial situation.

The final problem is that because neoclassical/ neoliberal economics don’t consider that economic crises, bubbles or crashes are real.

That has huge consequences;

No one prepares for the impossible. If you don’t think something can happen, why plan for it?

No one knows how to defuse a financial crisis or bubble even as it is bursting and doing damage to the economy, which is happening now.

No one knows how to effectively avert the harms of an extended recession, or even a Depression that could result from such a crash. Despite concrete lessons and policies from the U.S. and Canada in the 1930s and 1940s, the assumption is that nothing can be done.

There is a growing sentiment that the current rally can’t last forever, and there are predictions that the market is massively overpriced.

There is a fatalism to all of this, because neoclassical economics has taught use to treat this all as something we have no power or say over - because the “market” has been used as a stand-in for “the will of the people” for 50 years, even as fewer and fewer people and corporations comprise “the market.”

The flip side of all this ignorance this was a powerful saying I read, “competence leads to confidence.”

There are a select few people who paid attention and learned from the Global Financial Crisis about what went wrong, what economic theories should be tossed in the wastebin of history, and actual concrete measures to move forward.

Adair Turner, who wrote “Between Debt and the Devil” and who was the Chairman of the UK’s Financial Services Authority throughout the Global Financial Crisis is one of the few people who pairs a theoretical understanding of economics with practical experience in why they don’t work.

The other is William White, former advisor to the Bank of International Settlements who predicted the 2008 Global Financial Crisis in 2003, and who has written extensive recommendations on reforms, especially on creating better ways to restructure debts in a way that is controlled and organized, and not chaotic and explosive.

Post-Keynesian economists like Stephanie Kelton, Marianna Mazzucatto, Steve Keen and others have proposed reforms.

Part of the reason that the economic intellectual revolution of the 1970s was possible is that people (with lots of money and backing) seized the political opportunity of economic distress to justify bringing in a new economic theory, which was already ready.

Modern Monetary Theory is certainly much better at describing the mechanics of the economy, but it is incomplete.

In On Liberty, J.S. Mill described the era he lived in as “destitute of faith, but terrified of skepticism.”

There’s a metaphor there - of trying to get someone out of a lifeboat in heavy seas, but they can’t bring themselves to let go, to make the step to safety.

That’s where we are at now. We are stuck doing things the wrong way, even when it is taking us into an economic and political abyss, for lack of a new and better theory.

I know there are people who talk about regulatory capture or corruption, but the reality is that neoclassical economics is, in every sense, a false religion, and economists are like the clergy in a medieval theocracy, where the values and the belief system of that secular religion are imposed on everyone. They are the court astrologers, who used real mathematics and real calculations to cast horoscopes for medieval rulers.

It’s long past due time to nail some articles to the doors of central banks, because they truly are responsible for the state of the global economy, this new gilded age of bullyboy oligarchs and people with enough money to corrupt absolutely everything. It has left the vast majority of all the property in the world in the hands of a tiny few, many of whom are criminals of the worst kind. Child rapists, sex traffickers, drug dealers, terrorists, radicals and extremists, dictators and corrupt public officials, warlords and crime lords.

They can’t even strictly be called a corrupt priesthood, because they’re so good at deceiving people, they’ve even convinced themselves that this nonsense is true. They’ve gone full George Costanza, who famously told Jerry on Seinfeld “Remember - it’s not a lie if you believe it.”

Independent central banks quite literally have the all the power they need, right now, to resolve economic crises in the public and the private sector.

They can undo some of the appalling harm they’ve done in ruining lives. bankrupting people so they lose everything. I mean, whether people can get a loan or not for anything is determined by the policies of a central bank.

Because central banks have the power to print unlimited amounts of money. To create it out of thin air, with the click of a button.

At the beginning of the Global Pandemic, in March 2020, the chair of the U.S. Federal Reserve committed to “unlimited” money creation. The Bank of Canada and central banks around the world made similar commitments, and immediately started printing hundreds of billions of dollars to prevent the total collapse of the economy, which would have occurred without government intervention, because the private sector depends on government.

Central Banks Need to act in the Public Interest, not just the Private Interest

We should be much clearer about who owns central banks. They are public. They belong to everyone who must use their money. These are public institutions. So, when they create new money from thin air, which they have done in the trillions of dollars, that is our money they are using.

Instead of going to public governments that we all own, to help them pay their bills, make investments in improving the community or creating jobs, and instead of just making sure that everybody had enough money to buy groceries during the pandemic, all that money was created in bank accounts for banks and investors, so they could lend more money to you.

It is insane that this happened. The consequences, combined with ultra-low interest rates, have included massive increases in inequality, and in billionaires, and in corruption, because some of those billionaires are criminals, and became billionaires by criminal means. Flooding the market with cheap debt created a market of suckers for thieves to exploit.

The rules need to change. That’s what freedom and democracy are about. We have one set of rules we’re living under; it is literally our constitutional right to get together and change them, so they work better.

It must be said: if central banks compensated people for the economic harm that has been done to them by their policies, you could arguably solve the crisis we are in. Reduce people’s debt. If they were bankrupted unnecessarily by these policies, replace what they lost. Put money into restoring ecosystems.

Central banks are independent. They can ignore any elected official. That’s the point of their independence. The problem is that their economic models aren’t reality based. But if they change them, they could immediately act to change them and improve the economy in ways that would have long-lasting benefits.

A central bank could create money to reduce people’s debt. There is no question that many, many people have lost their jobs, their homes, their business or their farms because the central bank was messing around with interest rates that tilted a once-functioning market against them.

They could provide people with capital financing to start a business, or buy a farm, or housing that was lost.

The losses to working class and middle-class folks over the years have been in the hundreds of billions of dollars in Canada alone, and these mistakes have been made everywhere.

Can it Be Done? Would it Work?

There are two questions here. One is whether it could be done. Is it realistic and achievable? The other is that, if it can be done would it work without harming the economy?

The answer to the first question is, “Given that central banks have been able to print trillions of dollars to give to banks and investors, it is something that has already been shown to be practically achievable.”

The other, “Would it work?” is an answer that existing economics can’t genuinely answer. It goes against their rules.

The condition must be that it is new investment for the long term, not speculation.It would mean transparent investment in rebuilding the working and middle classes, and in real economy businesses.

These investments and private activity will likewise reinvigorate revenues for government, allowing then to increase investments and balance budgets,

This could be done today, or tomorrow, and it does not matter who the elected party in power is. These central banks are independent. The federal reserve promised money without limit to support the value of assets.

The reason we can’t is that we’ve got the wrong set of economic rules. They can change, and should change, and we can do it and still have a functioning economy that makes sense. Make the economy make sense again. Because it’s a bullshit economy.

That’s what a “new deal” means.

It really is a new set of rules for how to have a better economy than one that’s either falling apart, or all the money’s being hoarded, and there are tons of scams, and you have no choice but to play along.

Mob casinos may be fun and exciting to visit, but they’re no way to run a whole economy. It doesn’t make for a great place to live.

It doesn’t have to happen. Ownership and money and politics and the law is all about one thing: rules. Corporations and business have rules. Government has rules. Education, health care, science, faith, all have rules.

Life is about these rules - enforcing them, changing them. And things break down when things break down, because these are not rules of a game, these are life-and-death rules.

And that’s what we need to realize. That we are all saying we need to change the rules. We need to be clear which rules need changing - and what will bring relief.

While people are quoting John F Kennedy when he said, “those who make peaceful revolution impossible make violent revolution inevitable.”

I don’t believe that violent revolution is inevitable, nor is it desirable. Real conflict always kills a lot of innocents. There still needs to be dedication to a peaceful revolution, and that requires ideas, and a plan.

More bleeding isn’t the answer.

-30-

Yep, all it takes is a twist of the dials they control to make things rational again.

They used those dials to keep us losing, thinking that's the best way to control us.

But I feel like a new faction of the wealthy may realize the popularity of cutting out the middle men that steal from both sides while producing nothing.

I think you totally nailed it with the free market becoming a religion. You stay within economics or what use to be called political economy, but it's even more existential. As science has discredited the mythologies or religion it hasn't replaced the meaning and purpose of life given by religion, and since most people want some sort of higher purpose ideology, they have, without really knowing it, replaced religion with the endless pursuit of money, which might even work at least for a while if people were actually getting wealthier, and the "religion" behind that concept is the "free market".