How The Economist & The Globe and Mail Are Getting Canada's Economy so Utterly Wrong

Canadians hoping for clarity or facts on the economy are out of luck. They're getting right-wing fairy tales instead.

Back in October, the Economist printed a feature about Canada’s economy, and I’ve been meaning to write a critique of their assessment of the economies of Canada and the U.S. The Globe and Mail, Canada’s paper of record put out what they claimed was a history of Canada’s “big spending, big government” under Justin Trudeau. David MacNaughton, a Liberal, has called for some kind of return to the 1990s.

It’s hard to adequately express just how bad all of these assessments are. Blinkered, facile, and superficial is only a start, and it not just a question of the reporting. Even the insights offered by experts are provincial and parochial. They’re just blatantly wrong. The idea, repeated endlessly by Canada’s opposition, it’s apparatchiks, and by armies of pundits, ideologues and propagandists.

We need to recognize that the people who suggest that Canada’s governments and political parties are even remotely left-wing are people writing from a far-right point of view.

What The Economist’s own article shows is that Canada’s economic showing is not because the government has been Keynesian or engaged in stimulus spending: the reality is just the opposite.

Japan, China and the U.S are all running massive deficits to deal with the harm to their economies. Japan’s deficit is 9% of GDP and so is China’s, while the US is 7%. Canada’s deficit in 2023 was 1.1%, while inflation was much higher.

since the pandemic North America’s two richest countries have diverged. By the end of 2024 America’s economy is expected to be 11% bigger than five years before; Canada’s will have grown by just 6%. The difference is starker once population growth is accounted for. The IMF forecasts that Canada’s national income per head, equivalent to around 80% of America’s in the decade before the pandemic, will be just 70% of its neighbour’s in 2025, the lowest for decades.

Why? Because the Bank of Canada chose to engineer a recession:

… Unfortunately, that demand has been throttled by higher interest rates. Monetary policy has had more "traction" in Canada than in America, says Tiff Macklem, the central-bank governor. In the latter, most mortgages are fixed for 30 years, whereas in Canada they are typically set for five.

A greater share of Canadians than Americans have already seen their mortgage payments rise. This is all the more painful as Canadian households bear more debt, relative to income, than anywhere in the G7 club of large, rich countries. They now fork out an average 15% of their income to pay back debt, up one percentage point since

2019. And unlike Uncle Sam, Canada's government has not tried to soften the blow by loosening the purse strings. It ran a deficit of just 1.1% of GDP in 2023, compared with 6.3% in America.

So there is the explanation, right there. Why is the U.S. economy doing “better”?

Because the U.S. government was putting much more into the U.S. economy than it was taking out. That’s what a deficit does.

The problem in the U.S., as everywhere else around the world, is that the economy is massively out of whack due to a colossal “everything bubble” caused largely by monetary policy responses and a private economy that’s collapsing under the weight of its own debt.

There were a number of warnings after 2008 that there was danger of an even larger crisis than before. Monetary stimulus and years of ultra-low interest rates meant ungodly amounts of low interest debt, all around the world. In 2014, I was told by an investment banker friend who had worked in The City in London through the Global Financial Crisis that there was likely to be another crisis, even bigger than before.

central banks became ever more committed to the pursuit of a low, positive inflation objective, an objective generally (and wrongly) referred to as "price stability".

In pursuing [this] objective, central banks ignored the broader implications of the other two major trends. In effect, by adopting an over simplified model of the world, one that abstracted from both supply side and financial shocks, central bank policies have created the instability they were seeking to avoid.

The reason was simple - there was so much low-interest debt out there that if inflation or interest rates went up, it would cause a crisis. If inflation went up faster than interest rates, then investors would lose money. If interest rates went up, then borrowers wouldn’t be able to pay, some would default, and investors would lose money.

Either way, investors lose money. This is the direct consequence of repeated central bank attempts at “monetary stimulus” - lowering interest rates in an effort to give the economy a boost, as well as using “quantitative easing” (QE) by buying billions of assets from investors.

When people want to chastise people today for not “living within their means” when they get into trouble in debt, it means completely ignoring that since the 1970s, the entire basis of the economy has been encouraging individuals and consumers to shoulder the burden of driving economic recovery by taking on more debt.

One of the major lessons of the 2008 global financial crisis should have been to remind us that private debt and mortgages can causes global financial crashes. I say “remind us” because going into private debt to speculate that a non-productive asset will go up in price is the cause of all economic manias, dating back centuries. Non-productive assets includes personal housing, any shares purchased after they have already been issued, and commodities, including metals, and cryptocurrency.

Neoclassical economics does not model banks, money, or private debt at all, which means that the financial sector does not exist. Austrian economics does model banks, but operates on the false assumption that markets are rational, because of a miscalculation that enough people observing a situation will achieve certainty. Uncertainty is missing information, and it is an indisputable and escapable reality of human existence. While people may feel justified in making leaps of faith where the spiritual realm is concerned, no human is justified in expressing certainty and total information about the market.

For those reasons, neoclassical economics is oblivious to the cause of financial crises, as well as to how to resolve them, and Austrian economics recognizes the cause, but wants to pretend that economic self-flaggelation and economic debasement is required for the spirit of growth to return.

The reason both are wrong is that they fail to recognize what has been obvious for millennia, which is that money is informational, which means not only that it can be created, but it is destroyed, and in fact, that is part of how lending and credit work, and always have worked. The first money was marks on a clay tablet. We have always had accounts. Some cultures had knots. Some had beads and wampum. These are records. Money is a token of obligation. It is a tool invented by humans. Anyone can create money as credit, with an IOU. The problem is getting anything of value for it.

When I say that money can be destroyed, that’s what happens when people default. The money doesn’t exist anymore. And with debt, almost any loan pays back double.

So, the solution to get out of the mess is to restructure private debts and to stimulate the economy with directed fiscal investments in jobs, industry and environmental restoration.

Instead, what we have is extremely high personal debt, most of it mortgage debt, which has created a housing and affordability crisis. The problem in Canada is not a housing shortage. It is because the price of housing has been driven up because of these ultra-low interest rates, and because governments have at all levels have become captured by revenue from the FIRE sector: finance, insurance and real estate. When I say captured, this is a sector that generates tax revenue for government, as well as donations to political parties, and think tanks.

This is a critical economic difference that is generally ignored - that the FIRE sector is different from the rest of the economy, which includes all “non-FIRE” businesses, which includes industrial capitalism, and labour.

This is important, because in many countries there are often only two major parties of “right” and “left”. On economic issues, the right is associated with management, business and capitalism, and the left is associated with employees, labour and socialism.

This is a reflection of the lasting inadequacies of the way are taught to think about the economy. For all the generations of disappointed leftists who wonder why nothing seemed to changed even after they voted in outspoken progressives, it’s because the left and the right don’t actually have different economic formulas and theories.

Marx and Communism is based on the model of the state as trickle-down capitalist corporation, with a CEO, his executives, and the board centrally planning and directing the corporation’s various divisions to hit various quotas. That’s the reason people say far left communist and far right fascist governments are similar, and it’s because they run governments the same way. There are no public police: the cops are all on the company payroll.

Authoritarianism is all about following rules despite what your eyes and reason tell you. Liberalism, by contrast, is not an economic philosophy at all. It is a belief that the only way freedom and justice can only be achieved through the rule of law, which places the rights of all individuals to be free above all else. That means that we have certain responsibilities and obligations to one another as citizens, and if we ignore those responsibilities and violate those obligations, we all face consequences. Further, to protect one another from abusing the system, we will have checks and balances, and due process, as well as independence and freedom from bias and corruption.

That means protecting individuals from certain private intrusions into their freedoms as well as public. It does not say to make everyone equal, but it does say that at certain critical times, no one gets to stop or interfere with people. There is a constitutional right to vote, to freedom of expression, to freedom of association, to due process. Unless individuals are able to speak truth - and I do emphasize truth - to power without fear of retribution, it is a guarantee of corruption.

In order to have any of this, you must have an independent judiciary that has the authority to challenge even the most powerful criminal. If you don’t have that, you no longer have the rule of law. This is not about making people equal: it’s that everyone is equal in the eyes of the law.

Those are the underlying principles of human rights as well as the US and Canadian Constitutions. These are enlightenment values, and currently, they are being crushed out of existence.

I emphasize all of this to make a point about economics and politics. Authoritarian governments are not about the rule of law: they are about following rules.

This is what is at risk, and what we can’t possibly lose, and must restore where it has been lost. For all the cynics and poisonous divisions there are right now, whenever people talk about periods of greatness, and progress, it was associated with these ideas.

Can We Avoid Another Financial Crisis?

In 2017, Professor Steve Keen wrote a fine, readable, brief book entitled “Can we avoid another financial crisis?” where he explained the factors he thought were strong indicators of the possibility of a financial crisis.

“For example, if the corporate debt ratio merely stabilised, then Canadian household debt would need to rise from 96 per cent to 143 per cent of GDP by 2020 to compensate. Australia, which already has the highest household debt ratio in the world of 125 per cent of GDP, would need to reach 170 per cent. That simply isn't going to happen.

Consequently, both countries are very likely to suffer a severe economic crisis before 2020 - and possibly as early as 2017. This crisis will be blamed on the incumbents and the economic policies they follow - and in Canada's case, it will mean that Trudeau's decision to run a government deficit, which he flagged during the electoral campaign, will be blamed for the crisis.

Far from being the cause of the crisis, Trudeau's deficit will in fact soften the blow of collapsing credit, when it comes (while Turnbull's swing towards austerity will make Australia's crisis worse).

But the peculiar dynamics of debt mean that casual observation supports the proposition that a politician who either triggers or benefits from a debt bubble is a good economic manager - capable of delivering good times and also running a government surplus - while the politician who wears the aftermath of the bubble stands accused of being an economic incompetent who presides over a serious recession and runs a government deficit.

This is why America's ex-President Bill Clinton (Democrat), at one political extreme, and Australia's ex-Prime Minister John Howard (from Australia's conservative Liberal Party), at the other, are both falsely feted as good economic managers. In fact, both leaders happened to come into power when a previous private debt-induced downturn had come to a close and a new debt bubble had begun, firing up the economy's performance with credit and filling government coffers with tax revenue.”

In fact, there were indications of serious financial disturbances in the fall of 2019.

In 2019, “Overnight lending rates topped at an annualized rate of 10% last week, four times higher than the prior week. That essentially meant some banks were willing to pay upwards of 10% interest rates for cash.”

The U.S. Federal Reserve responded by setting up a “Standing Repo Facility” to keep those interest rates down - by making sure money was always available to borrowers. Because of the jargon people don’t grasp it, but what it means is that the U.S. federal reserve was using public money to make sure that people could borrow at lower interest rates.

The pandemic happened just at the moment the bubble was bursting.

the first three of the four interest cycles we have seen since the late 1980's - ending in 1990, 2001, 2008 and 2020 - ended with a financial crisis, while the fourth upturn was cut short by the covid pandemic. Each crisis had its origins in monetary stimulus intended to foster recovery from the previous recession, but each ended in financial "bust" and recession.

In March of 2020, the Federal Reserve committed to “unlimited” amounts of QE, and countries around the world did the same. Trillions of dollars in public central bank money were created in order to buy up assets.

This was presented as “sending a signal to the market” that it was ok to invest, when it was giving free money to people and institutions were collapsing in value - due to bad credit - and replenishing their reserves with cash so they could continue to fuel the bubble.

As the pandemic was spreading, but before it had been declared a public health emergency, my legislative colleagues and I had called on the Manitoba government to prepare on a number of fronts, including being willing to crack down on price gouging, which always - ALWAYS - goes hand in hand with emergencies.

When inflation struck, there is copious evidence that it was due to corporate collusion, including price fixing of the price of oil.

Because the Bank of Canada operates on Milton Friedman’s mistaken belief that government stimulus causes inflation, and ignores the market’s role in raising prices, the BofC launched its own, punishing monetary austerity, hiking interest rates in order to crush inflation, which means unemployment, personal and business defaults.

It has to be said that the Bank of Canada in 1936 had a far better understanding of money and stimulus than we do today:

“in stimulating business activity the vital matter is not the amount of money in existence, it is the size of people’s income, in other words, the size of the national income. This can grow, and does grow, without any definite connection between such growth and a growth in bank deposits or note circulation. (Bank of Canada 1936, 12)

This is the sheer, stubborn, mindless stupidity of current monetary policy, which defines all inflation as being caused by government, despite stacks of evidence that it is being caused by price-gouging in a crisis.

Instead of investing to rebuild after the pandemic - with global conflict and instability growing - The Bank of Canada and Canada’s federal and provincial governments have all been engaged in austerity. This is absolute madness in the shadow of an incredibly destructive pandemic, but it is inevitable when everyone and their dog is a fiscal conservative.

Fiscal conservatism in a crisis is to be part of a death cult.

I don’t say that lightly. I mean it, and I have seen it. I live in a province where every winter homeless people die on the street frozen to sidewalks, where errors lead to preventable deaths in our health care system, a province that exports food to feed the world while there are thousands of hungry children, because people have been conditioned to treat our economic system as an expression of God or Nature’s will that cannot be challenged, when it is a political and financial arrangement.

Austerity in the slump never, ever works. Mark Blyth, a political scientist, wrote a fantastic book: Austerity: History of a Dangerous Idea that details the political and economic history of austerity. He summed it up as “It never works, and it leads to very nasty politics.”

We have not run out of people or resources. The entire problem is the current distribution of money in the economy, paired with the political and economic taboo that we can do nothing about it. We have a bunch of idiot savants insisting that appalling human suffering and human sacrifice is necessary in order to preserve the current value of assets.

There’s also the issue that the U.S. economy is in a massive asset superbubble - an “everything” asset bubble, and those assets don’t produce anything.

This is the illusory “strength” of the U.S. market - insane overvaluation of stocks and companies, and the enrichment of absolute criminals.

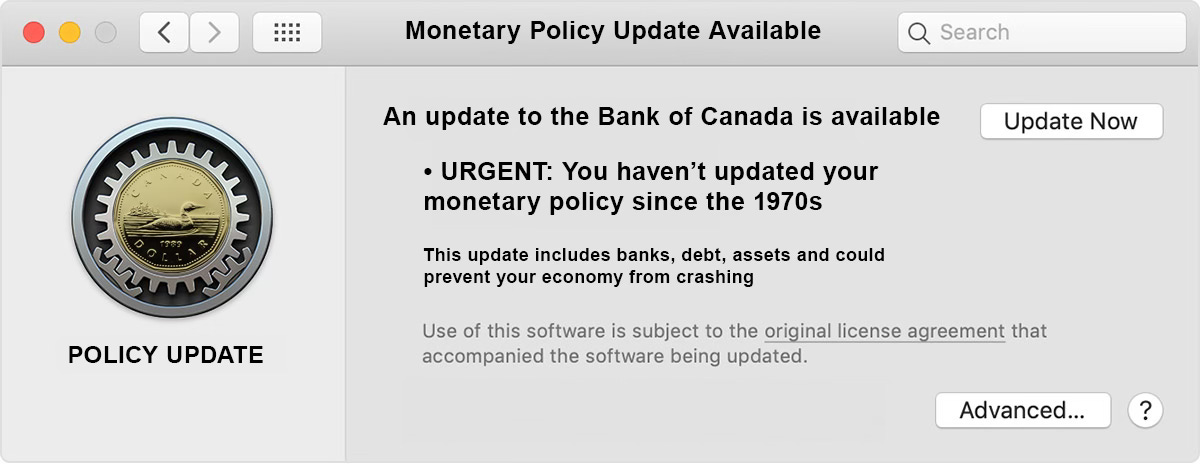

These asset superbubbles, as well as Canada’s housing and affordability crisis, were directly caused by the Bank of Canada’s monetary policy, which is stuck in the past, and have not been updated despite their total failure to predict the 2008 Global Financial Crisis.

The Bank of Canada - like central banks everywhere - runs on 1970s neoliberal and neoclassical economic formulas that have been driving inequality ever since they were implemented, because the entire principle of supply-side Friedmanite voodoo libertarian economics is that if you just give all the money to owners, they’ll make life better for everyone.

That is a swindle. For the horrific damage these policies have had over the last decades - collapse, death, war, suffering, conflict - Milton Friedman should be regarded as one of the worst criminals in history. As far back as the 1940s, he was taking money from corporations to spread misinformation about rent control, which were presented as independent research but was backed by the real estate lobby.

The Economist goes on:

The second faltering growth driver is Canada’s petroleum industry, which accounts for 16% of exports. Canada underinvested in new production for years after 2014, when a collapse in oil prices hurt its fuel-dependent economy. In America, by contrast, oil-producing states suffered but consumers cheered. When prices spiked after Russia invaded Ukraine, investors did more to support American shalemen; the country’s crude output has rocketed. It was one-quarter higher in the first seven months of 2024 than it was during the same period six years ago. Canada’s has grown by only 11% over the same period.

This is an astonishing piece of revisionist history, and profoundly inaccurate.

First, the 2014 “collapse” in the price of oil was a deliberate decision on the part of Saudi Arabia and OPEC to launch a price war in order to bankrupt North American shale producers, and it was successful.

As I have written, the price of oil in Canada has been going up for 15 years straight and had been over $100 a barrel for several years, with everyone predicting that the price would never drop. Since Conservative Prime Minister Stephen Harper was elected from Alberta with the direct assistance of the oil lobby, it led to all-too-familiar hubris.

Harper’s entire political career - and his political party - were the result of the collapse of oil prices in the 1980s, where there was an Alberta bumper sticker that said “Lord, please send me another oil boom, I promise I won’t piss it away like I did last time.”

High oil prices mean a high Canadian dollar, which contributed to the loss of hundreds of thousands of manufacturing jobs for export in Ontario, hollowing out Canada’s middle class and the economy.

For the Economist to write “Canada underinvested in new production” after 2014 requires ignoring that at those low oil prices, no investment was profitable.

This really is sheer stupidity, and a failure to grasp what everyone calls “economics 101” of supply and demand. The more production and supply, the lower the prices.

First, saying “Canada” manages to reinforce the bizarre notion that Canada is a Soviet-Style economy where the government is making the investments.

What happened is that hundreds of billions of dollars in planned private investments in Canada’s oil patch were suspended or cancelled because they were only profitable at higher oil prices. Welcome to the real world of the downside of risk.

The economies of Alberta and Saskatchewan were running based on the assumption of high oil prices - with individuals and businesses taking out mountains of debt in expectation that the party would never end.

Saudi Arabia’s decision to deliberately drive down the price of oil meant uncertainty for investors. When no private investors would step up, the Federal Government purchased and funded the twinning of a trans-mountain pipeline, which increased Alberta’s capacity to get oil to market.

The claim that everything was rosy in the U.S. oil market is also not true.

Donald Trump routinely pushed for low oil prices, and pressured Iran, Saudi Arabia and others to produce even more oil. The result was lower prices and more punishment for the North American oil industry, with Canada hurting more.

This resulted in U.S. refinery closures. When OPEC drops its prices, it makes U.S. and Canadian oil less competitive - which has an impact on refineries profitability.

This report on the U.S. losing refinery capacity illustrates the problem.

First, it is possible to make billions of dollars as a company, but to lose money consistently in an individual refinery. We have seen this happen a lot with East Coast refiners that didn’t have access to cheaper oil from the U.S. shale boom. They had to continue to procure crude oil on the international markets, and that put them at a competitive disadvantage.

Likewise, the international spike in the price of oil after the invasion of Ukraine was not just a market response to supply disruptions.

In fact, U.S. Oil Producers, specifically executive Scott Sheffield, was working with OPEC - OPEC plus, which includes Russia - to throttle oil production and drive up prices.

The Federal Trade Commission made it clear that they had hundreds of pages of texts and WhatsApp messages, sharing production targets, and threatening to discipline any company that broke ranks.

When this happened - in the U.S. and in Canada - inflation soared as oil companies raked in record profits that went entirely to shareholders and bondholders, not back into production.

This is the sort important economic news that you would expect a magazine called The Economist to know about.

Now, The Economist does make this point:

Oil’s decline penalises Canada’s economy at large, because it is one of the country’s most productive sectors.

That adds to a long-standing productivity problem.

When people talk about “productivity per worker” it’s really important to understand that the economic footprints of different kinds of industries make a big difference.

There’s a reason why people talk about the “resource curse,” and there’s also a reason why two small island nations, Japan and the UK, managed to become manufacturing powerhouses despite a lack of local resources.

When asked about the secret to making a lot of money, John D. Rockefeller is alleged to have said, “Get up early in the morning and discover oil.”

The reason oil is productive is because it is highly mechanized, and it doesn’t take a large number of people to extract the oil.

You can see this in how few people are required to run the industry:

Ten years ago in Alberta, 139,000 people, or 7.1% of the population worked directly in the oil industry. In turn, they produced 25% of that province’s GDP, 33% of the provincial government’s annual revenues, and 50% of the province’s exports.

This means the benefits are highly concentrated as well. In 2012, 50% of all income in Alberta was made by the top 10% - and the higher you went, the more concentrated it was. When you factored in inflation, most people in Calgary and Edmonton didn’t share in the benefits.

Alberta’s economy grew quickly after 2000 because the price of oil soared increased, but between between 2000 and 2009 (though this includes a sharp recession after 2008) Canada as a whole lost 500,000 manufacturing jobs.

The Harper Government imposed harsh austerity after Global Financial Crisis. It was one of the weakest responses to a financial disaster of any federal government in decades. The Federal Government slashed transfers to provincial governments, freezing health and other transfers for years, ignoring both inflation and population growth.

At the time, Canada’s Federal Government was the smallest it has been as a percentage of GDP since the 1930s. Canada’s defense spending was less than half what it was under Pierre Elliott Trudeau in the 1930s. Canada lost its “Bluewater navy”.

The other crisis in the Canadian economy relates directly to monetary policy and the housing market.

The first post I ever printed on this substack was about what I called the single most important thing Canada needs to do to fix its economy, which is to adopt monetary policy reform -

Says Chancellor

This was the recommendation of William White

“[S]timulative monetary policy has had a variety of unintended and unwelcome consequences that can only worsen; credit “booms and busts”, potential financial instability, fiscal unsustainability, a progressive loss of central bank “independence”, growing inequality of wealth and opportunity and a slower growth rate of potential output. Fourth, as the threat posed by these unintended problems have cumulated over time, “exit” and the “renormalization” of policy has become ever harder to achieve.

To sum up, the current monetary system has trapped us on a path we do not wish to follow because it leads inevitably to ever bigger problems. This is why fundamental reform is needed.”

The Utter Disaster of Central Bank Monetary Policy: Making the Rich Richer and Bankrupting the Rest

The destructive role of neoclassical / neoliberal central bank monetary policy can barely be understated.

It must be said that the sheer amount of money affected by the impact of central banks changes in interest rates on personal debt and the private sector dwarfs the fiscal policies of any government.

For a typical person, when the government cuts taxes for them it might improve their finances by few hundred dollars in a year.

By contrast, when a central bank “stimulates” the economy with a change in interest rates of 1% it can add $50,000 or more to a mid-sized mortgage that millions of working- and middle-class North Americans might pay, or it can reduce an owner’s equity in their home by dropping prices by $50,000, which will require finding $100,000 to repay once interest is factored in?

Imagine if an elected official’s decision had the effect of increasing costs by $50,000 in a single year, and $100,000 in a lifetime?

This what Central banks have done to “stimulate” or cool off the economy for decades.

The private economy is too distorted by overpriced assets that aren’t worth it and record levels of private debt.

These pre-existing disparities in concentrations of income and wealth means that both monetary stimulus, and monetary austerity and even more damaging.

When debt levels and inequality are high, central banks do damage whether interest rates are being raised or lowered:

When a central bank lowers interest rates, it drives up existing asset prices, when ownership is already concentrated, so it makes the rich much richer.

When a central bank hikes interest rates, it bankrupts individuals and businesses, so it makes people poorer.

This has been happening since the 1970s. Central bank policy is directly responsible for this, informed by neoclassical economics which insist that governments should avoid fiscal measures and leave fixing the economy up to central banks futzing around with interest rates.

These rules have created one of the fundamental crises in developed countries around the world: too many people are on the brink of debt default.

This Is An Emergency. Start Acting Like It.

Canada has gone through a series of economic crises where the private sector has imploded. The dot.com crash. The Global Financial Crisis. The OPEC Oil Price War, and the pandemic.

During the pandemic, the Government of Canada prevented the economy from collapsing, but not enough was done, because so many governments pursued policies that spared the wealthy and well connected while letting small and medium sized businesses take the hit.

This all happened as the world has yet to recover from the Global financial crisis (or the austerity that followed) or the Oil crash, or the pandemic.

Canada is now facing the threat of annexation by the U.S., and we have been experiencing threats and attacks on our sovereignty from Russia, China and India.

In response, the major focus of policy makers and the Bank of Canada is not preserving our sovereignty, or funding an effort to strengthen our defenses, or ensure that every Canadian is able to contribute, it is inflation.

With weeks to go before the U.S. (possibly) imposes a series of tariffs on Canada on the phony pretense that Canada poses a threat to the U.S., Canadian officials are scrambling for more free-market solutions - more free trade deals, more internal free trade, more tax cuts, more government layoffs, more private and foreign investment.

These are not tariffs as negotiating tools, these are better understood as economic sanctions in order to collapse the Canadian economy so that we will have no choice but to join the U.S.

The entire premise of Trump’s strategy is based on the same junk economics. Sanctions on Russia and on Iran failed, because both countries used the opportunity to make themselves stronger.

In 1940, John Maynard Keynes wrote “How to pay for the war”.

We shall, I assume, raise our output to the highest figure which our resources and our organisation permit.

... The aim of these pages is, therefore, to devise a means of adapting the distributive system of a free community to the limitations of war. There are three main objects to hold in view: the provision of an increased reward as an incentive and recognition of increased effort and risk, to which free men unlike slaves are entitled; the maximum

freedom of choice to each individual how he will use that part of his income which he is at liberty to spend, a freedom which properly belongs to independent personalities but not to the units of a totalitarian ant-heap; and the mitigation of the necessary sacrifice for those least able to bear it, a use of valuable resources which a ruthless power avoids.There is one thing that Canada produces that is made nowhere else at all: Canadian dollars. The idea that Canada must go to China, or India, or the U.S., or anywhere else to get Canadian dollars for investment is absolute nonsense.

After the Second World War, the Bank of Canada financed the precursor to the Business Development Bank of Canada and provided access to capital for entrepreneurs.

Trump’s theory (and that of his advisors) is a near-religious belief in the economics of the 19th century, which led to continual economic crashes throughout the 1800s, culminating in the crash of 1929, and turning that crash into a Depression through austerity.

A core part of that mistaken belief is the idea that money is something that is produced by the private sector and that the government depends on taxes or debt to pay its bills, when money is a creation of the state.

Canada - and the world - are under no obligation to dance to this tune.

To pay for its First World War effort, instead of relying on taxes and debt, the Canadian government created new money to cover its costs.

When the Bank of Canada was created in 1935, it started creating money and supporting public and private recovery. This support continued throughout the Second World War, and helped Canada’s post-war recovery.

Canada has the monetary and financial capacity to defend itself and strengthen itself and certainly to ensure that all of its citizens are supported.

That requires a focus on positive Canadian economic nationalism: Canadian ownership, Canadian sovereignty, and greater economic self-sufficiency, more competition and more innovation.

All of these are necessary now. They were necessary after the pandemic. They were necessary after the 2014 oil crash. They were necessary after the 2008 Global Financial Crisis. They were necessary after the dot.com crash, and 9/11. They were necessary after the 1980s oil crash, and the real estate bubble bursting.

Canada - and the world - is not in the current state of madness because of Keynesian economics, which is outlawed in the EU and in many juridictions, including Canadian provinces where balanced budget bills are in place.

Keynesian economics was rejected because they failed to predict stagflation.

Neoclassical / neoliberal economics failed to predict the Global Financial Crisis. It failed to predict the Euro Crisis.

Apparently no failure is bad enough to justify reconsidering our current economic paradigm, no matter how much evidence piles up. The 1970s Friedmanite revolution has not only resulted in 50 years of stagflation and the current, insanely unstable current moment. Worse, they make action impossible.

All of this has happened as central banks in Canada, the US, the UK, the EU Japan and elsewhere keep bailing out investors with trillions of dollars, pounds, euros, etc., when what is required to stabilize the economy is not more debt, but less of it.

As William White wrote:

“These shortcomings point to the need for explicit debt restructuring or even outright forgiveness. However, the administrative and judicial mechanisms needed to do this effectively are lacking and need to be put in place. In recent years, the Working Party on Macro-Economic and Structural Policy Analysis at the OECD and the Group of Thirty have published extensive documentation of current shortcomings and suggestions for improvements. Procedures for resolving debt problems in the corporate and household sectors need improvement. Not least, “zombie” companies must be restructured rather than be given “evergreen loans” as is currently the case. Indeed, measures taken to reduce the economic costs of the pandemic have sharply worsened this problem. Procedures for resolving financial sector insolvencies are even more inadequate. The problem of banks that are “too big to fail” must be dealt with definitively. We also need an accepted set of principles for the restructuring of sovereign debt.

These are the realities of the Canadian economy. At a time of global crisis, it’s disgraceful that the analysis and reporting by the Economist and the Globe and Mail are abysmal.

Once again - this Zeit needs a new Geist.

-30-

As a ‘far right winger’ I always have to push to read your articles :). Curious have you written a “treatise” on the “correct” economic theory?

I just want to encourage everyone who is interested in economics and monetary policy to read the Keybernomics PDF. I’m getting to the end and it’s still a great read all the way through. Very worthwhile if you’re seriously looking for solutions. Thanks