Why Canada's Economy Cannot Fail: Monetary Sovereignty Means We Cannot Be Bankrupted. Ever.

The biggest problem with Trump's plan to bring the Canadian economy to its knees? It's based on junk economics.

There is a huge amount of anxiety - and rage - in Canada over the tariffs being imposed by the U.S. for completely fraudulent reasons.

The phony pretense is that Canada is a threat to the U.S. because of illegal drugs and crime. It’s absolutely clear from the numbers that the U.S. by a President and his goons who, by every appearance, are trying to turn the US into a mafia state. It is a presidency that is soaked in corruption. Trump’s own commerce secretary, Howard Lutnick, runs a company, Tether, that launders over $19-billion in criminal proceeds per year, including laundering money for Mexican drug cartels and Chinese organized crime.

Trump’s cabinet members are incompetent stooges and frauds who are hopelessly compromised in every way - ethically, morally, and intellectually, and the administration is actively dismantling independent law enforcement and trying to corrupt the Department of Justice, which is currently in open revolt.

While Democrats and others may say that “tariffs are a distraction,” they are not. This phony pretense looks like Canada is being set up, so that if we fail to adequately contain the phony threat, the U.S. will have “no choice” but to act.

These should not be seen as tariffs, at all. They are sanctions, intended to weaken Canada’s economy. Trump has said he wants Canada to be the 51st state, keeps referring to the Prime Minister as the “governor” and has said he will use “economic force” to do so.

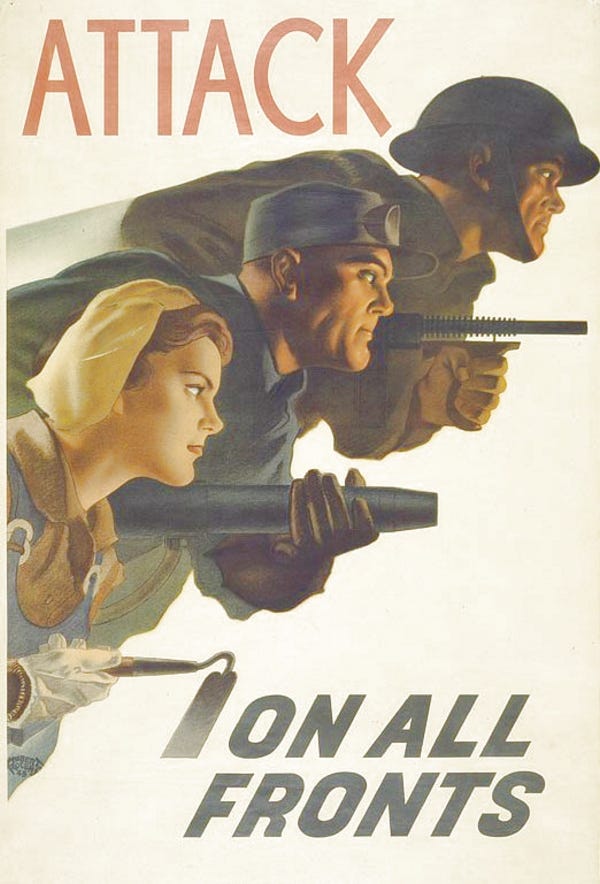

This has had the effect of putting all Canadians on a war footing. I am not exaggerating. It has upended politics in Canada. The Conservatives, led by Canadian Trumpette Pierre Poilievre are faltering, as the Liberals, who are in a leadership contest have soared. Polls are showing that a Liberal majority could be possible - something that seemed unthinkable just weeks ago.

What Canadians - and everyone - should realize - is that Trump’s ideas are based on junk economics - the idea that Canada is obliged to play by Trump’s understanding of the rules. We are not.

Canada is monetarily sovereign. We have our own currency. Our government’s debt is almost entirely in Canadian currency. We have a floating exchange rate.

Monetary sovereignty means that a country cannot run out of its own currency. Ever. The United States of America cannot go bankrupt in dollars denominated in American debt. The Canadian government cannot go bankrupt in debt denominated in Canadian dollars.

Canada’s governments, and the Bank of Canada, together have extraordinary powers to intervene in and preserve the economy, where Canadian dollars are involved.

Monetary Sovereignty

What does monetary sovereignty mean?

The idea we constantly have drilled into our heads is that government has to collect taxes before they can be spent. This is historically and practically false.

If you ask yourself “which came first, taxes or government creating money” the answer is government spending money.

This is self-evident when you consider it. If taxes are paid in a particular currency, where did people get the currency in the first place?

A Monetarily Sovereign government has the exclusive and unlimited power to create its sovereign currency.

The United States is Monetarily Sovereign. It has the exclusive, unlimited power to create the U.S. dollar.

China, Canada, Australia, the UK, and Japan are Monetarily Sovereign. They have the exclusive, unlimited power to create their sovereign currencies.

By contrast, America’s states, counties, cities, businesses and people all are monetarily non-sovereign. They are users, not creators of the dollar and not sovereign over its creation.

That means when you lend to a government, you will always get paid back.

These economists, and many others, agree:

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Alan Greenspan: “Central banks can issue currency, a non-interest-bearing claim on the government, effectively without limit. A government cannot become insolvent with respect to obligations in its own currency.”

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.

No one has ever made money betting against a country’s monetary sovereignty.

Governments are the only source of fiat money in the economy. Technically, anyone in an economy can create money, by writing an IOU. The trouble is getting paid for it. Governments do not have this problem.

Commercial banks, on the other hand, extend credit, which is private credit-money in the economy. Because these institutions can’t create their own money, they tend to create financial crises.

This is the absolute opposite of much of how we are told the government and the economy does and must run, but that doesn’t change the fact that Government of Canada cannot default on debt in Canadian dollars. The capacity to create money is the Federal Government’s legal responsibility, as set out in the Canada’s 1867 constitution, the British North America Act, and it remains in our constitution today.

Canada did not have a central bank until 1935, and its preamble says that the Bank of Canada’s mandate really can include doing whatever it takes to fix the Canadian economy. Its legal mandate is incredibly broad.

On top of that, the fact that Canada is a constitutional monarchy actually means that “the Crown” actually still has has some exceptional authority that can be used to protect and defend the economy.

That includes supplying governments with funds required to pay employees and keep operating and investing, with what are called monetized deficits.

Canada has done this in the past. During the First World War, Canada paid for its war effort through the creation of money, even though we did not have a central bank.

It is also how Canada funded relief and escape from the Depression after the creation of the Bank of Canada in 1935.

It was not inflationary. In fact, there is no evidence that creating money for domestic purposes by a government has ever been inflationary, with sole and extraordinary exception of Zimbabwe.

That is because Milton Friedman’s conception of money creation creating inflation is wrong. Money is a not a pool: it is discrete and in individual accounts.

If you’re wondering whether that would be inflationary, it wasn’t the last time the Bank of Canada did it, which helped get Canada out of the Depression and build our post-war economy. Josh Ryan Collins wrote about the Bank of Canada in “Is Monetary Financing Inflationary? A Case Study of the Canadian Economy, 1935-75” (Spoiler alert: it’s not.)

“The Bank of Canada commenced operations on March 11, 1935 and immediately began to help the Canadian economy out of depression via expansion of the money supply and the maintenance of low interest rates. The Bank pursued a cheap-money policy with Governor Graham Towers strongly rejecting inflationary warnings from monetary conservatives and adopting a stance that appears much closer to the “credit theory of money” discussed in earlier chapters:

“…in stimulating business activity the vital matter is not the amount of money in existence, it is the size of people’s income, in other words, the size of the national income. This can grow, and does grow, without any definite connection between such growth and a growth in bank deposits or note circulation. (Bank of Canada 1936, 12)

Expansion was initially achieved through direct central bank money creation via advances to the state: $4 million was advanced to the government in 1935 in four installments, all of which were eventually repaid. However, the vast bulk of financing was achieved through the Bank’s active participation and shaping of the Canadian government bond market….

In the prewar period between 1935 and 1939, the Bank played a major role in Canada’s recovery from the Great Depression, funding over two-thirds of government expenditure over these five years. Nominal gross national product (GNP) expanded by 77% in contrast to the 70% contraction in the previous five years, with a sharp increase in capital investment and private expenditure. Bank deposits expanded by a similar amount, while currency in circulation increased by 70%.29 Deflation was reversed but inflation remained stable despite the massive expansion in the money supply.”

I say all that as a word of reassurance to any and every Canadian. There is a saying about central banks of countries like Canada that have monetary sovereignty: you cannot run out of ammunition.

And this is a good thing, and Canada’s own history shows that there is something wrong with conservative economics, because the historical evidence contradicts their theory. And theories that are contradicted by evidence should be re-examined.

The entire idea that Canadians must choose austerity is false.

The insistence that funding of government can only be through private means is ideological.

For example, take the idea that Canada must, for some reason rely on foreign investment. To invest in Canada, foreign investors have to buy Canadian dollars, which are created by the Bank of Canada for that purpose.

Mathematically, there is no difference between the Bank of Canada creating that new money for investment and injecting it into the Canadian economy, and a foreign entity buying that Canadian money and injecting it into the Canadian economy.

The taboo on doing so is related to false claims about inflation and hyperinflation: it’s an ideology that sets out to guaranteeing that no matter what government does, private investors will always benefit - and that if they aren’t part of the deal, they get to shut it down.

As I wrote, one of the most famous examples of hyperinflation, in 1920s Germany, was not caused by public money printing at all. It was caused by private banks, who were allowed to write IOUs that could be exchanged for real money at the central bank.

The economic and financial reality is that the finance sector worldwide has received multiple multi-trillion dollar (and Pound, and Yen, and Euro) bailouts over the last quarter century and more to the same individuals and institutions who then turn around and demand austerity from government for the damage created by their own ill-considered and extractive investments.

Canada’s federal and provincial and municipal governments could all have their budgets topped up by the Bank of Canada to ensure full employment and all necessary investments are being made.

We can finance military and defense efforts. We can finance re-industrialization. We can provide access to capital for Canadian companies to expand and scale up, so we don’t have to rely on exports.

We can ensure that everyone has money for food, shelter and jobs. We can work with financial institutions and businesses to protect them.

This is what Keynes meant when he said “If it can be done, it can be paid for.”

The entire premise of the American attacks on Canada’s economy - and on its own - is that the economy has to work the way they believe it does, when their ideas are already delusional.

The biggest obstacle in Canada is that these economic delusions are so widespread. Central banks themselves (though not Japan), including the Bank of Canada and the U.S. Federal Reserve, are operating on the same delusional economics, which consist of blowing massive speculative asset bubbles that massively enrich people who are making no productive contribution or investment in society at all.

Central banks keep relying on "monetary stimulus” and “monetary austerity” that have been incredibly damaging to Canada’s economy, and the world’s. When what is required is targeted fiscal investment, monetary policy has created an “everything bubble”.

So, while Canada is monetarily sovereign - as are many other countries, central bank monetary policy effectively prohibits them from exercising it. This, quite frankly, is a colossal failure and amounts to undermining democracy, in Canada and abroad.

In the very first post in this substack, I wrote that the single most important thing Canada can do to save its economy is to change monetary policy - based on the sage advice of William White, a Canadian economist who advised the OECD and worked for the Bank of International Settlements, where in 2003 he warned Alan Greenspan the US economy was in big trouble.

Canada, and the world, are facing emergencies because of the behaviour of the U.S. India, China, and Russia. Canada is not the only country that can do this.

This is why monetary sovereignty matters: it is also democratic sovereignty. Canadians should be reassured. But the Bank of Canada needs to get on board.

-30-

DFL

Letter to G&M:

Re: Do trade deficits matter? How economists think about Trump’s obsession, Mark Rendell, February 14, 2025

https://www.theglobeandmail.com/business/economy/article-trade-deficit-trump-us-canada/

A trade tariff imposed on Canada could cause an immediate economic slowdown leading to production and employment losses, especially in oil, energy, and auto industries.

However, the Covid epidemic delivered a similar economic shock, yet we prevailed because government stepped up and supported affected businesses and households until more normal conditions returned.

As owner of the Bank of Canada which issues the fiat Canadian dollar, our federal government can take similar action today until businesses can adjust or tariffs disappear.

American economist Dean Baker explains, "if Donald Trump is determined to act like an idiot in dealing with international trade, he can cause short-term disruptions. But in the longer term, the rest of the world could do just fine without the U.S. market. In that story, the U.S. economy will be the big loser."

As the daughter of a farmer and historian, I've said for decades that they can always print more money, but they're not building more land.