Updated: Why Trump Won: It's the Economy, Stupid. Especially the Fed.

FOUR points about the election: supporters, inflation & interest rate shocks

We are not living in the same world we lived in on Monday. Donald Trump was elected President of the U.S. His supporters are elated, his opponents are dismayed, and many, I am sure, are suffering what is known as a “moral injury.”

It’s a kind of mental hurt that is profound and deep because it is felt as a kind of betrayal and heartbreak. You thought - morally - that people would make a different decision and they don’t. It’s soul-crushing.

People ask, of a given candidate “How could anyone every support X, given that they said or did Y, that was so terrible?” The reality is that this is a question anyone may face when asked about a particular politician they support. The answer is that some of those people clearly don’t see the leader that way. It’s a rare voter who agrees with every single thing a politician stands for.

So, one of the things that is important is to remember is to avoid falling into the trap of dehumanization. Some people are terrible, it’s true, but one of the defining features of human beings is that they from childhood on, we can be oblivious to the pain we can cause.

What I am saying is that this is the factor that tipped the election in Trump’s favour.

And there are also very important reasons why we don’t see it, which is that the economy has been in a bubble - which means some parts of it are booming like crazy, while others are not. And the money, noise & mania from the boom overwhelms the quiet crumbling that’s happening elsewhere.

We are where we’re at because people are stressed, and fearful after a traumatizing pandemic that was horrible, mentally, physically, and economically.

The other question is why would people vote for Trump, and the answer is that they are doing badly under the economy that everyone says is going well, when it is not.

In 1944, U.S. President Franklin Delano Roosevelt, said “People who are hungry and out of a job are the stuff of which dictatorships are made”.

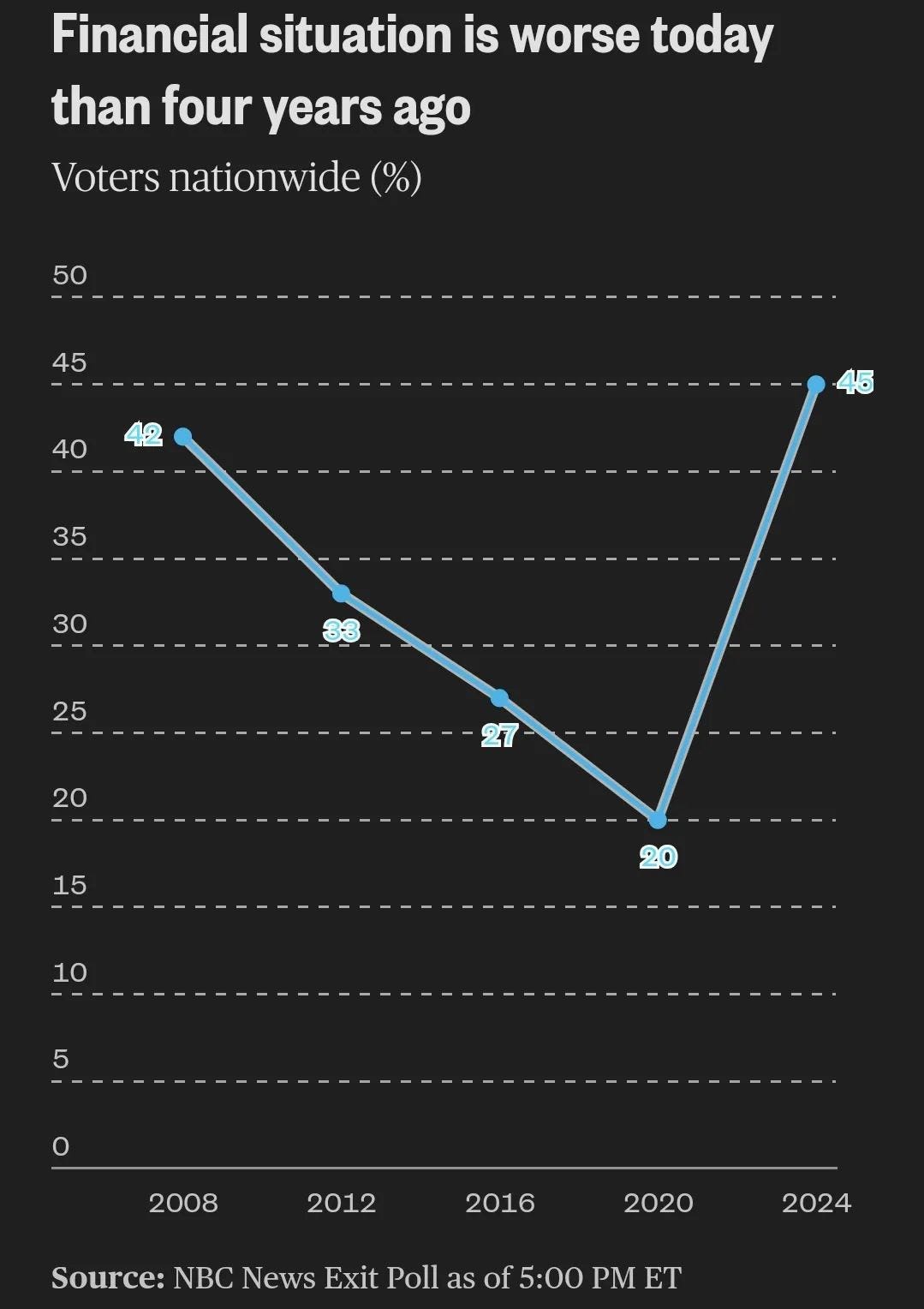

When people were asked at exit polls about how they were feeling about the economy, an astonish 45% of voters said it was worse today than it was four years ago.

Why would that be?

Everyone has been talking about how well the U.S. economy has been doing - using the wrong metrics. One is the stock market (which is owned by a fraction of the population).

The two engineered economic events that elected Trump

1. Oil Price-Fixing that Fuelled Inflation

In addition to the pandemic, there was a massive spike in inflation - one of the highest and sharpest such spikes since the early 1980s. Current macroeconomic theory blames inflation like this on government spending, when a huge portion of inflation in question was driven by soaring oil prices, which also resulted in record profits for the oil sector.

Those high oil prices were the result of a price-fixing scheme. In 2014, Saudi Arabia and OPEC launched a price war, cutting the price of oil from over $100 a barrel to under $50. The impact on Canada and U.S. producers was brutal. It resulted in layoffs, bankruptcies, cancelled capital projects.

When Russia invaded Ukraine, the price of oil shot up, and it was blamed on the crisis. However, it emerged that oil companies in OPEC and the U.S. were colluding together, sharing information about production and making sure new production didn’t happen so prices would stay high. They did. At the time, reports explained that these companies were playing “catch-up” from the pandemic - paying off shareholders and debt.

In many cases, inflation was being driven by price collusion. It wasn’t because people were making or spending too much money.

2. Shock Treatment & Interest Rate Hikes

When central banks get worried about inflation, which they think is from an economy running “too hot” because it has too much government money in it, they will raise interest rates, to “cool it off”. Banks will not lend as much, to fewer people, and borrowing costs are higher.

The result is to deliberately engineer a recession. As interest rates go up, and loans shrink and fewer people qualify, it means less money in general flows into the economy. It can bankrupt borrowers and developers and businesses, and puts people out of work.

If you ask why this is considered a good idea, it’s supposed to be because elected officials will never do what it takes to make the “tough decisions,” and despite the fact that the pandemic was not even finished, central banks and economists demanded a kind of “shock treatment” for the economy.

In the U.S. and in Canada, pandemic support programs were wound down, and interest rates were hiked - one of the fastest such hikes in history.

At a time when, arguably the single most important thing was rebuilding the economy and getting people and businesses back on their feet, central banks launched a painful round of monetary austerity, with the idea that people can just borrow again when interest rates come down again. The problem with that theory is that the damage is already done.

In Canada, there have been personal and business insolvencies. These have a knock-on effect - like dominoes.

“the Fed hiked interest rates 11 times in 2022 and 2023, dealt a significant blow to the mortgage market.

That increase in rates translated into higher borrowing costs (monthly mortgage payments) for homeowners who purchased while interest rates were at their highs. For some, it has become increasingly challenging to meet the higher obligations, potentially contributing to the year-over-year surge in delinquencies that TransUnion has documented.

Now, while this may look good in comparison the higher rates in 2008-2009 were the Global Financial Crisis.

Serious delinquencies were up 5.9% from the previous month, by 26,000.

The share of borrowers who were 60 days past due on their mortgage loan was up to the highest level since January 2021, the company said. Sixty-day delinquencies rose by 12,000 in September as compared to the previous month.

The number of borrowers missing a single month's payment was at a three-month high of 42,000.

Overall, the national delinquency rate was up for the fourth month in a row. In September, the national delinquency rate was up 4.3% from the previous month and up 5.7% from a year ago.

The increase has been driven by "pressure from elevated interest rates over the past couple of years, hurricane-related pressures and slowly rising unemployment, among other factors," the company said in the report.

The other details matter

Who's missing mortgage payments

The largest increases in delinquencies in September were among homeowners who took on a mortgage backed by the Federal Housing Administration or by the U.S. Department of Veterans Affairs. Their delinquency rates were up 9% and 24%, respectively, from a year ago.

There was also a notable increase in new mortgage borrowers missing payments. In September, 1.7% of loans that were originated to borrowers in 2024 were delinquent six months after they were created, ICE said. Outside of the pandemic, that was the highest share since the Great Recession in 2008.

Just to repeat that last one, with emphasis:

In September, 1.7% of loans that were originated to borrowers in 2024 were delinquent six months after they were created, ICE said. Outside of the pandemic, that was the highest share since the Great Recession in 2008.

This is why I always talk so much about personal debt and mortgages.

It is not government debt that causes financial crises. Financial crises happen in the financial sector. There have been land booms and busts for centuries. People borrow money to speculate, lose everything and still end up owing money. The “Great Recession” or “Global Financial Crisis” started with mortgages.

While markets are excited about Trump’s election, the madness and frenzy that is driving politics around the world - street violence, mass protests. You have record inequality and billionaires, while it’s getting impossible for people to rent, make a living, afford a house, and raise a family because “regular” good paying jobs are disappearing.

It is all driven by private debt - by private borrowers and private banks. But the interest rate decisions are made by central banks.

The reason people in the U.S. and Canada and the UK and other developed countries are willing to consider voting for some extreme-right conservatives is that they are in true economic distress that is not recognized.

Third

On either side of a partisan divide, people are much more comfortable calling each other names, and when someone goes broke with a lot of debt, it is almost always viewed through a moral lens, as if the person did something wrong for which they deserve to be punished - not that they were unlucky, or that there were problems beyond anyone’s control.

This is the non-scientific basis for our economic thinking.

However, this is the idea behind austerity. It’s sort of the idea that people went wild and borrowed too much to party, and then they need to sober up and clean up and tighten their belt. That idea works for individual players within the economy, but not for the whole economy. If you cut back while everyone else is spending, you’ll be all right. But when everyone cuts back at once, the economy shrinks.

The Giant Bubble That’s Been Bursting, One Family and One Business at a Time

Any economy like the U.S. or Canada, the reality is that Federal governments like Biden’s and Trudeau’s rolled out useful and important programs, but they are not adequate to address the massive distortions in the economy being created by the markets.

Jeremy Grantham is a billionaire investor whose understanding of the market is not driven by mania. His main concern is bubbles, and in 2022, he said that the largest bubble in history is starting to burst. The name “bubble” is deceptive, because they don’t just pop and disappear. It’s more like when you buy a new fish for your tank, which gobbles up the fish you already have, then goes belly-up.

Grantham, writing in 2022:

"Today in the U.S. we are in the fourth superbubble of the last hundred years. Previous equity superbubbles had a series of distinct features that individually are rare and collectively are unique to these events. In each case, these shared characteristics have already occurred in this cycle.

Previous equity superbubbles had a series of distinct features that individually are rare and collectively are unique to these events. In each case, these shared characteristics have already occurred in this cycle.- an acceleration in the rate of price advance to two or three times the average speed of the full bull market. In this cycle, the acceleration occurred in 2020 and ended in February 2021, during which time the NASDAQ rose 58% measured from the end of 2019 (and an astonishing 105% from the Covid-19 low!).

- a sustained narrowing of the market and unique underperformance of speculative stocks, many of which fall as the blue chip market rises. This occurred in 1929, in 2000, and it is occurring now.

For the first time in the U.S. we have simultaneous bubbles across all major asset classes. To detail:

First, we are indeed participating in the broadest and most extreme global real estate bubble in history.

Today houses in the U.S. are at the highest multiple of family income ever, after a record 20% gain last year, ahead even of the disastrous housing bubble of 2006.

But although the U.S. housing market is selling at a high multiple of family income, it is less, sometimes far less, than many other countries, e.g., Canada, Australia, the U.K., and especially China. (In China, real estate has played an unusually important and unique role in the extended boom and thereby poses an equally unique risk to the economy and hence the rest of the world if its real estate market loses air exactly as it appears to be doing as we sit.)

Second, we have the most exuberant, ecstatic, even crazy investor behavior in the history of the U.S. stock market. The U.S. market today has, in my opinion, the greatest buy-in ever to the idea that stocks only go up, which is surely the real essence of a bubble. (Interestingly, where other developed countries lead in housing prices, they lag the U.S. in equity prices. Some, such as Japan, by so much that they are merely slightly overpriced today.)

Third, as if this were not enough, we also have the highest-priced bond markets in the U.S. and most other countries around the world, and the lowest rates, of course, that go with them, that human history has ever seen.”

And fourth, as gravy (as if we needed any) we have broadly overpriced, or above trend, commodities including oil and most of the important metals. In addition, the UN’s index of global food prices is around its all-time high (see Exhibit 2).

These high prices are important as they push inflation and stress real incomes. The combination, which we saw in 2008, of still-rising commodity prices with a deflating asset price bubble is the ultimate pincer attack on the economy and is all but guaranteed to lead to major economic pain.”

WHY DON’T WE SEE IT?

Grantham explains - he is is a contrarian. From October, 2024 - Grantham is still taking the same position, but he also explains why it is that these other problems are missed.

During a manic economy, it is “euphoric” for the people who are enjoying ridiculously overvalued investments and stocks. One sign of an overvalued stock is its Price-to-Earnings Ratio.

Grantham even makes a point about being precise in his language as part of his investment practice. He tries to discourage the use of the present tense: he doesn’t say “we’re seeing growth” he says “we have seen growth” as way of staying disciplined that the past is not the present or the future.

As Grantham points out, what people are taught in school about P/E is wrong.

We all learned at business school that high P/Es are meant to be reflecting the best possible future. And what we find is the highest four P/Es, highest amount of euphoria are precisely followed by the four worst economic outcomes: the Great Depression, the Great Recession of ’73-’74, the worst since the Depression, the crash and the recession after the tech bubble burst, and the real moment of truth when the great financial crash occurred, when the whole financial system of the developed world teetered on the edge of total meltdown. So, what a strange paradox that the market’s predictive power is precisely, perfectly the opposite of what we were taught.

… it’s not an accident that the most euphoric periods in the market’s history, all four of them really—1929, 1972, tech bubble of 2000, the great financial crash, 2008, and you could add, 2011, December. Those are the five euphoric points, and the first four, it’s not an accident, they’re all followed, not by the best economic times and the best market returns. They are followed by the four worst economic setbacks and the four worst periods of stock market return. What a strange coincidence.

As he points out, about P/E

“the market does not make any attempt at predicting the future. The market is a coincidence indicator of what makes money managers feel comfortable today. They love high profit margins, even though they mean revert. They hate inflation, even though it mean reverts. And that’s the way it is. If you give me a market with high profit margins and low inflation in history, I will give you a high P/E.”

These problems and bubbles have largely been created by central monetary policy interventions.

Lessons

There’s a lesson here for democracy as well as the economy. The reason Trump was elected and that other right-wing parties are thriving is not due to scapegoats - it’s due to the economy. As I wrote elsewhere, developed governments are making the same mistake as Germany’s Social Democrats after 1929. They are following austerity, and hiking interest rates to fight inflation instead of ensuring people had financial help.

One aspect of Trump’s re-election that we should take very, very seriously, is that the basic ideas of “neoliberalism” no longer apply, and that developed countries should focus more on jobs, full employment. We do not have to follow the Trump model, but we need options to the status quo.

Financial problems have financial solutions. These are signs of what used to be called an “irrational market” but the risk is not just a recession, but that defaults set off a chain reaction of a more serious crisis. In my view, one of the single greatest threats is that we experience another serious financial crisis. Elon Musk has said that Americans might have to “endure hardships” but the reality is that shock-treatment austerity will result in a shock wave of defaults.

As I have written many times, what’s required is not the status quo, and not austerity, but a Marshall Plan, with relief and a plan to reindustrialize. The U.S. and Canada and the UK and Europe are all suffering from the same problem Japan faced after its economy and banks crashed.

We’ll keep getting the same results until we try something different - and I suggest an option here:

-30-

How would you fund the Marshall Plan? Isn’t the problem that Govs & central banks have been trying their version of a Marshall plan since 2008 but it’s way beyond the point of diminishing returns & now every new round of QE is making the economy worse? I agree with most of what you write but I think William White’s comments on a modular economy are even more valuable than his thoughts on private debt. Western economies are close-coupled, geographically specialised & centrally controlled by finance-supporting central banks. Ricardian comparative advantage might be ok if countries can control their basic critical infrastructure & have economic sovereignty but privatisation swept that all away. So now we have countries operating a fake model: democracy, elected govts, taxation to fund services etc; In fact, democracy doesn’t exist - sovereign govs can’t even control their own societal infrastructure because it’s been sold off to foreign capital or is subject to the trade agreements that favour capital over citizens. They can’t raise money to fund investment because capital markets say: ‘nope. Either crush labour & privatise more or we’re skipping off elsewhere’. And they can’t raise taxes because capital backed populists come along & say: this is a post tax world. Taxes make you poorer. We can just run deficits & keep piling on debt so long as we stick to the plan - fake democracy, depressed wages, central banks that backstop capital. Clearly the whole thing is no longer sustainable. But how do we avoid a collapse & build something better? For me, the modular economy is critical. Bottom up national economies are the start. Core infrastructure & services owned nationally - not necessarily nationalised but owned by citizens of a country. Shelter & help for small or growing businesses & international competition for big businesses. Capital - and this is the big bit - kept in sovereign nations not spirited off into SPVs, holding cos & tax havens. I don’t mind Amazon offering cheap goods in my country (UK) if it follows our labour laws, pays taxes on revenue transacted here & receives its income through British banks. Sovereign nations should get back to running their own economies in their own way & trading their surplus according to international rules. The IMF & WTO should get back to disciplining surplus countries & rebuilding crisis hit countries instead of the opposite. We all traded sovereignty for global connectedness when the Soviets were marching through Europe. But we failed to see that it was making our system fragile & open to exploitation by a bigger force than the Soviets - the Western oligarchs. I’m not sure pouring more fiat money into this world will do a damn thing until we can stop it leaking into the pockets of global capital.

I'm not a financial expert at all -- just two other things that come to mind -- one is medical expenses -- Covid made a lot of people very sick, of course many died, some after very lengthy stays in ICUs. That is phenomenally expensive, even with insurance. How did that impact budgets, and people's ability to pay their mortgages? Second, homeowners insurance rates have skyrocketed, and many people across the country have had their homes damaged or destroyed due to various weather events. How have those expenses impacted people's ability to keep up with their monthly payments? I would think that for many people one or both of those could be the last straw.