Four Lessons From History, So We Don’t Have to Repeat It

Those who fear for democracy's future should remember Roosevelt's 1944 words: "People who are hungry and out of a job are the stuff of which dictatorships are made"

The decision by central banks to fight inflation by cranking up interest rates is not only engineering a recession, when it comes to both social and political unrest, it is putting out the fire with gasoline.

Last year, Edward Chancellor warned that normalizing interest rates could collapse the economy.

Turning interest rates up and down like twisting a volume knob, has been distorting Canada’s economy and housing market for a generation

You can read about that here:

To fight Inflation, the Bank of Canada is Engineering a Recession. They don't need to.

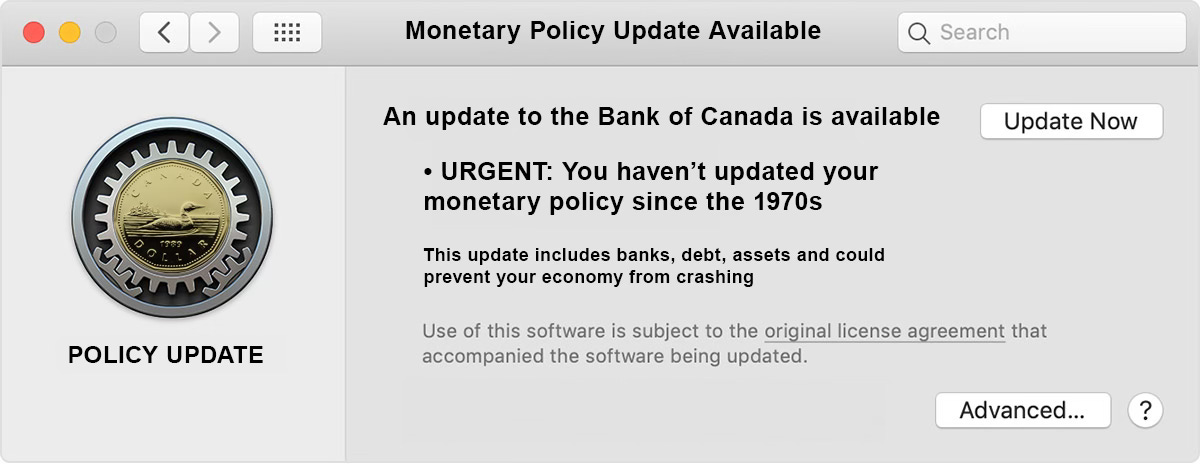

While politicians shouldn’t be telling the Bank of Canada to change interest rates, that doesn’t mean it should be taboo to discuss the failures of the BoC’s monetary policy, when folks are warning that it will be “impossible to normalize interest rates without collapsing the economy.

Too many Canadians and Canadian businesses are on the brink, and it’s because of the way the central bank policy has worked for decades.

There ARE things we could be doing differently, starting with better monetary policy that doesn’t just aim at one indicator - inflation.

William White and others are saying central banks in developed countries need to reform their monetary policy.

This is the single most important thing that the Canadian Government could do, right now - have the Bank of Canada follow the suggestion of William White and others to reform their monetary policy. It’s a reasonable request from very reasonable people.

The Single Most Important Thing We Can do to Address Canada’s Economic Challenges

While some economic indicators in Canada are ripping higher, the struggles Canadians are facing are undeniable, and the current policies of the Bank of Canada massively adding stress to Canadian businesses and families alike, in the name of fighting inflation.

We’re nowhere near out of the economic destruction wreaked by the pandemic and central banks are engineering a recession, making others pay for their own blunders. They’ve printed trillions of dollars while pursuing policies that created financial crises and are once again squeezing people out of homes, jobs and businesses.

We have never properly dealt with, or recovered from, the 2008 financial crisis. And after financial crises, governments often go hard right. People are fighting because they are desperate, and they are desperate because they have less and less control in their lives, because they are getting more financially insecure. Yes it’s growing costs - but worse, it’s growing debt.

How Financial Collapses drive Extremism and War

Above: the 30 Years’ War in Europe "Those who fear for democracy’s future should remember Roosevelt’s 1944 words. “People who are hungry and out of a job are the stuff of which dictatorships are made” In their paper Politics in the Slump: Polarization and Extremism after Financial Crises, 1870-2014

We CAN get out of this - it’s important to learn the right lessons of history. We’ve recovered from these challenges in the past, including in Canada.

One of the most important lessons comes from what really happened when Germany was hit by hyperinflation so hard that in a single year, a loaf of bread went from costing 160 marks to 200-billion marks.

The myth is that after the First World War, Germany end up printing money to try to pay its debts, and that they printed so much it caused hyperinflation and an economic crisis, that eventually led to the rise of the Nazis.

We can call this a kind of “folk history” - the real story is that the hyperinflation was caused when private banks were allowed to print their own money, including for loans which were used by speculators to bet that the value of the currency would drop!

And extremism and authoritarian governments rose to power in Germany and Japan, not after inflation, but after periods of austerity.

The History of Hyperinflation in Germany after WWI is Dangerously Wrong. Here's Why That Matters.

Many economists, historians and news articles will seek to explain the dangers of hyperinflation by citing Germany, but the history is almost entirely wrong. In the mid-1920s, there was a period of hyperinflation in Germany when the value of money dropped so badly that people were wheeling money around in wheelbarrows or used it as wallpaper (all true).

Another excellent article. Thank you for this. I'm reading a good article by Branko Milanovic, a professor at the London School of Economics.

It's in Foreign Affairs: the article is called: The Clash of Capitalisms.

Germany's hyperinflation was due to foreign currency debts forced on Germany by the Versailles Treaty, true.

However, this doesn't mean that inflation is not ever a problem.

I can't speak for Canada, but for the US - the problem with inflation is that you cannot have stunted blue collar wages AND inflation. US wages during Biden's term are up comparably with increases during Trump's term, but real US wages during Biden's term are negative due to inflation.

Advocating high inflation plus low interest rates is far more a subsidy to the wealthier sections of a nation than anything else: these classes are most able to take on debt which is eroded by inflation and are also able to get disproportionate income increases whether by salary or income from investments.

I also note that low interest rate regimes penalize retirees who are dependent on fixed income.

The low interest rate regimes of the past decade plus are an anomaly in history; longer term trends conform far closer to interest rates at levels more like the present one.