Milton Friedman Blaming Governments for Inflation is One of the Most Pernicious Lies of the Last Half-Century

As soon as you start to think the claim through, it falls apart. But it's taken as scientific fact across the political spectrum. That needs to change.

Donald Trump has promised he will immediately implement tariffs of 25% on Canada and Mexico when he is inaugurated. There have been arguments about the impact of it, with lots of people pointing out that it will be inflationary.

Trump’s team is denying it, of course:

White House Senior Trade Counselor-designate Peter Navarro: “We put on significant tariffs on China, steel, aluminum, dishwashers, solar, a lot of increased countervailing duties to stop the dumping [in Trump’s first administration]. We had zero inflation from any of that. It never happened, and it’s the same movie this time.

Inflation is a monetary phenomenon, where we run a Federal Reserve that prints too much money, and they do that to accommodate fiscal irresponsibility.”

There’s a big difference between putting a tariff on finished items from China and putting a 25% tariff on inputs from Canada that American businesses use to make their own products.

Canada is not “dumping” cheap products into the U.S. Market, and the use of tariffs to demand that other countries reinforce the U.S.’s own borders is more like sanctions than tariffs, but that’s for another article. Tariffs are an import tax paid by American businesses, and arguably a violation of the USMCA (formerly NAFTA), which was renegotiated under Trump. U.S Canada trade is usually pretty fairly balanced, and often tips in favour of the U.S.

In fact, Canada imports more finished goods from the U.S., and we tend to export more raw materials. It’s only oil exports that turns a trade deficit for Canada into a trade deficit for the U.S. What we export to the U.S. in raw materials is having value added production for American companies and American workers, and is sometimes then sold back to Canada as a finished product. That 4-million barrels of heavier Canadian oil is being refined in a number of midwestern refineries which are suited to it, and not to refining the lighter U.S. oil. They will face an overnight 25% increase in the price of the only kind of oil they are able to refine. There are a number of border communities that rely on Canadian natural gas, because there are no U.S. natural gas pipelines to serve them.

Milton Friedman Was a Terrible Economist and Great Propagandist

But it’s the second half of Navarro’s statement that I want to draw attention to. It is a restatement of Milton Friedman’s claim, which asserts that all inflation is a result of central bank monetary policy.

You would think that someone like Robert Reich, the former secretary of Labour under Bill Clinton, who often praises Bernie Sanders and talks about inequality, and who is a strong critic of Trump would disagree, but he doesn’t.

In an October newsletter, Reich basically agrees with Navarro on the idea that fiscal government spending causes inflation:

“Trump claimed that the American economy under him was better than the economy under Biden and Harris, and that under Harris the economy would be ruined. In fact, under Trump, America lost almost 3 million jobs. And Trump’s unforgivable failure to contain COVID as well as other advanced countries did required massive government expenditures that fueled inflation. (Emphasis mine).

Biden and Harris, by contrast, have presided over an explosion of job growth while inflation has been tamed.”

Reich is not alone, and it is routine for people to believe that government spending in a crisis must be inflationary. It is taken as a given, and people on the left and centre say it as much as people on the right.

As Matt Stoller wrote at his substack about monopolies, “Big”

Aside from some antitrust-focused analysts and MMT folks, the economics establishment have argued that the whole premise that market power is relevant to pricing is silly. Even Adam Tooze, the economic historian who tends to take the more progressive side of the economics world, dismissed the notion. The more mainstream you get, the more harshly the idea is dismissed.

The thing is, Friedman’s argument (and Larry Summers’) is a load of bollocks. It doesn’t describe the mechanics of the market and government relationship, at all. It’s a cartoon version of the economy that serves two political purposes: not only does it shift the blame from the real culprits in the private sector who may be raking in record profits, while treating government stimulus as the problem.

All you have to do is consider what Friedman is arguing to see that it is absurd.

Consider the two explanations for inflation:

Inflation is caused by businesses raising their prices in a crisis. This is showing up as higher-than-usual profits, as customers struggle to pay their bills.

Inflation is caused when governments borrow to put money into the economy, increasing the money supply.

“The monetarist view is perfectly encapsulated by Friedman’s remark that “inflation is always and everywhere a monetary phenomenon.” According to this view, the principal factor underlying inflation has little to do with things like labor, materials costs, or consumer demand. Instead, it is all about the supply of money.”

When we consider for a moment, it’s the idea is that governments, through fiscal means, have showered the population with so much extra money that they are bidding up the price of eggs and milk, and that central banks played a role in making that happen.

That is a completely fictional description of what happens. This is not how any of the flow of money into the economy works, at all.

The fact that experts are repeating it is not a validation, its an embarrassment. It shows the total lack of critical thinking involved.

When a government runs a fiscal deficit to stimulate the economy, that spending is targeted, and it is usually to help make up for people suffering shortfalls. All that spending ends up being someone’s income. People have to pay taxes on it, but they don’t have to pay it all back.

When a central bank lowers interest rates to run a monetary stimulus, it’s about encouraging banks to extend more credit. So people with worse credit suddenly qualify, and the amount that everyone can borrow increases, with people with the best credit benefiting the most and getting the best rates.

This is what economists deceptively call “money printing” when the new money going into the economy is all in the form of loans, from banks. It’s not government money. It’s money people have to borrow. Those loans aren’t used for day to day spending. They’re usually to buy property. So it doesn’t help with increases in day-to-day costs.

Instead, lower interest rates drive up the housing market, in particular - partly because large borrowers can take out loans to “bulk buy” properties. This raises the cost of living, and creates pressure on the cost of labour.

But it has nothing to do with fiscal spending.

It’s not just an economic rule, it’s a political rule, which defines inflation as something that can’t be caused by the private sector, or international cartels.

The rule is that it must have been caused by government and monetary policy. Evidence to the contrary will be rejected.

The goal of the propaganda was to lead everyone to believe that if governments run a fiscal deficit, it will result in the risk of inflation - that it will make things worse, not better, when that is simply not true.

It is a classic example of the propaganda technique mastered by big tobacco and big oil, of being “merchants of doubt”.

Even if you provide examples of private sector, industry-wide price hikes that occurred after companies with over 90% of the market shared information and cooperated to increase prices (of which there are many), that will be dismissed as “not inflation” because it doesn’t fit the definition as being caused by government.

But the campaign has been so successful, that centre-right liberals like Larry Summers, and centre-left labour friendly figures like Robert Reich are repeating Milton Friedman’s myth about inflation, which is also a myth about the impact of fiscal policies.

Evidence for what HAS caused inflation, 1: Collusion and Price Hikes

As Matt Stoller has reported, in the U.S., investigations into abuse of monopoly power shows that alleged price-fixing in the oil industry was responsible for 27% of all inflation in 2021, that for U.S. rents between 2020 and 2024, up to a quarter of the inflation is due to price-fixing.

Stoller started his blog in part as a counter and to show where Larry Summers, a former economic advisor to Barack Obama is getting it wrong - dangerously and recklessly wrong.

Stoller wrote

My belief at the start of the pandemic was concentrated market power and thin supply chains would induce shortages, and that indeed happened. One remedy for that, though not the only one, are antitrust rules that prohibit price-fixing, price discrimination, and monopolization, which often cause higher prices. (Other remedies include re-regulating shipping, which Congress is doing.)

Summers, however, doesn’t see the problem in terms of market power. His view of inflation is that government spending is driving price hikes by giving Americans too much purchasing power. He is so hostile, in fact, that he has pronounced the idea of market power as a causal factor a form of ‘science denial.’

Summers’s whole thread is worth reading, but what’s most interesting is how his thesis seems to cut against what CEOs are telling investors (as well as what he himself said in July, when he said concentration could be inflationary). Wall Street is explicit that margin expansion is the big story of the pandemic. “What we really want to find are companies with pricing power,” said Giorgio Caputo, senior portfolio manager at J O Hambro Capital Management told Bloomberg. “In an inflationary environment, that’s the gift that keeps on giving because companies can pass along their pricing on the way up, and don’t necessarily need to get it back on the way down.”

Margin expansion is one factor that has pushed the stock market to an all-time high, with large firms doing much better than small ones. Bloomberg has noted that behind this are corporate profit margins, which are at a 70-year record. All of which leads to an interesting question. How much of inflation is a result of market power, and how much is due to some other set of causes such as government spending or thin supply chains? Let’s do some rough numbers.

Just before the pandemic, in 2019, American non-financial corporations made about a trillion dollars a year in profit, give or take. This amount had remained constant since 2012. Today, these same firms are making about $1.73 trillion a year. That means that for every American man, woman and child in the U.S., corporate America used to make about $3,081, and today corporate America makes about $5,207. That’s an increase of $2,126 per person.

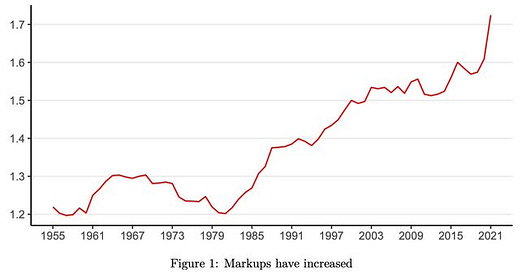

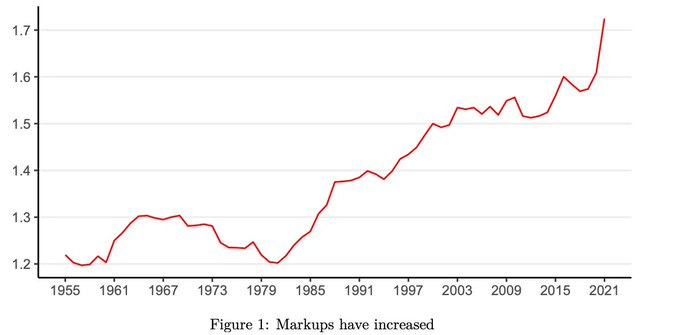

Corporate markups have increased for decades, skyrocketing during the pandemic.

Something real is going on. In individual markets, CEOs have been bragging publicly that they are restraining production to increase prices. Profit margins in the food industry jumped during Covid and haven’t come back down. Or take rent. There’s a company called RealPage that works with the biggest corporate landlords to hold apartments empty so they can increase prices, which jumped up 11% in 2022. There’s some evidence of conspiracy around pricing in virtually every industry. Turkey, poultry, and pork. Frozen french fries. PVC pipe. Anesthesiology. Oil. Ammunition. Pharmaceuticals. K-Pop. Credit bureaus and FICO, Verisign, industrial gasses, architectural software, locks, entertainment data. Homebuilders. Garden chemicals. Defense and aerospace. Ticketing. Estate Sales. Gaming. Drug wholesaling. Work ID information. Seeds and chemicals. Etc.

High prices are a big problem, but even more than high prices, unfair prices are common. Think about all the ticky-tack fees we’re subjected to, resort fees for hotels, convenience fees for Ticketmaster, even school lunch transaction fees! According to Consumer Reports in 2019, 85% of Americans “have experienced a hidden or unexpected fee for a service in the previous two years,” and 96% found them “highly annoying.”

One of the new developments is that tech companies are peddling products that effectively create cartels, by sharing market information - between landlords, as one example - so that they are effectively all coordinating their rent hikes together. It’s also been used in private health insurance to deny people care.

These price hikes have been under investigation in the U.S and in Canada.

I’ve written about inflation before and it’s clear that inflation itself is a response to increased uncertainty - war, natural disasters and states of emergency. In the current devastating fires in L.A., there have been rent increases as high as 41%.

Surges in inflation being a conflict phenomenon are being supported by theory:

In April 2023, Guido Lorenzoni and Iva ́n Werning wrote a paper, “Inflation is Conflict”Eckhart Hein wrote a Post-Keynesian perspective “Inflation is always and everywhere ... a conflict phenomenon: post-Keynesian inflation theory and energy price driven conflict inflation.”

There’s a notable paper from 1977 by Robert Rowthorn.

Conflict means uncertainty, and uncertainty raises costs, as well as opportunities for exploitative profit-taking.

This is not a new observation: it is written in Sun-Tzu’s The Art of War:

“Where the army is, prices are high; when prices rise, the wealth of the people is exhausted. When wealth is exhausted the peasantry will be afflicted with urgent exactions.”

Chia Lin: … Where troops are gathered the price of every commodity goes up because everyone covets the extraordinary profits to be made.

It is also common for people to refer to the incidence of hyperinflation in Germany as an example of money printing by government - which is completely incorrect. It was not the government at all - it was the central bank had been privatized and was allowing banks to print their own money, and they did.

There are economists who have been pushing for a better and more scientific economics that at least accurately describes how the economy is functioning in a way that does not rely on so many theoretical assumptions. We have access to unparalleled amounts of data. We do not have to assume, when we can observe.

Inflation is not being caused by fiscal stimulus, nor is fiscal spending being supported by a monetary stimulus.

The private economy faces uncertainty due to an event - a war, a cartel price hike, a natural disaster, or nearing the end of a interest cycle, where debts all start coming due and cratering the economy.

Prices rise, shortages may grow, tempers fray, and people need increased financial assistance to cope. Fiscal assistance - which still needs to be effective and targeted - is a response to inflation, not a cause of it.

The objections to Keynesian stimulus are purely ideological, and in fact political - the idea that only the private sector should be an investor, and that government should play no role in the creation of new capital. This has been described as monopoly rent-seeking, because the only people who will invest are those who already can.

This kicks away the ladder for future generations - and did, in 1978, when these strict anti-inflationary policies were implemented by centre-left governments in the U.S., the UK and Canada. It wasn’t Reagan, Thatcher and Mulroney. It was Carter, Callaghan and Trudeau, and their respective central banks, because it the new ideology was presented as a scientific discovery, when it was a coup d’état, by a secular religion, the Utterly Unreformed Church of Neoliberal Orthodoxy.

People are oblivious to the ways in which social turmoil is driven by extremely basic levels of deprivation and debt, which drive fear, anger and pain to the point that people take their own lives and others.

We are not in an inflation crisis: inflation is a painful signal of uncertainty and problems in the economy.

Inflation is a sign something is wrong that needs to be addressed - very likely high debt levels, and too much ownership and income in too few hands, so people outside that privileged group have fewer and fewer opportunities.

Instead of addressing the cause of the inflation, central banks have been suppressing the warning signal for 50 years.

We are in an insolvency crisis, and it’s caused by a collapsing private sector due to excess debt, not government.

While right-wing political parties are blaming big government overspending on inflation - and “liberal” economists agree, that is the problem right there.

Joseph Stiglitz, William White, Angus Deaton and Paul Romer are just some examples of economists who are defecting from neoclassical economics and have recognized that the formulas and theories just don’t add up.

There is a saying about safety regulations - that every one is written in blood. It was introduced and passed because someone was killed. It’s obvious when you think of it people always call for laws to be enacted after disasters. We haven’t done that with economic disasters since the 1970s.

All of this is vitally important to workable solutions. Parties are splintering and peopls are angry and voting with their bellies out of desperation. They just want this misery to stop. They are turning against each other as they fear that they won’t have enough. This is what austerity causes.

Inflation is being caused by collusion and by uncertainty and conflict, and the housing and affordability crisis is driven by central banks, interest rates and people looking to make the greatest amount they can from mortgages.

What this also means, however, is that fiscal stimulus that reduces uncertainty will have the effect of reducing inflation.

If the goal of tariffs is to get businesses to invest more in the U.S., then they still need capital. That would increase productivity and competition with new capital investments, while creating new jobs.

This capital can also come from government, who could set up business development banks that provide capital to real economy businesses.

The great news for Reich and the rest of us is that much more is possible under a reality-based economics. It doesn’t mean everything can be done, and it never has. Our limits are all human limits.

However, in the past both Canada and the U.S. used monetary financing - money created by central banks - to support government infrastructure as well as industrialization without significant inflation.

If it can be done, it can be paid for. And if it creates greater certainty, it will calm inflation, not cause it. In fact, central banks could be justified in assisting governments with monetary deficits, as well as providing either a people’s QE or an injection of capital into business development banks, because it these are alternate measures that would fit within their mandate of keeping inflation under control.

-30-

I do think you need to keep repeating this... There is a lot of misunderstanding of economics.

"White House Senior Trade Counselor-designate Peter Navarro: “We put on significant tariffs on China, steel, aluminum, dishwashers, solar, a lot of increased countervailing duties to stop the dumping [in Trump’s first administration]. We had zero inflation from any of that. It never happened, and it’s the same movie this time."

The biggest problem with this argument is that he's wrong. There were three inflation spikes during Trump's administration, from ~1.5% to ~2.5%, and there almost certainly would have been another if not for Covid. And there were clear policy reasons for them (tariffs, tax cuts and pressuring the Fed to keep rates low); they were not random fluctuation.

Now Trump wants to implement bigger versions of all those policies - one would expect bigger inflation spikes. And if inflation spikes lead to higher inflation EXPECTATIONS then you can really get in trouble, as people start demanding bigger raises and companies schedule price increases more aggressively, and the inflation feeds on itself, as it did in the 1970s.

Nobody noticed the spikes in 2017-2019 because inflation has to get above a certain amount before anybody notices. That's why so many people think there was no inflation for decades before 2020, and why so many people seemed to be comparing 2022 prices to 2010 prices. ["My grocery bill doubled under Biden!" F---ing no, it didn't.]

"Inflation is a sign something is wrong that needs to be addressed - very likely high debt levels, and too much ownership and income in too few hands, so people outside that privileged group have fewer and fewer opportunities."

I mean, that is something that creates inflationary pressure, but I think the inflation of 2022-2023 can be explained pretty easily by half the people in the world not going to work for six months.

What is really interesting is that because the inflation had different causes than historical inflation, it most likely had a different solution. Which is to say, the Fed raising interest rates was not what caused disinflation. Inflation was going to come down because of normal market forces; all the rate hikes did was f--- over Biden.

And because there is so much private debt, raising rates didn't even decrease EFFECTIVE inflation that much, because of higher debt payments! Those are NOT factored into CPI.

What they did was so textbook I have a hard time giving them too much guff, but things are just clearly different now from how they were in the 70s-90s, and the people who benefitted from the previous status quo are not breaking their backs to figure out how.

"We haven’t done that with economic disasters since the 1970s"

We haven't done it about ANYTHING since the 1970s. The government is incredibly laissez faire outside of taxing and spending.

There is no reason we needed to have a housing shortage. There is no reason we had to have the phone system become 99.5% junk by volume. There is no reason we needed to let tech billionaires drive teens to suicide, or let opiates permeate the countryside. These are the result of a government that has abdicated its responsibilities. And while the economic issues are mostly the fault of Republicans, the lack of crucial regulations for new technologies - the lack of even an ATTEMPT - falls on both parties.

"All of this is vitally important to workable solutions. Parties are splintering and people are angry and voting with their bellies out of desperation. They just want this misery to stop. They are turning against each other as they fear that they won’t have enough. This is what austerity causes."

To Republicans: a feature, not a bug. Ain't it convenient: bad governance makes people want to vote for authoritarians, even if it's the authoritarians who are causing the bad governance. You don't have to pay too much attention to know that's what's going on right now, but it's way beyond what most Americans are getting in terms of reliable information in the '20s. And half the Americans who even bother to tune in are getting a steady diet of lies and distortions.