No Government in Canada (or anywhere) Should be Cutting Right Now

Tariffs didn't create the Great Depression, cuts and austerity did. Canada and other countries have everything they need to defend their economies if Central Banks just step up.

Canada’s Prime Minister Justin Trudeau has quite accurately been saying that Donald Trump is inflicting massive tariffs on Canada in order to collapse our economy so he can annex it.

I’ve written before about the fact that Trump’s entire strategy is based on junk economics, because Canada has something called monetary sovereignty.

Canada is monetarily sovereign. We have our own currency. Our government’s debt is almost entirely in Canadian currency. We have a floating exchange rate.

Monetary sovereignty means that a country cannot run out of its own currency. Ever. The United States of America cannot go bankrupt in dollars denominated in American debt. The Canadian government cannot go bankrupt in debt denominated in Canadian dollars.

Canada’s governments, and the Bank of Canada, together have extraordinary powers to intervene in and preserve the economy, where Canadian dollars are involved.

You can read the whole thing here:

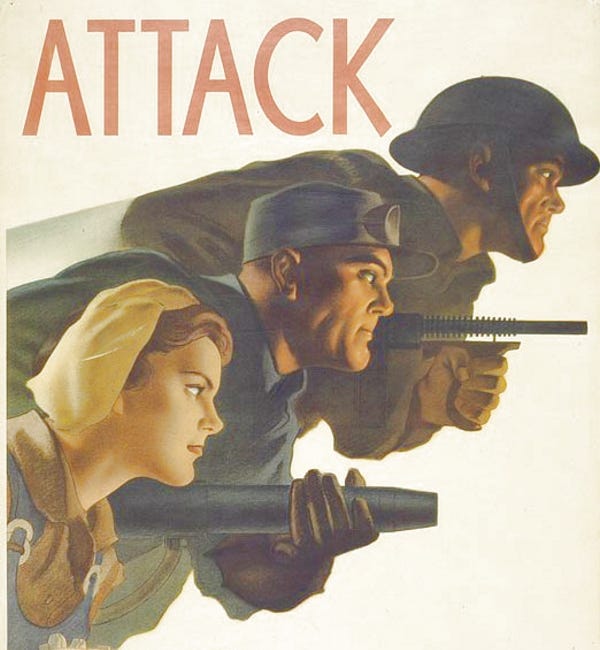

We need to recognize that this trade war is actually a form of financial warfare.

Trump started with the phony claim that the tariffs were being imposed because Canada is a threat and major source of fentanyl and crime.

Canada as a country is a more peaceful and has less crime than the U.S. Many times more drugs and illegal guns flow into Canada from the U.S. than the U.S. gets from Canada.

Its all just excuses when the real intention is to destabilize Canada’s economy and create unemployment, bankruptcies, and collapse.

The reason this does not need to happen is that, because Canada has monetary sovereignty, the Bank of Canada and the Crown generally have extraordinary powers that can be used to protect the Canadian economy.

Austerity is the most dangerous idea

One of the essential steps in protecting Canada’s economy is that no government in Canada should be cutting right now.

No governments in Canada should be cutting. That is part of what is driving the U.S. into recession: mass layoffs from the U.S. government, and huge cuts to government spending.

We are seeing, before our own eyes, how layoffs and cutting government spending creates recessions. The reasons for that is simple and obvious: the government is part of the economy, the people who work for it spend all their money in the private sector, and all government spending is spending into the economy.

People have been sharing a clip from Ferris Bueller of Ben Stein teaching about how when the U.S. introduced “Smoot-Hawley” tariffs, it made the great Depression worse.

What people don’t realize is that Stein, a right-wing Republican who worked in the Nixon White House, is repeating an inaccurate explanation for the Depression - that tariffs and trade barriers, which are restrictions on the free market, are to blame for the Depression when the world’s largest economies were all contracting at the same time.

The reason Stein - and this historical account are wrong, is that unlike present-day Trump tariffs, which are going from zero to 25% overnight, when in the 1920s and 30s, U.S. tariffs had already been high for a century.

“One influential view, propagated by neo-liberal economists, is that this large but totally manageable financial crisis was turned into a Great Depression because of the collapse in world trade caused by the 'trade war', prompted by the adoption of protectionism by the US through the 1930 Smoot-Hawley Tar-iffs.

This story does not stand up to scrutiny. The tariff increase by Smoot-Hawley was not dramatic - it raised the average US industrial tariff from 37 per cent to 48 per cent. Nor did it cause a massive tariff war. Except for a few economically weak countries such as Italy and Spain, trade protectionism did not increase very much following Smoot-Hawley. Most importantly, studies show that the main reason for the collapse in international trade after 1929 was not tariff increases but the downward spiral in international demand, caused by the adherence by the governments of the core capitalist economies to the doctrine of balanced budget.'

That is explained in a BBC article here.

After a big financial crisis like the 1929 Wall Street crash or the 2008 global financial crisis, private-sector spending falls. Debts go unpaid, which forces banks to reduce their lending. Being unable to borrow, firms and individuals cut their spending. This, in turn, reduces demands for other firms and individuals that used to sell to them (e.g., firms selling to consumers, firms selling machinery to other firms, workers selling labour services to firms). The demand level in the economy spirals down.

In this environment, the government is the only economic actor that can maintain the level of demand in the economy by spending more than it earns, that is, by running a budget deficit. However, in the days of the Great Depression, the strong belief in the doctrine of the balanced budget prevented such a course of action. As tax revenues were falling due to reduced levels of economic activity, the only way for them to balance their budgets was to cut their spending, leaving nothing to arrest the downward demand spiral. To make things worse, the Gold Standard meant that their central banks could not increase the supply of money for fear of compromising the value of their currencies. With restricted money supply, credit became scarce, restricting private-sector activities and thus reducing demand even further.

It wasn’t tariffs that caused or extended the Great Depression following the Wall Street crash of 1929: austerity did.

Markets collapsed, and so did the price of commodities, creating waves of bankruptcies and defaults that collapsed hundreds of banks.

Treasury Secretary Andrew Mellon famously said

“Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.”

That is what caused the Great Depression, and years of austerity drove the rise to power of ultranationalist governments in Germany and Japan.

Almost all of our economic assumptions are based on the strange idea that a domestic economy cannot grow on its own, and that growth and investment happens only because of trade.

This is why, in Canada, every government should maintain their budgets. Proceed with hiring, keep infrastructure projects going. Do not cut education, do not cut universities. Do not cut, period.

Trying to stimulate the economy through tax cuts will, generally, not work, when what people and businesses need is revenue. We need to keep money flowing if we are going to defend ourselves.

The one missing part of what needs to be done in this is that the Bank of Canada needs to be part of the solution, instead of sitting on the sidelines.

If governments at any level - federal, provincial, municipal, territorial, First Nation, Inuit, Métis and any others- are facing a greater shortfall and growing deficit because of these tariffs, the Bank of Canada should be providing financing to ensure that we keep people working, keep people learning, and keep infrastructure projects going as well.

For governments, it should be “business as usual” except that instead of issuing bonds that private investors buy, the Bank of Canada buys them directly instead.

For governments, budget priorities are all still the same. Public audits and oversight are usually very thorough and robust in Canada, despite any claims to the contrary.

They should not be cutting taxes, but instead of having private investors buy their bonds, the Bank of Canada should buy them instead.

That way it’s all public, its all audited.

What is a surplus for the government is a deficit for the active economy.

The whole point is not to react in the way that the U.S. is anticipating we will react. Whether the Canadian economy falls apart is up to Canadians, not anyone else.

For anyone who wants to argue this is inflationary, or hyperinflationary, please read my account of the hyperinflation in Germany, because it’s likely that you have been misinformed.

Yes, there was a period of hyperinflation in Germany in the 1920s, and no, it absolutely was not caused by the government printing money. It was caused by private banks issuing credit - which the private central bank then converted to cash for them. It was private money-printing that caused the crisis - as it always does.

If you want to understand why running deficits in this manner is stabilizing, and not inflationary, consider what is happening.

The money you thought was going to be there is not there anymore.

You replace the money you thought was going to be there.

That brings you back to where you were.

That’s why monetized deficits are not inflationary when you’re just continuing to pay everyone to keep doing their job.

Second, “Greenfield” investments that create new value are not inflationary, precisely because they are creating new value.

The economic crisis we are in is because there is too much private debt in the economy, and it is used to gamble and speculate, and place bets on bets on bets.

This is the essential aspect of market crashes that must be understood, because we are not just dealing with transactions of buyers and sellers, with money on one side and a product or service on the other.

We are talking about people taking high-stakes, high risk gambles. High risk means there is a very big payoff, but a high chance of failure. The temptation of a big win means people may not fully grasp what a painful loss will cost.

As in gambling, depending on the odds, it’s possible to have enough money to make a bet which, if you lose, you cannot possibly repay. That is what causes financial crashes, because of financial manias. Too many people borrow money to buy something they expected to sell at a profit, then the price drops.

Mark Blyth wrote an outstanding book, Austerity: History of a Dangerous Idea, which dismantles the bad ideas and shows the historical evidence that austerity never works.

For all that people condemn austerity for its terrible effects in enriching a few while impoverishing the rest, the irrational aspect of it has to be addressed.

Austerity is a fear response, driven by a growing lack of control that is quite real.

While economics is supposed to be concerned with allocating “scarce resources” all real-world resources are finite - but money, which can be created out of thin air, is not.

We are currently living in a world of material plenty, where too many people do not have the money to access that plenty.

When people don’t have enough money to feed themselves or their family, for them, not having the money means not having the food, or shelter, or health care.

This is a direct result of the economic of the 1970s that is embodied in neoclassical economics, which has one fundamental rule, which is to keep giving people who already have wealth and income more of it.

As J K Galbraith wrote, trickle-down / supply-side / neoclassical economics is based on the idea that if you stuff a horse with oats, there will be more for the sparrows at the other end.

It is not scientific, it is not evidence based: it is just a series of rules, like a secular religion, in which economists act like a priesthood, or court astrologers. They are a hermetic order where the fact that their pronouncements are cryptic and their mathematical formulas are impenetrable are wielded as both a sword and a shield.

If something goes wrong, these rules state that the government is to blame, not the market. It substitutes its own morality and ethics, which is the secular religious belief that market outcomes are driven by individual character.

There is a belief that everyone is getting what they deserve. This is the morality of the market: that success in the market is moral success: that the rich are rich because they are good, hard working, virtuous and intelligent. Money and power are equated with virtue - not just being good at business, but being a “good” follower of the false religion of neoclassical economics.

By contrast, people who are poor, or who do not succeed in this system, are considered to deserve their failure: they are called lazy, disorganized, unintelligent and prone to vice and crime.

This is contrary to the actual teachings of every spiritual religion, especially. the teachings of Christ, but the attitudes of many Christian sects have ignored these teachings for decades and centuries. In the 1800s, many protestant denominations openly adopted eugenics and social Darwinism.

The reason we have record concentrations of wealth and inequality is that this false religion has spread into every corner of the economy - elected government’s fiscal and tax and regulatory policy towards finance, industry, and labour; central banks’ monetary policy, including interest rates and bailouts, which are focused only on protecting existing assets; the policies of corporations and investors which focus only on shareholder value, even if it means liquidating a corporation that is profitable over the long term, by extracting all the value by breaking it down and selling it off for short-term gains.

When there is a crisis - like a trade war designed to collapse Canada’s economy, we need to distinguish between what our instincts are telling us to do as individuals, and what we need to achieve as a group.

Tariffs do not have to collapse the economy: the expectation is that Canadians will collapse their own economy because governments will have “no choice” so long as they follow the current, expected economic dogma.

Canadian governments do have a choice, and it requires abandoning that economic dogma - especially at the level of Central Banks, who have been captured and continue to enforce these rules, even as their own researchers and policy choices make it clear that the economy does not work that way.

The Bank of England and the Bundesbank have both made it very clear that money creation does not happen in the way that neoclassical economics says it does. In addition to the researchers and experts who have disagreed all along, like Marianna Mazzucatto, Stephanie Kelton, Steve Keen Ha-Joon Chang and others, there are also prominent neoclassical economists who have been calling for reform because it’s clear to them that they don’t work. That includes William White, Joseph Stiglitz, Angus Deaton, Adair Turner, Paul Romer.

As I write this, I have just read that Trump is going to “pause” tariffs after speaking to the Big Three U.S. automakers, who have factories in Mexico and Canada.

During his first term, Trump’s tariffs on China were flicked on and off like a light switch.

What Canada needs to do, no matter what the U.S. or any other country does, is protect all of its citizens, and there is only one institution in the country tasked with that job: government.

This is also the fundamental reason that business and government are different. Businesses have customers. They treat people with money better than people without, and they have no obligation to treat people equally or fairly: to the contrary, they make more money by marketing to people with money and actively avoiding people who don’t have it.

The private interest is not the public interest.

By contrast, governments have a constitutional responsibility to all citizens, based on the rights of the individual. If government shirks these responsibilities, no one else can replace them.

The reason there are so many people who are trying to take over and burn down the government is because for 50 years, we have been “running government like a business” with a policy of strategic abandonment.

We are under economic attack, and we need to fortify Canada’s people and communities, and the Bank of Canada has unlimited capacity to do, as was demonstrated during the Depression, the Second World War, the Global Financial Crisis and the Pandemic.

The economic chaos being caused by the Trump administration is not going to stop - and Canada has an opportunity, an obligation and the capacity to protect its citizens.

The U.S. Constitution promises “life, liberty and the pursuit of happiness” and the Canadian constitution promises “peace, order, and good government”.

The reality is that the Canadian commitment of peace order and good government is what leads to the American ideals of life, liberty and the pursuit of happiness.

Canada needs to run a high-pressure economy. Governments need to keep people working and keep investing, whether it’s providing health and education, research and development and training at post-secondary institutions, or investing in infrastructure or providing access to capital for Canadian industry to retool and expand, or for new entrepreneurs to start up and scale up.

Canadian universities have an opportunity to attract some of the best researchers in the world who are facing an uncertain future in the U.S. Experts in health and medicine, in tech and in manufacturing. We could be attracting them to our universities and they could be teaching and doing research and adding to Canada’s innovation.

Austerity is based on instinct, not reason. It leads to the “paradox of thrift” because everyone tries to pull back (or hoard) at the same time. The reason why neoclassical economics has to talk so much about “confidence” and psychology is that they don’t model the distribution of money.

You don’t win trade wars, or real wars, by firing people and making it harder for them to survive in a crisis.

What’s required is defiance, not compliance, and Canada’s governments need to provide citizens with the resources to resist, because no one else will.

-30-

Thank you for making the case against government cutbacks!

Letter sent to Vancouver Sun:

Re: Opinion: Finance Minister Bailey must repair B.C.’s broken finances

Ben Eisen, Joel Emes, Feb 20, 2025

https://vancouversun.com/opinion/op-ed/opinion-finance-minister-bailey-must-repair-b-c-s-broken-finances

Fraser Institute opinion writers always call for rollbacks in provincial spending yet do not demonstrate that such cutbacks would actually return greater social and economic benefits.

For example, though millions were unemployed during the Great Depression, the federal government feared higher deficits, failed to act, and the populace was left to suffer. Yet once WWII began, massive spending was injected into the economy to fully equip and staff our military. The high public debt did not prevent a golden era of post-war prosperity when a disciplined workforce built highways, hospitals and universities, and when new social programs could be introduced.

True fiscal rectitude needs to focus not on what some ideologues think is a better statistical scorecard, but on real-world programs that improve provincial infrastructure, reduce costly social problems, and get B.C.'s 6% unemployed - 187,000 people - back into productive work.

Footnotes:

1. 1939--1945: World War II Transformed the Canadian Economy

http://web.archive.org/web/20050507140447/http://canadianeconomy.gc.ca/english/economy/1939ww2.html

"The government budget deficit also increased rapidly: in 1939, the budget deficit was less than 12% of GNP; in 1945, that rate rose above 42%. Nevertheless, by 1944, the Great Depression had faded into memory, and the unemployment rate was less than 1%.

By the end of the war, the economy had a more highly skilled labour force, as well as institutions that were more conducive to sustained economic growth."

2. MMT: What it Means for Canada

http://www.progressive-economics.ca/2011/08/12/mmt-what-it-means-for-canada/

"For example, in the debate over how to address the aging population, it should be obvious that the only way to address this issue is to increase future productive capacity. This involves the application of real resources now to research, infrastructure development, education (including in areas relevant to servicing an aging population), etc. So while more resources will probably be needed in the future to attend to a larger cohort of elderly people, it does not follow that if the government “saves” money now, this will somehow help to address the needs of the aging population in twenty years time, say. Indeed, why on earth would cutting spending now increase the availability of the real resources required in the future: workers, buildings, energy, or metals and plastics for joint replacements?"

3. Anything We Can Do, We Can Afford

John Maynard Keynes, in a 1942 BBC address

https://jwmason.org/slackwire/keynes-quote-of-day-2/

"Anything we can actually do, we can afford.

***

With a big programme carried out at a regulated pace we can hope to keep employment good for many years to come. We shall, in fact, have built our New Jerusalem out of the labour which in our former vain folly we were keeping unused and unhappy in enforced idleness."

4. For Overspending Governments, an Alternative View on Borrowing Versus Raising Taxes

https://www.bloomberg.com/news/articles/2018-10-19/this-theory-has-some-u-s-politicians-thinking-big-quicktake

"Deficits, per se, are not disturbing," Kelton wrote in a September column for Bloomberg Opinion. "Is there a limit to how big the deficit can safely climb? Absolutely! Deficits matter. They can be too big -- risking accelerating inflation. But they can also be too small, robbing the economy of a critical source of income, sales and profits."

5. John Maynard Keynes, (1883-1946) British economist

http://rortybomb.wordpress.com/2012/03/06/vsp-historical-trip-also-keynes-look-after-unemployment-and-the-budget-will-look-after-itself/

"I do not believe that measures which truly enrich the country will injure the public credit…It is the burden of unemployment and the decline in the national income which are upsetting the Budget. Look after the unemployment, and the Budget will look after itself."

6. Chill out time: better get used to budget deficits | Bill Mitchell

http://bilbo.economicoutlook.net/blog/?p=8263

"So when all these political leaders have been falling into the deficit hysteria mantra and assuring us that they would be invoking fiscal austerity strategies in the coming year – all that was telling private investors (that is, the real investors who build productive capacity) was that demand would probably deteriorate even further and so why create new productive capacity. It becomes a vicious circle – private spending declines – the automatic stabilisers drive up the public deficit – the deficit terrorists go crazy and because they have control of the media create political pressures for the government – the government runs scared and announces austerity – private spending declines further on the news – the automatic stabilisers drive up the public deficit and so on."

7. William Mitchell is Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), University of Newcastle, NSW, Australia

http://bilbo.economicoutlook.net/blog/?p=40988

"The state of Victoria (Australia) held its State Election last Saturday and the Labor Party was returned to office in a landslide, with voters categorically rejecting the campaign of fear and surpluses that the conservative parties relied on to get into office.

Victoria is the “most progressive” state in Australia and ran a campaign that included ‘doubling the state’s debt’ to further build new infrastructure in health, education and transport.

There are massive public transport projects underway, which people are seeing benefit their daily lives.

The lesson is fairly clear – governments are elected to advance well-being not ‘balance’ the books.

People want governments to do things that improve their lives not attack their living standards in the name of running surpluses.

As it happens, Victoria is the fastest growing state in Australia and the tax revenue that has come with that growth has generate(d) state surpluses for the last four years."

8. William Mitchell is Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), University of Newcastle, NSW, Australia

http://bilbo.economicoutlook.net/blog/?p=34412

Blustein (2008: 230) documents the findings of a plethora of research studies that have focused on the importance of work for psychological health.

1. “the loss of work has been consistently linked to problems with self- esteem, relational conflicts, substance abuse, alcoholism, and other more serious mental health concerns”.

2. “the loss of work has been associated with a notable decline in the quality of neighborhoods, a decline in the quality of family relationships, and an increase in crime as well as problems in other critical aspects of contemporary life”.

3. “the loss of employment opportunities … [leads] … to a marked disintegration in the quality of life, with corresponding elevations in drug abuse, criminal activity, violence, and apathy.”

9. Labour force characteristics by province, seasonally adjusted

https://www150.statcan.gc.ca/n1/daily-quotidien/250207/t003a-eng.htm

British Columbia Dec '24

Jan '25

Population 4,798.3 4,805.9

Labour force 3,104.5 3,131.1

Employment 2,920.6 2,944.0

Full-time employment 2,321.7 2,341.6

Part-time employment 598.9 602.4

Unemployment 183.9 187.1

Participation rate 64.7 65.2

Unemployment rate 5.9 6.0

... ...

Employment rate 60.9 61.3

... ...

Source(s):

Table 14-10-0287-03.

--

__________________________________________

Modern Monetary Theory in Canada

http://mmtincanada.jimdo.com/

The thought that the Canadian commitment to peace, order and good government is what leads to the American ideals of life, liberty and the pursuit of happiness is an error on your part, Dougald.

The American "ideals" depend on individual actions assessed by individuals. They don't require any stamp of approval from any authority.

The Canadian "commitment" depends on a centralized authority defining "peace, order and good government" and then telling us if they've accomplished their goals.

That's why the US beliefs are "ideals" accessible to all, but the Canadian beliefs are "commitments" from the authorities to the governed.

As for the rest of your post, the Canadian government is spending too much of our money. In some cases, as with the multiple malfeasance at SNC Lavalin and within the famous Federal government, "Green Slush Fund," the current government is actively stealing from the public purse.

I think we should encourage the current government to stop stealing, at the very least. Surely that would return both social and economic benefits, all by itself.